|

市场调查报告书

商品编码

1687939

行动边缘运算-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Mobile Edge Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

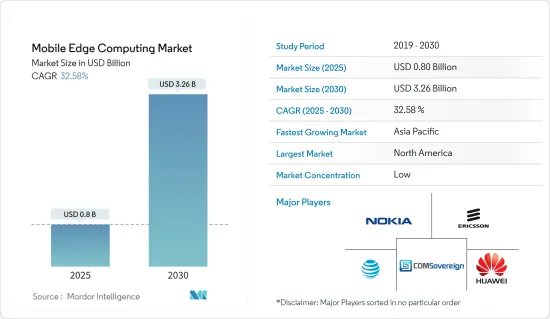

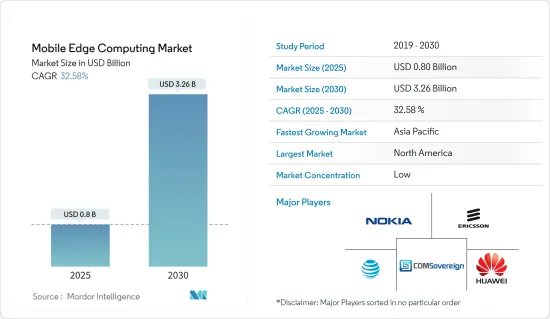

行动边缘运算市场规模预计在 2025 年为 8 亿美元,预计到 2030 年将达到 32.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 32.58%。

多接取边缘运算(MEC),通常称为行动边缘运算边缘运算,是一种边缘运算形式,它将云端运算带到网路边缘以增强功能。 MEC 是欧洲通讯标准协会 (ETSI) 一项计划的成果,该计划最初旨在将边缘节点放置在行动网路中,但后来也扩展到固定(或最终融合)网路。 MEC 使得操作可以在基地台、中央局和网路上的其他聚合站点进行,而传统的云端运算则发生在远离用户和设备的伺服器上。

关键亮点

- 随着无线订阅量的急剧增长,对数位媒体服务的需求也不断增长。为了满足这一日益增长的需求,行动无线网路正在呈指数级发展。各行各业的公司开始采用各种技术创新,包括感测器和其他资料生成和收集设备以及分析工具,以推动新的性能和生产力水平。传统上,资料管理和分析是在云端或资料中心进行的。然而,随着智慧製造、智慧城市等网路技术和倡议的日益普及,这种情况似乎正在改变。

- 此外,随着目前 4G 网路达到极限,5G 将需要更智慧地管理线上流量,而行动边缘运算将发挥重要作用。除了管理资料负载之外,MEC 还有望显着降低 5G 网路的延迟。

- 在通讯业,边缘运算(也称为行动边缘运算、MEC 或多多接取边缘运算)为更靠近最终用户的网路应用程式提供执行资源(运算和储存),通常位于通讯业者网路内或边缘。边缘解决方案具有低延迟、高频宽、设备上处理、资料分流以及可靠的运算和储存等关键优势。

- 与其他网路技术/架构一样,MEC 缺乏安全框架,因此容易受到各种威胁和硬体入侵。 MEC 网路中可能会出现各种各样的威胁和危险。然而,阻碍市场成长最常见的攻击包括通讯协定外洩、资讯和日誌篡改、政策执行失效、中间人攻击、资料遗失等。

行动边缘运算(MEC)市场趋势

终端用户产业越来越多地使用 5G 和工业IoT服务

- 在物联网 (IoT)机芯的推动下,工业 4.0 描述了在世界任何地方将不同的技术平台互连并与位于世界任何地方的製造设备介接的能力。随着工业 4.0 改变产业,从旧有系统转向智慧组件和智慧机器,并朝着推动数位化工厂和发展互联工厂和企业生态系统的方向发展,MEC 平台看到了令人兴奋的部署机会。

- 工业自动化领域的物联网预计将从 5G 服务中受益最多。支持这一领域的能力目前正在由 3GPP 定义,并受到工业 4.0 计划和 5G-ACIA 等行业团体的影响。此部分将是针对本地区域用例和私有网路部署的 5G 专用部分。

- 在医疗保健产业,物联网将使服务提供者能够透过连网医疗解决方案远端监控患者的健康状况,并实现即时资料收集和扩大即时监控和分析的存取权限。医疗领域正在增加 5G 服务的部署。例如,三星医疗中心与韩国最大的电信业者KT公司宣布合作开发智慧患者照护、利用5G创新医疗程序,并提高医院营运效率。

- 能源公共产业正在积极改善 5G 的商业案例、服务和伙伴关係关係。据印孚瑟斯公司称,56%的能源公用事业公司已经定义了5G用例,20%的能源公用事业公司已经与生态系统合作伙伴建立了5G服务组合。该公司进一步预测,智慧城市可以产生 1,000 亿美元的公共产业收益。由于电力分销商控制整个城市或社区的电线杆和电线,他们可以利用其资产为当地社区、执法部门和企业提供智慧监控和照明解决方案。

预计北美将占很大份额

- 北美有三大云端服务供应商:Amazon Web Services、Microsoft Azure 和 Google Cloud。此外,Verizon Communications Inc. 和 AT&T Inc. 等行动边缘运算市场主要供应商在该地区的存在正在对该地区的行动边缘运算市场产生积极影响。该地区也被视为所有重大技术创新的中心,包括 5G、自动驾驶、物联网、区块链、游戏和人工智慧。

- 美国和加拿大等国家以率先采用新技术而闻名。当今大多数新技术都是资料密集型的。随着如此多的资料被创建、处理和传输,我们目前的资料中心和云端基础设施已接近最大容量。如今,随着新资料量的产生和使用,这些基础设施不太可能满足客户的需求。在所有涉及的参数中,延迟可能是对您的业务最关键的因素。

- 大多数企业依赖即时资料存取和处理,因此严重的延迟可能会扰乱整个流程。这就是边缘运算的作用所在,它可以帮助基础设施开发人员解决问题。随着新技术的成熟,边缘运算预计将产生重大影响。

- 此外,行动边缘运算将使各领域的消费者和企业能够近乎即时地利用资料中心的功能,进一步释放高速、低延迟行动网路的潜力,为从家庭娱乐和游戏到医疗保健和农业等各个领域的变革技术提供动力。

- 该地区的各个终端用户正在深化与边缘运算供应商的伙伴关係,以开发结合 5G、物联网和行动边缘运算等先进技术的创新平台。例如,2022 年 1 月,沃达丰宣布与 Proximie 建立合作关係。 Proximie 是一个医疗技术平台,透过数位化世界各地的手术室和共用世界最佳临床实践来拯救生命。 5G、物联网和边缘运算等技术与 Proximie 世界领先的互联外科护理软体相结合,将使医疗专业人员能够在世界各地的手术室中进行虚拟“刷卡”、“记录”和“互动”,有助于加快和改善劳动力发展,更有效地大规模提供优质外科护理。

行动边缘运算(MEC)产业概览

MEC 市场由多家全球和地区性公司组成,它们在相当激烈的市场竞争中争夺关注。然而,市场主要由拥有大量市场份额的大型供应商主导,它们竞相在各个地理市场中站稳脚跟,成为先驱。总体而言,供应商竞争激烈,预计在预测期内仍将保持这种状态。

- 2022 年 9 月,诺基亚宣布了其内部关键任务工业边缘 (MXIE) 运算解决方案的新平台功能和应用。 MXIE 也制定了特定产业的蓝图,以简化工业企业的数位转型。

- 2022 年 9 月,Verizon 与美国军方合作,在珍珠港希卡姆联合基地 (JBPHH) 的飞机维修机库内建立了私人 5G 网路。该设计将使军事领导人更容易利用 Verizon 5G 的高速、大频宽和低延迟。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链分析

- COVID-19 对行动边缘运算市场的影响

第五章市场动态

- 市场驱动因素

- 延迟特定应用的流行和增长

- 拓展5G及工业IoT服务在终端产业应用

- 市场限制

- 缺乏通用的安全框架

第六章市场区隔

- 按组件

- 硬体

- 软体

- 按最终用户

- 金融与银行

- 零售

- 医学生命科学

- 产业

- 能源公共产业

- 通讯业

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- Comsovereign Holding Corp

- AT& T Inc.

- Huawei Technologies Co. Ltd.

- Verizon Communication Ltd

- SGH, Inc.(penguin Solutions)

- ADLINK Technology Inc.

- Vodafone Group PLC

- Adva Optical Networking SE

第八章投资分析

第九章 市场机会与未来趋势

The Mobile Edge Computing Market size is estimated at USD 0.80 billion in 2025, and is expected to reach USD 3.26 billion by 2030, at a CAGR of 32.58% during the forecast period (2025-2030).

Multi-access edge computing (MEC), popularly known as mobile edge computing, is a form of edge computing that brings cloud computing to the network's edge to increase its functionality. MEC is a result of the European Telecommunications Standards Institute (ETSI) program that was first intended to place edge nodes on mobile networks but has since expanded to include the fixed (or eventually integrated) network. MEC permits operations in base stations, central offices, and other aggregation sites on the network, as opposed to traditional cloud computing, which takes place on distant servers, far from the user and device.

Key Highlights

- The demand for digital media services is increasing as the number of wireless subscriptions grows exponentially. Mobile wireless networks have advanced tremendously to meet this growing need. Enterprises across industries are beginning to drive new levels of performance and productivity by deploying different technological innovations, like sensors and other data-producing and collecting devices, along with analysis tools. Traditionally, data management and analysis are performed in the cloud or data centers. However, the scenario seems to be changing with the increasing penetration of network-related technologies and initiatives, such as smart manufacturing and smart cities.

- Furthermore, with the current 4G networks reaching their maximum limit, 5G will have to manage online traffic far more intelligently, in which mobile edge computing will play a major role. In addition to managing the data load, MEC is expected to significantly reduce the latency in 5G networks.

- In the telecom industry, edge computing, also known as mobile edge computing, MEC, or multi-access edge computing, offers execution resources (compute and storage) for applications with networking close to end users, often within or at the boundary of operator networks. Edge solutions offer key advantages: low latency, high bandwidth, device processing, data offloading, and reliable computing and storage.

- As with any network technology/ architecture, MEC is prone to various threats and hardware that lay in wait owing to its lack of security framework. A wide variety of threats and hazards could potentially occur in the MEC network. However, the most common attacks that hinder the market's growth can be narrowed down to compromised protocols, falsified information and logs, loss of policy enforcement, man-in-the-middle, and data loss.

Mobile Edge Computing (MEC) Market Trends

Rising Application of 5G and Industrial IoT Services Among End-user Industries

- Industry 4.0, powered by the Internet of Things (IoT) movement, involves interconnecting various technological platforms and presents the ability to interface with manufacturing equipment located anywhere in the world, from anywhere in the world. With Industry 4.0 transforming industries, from legacy systems to smart components and machines to facilitating digital factories and developing an ecosystem of connected plants and enterprises, MEC platforms find exciting opportunities for deployment.

- IoT in industrial automation is expected to derive maximum benefit from 5G services. The functionality to support this segment is currently being defined in 3GPP, influenced by Industry 4.0 initiatives and industry bodies, such as 5G-ACIA. It will be a 5G-specific segment for local area use cases and private network deployments.

- In the healthcare industry, IoT enables providers to monitor patient health remotely through connected medical solutions, along with real-time data collection and extended access to real-time monitoring and analysis. The healthcare sector is witnessing an increase in the deployment of 5G services. For instance, Samsung Medical Center and Korea's largest telecommunications company, KT Corporation, announced that they have partnered to develop smart patient care, 5G-powered innovative medical practices, and improve hospital operational efficiency.

- Energy and utility companies are driving the pack in actively improving business cases, services, and partnerships around 5G. According to Infosys, 56% of the energy and utility companies are defining use cases for 5G, and 20% have already established their 5G service portfolios along with the ecosystem partners. The company further anticipates that smart cities will create USD 100 billion in utility revenue. As electricity distributors manage poles and wires to all parts of the cities and neighborhoods, they could leverage their assets to offer smart surveillance solutions or smart lighting solutions to communities, law enforcement agencies, and enterprises.

North America is Expected to Hold Major Share

- North America is home to three major cloud service providers: Amazon Web Services, Microsoft Azure, and Google Cloud. In addition, the region is home to major mobile edge computing market vendors such as Verizon Communications Inc., AT&T Inc., etc., which positively impacts the mobile edge computing market in the region. This region is also considered to be the hub for all major technological innovations, such as 5G, autonomous driving, IoT, blockchain, gaming, and AI, among others.

- Countries like the United States and Canada are known to be early adopters of new technologies. Most new technologies at present are data intensive. They create, process, and transfer large amounts of data, due to which the current infrastructure, consisting of data centers and the cloud, is inching toward its maximum capacity. With the amount of new data generated and used presently, these infrastructures would not be able to support their customers' needs. Of all the parameters involved, latency is going to be the most crucial factor for business.

- Since most companies rely on real-time data access and processing, low latency can disrupt their entire process. This is where edge computing has helped infrastructure developers address the issue. With new technologies maturing, edge computing is expected to have a significant impact.

- Further, mobile edge computing allows consumers and businesses from various sectors to capitalize on the power of a data center in near real-time, unlocking the further potential for fast, low-latency mobile networks to empower transformative technologies for everything from home entertainment and gaming to healthcare and agriculture.

- Various end-users in the region are indulging in partnerships with edge computing providers to develop innovative platforms coupled with advanced technologies such as 5G, IoT, and mobile edge computing. For instance, in January 2022, Vodafone announced a partnership with Proximie, the health technology platform that digitizes operating rooms worldwide to save lives by sharing the world's best clinical practices. Combining technologies such as 5G, IoT, and Edge Computing with Proximie's world-class connected surgical care software, healthcare experts will be able to virtually' scrub in,' record, and interact with operating rooms across the world to help accelerate and improve workforce training and more efficient delivery of high-quality surgical care, at scale.

Mobile Edge Computing (MEC) Industry Overview

The MEC market comprises several global and regional players vying for attention in a fairly contested market space. However, the market is dominated by major vendors that cover a significant share of the market and compete to gain a foothold and become pioneers in different regional markets. Overall, the competitive rivalry among the vendors is expected to be high and remain the same during the forecast period.

- In September 2022, Nokia introduced new platform capabilities and applications for its on-premise Mission Critical Industrial Edge (MXIE) compute solution that would enable to host of applications from different ecosystems to advance enterprise digital transformation. It also developed vertical-specific blueprints that guide industrial enterprises to simplify their digital transformation.

- In September 2022, Verizon partnered with US Armed Forces to construct a private 5G network inside an aircraft maintenance hangar on Joint Base Pearl Harbor Hickam (JBPHH). With this design, it would be easy for military leaders to leverage the high-speed, high-bandwidth, and low latency of Verizon 5G.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Impact of COVID-19 on the Mobile Edge Computing Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Widespread Adoption and Growth of Latency-specific Applications

- 5.1.2 Rising Application of 5G & Industrial IoT Services Among End-user Industries

- 5.2 Market Restraints

- 5.2.1 Lack of a Common Security Framework

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 By End-user

- 6.2.1 Financial and Banking Industry

- 6.2.2 Retail

- 6.2.3 Healthcare and Life Sciences

- 6.2.4 Industrial

- 6.2.5 Energy and Utilities

- 6.2.6 Telecommunications

- 6.2.7 Other End-users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nokia Corporation

- 7.1.2 Telefonaktiebolaget LM Ericsson

- 7.1.3 Comsovereign Holding Corp

- 7.1.4 AT&T Inc.

- 7.1.5 Huawei Technologies Co. Ltd.

- 7.1.6 Verizon Communication Ltd

- 7.1.7 SGH, Inc. (penguin Solutions )

- 7.1.8 ADLINK Technology Inc.

- 7.1.9 Vodafone Group PLC

- 7.1.10 Adva Optical Networking SE