|

市场调查报告书

商品编码

1851813

电脑视觉:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Computer Vision - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

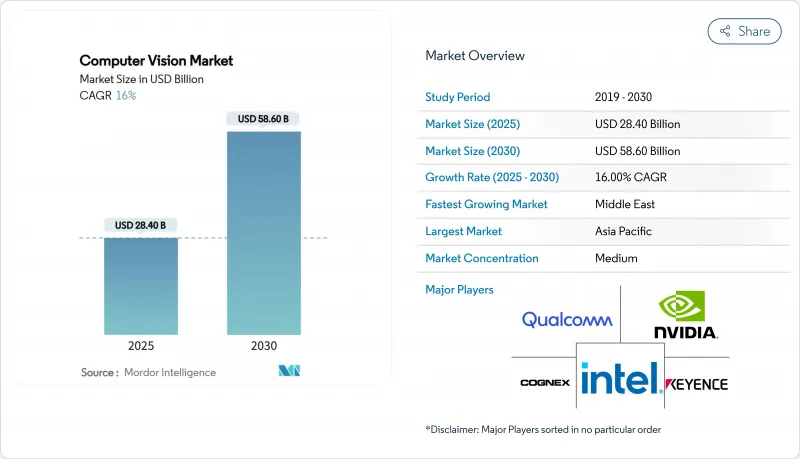

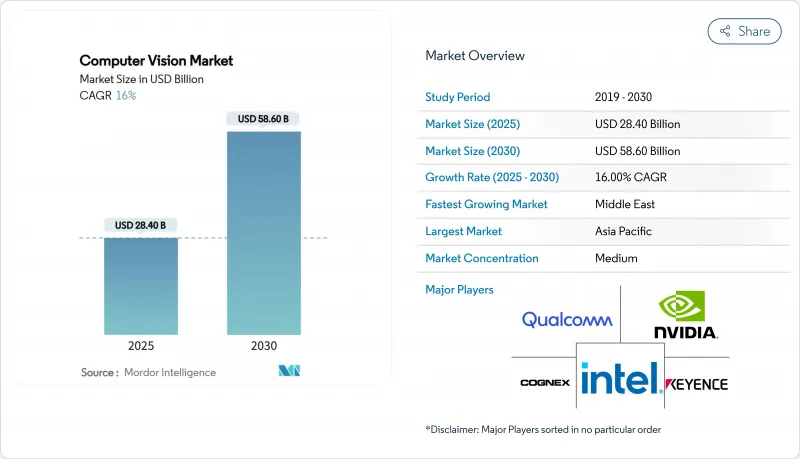

电脑视觉市场规模预计在 2025 年达到 284 亿美元,预计到 2030 年将达到 586 亿美元,预测期(2025-2030 年)复合年增长率为 16%。

成长的驱动力来自速度更快的边缘人工智慧晶片组,这些晶片组将推理任务从云端伺服器转移到设备端处理器。此外,工厂劳动力短缺、视觉引导机器人的日益普及以及亚太地区出口型工厂广泛采用工业相机也是推动需求成长的因素。同时,汽车原始设备製造商 (OEM) 正在部署多摄影机高级驾驶辅助系统 (ADAS) 套件,以符合欧盟通用安全法规 II (GDPR II) 的要求,从而将监管期限转化为嵌入式视觉感测器的批量出货。先进晶片的出口限制正在收紧对二线经济体的供应,刺激国内半导体投资并改变市场竞争动态。

全球电脑视觉市场趋势与洞察

製造业中视觉引导机器人技术的应用日益普及

工厂管理者正将自动化程度提升到超越常规取放任务的水平,配备先进视觉系统的协作机器人如今能够执行以往需要人工才能完成的组装检验和缺陷检测任务。美国国家标准与技术研究院 (NIST) 将机器视觉列为实现机器人灵活性的关键支柱,尤其是在半导体和生物製造无尘室等对亚微米级公差要求极高的领域。现代汽车的电子产品生产线在部署了能够利用混合资料集重新训练演算法并保持模型更新而无需停产的移动机器人后,一次合格率显着提高。视觉引导的协作机器人也为预测性维护提供了支持,能够在故障导致生产计划中断之前识别工具产量比率。它们的投资回报率超过了人形机器人,因此在建筑和农业等以往因环境非结构化而难以自动化的行业中得到了更广泛的应用。这些转变共同重塑了工厂的经济格局,减少了对稀缺技术纯熟劳工的依赖,并提高了多品种生产线的产量稳定性。

受监管行业严格的品管要求

由于反覆的召回事件暴露了人工检测的局限性,监管机构现在认为自动化光学检测至关重要。欧盟通用安全法规II要求汽车製造商自2024年7月起必须配备行人侦测摄影机和紧急煞车逻辑,这迫使一级供应商围绕视觉模型重新设计电控系统。製药公司正在部署深度学习视觉技术来检验泡壳包装的完整性和标籤的准确性。食品加工商正在整合康耐视In-Sight感测器,以实现100%的异物侦测率,从而减少污染召回并加强审核追踪。环保机构也同样要求提供废水合规性的持续视讯证据,这使得视觉系统从一项可有可无的支出转变为一项影响采购决策的风险缓解资产。

复杂的系统整合要求

传统工厂生产线依赖专有的现场汇流排通讯协定和非屏蔽线路,这使得用摄影机系统直接取代人工侦测变得复杂。恶劣工作环境中的振动和电磁杂讯会降低影像保真度,需要坚固耐用的光学元件和较长的校准週期。当多感测器融合技术加入雷射雷达或热成像输入时,整合商必须同步不同即时作业系统之间的资料流,这会延长缺乏内部专业知识的中小型企业的部署週期。客製化中间件和安全认证会增加计划预算,超越最初的投资报酬率预期,从而阻碍技术的普及应用。

细分市场分析

到2024年,硬体将占电脑视觉市场收入的68.0%,这主要得益于企业采购工业相机、照明设备和专用处理器来改造生产线。其中,边缘AI加速器到2030年将以24.5%的复合年增长率成长,成为所有子组件中成长最快的。相机模组仍将占据最大份额,但随着智慧感测器整合影像撷取和推理功能,降低线缆成本和延迟,其市场份额将会下降。光学设备供应商将受益于高光谱遥测镜头,这种镜头能够检测可见频谱以外的材料特征,应用于农业和回收领域。在软体方面,容器化推理堆迭和中介软体的年度订阅预算高于永久授权演算法,这反映出模型正在向持续重新调优转变。预计到2030年,电脑视觉硬体市场规模将超过340亿美元,主要得益于汽车和电子产品原始设备製造商(OEM)的强劲资本支出。

2024年,软体平台支出将占总支出的32.0%,并随着企业优先考虑资料管道和DevOps整合而非一次性配置而稳定成长。边缘编配框架有助于将模型更新分发到数千个终端,从而将设备丛集转变为自适应感测器网路。这一转变与日益增长的网路安全担忧不谋而合,这些担忧促使企业倾向于本地资料处理和透明的审核追踪。因此,系统整合商正在提供承包解决方案,以缩短没有专门机器学习团队的中型工厂的价值实现时间,从而扩大电脑视觉市场的潜在需求。

电脑视觉市场按组件(硬体和软体)、最终用户产业(生命科学、汽车製造、零售和电子商务、物流和仓储等)以及地区进行细分。

区域分析

到2024年,亚太地区将占电脑视觉市场收入的41.0%。受机器人技术快速普及的推动,中国工业相机销售额预计将从2023年的185亿元人民币成长28.35%至2024年的207亿元。日本晶片代工厂和韩国智慧型手机OEM厂商将维持对晶圆级AOI工具的强劲需求,而印度将扩大精密农业试点规模,以缓解气候变迁带来的粮食供应压力。政府的绿色工厂计划为智慧相机维修津贴补贴,在宏观经济逆风的情况下,支撑了稳定的资本投资。限制高阶GPU出口的出口管制政策正促使本地晶圆厂转向国产加速器,逐步提升该地区的自主研发能力。

到2030年,中东地区将以17.2%的复合年增长率成为成长最快的地区。沙乌地阿拉伯设立了1000亿美元的人工智慧基金,而阿联酋的目标是到2031年跻身全球十大人工智慧中心之列。在利雅德和杜拜,政府支持的智慧城市建设正在推动大量配备边缘分析技术的监视录影机的采购,以保障交通流量和关键基础设施的安全。同时,港口和自由区在物流自动化方面的投资也将进一步扩大沿岸地区的电脑视觉市场。

在北美,美国国家公路交通安全管理局 (NHTSA) 即将实施的自动煞车强制令推动了高级驾驶辅助系统 (ADAS) 摄影机的持续出货,而美国国防部也在资助以视觉为中心的自动驾驶计划并保持强劲的采购势头。然而,人才短缺和晶片出口受限正在减缓近期的成长,凸显了本地化培训计画和多样化晶片供应的必要性。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 製造业中视觉引导机器人的应用日益普及

- 受监管行业必须遵守严格的品管义务

- 车载ADAS摄影机整合激增

- 边缘AI晶片组可降低装置端视觉的延迟和功耗。

- 高光谱遥测和神经形态感测器开启了新的应用场景

- 市场限制

- 复杂的系统整合要求

- 熟练的电脑视觉工程师短缺

- 数据标註成本不断上升

- 对先进视觉处理器的出口限制

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按组件

- 硬体

- 相机

- 处理器(GPU/ASIC/FPGA)

- 光学与照明

- 软体

- 传统演算法

- 深度学习框架

- 边缘中介软体

- 硬体

- 按最终用户行业划分

- 生命科学

- 製造业

- 电子组装

- 饮食

- 包裹

- 国防与安全

- 车

- ADAS

- 自动驾驶汽车

- 零售与电子商务

- 物流/仓储

- 农业和林业

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- ASEAN

- 澳洲和纽西兰

- 亚太其他地区

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Intel Corporation

- Cognex Corporation

- Keyence Corporation

- Sony Group Corp.

- NVIDIA Corporation

- Omron Corporation

- Basler AG

- Teledyne FLIR LLC

- Qualcomm Inc.

- Google LLC

- Advanced Micro Devices(AMD)

- Adlink Technology Inc.

- Hikvision Robotics

- Stemmer Imaging AG

- Dahua Technology

- Zebra Technologies

- Amazon Web Services(AWS)

- Clarifai Inc.

- Allied Vision Technologies

- OpenCV.ai

- Matrox Imaging

第七章 市场机会与未来展望

The Computer Vision Market size is estimated at USD 28.40 billion in 2025, and is expected to reach USD 58.60 billion by 2030, at a CAGR of 16% during the forecast period (2025-2030).

Growth pivots around faster edge-AI chipsets that move inference from cloud servers to on-device processors, a shift encouraged by stricter automotive and manufacturing regulations that insist on real-time, auditable inspection data. Demand also benefits from acute labor shortages on factory floors, increasing use of vision-guided robotic,s and wider industrial camera uptake across Asia-Pacific's export-oriented plant,s Sohu. Simultaneously, automotive OEMs implement multi-camera ADAS suites to comply with EU General Safety Regulation II, turning regulatory deadlines into volume shipments for embedded visionsensorsr. Export-control rules on advanced chips tighten supply for Tier 2 economies, yet they accelerate domestic semiconductor investments, altering competitive dynamics in the computer vision market.

Global Computer Vision Market Trends and Insights

Rising Adoption of Vision-Guided Robotics in Manufacturing

Plant managers escalate automation beyond pick-and-place routines as collaborative robots equipped with advanced vision now handle assembly verification and defect inspection that previously required human eyes. NIST classifies machine vision as an enabling pillar for robotic flexibility, especially in semiconductor and biomanufacturing cleanrooms where sub-micron tolerances are non-negotiable.Hyundai's electronics lines report higher first-pass yield after introducing mobile robots that retrain algorithms on mixed data sets, keeping models current without halting production. Vision-guided cobots also underpin predictive maintenance, identifying tool wear before failures disrupt schedules. Return on investment outperforms humanoid robotics, widening use in construction and agritech, where unstructured settings once resisted automation. Together, these shifts reshape factory economics by curbing reliance on scarce skilled labor and boosting throughput consistency in high-mix lines.

Stringent Quality-Control Mandates Across Regulated Industries

Regulators now view automated optical inspection as essential after repeated recalls exposed limitations of manual checks. EU General Safety Regulation II obliges automakers to embed pedestrian-detection cameras and emergency-braking logic from July 2024, compelling tier-one suppliers to redesign electronic control units around vision models. Pharmaceutical packagers deploy deep-learning vision to verify blister-seal integrity and label accuracy, aligning with FDA validation guidelines for automated inspection. Food processors integrate Cognex In-Sight sensors that achieve 100% foreign-object detection, reducing contamination callbacks and strengthening audit trails.Environmental agencies likewise demand continuous video evidence of effluent compliance, turning vision systems from discretionary spend into risk-mitigation assets that influence procurement decisions.

Complex System-Integration Requirements

Legacy factory lines rely on proprietary field-bus protocols and unshielded wiring that complicate the drop-in replacement of manual inspection with camera systems. Harsh shop-floor vibration and electromagnetic noise degrade image fidelity, demanding ruggedized optics and lengthy calibration cycles. When multi-sensor fusion adds LiDAR or thermal inputs, integrators must synchronize data streams across heterogeneous real-time operating systems, extending deployment timelines for small and mid-sized enterprises that lack in-house expertise. Custom middleware and safety certification inflate project budgets, sometimes eclipsing initial ROI calculations and postponing adoption.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Automotive ADAS Camera Integration

- Edge-AI Chipsets Lowering Latency & Power for On-Device Vision

- Shortage of Skilled Computer-Vision Engineers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024 hardware accounted for 68.0% of computer vision market revenue as enterprises purchased industrial cameras, illumination units and dedicated processors to retrofit production lines. Within this total, edge-AI accelerators exhibit a 24.5% CAGR through 2030, the fastest trajectory among all sub-components, as designers replace discrete GPU farms with low-power ASICs and NPUs embedded at the image source. Camera modules remain the largest slice, yet their dollar share narrows as intelligent sensors merge image capture and inference, trimming cabling costs and latency. Optics vendors profit from hyperspectral lenses that detect material signatures beyond the visible spectrum for agriculture and recycling. On the software side, containerized inference stacks and middleware now receive annual subscription budgets larger than perpetual-license algorithms, reflecting the pivot toward continuous model retuning. The computer vision market size for hardware is forecast to exceed USD 34 billion by 2030, supported by resilient capital expenditure among automotive and electronics OEMs.

Software platforms contribute 32.0% of 2024 outlay and grow steadily as firms valorize data pipelines and DevOps integration over one-off deployments. Edge orchestration frameworks help distribute model updates across thousands of endpoints, turning device fleets into adaptive sensor networks. The shift aligns with rising cyber-security concerns that favor on-premises data handling and transparent audit trails. As a result, systems integrators bundle turnkey stacks that compress time-to-value for mid-tier factories lacking dedicated ML teams, in turn expanding addressable demand for the computer vision market.

The Computer Vision Market is Segmented by Components (Hardware and Software), by End-User Industry (Life Science, Manufactur Automotive, Retail and E-Commerce, Logistics and Warehousing and More) and Geography.

Geography Analysis

Asia-Pacific commanded 41.0% of the computer vision market revenue in 2024, buoyed by China's industrial camera sales that rose from CNY 18.5 billion in 2023 to CNY 20.7 billion in 2024, a 28.35% jump tied to rapid robotics adoption. Japan's chip foundries and South Korea's smartphone OEMs sustain high unit demand for wafer-scale AOI tools, while India scales precision-agriculture pilots to offset climate stress on food supply. Government green-factory programs subsidize retrofits with smart cameras, anchoring a steady capital-spending stream even amid macro headwinds. Export-control policies restricting top-tier GPUs push local fabs toward domestic accelerators, gradually lifting regional self-reliance.

The Middle East exhibits the fastest trajectory at 17.2% CAGR to 2030, propelled by Saudi Arabia's USD 100 billion AI fund and the UAE's ambition to rank among the top 10 global AI hubs by 2031. State-backed smart-city builds in Riyadh and Dubai purchase large volumes of surveillance cameras with edge analytics for traffic flow and critical-infrastructure protection. Parallel investments in logistics automation at ports and free zones further enlarge the computer vision market in the Gulf.

North America benefits from NHTSA's impending automatic-braking mandate, driving continuous ADAS camera shipments, while the US Department of Defense bankrolls vision-centric autonomy projects, sustaining a robust procurement c. Europe's Industry 4.0 policy fund supports AI-powered inspection retrofits, and its strict labeling standards stimulate demand in food and pharma plants. However, talent scarcity and chip export curbs moderate near-term growth, highlighting the need for local training initiatives and diversified silicon supply.

- Intel Corporation

- Cognex Corporation

- Keyence Corporation

- Sony Group Corp.

- NVIDIA Corporation

- Omron Corporation

- Basler AG

- Teledyne FLIR LLC

- Qualcomm Inc.

- Google LLC

- Advanced Micro Devices (AMD)

- Adlink Technology Inc.

- Hikvision Robotics

- Stemmer Imaging AG

- Dahua Technology

- Zebra Technologies

- Amazon Web Services (AWS)

- Clarifai Inc.

- Allied Vision Technologies

- OpenCV.ai

- Matrox Imaging

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of vision-guided robotics in manufacturing

- 4.2.2 Stringent quality-control mandates across regulated industries

- 4.2.3 Surge in automotive ADAS camera integration

- 4.2.4 Edge-AI chipsets lowering latency and power for on-device vision

- 4.2.5 Hyperspectral and neuromorphic sensors opening new use-cases

- 4.3 Market Restraints

- 4.3.1 Complex system-integration requirements

- 4.3.2 Shortage of skilled computer-vision engineers

- 4.3.3 Escalating data-labeling cost inflation

- 4.3.4 Export-control curbs on advanced vision processors

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Components

- 5.1.1 Hardware

- 5.1.1.1 Cameras

- 5.1.1.2 Processors (GPUs / ASIC / FPGA)

- 5.1.1.3 Optics and Lighting

- 5.1.2 Software

- 5.1.2.1 Traditional Algorithms

- 5.1.2.2 Deep-Learning Frameworks

- 5.1.2.3 Edge Middleware

- 5.1.1 Hardware

- 5.2 By End-user Industry

- 5.2.1 Life Sciences

- 5.2.2 Manufacturing

- 5.2.2.1 Electronics Assembly

- 5.2.2.2 Food and Beverage

- 5.2.2.3 Packaging

- 5.2.3 Defense and Security

- 5.2.4 Automotive

- 5.2.4.1 ADAS

- 5.2.4.2 Autonomous Vehicles

- 5.2.5 Retail and E-commerce

- 5.2.6 Logistics and Warehousing

- 5.2.7 Agriculture and Forestry

- 5.2.8 Other Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 South Korea

- 5.3.3.4 India

- 5.3.3.5 ASEAN

- 5.3.3.6 Australia and New Zealand

- 5.3.3.7 Rest of Asia-Pacific

- 5.3.4 Middle East

- 5.3.4.1 GCC

- 5.3.4.2 Turkey

- 5.3.4.3 Rest of Middle East

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Nigeria

- 5.3.5.3 Rest of Africa

- 5.3.6 South America

- 5.3.6.1 Brazil

- 5.3.6.2 Argentina

- 5.3.6.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Intel Corporation

- 6.4.2 Cognex Corporation

- 6.4.3 Keyence Corporation

- 6.4.4 Sony Group Corp.

- 6.4.5 NVIDIA Corporation

- 6.4.6 Omron Corporation

- 6.4.7 Basler AG

- 6.4.8 Teledyne FLIR LLC

- 6.4.9 Qualcomm Inc.

- 6.4.10 Google LLC

- 6.4.11 Advanced Micro Devices (AMD)

- 6.4.12 Adlink Technology Inc.

- 6.4.13 Hikvision Robotics

- 6.4.14 Stemmer Imaging AG

- 6.4.15 Dahua Technology

- 6.4.16 Zebra Technologies

- 6.4.17 Amazon Web Services (AWS)

- 6.4.18 Clarifai Inc.

- 6.4.19 Allied Vision Technologies

- 6.4.20 OpenCV.ai

- 6.4.21 Matrox Imaging

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment