|

市场调查报告书

商品编码

1438475

倾斜感测器:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Tilt Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

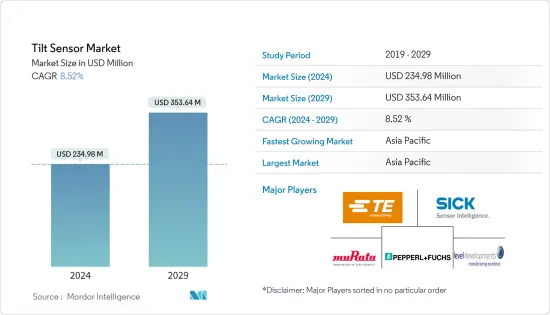

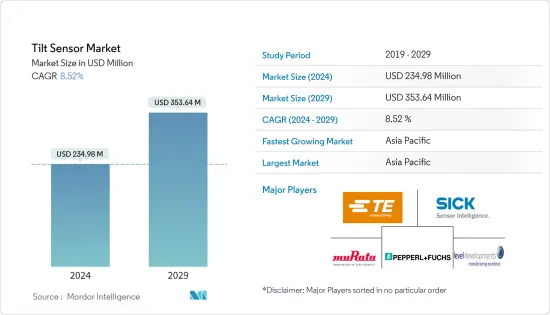

倾斜感测器市场规模预计到 2024 年为 2.3498 亿美元,预计到 2029 年将达到 3.5364 亿美元,预测期内(2024-2029 年)复合年增长率为 8.52%。

由于水平和垂直对准对于工厂和机械可靠运行的重要性和要求日益增加,用于移动机械的角位置检测和调平的倾斜感测器的应用变得越来越重要,在测量物体的角度时增加。重力。

主要亮点

- 随着水平和垂直对准对于工厂和机械可靠运行的重要性和要求的增加,用于角位置检测或移动机械调平的倾斜感测器的使用越来越多。倾斜感测器测量每个物体相对于重力的角度。

- 随着MEMS技术的发展以及感测器市场的小型化,倾斜感测器的采用水准逐年提高。倾斜感测器的需求正在扩展到各个领域,包括航太、汽车、通讯,甚至最近引起关注的游戏应用。

- 虽然最近全球经济放缓导致跨境投资减少,但房地产行业和政府建筑投资正在推动建筑业务的成长,拉动对施工机械和倾斜感测器等精密感测器的需求。产业范围不断扩大。

- 除了对基于MEMS的倾斜感测器的需求不断增加之外,基于力平衡原理的倾斜感测器的使用由于其高成本而受到限制。这是影响市场成长的因素之一。

- 在农业领域,工人安全仍是重中之重。拖拉机、起重机、载人升降机、越野车和升降平台等农用车辆必须安全操作,以避免操作员或旁观者受伤。

- 此外,随着时间的推移,这些产业对自主控制能力的依赖显着增加。这些特性,加上对车辆效率、安全性和操作员舒适度日益增长的需求,使得专注于防翻滚、平台调平和倾斜警告的传感器在这些行业中变得非常重要。

倾斜感测器市场趋势

汽车和交通领域需求显着成长

- 倾斜或倾斜感测器越来越多地应用于汽车中。它们主要与陀螺仪结合使用,以提高乘客安全和车辆效率。倾斜感测器在汽车中的应用包括多种应用,包括电子式驻煞车系统、翻滚检测、电子稳定性控制和怠速停止启动。

- 此外,随着汽车公司增加对车辆自动化的投资,ADAS 和惯性导航、坡道起步辅助和动态头灯调平等应用也不断扩大。例如,梅赛德斯开发了自动调平车头灯,可以适应道路弯道的坡度。同样,该公司也推出了用于这种自动化的倾斜感测器。

- 此外,汽车产业正在朝着自动驾驶汽车的发展方向发展。近年来,这些车辆的产量和普及迅速增加。例如,BMW于 2019 年 3 月运作了一家新工厂,生产自动驾驶电动车。瑞银也表示,到2030年,自动驾驶汽车的生产和销售收入预计将达到2,430亿美元。

- 此外,我们还看到对 MEMS 感测器的需求不断增加,以解决车辆倾斜角度问题并避免车辆因拖曳而被盗。现代汽车配备了倾斜检测系统。 MEMS 感测器具有 3 轴 MEMS加速感应器,用于测量相对于地面的倾斜角度,这使其成为比电解倾斜感测器更好的解决方案。

- 例如,2022年1月,新纳公司推出了INS401 INS和GNSS/RTK等感测器,这是用于自动驾驶车辆精确定位的承包解决方案。 INS401是新纳新产品系列的一部分,为各类车辆的高级驾驶辅助系统(ADAS)和自动驾驶解决方案的开发商和製造商提供高精度、高完整性的定位。

- 预计在预测期内,这些开发的进一步投资和扩张计划将继续,预计这将推动该行业对倾斜感测器的需求。

亚太地区预计将占据最大的市场占有率

- 由于该地区存在强大的半导体市场,以及基础设施、航太和国防以及通讯行业发展的投资大幅增加,预计亚太地区倾斜传感器市场将占据主导地位。 。中国、日本和韩国尤其大力推广。

- 此外,印度是推动该地区需求的主要经济体之一。该国的电力和水泥产业预计将支持金属和采矿业。该国的钢铁需求也有所增加。这种需求预计将推动建筑和采矿设备市场,从而导致对倾斜感测器等高精度感测器的需求增加。

- 据IBEF称,印度生产95种矿物,其中4种与燃料相关的矿物、10种金属矿物、23种非金属矿物、3种原子矿物和55种微量矿物。该国是第三大煤炭生产国和第四大铁矿石生产国。由于这些因素,该国是最大的采矿设备市场之一。

- 此外,近年来中国对感测器的需求翻了一番。未来十年产量和需求将持续成长。二十多年来,在工业生产、进出口、消费和建筑业资本投资稳定成长的拉动下,中国经济维持了快速成长。

- 中国也有许多智慧型手机和其他消费性电子产品的客户。因此,分析倾斜感测器最终用户行业的成长以推动感测器市场。

- 中国公司正致力于透过创新和供应新产品来扩大业务。例如,2020年11月,智川的测斜仪为印尼一座名为Martabe金矿的金矿提供动力。为了实现员工和承包的“零事故”,降低事故风险,Agincourt Resources实施了采用ZC感测器ZCTCX300无线远端测斜仪监测系统的Martabe金矿安全管理系统。

- 此外,日本为本地区和许多其他地区做出了重大贡献。这里是各种知名汽车、运输、航太、国防、采矿和建设公司的所在地。这是推动该地区市场成长的另一个因素。

倾斜感测器产业概况

倾斜感测器市场适度分散,许多大公司都提供产品。这些公司不断投资于建立策略合作伙伴关係和产品开发,以占领更多的市场占有率。下面列出了一些公司最近的进展。

- 2022 年 1 月 - ComNav Technology 宣布针对全球市场升级其 T300 和 T300 Plus GNSS接收器。这包括将两个接收器升级到新的 GNSS-K8 平台,并用 T300 Plus IMU 模组替换倾斜感测器。

- 2021 年 12 月 - 横滨国立大学开发了一种使用导电液体材料捕获数位二进位讯号的倾斜感测器。该设备能够使用直流开/关状态等二元讯号捕获倾斜讯息,使研究小组能够同时测量二维倾斜角度和方向。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

- 调查系统

- 二次调查

- 初步调查

- 对资料进行三角测量并产生见解

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 产业价值链分析

- 评估新型冠状病毒感染疾病(COVID-19)对市场的影响

第五章市场动态

- 市场驱动因素

- 对基于 MEMS 技术的倾斜感测器的需求不断增长

- 施工机械需求增加

- 市场挑战/限制

- 基于力平衡技术的高成本倾斜感测器

第六章市场区隔

- 按外壳材质

- 金属

- 非金属

- 依技术

- 力平衡

- MEMS

- 液体填充

- 按最终用户产业

- 采矿和建筑

- 航太和国防

- 汽车和交通

- 通讯

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- TE Connectivity

- Sick AG

- Murata Manufacturing Co., Ltd.

- Pepperl+Fuchs Vertrieb GmbH &Co. Kg

- Level Developments Ltd

- IFM Electronic GmbH

- Balluff GmbH

- Jewell Instruments LLC

- The Fredericks Company

- DIS Sensors Bv

- Gefran

第八章投资分析

第九章市场机会与未来趋势

The Tilt Sensor Market size is estimated at USD 234.98 million in 2024, and is expected to reach USD 353.64 million by 2029, growing at a CAGR of 8.52% during the forecast period (2024-2029).

As the importance and requirement of horizontal as well as vertical alignment are increasing for reliable operation of plants and machinery, the application of tilt sensors for angular position detection or leveling of mobile machinery is growing as they measure the angle of the respective object in relation to gravity.

Key Highlights

- The use of tilt sensors for angular position detection or leveling of mobile machinery is growing as the importance and requirement of horizontal and vertical alignment for the reliable operation of plants and machinery grows. Tilt sensors measure the angle of the respective object in relation to gravity.

- With the development of MEMS technology in the sensors market along with miniaturization, the adoption level has increased over the years for tilt sensors. The demand for tilt sensors has widened for application across the fields, including aerospace, automotive, telecommunication as well gaming applications, which has gained traction recently.

- Though the cross-border investments have diluted recently due to the global economic slowdown, the real estate industry and architectural investments by the governments are fueling the growth in the construction business, driving the demand for construction equipment and the application of precision sensors like tilt sensors in the industry has widened.

- In addition to the growing demand for MEMS-based tilt or inclination sensors, the use of tilt sensors based on the force balance principle has been constrained due to their expensive cost. This is one of the factors that have an impact on market growth.

- In the agricultural industry, worker safety remains a top priority. Agricultural vehicles such as tractors, cranes, man-lifts, off-road vehicles, and lift platforms must be operated safely to avoid injury to the operator or those nearby.

- Furthermore, these industries' reliance on the utilization of autonomous control functions has substantially increased over time. Due to these characteristics, as well as the rising demand for vehicle efficiency, safety, and operator comfort, sensors with a focus on tip-over protection, platform leveling, and tilt warnings have become important in these industries.

Tilt Sensor Market Trends

Demand from Automotive and Transportation Segment to Grow Significantly

- The application of tilt or inclination sensors is increasing in the automotive. These are being used along with gyroscopes primarily for improving passengers' safety and vehicle efficiency. The application of tilt sensors in the automotive are used in various applications, including electronic parking brakes, roll overdetection, electronic stability control, and idle stop-start, among others.

- Additionally, with the increasing investments by automotive companies for automation in vehicles, the application has widened for ADAS & inertial navigation, hill-start assistance, and dynamic headlight leveling. For instance, Mercedes has developed self-leveling headlights to adapt to the inclination of turns on the road. For the same, the company has deployed tilt sensors for this automation.

- Moreover, the automotive industry is moving with its step toward the development of autonomous vehicles. These vehicles' production and adoption rates have witnessed rapid growth in recent years. For instance, in March 2019, BMW started its new plant for manufacturing autonomous electric cars. UBS has also stated that AV production and sales revenue is expected to reach USD 243 billion by 2030.

- Additionally, it is also found that the demand for MEMS sensors will increase to solve the problems of tilt angles of vehicles and avoid car theft by towing; a tilt detection system equips in modern cars. The MEMS sensors become a better solution than Electrolytic fluid tilt sensors as these sensors have a 3-axis MEMS accelerometer used to measure the inclination angle concerning the ground.

- For instance, in January 2022, Aceinna Inc. announced the sensors such as INS401 INS and GNSS/RTK, a turnkey solution for autonomous vehicle precise positioning. The INS401 is part of Aceinna's new product portfolio that provides high accuracy and high integrity localization for developers and manufacturers of an advanced driver-assistance system (ADAS) and autonomy solutions for vehicles of all types.

- More investments and expansion plans in these developments are expected to continue in the forecast period, which is estimated to drive the demand for tilt sensors in the industry.

Asia Pacific Region is Expected to Hold the Largest Market Share

- The tilt sensor market in the Asia-Pacific region is expected to dominate the market due to a significant increase in the investments in the development of infrastructure, aerospace and defense, and telecom industry, along with the presence of a strong semiconductor market in the region especially driven by China, Japan, and South Korea.

- Additionally, India is one of the major economies driving the demand in the region. The country's power and cement industries are expected to aid the metals and mining sector; the country is also observing an increase in demand for iron and steel. The demand is expected to drive the construction and mining equipment market, resulting in growth in the demand for precision sensors like tilt sensors.

- According to IBEF, India produces 95 minerals, four fuel-related, ten metallic minerals, 23 non-metallic minerals, three atomic minerals, and 55 minor minerals. The country is the third-largest producer of coal and fourth in Iron ore. Owing to these factors, the country is among the largest mining equipment markets.

- Moreover, China's demand for sensors has multiplied over the last few years. Both production and demand will continue to grow over the next decade. The Chinese economy has maintained rapid growth for over 20 years, stimulated by a steady increase in industrial production, imports and exports, consumption, and capital investment in the construction industry.

- Also, China has a large audience of smartphones and other consumer electronics. Hence the growth in end-user industries of tilt sensors is analyzed to propel the sensors market.

- Companies in China are focusing on expanding their businesses by innovating new products and supplying them. For instance, in November 2020, Zhichuan's inclinometer empowered the Indonesian Gold Mine known as Martabe Gold Mine. To achieve "zero accidents" for employees and contractors and strive to reduce the risk of accidents, Agincourt Resources has a Martabe gold mine safety management system with a ZC sensor ZCTCX300 wireless remote inclinometer monitoring system.

- Further, Japan is making significant contributions and the region and many others; it is home to a variety of well-known automotive and transportation companies, aerospace and defense companies, and mining and construction companies. This is another factor driving market growth in the region.

Tilt Sensor Industry Overview

The market for tilt sensors is moderately fragmented because of the presence of many major companies in the market offering the products. These companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments by the companies are listed below.

- January 2022 - ComNav Technology announced an upgrade to the global market's T300 and T300 Plus GNSS receivers, including an upgrade to the new GNSS-K8 platform for both receivers and a replacement for the tilt sensor with the T300 Plus IMU module.

- December 2021 - Yokohama National University has developed a tilt sensor that uses a conductive liquid material that captures digital binary signals. The device was able to capture tilt information using binary signals such as DC on/off status, allowing the group to simultaneously measure tilt angle and orientation in two dimensions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation And Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand For Mems Technology-based Tilt Sensors

- 5.1.2 Rising Demand For Construction Equipment

- 5.2 Market Challenges/restraints

- 5.2.1 High Cost Of Tilt Sensors Based On Force Balance Technology

6 MARKET SEGMENTATION

- 6.1 By Housing Material Type

- 6.1.1 Metal

- 6.1.2 Non-metal

- 6.2 By Technology

- 6.2.1 Force Balance

- 6.2.2 MEMS

- 6.2.3 Fluid Filled

- 6.3 By End-user Vertical

- 6.3.1 Mining and Construction

- 6.3.2 Aerospace and Defense

- 6.3.3 Automotive and Transportation

- 6.3.4 Telecommunication

- 6.3.5 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Rest of the World

- 6.4.4.1 Latin America

- 6.4.4.2 Middle-East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TE Connectivity

- 7.1.2 Sick AG

- 7.1.3 Murata Manufacturing Co., Ltd.

- 7.1.4 Pepperl+Fuchs Vertrieb GmbH & Co. Kg

- 7.1.5 Level Developments Ltd

- 7.1.6 IFM Electronic GmbH

- 7.1.7 Balluff GmbH

- 7.1.8 Jewell Instruments LLC

- 7.1.9 The Fredericks Company

- 7.1.10 DIS Sensors Bv

- 7.1.11 Gefran