|

市场调查报告书

商品编码

1438477

数位印刷:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Digital Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

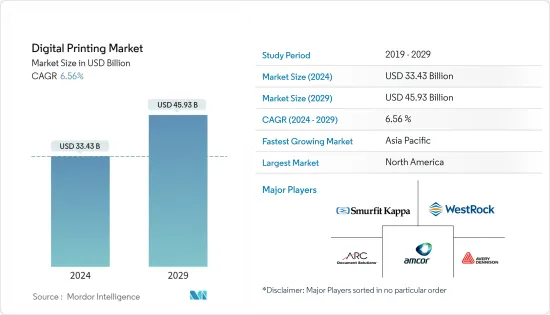

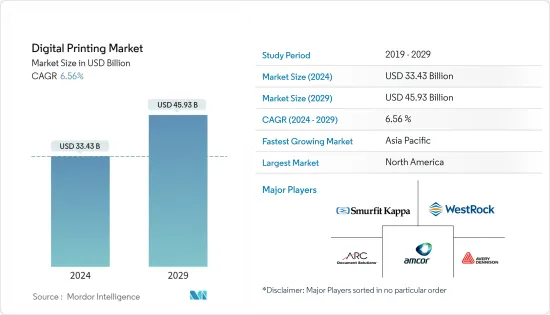

数位印刷市场规模预计2024年为334.3亿美元,预计到2029年将达到459.3亿美元,在预测期内(2024-2029年)复合年增长率为6.56%增长。

数位印刷是标牌行业成长最快的领域之一。从它现在生产的令人难以置信的规模就可以看出它的崛起。无论讯息或产品,尺寸正在成为广告的重要趋势。

主要亮点

- 印刷製造效率的显着提高、高效生产以及对供应链管理的更加重视(包括更好的需求预测)减少了整个印刷市场的浪费。数位印刷技术的进步使得最大限度地减少浪费并保持高印刷品质成为可能。

- 与固态油墨印刷和胶印等传统印刷技术相比,数位印刷的先进技术包含更温和的溶剂和有害化学物质。因此,印刷电子市场对数位印刷解决方案的需求不断增长,并且越来越注重环保印刷和经济高效的生产。

- 商业印刷作为一种重要的应用,正在经历一场转型和结构性的变化,因为从传统印刷方式即时过渡到数位化是很困难的。这仍然是一种小众方法,需要列印较短/客製化的批次,因此预计列印成本会更高。

- 许多公司投资了多种解决方案、扩张活动、合作伙伴关係和协作活动,以加强其市场地位并扩大其在全球的影响力。例如,数位影像解决方案公司佳能美国公司于 2022 年 4 月发布了 PRISMAcolor Manager 解决方案。此解决方案可协助使用者使用相容印表机评估和监控列印品质。它还向用户显示列印颜色与任何普遍接受的商业行业或用户内部列印规格的比较。作为云端基础的解决方案,它易于部署,并允许用户随着时间的推移追踪和比较结果。

- 人工智慧、机器学习、物联网和资料分析的现代进步使服务更加个人化。数位印刷集成为大批量订单提供了个人化印刷的优势。然而,成本因素仍然是一个主要障碍。而且,高投资制约了数位印刷业的整体市场成长。这些成本包括购买价格、支援费用、安装费用(如果适用)、维护费用、墨水和其他消耗品价格。

数位印刷市场趋势

包装产业预计将显着成长

- 包装行业看到了数位印刷的巨大应用空间。不同的包装方法和技术引入不同的印刷技术,以满足不同产品对特定类型品牌的需求。一些包装行业包括纸箱、标籤、金属包装、硬质塑胶包装、瓦楞包装和软包装。

- 瓦楞纸箱和展示架製造处于加工行业的数位化前沿。数位印刷可以在印前或印后生产中取代平版印刷或弹性凸版印刷,但每种印刷都需要不同的配置。在过去的十年中,高速、单一途径印刷机取得了进步,其配备了强大的送纸器,每小时可以处理数千张纸,实现了比平板印刷机更高的吞吐量。大型喷墨机的优点之一是它们可以比最大的平版印刷机大得多。一些最受欢迎的零售商品(例如大型电视和割草机)的盒子可能需要层压两张或更多张平版纸以覆盖整个区域。然而,一台知名的数位印刷机就可以完成这一切。

- 为了在所研究的市场中保持竞争力,供应商正在投资数位印刷机以提高生产能力。例如,瓦楞纸加工企业Complete Design & Packaging (CDP)于2022年4月将单一途径喷墨数位印刷技术的投资增加了一倍,成为一家负责产业创新和成长的公司。这家总部位于北卡罗来纳州康科德的公司正在推出 Electronics For Imaging, Inc. 推出的第二款超高速 Nozomi 直接到瓦楞纸解决方案 - 新型 EFI Nozomi 14000 LED 数位印刷机。

- 硬质塑胶包装也受到具有环保意识的客户的欢迎。因此,UV LED 印表机还有一个额外的好处,那就是对品牌来说是一种非常环保的工艺。客户的另一个好处和潜在利润成长是能够轻鬆地将可变资料、序列化、条码、QR 码或这些的组合合併到他们的产品中。许多品牌正在硬质塑胶包装上使用数位印刷,以增加产品吸引力并创造竞争优势。

- 软包装市场还需要数位印刷技术来满足不断增长的需求。由于新的收购,市场预计将在预测期内实现显着成长。例如,2022年4月,颇具影响力的印刷包装解决方案供应商Fortis Solutions收购了加拿大公司Profecta Labels。 Profecta Labels 生产用于标籤和软包装印刷的弹性凸版印刷和数位解决方案。此次收购符合富通加强产品供应和足迹以更好地服务客户的策略。

亚太地区可望成为成长最快的市场

- 中国印刷业对资料库新经营模式、数位平台解决方案和端到端数位化价值创造链充满热情和兴趣。数位印刷的普及将包装设计带到了最前沿,本地设计师现在可以在线上存取超过 12,000 种折迭纸盒设计。

- 企业正在购买数位印刷机,因为印刷过程中的步骤更少。因此,可以快速交货最终产品并提高产能。例如,2021年10月,中国印刷公司番茄云科技订购了10台新的Fujifilm Jet Press 750S数位喷墨机。该公司已在其设施中安装了四台 Jet Press 750S 印刷机,预计明年还将安装 10 台,到年终,该公司可能会成为全球最大的 Jet Press 客户之一。 6月,FUJIFILM与番茄云科技在China PRINT 2021举行合作签约仪式。

- 新印字头于2021年下半年(至2022年3月)推出。目前有五个不同系列的喷墨头,允许在数位印刷方面有更多的应用。为了避免喷嘴附近水分蒸发造成的潜在问题,D3000-A1R 允许墨水在喷嘴处循环。循环使列印更加稳定,并让工程师在设计设备和油墨时有更大的迴旋余地。这些印表机头具有 1200 dpi 解析度和高频驱动,为数位印表机提供与传统类比印表机相同的影像品质和列印速度。对于多头阵列,无需改变头部位置。

- 此外, 年终年3月,DS Printech China将推出一个响应不断增长的需求的新主题专区,永续性和效率成为数位和网版印刷行业参与者关注的焦点。作为专注于数位和网版印刷行业的重要平台,博览会继2020年在深圳举办第一届之后,将在华南地区举办。将于11月16日至18日于广州中国进出口商品交易会举行。 ,2022 年。

- 用于可变资料印刷的数位印刷设备已经提供了不同类型的大部分功能。黑白或彩色列印、不同规格、不同尺寸列印材料的相关印表机的存在表明市场相对活跃。富士全录和柯达Onein等一些大公司提供完整的数位印刷产品、软体处理以及整个数位印刷流程的管理。相较之下,国内确定的主要设备供应商有富士全录、惠普、柯达曼能、Epson、赛康、Canon、佳能、Ricoh、Konica Minolta、OKI。我们观察到中国的多项进展尚未推出这些最新产品。

数位印刷业概况

数位印刷市场由多家大公司组成,竞争激烈。目前,就市场占有率而言,少数主要企业占据市场主导地位。两家公司都提供专业产品并利用策略合作倡议来提高市场占有率和盈利。在市场上经营的公司更喜欢併购新兴企业,以增强其产品能力并改善数位印刷设备提供的市场组合。

- 2022 年 2 月 -Canon在其位于芬洛的工厂推出了一座新的高度自动化的水性聚合物墨水製造工厂,以满足全部区域喷墨生产对水性聚合物墨水不断增长的需求。占地 1,500平方公尺的场地经过优化,配备了最新的油墨生产设备和自动化水平,以提高效率,始终如一地提供高品质的水性聚合物 CMYK 油墨并最大限度地减少浪费。

- 2022年1月-Smurfit Kappa集团宣布将在巴西投资超过3,300万美元,扩大其福塔雷萨工厂的产能,以满足对创新和永续包装不断增长的需求。该公司将部署多台高阶印表机,以提供电商包装所需的高精度和品质。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 技术简介

- 评估新型冠状病毒感染疾病(COVID-19)对市场的影响

第五章市场动态

- 市场驱动因素

- 包装和纺织业的成长以及对数位广告的需求不断增长

- 使用数位印刷机降低印刷成本

- 市场限制因素

- 研发活动投资与额外资本支出

第六章市场区隔

- 按印刷工艺

- 电子摄影

- 喷墨

- 按用途

- 图书

- 商业印刷

- 包装

- 标籤

- 纸板包装

- 纸盒

- 软包装

- 硬质塑胶包装

- 金属包装

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 俄罗斯

- 波兰

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Smurfit Kappa Group PLC

- Westrock Company

- Southland Printing Company Inc.

- IronMark Inc.

- Xeikon NV

- ARC Document Solutions LLC

- Avery Dennison Corporation

- Multi Color Corporation

- Amcor PLC

- Sato America

- DS Smith PLC

- Mondi PLC

- CPI Corporate

- Core Publishing Solutions

- Command Companies

- Quad/Graphics Inc.

- Walsworth Publishing Company

第八章投资分析

第九章市场机会与未来趋势

The Digital Printing Market size is estimated at USD 33.43 billion in 2024, and is expected to reach USD 45.93 billion by 2029, growing at a CAGR of 6.56% during the forecast period (2024-2029).

Digital printing is one of the fastest-growing segments of the sign industry. Its rise can be seen in the incredible size of what can be produced now. Whatever the message or product, size has become a significant trend in advertising.

Key Highlights

- Significant improvements in print manufacturing efficiency, time-efficient production, and enhanced focus on supply chain management, such as better demand forecasting, have reduced the print market's overall waste. Technological advancements favoring digital printing have enabled waste minimization, maintaining high print quality.

- The advanced technology of digital printing includes mild solvents and less-harmful chemicals than the ones used in conventional printing technologies, like solid ink printing and offset printing. Hence, the demand for digital printing solutions is growing in the printed electronics market, increasing the focus on green printing and cost-effective production.

- Commercial printing is witnessing transitional and structural changes as a significant application, as the immediate transition from conventional methods of print to digital is challenging. Since it is still a niche method requiring print of shorter/customized batches, the printing cost is expected to take a toll.

- Various companies have been investing in multiple solutions, expansion activities, partnerships, and collaboration activities, to enhance their market position, to expand their presence across the world. For instance, in April 2022, Canon USA, Inc., a digital imaging solutions company, announced the PRISMAcolor Manager solution. The solution can assist users in evaluating and monitoring print quality using compatible printers. It also shows users how their printed color compares to either one of the accepted commercial industries or a user's internal printing specifications. Being a cloud-based solution, it is easy to deploy and allows users to track and compare results over time.

- The latest advancements, such as AI, machine learning, IoT, data analytics, etc., have personalized offerings to a great extent. The convergence in digital printing enables superiority in print personalization for large-volume orders. However, the cost factor remains a big hurdle. Additionally, high-priced investment restrains the overall market growth of the digital printing industry. These costs included the purchase price, support costs, installation fees (if applicable), maintenance, and the price of ink and other consumables.

Digital Printing Market Trends

Packaging Segment Expected to Witness Significant Growth

- The packaging industry sees vast scope for implementing digital printing. Different packaging methods and technologies to cater to varying product demands for specific types of branding deploy different printing technologies. Some packaging industries include cartons, labels, metal packaging, rigid plastic packaging, corrugated packaging, and flexible packaging.

- Corrugated boxes and display making have been at the forefront of digital in the converting sectors. Digital printing can replace the litho or flexo for either pre-print or post-print production, although each requires different configurations. The past decade witnessed the advancement in high-speed single-pass inkjet presses with robust sheet feeders for much higher throughputs than flatbeds could ever manage, which could handle thousands of sheets per hour. One advantage of large inkjets is that they can be much larger than even the largest litho press. Boxes for the most prominent retail goods, such as big televisions, lawnmowers, and so on, might need two or more litho sheets to be laminated to cover the whole area. However, a prominent digital press can do it in one.

- Vendors are increasing their production capacity by investing in the digital press to remain competitive in the market studied. For instance, in April 2022, corrugated converting business Complete Design & Packaging (CDP) doubled its investment in the single-pass inkjet digital print technology that has helped make it an industry innovation and growth player. The Concord, N.C.-based company is installing its second ultra-high-speed Nozomi direct-to-corrugated solution from Electronics For Imaging, Inc.- a new EFI Nozomi 14000 LED digital press.

- Rigid plastic packaging is also gaining popularity among environment-conscious customers; thus, the UV LED printer has the added benefit of being an extremely green process for brands. Another benefit to the customer and a potential profit booster is its ability to incorporate variable data easily, serialization, barcodes, QR codes, or any combination of these to their products. Many brands use digital printing on rigid plastic packaging to increase their product's appeal and create a competitive point.

- The flexible packaging market also invites digital printing technologies to share the increasing demand. With the new acquisitions, the market is expected to cater a significant growth during the forecast period. For instance, in April 2022, high-impact printed packaging solutions provider Fortis Solutions acquired Canadian company Profecta Labels. Profecta Labels manufactures flexographic and digital solutions for labels and flexible packaging printing. The acquisition aligns with Fortis' strategy to strengthen its product offerings and locations to serve its customer better.

Asia-Pacific Promises to be the Fastest Growing Market

- The Chinese printing industry is enthusiastic and interested in new, data-based business models, digital platform solutions, and end-to-end digitized value-creation chains. The digital printing penetration has enabled local designers to have online access to over 12,000 folding carton designs, putting the designing of packaging at the forefront of adoption.

- Companies are purchasing digital presses due to the fewer steps in the printing process. As a result, the final product can be delivered quickly, enabling the company to increase its production capacity. For instance, in October 2021, Tomato Cloud Technology Co., Ltd, a Chinese printing company, ordered ten new Fujifilm Jet Press 750S digital inkjet machines. The company already has four Jet Press 750S presses at its facilities, and with another ten in the pipeline within the following year, it will be one of the world's largest Jet Press customers by the end of 2022. In June, Fujifilm and Tomato Cloud Technology had a signing ceremony at China PRINT 2021.

- The new printheads were made available in the second half of the fiscal year 2021. (ending March 2022). Inkjet heads currently come in five different series, allowing for more uses in digital printing. To avoid potential concerns caused by moisture evaporation near the nozzles, the D3000-A1R allows ink circulation at the nozzle level. Circulation makes printing more stable and gives engineers more leeway when designing equipment and ink. These printheads enable digital printers to achieve picture quality and print speeds comparable to conventional analog printers, thanks to their 1200-dpi resolution and high-frequency driving. In multi-head arrays, there is also no need to alter the position of the heads.

- Moreover, in March 2022, new themed zones addressing the growing demands debuted at DS Printech China at the end of this year, with sustainability and efficiency becoming key focuses among digital and screen-printing industry participants. The expo, a prominent platform dedicated to the digital and screen-printing industries, will be presented in South China after its initial edition in Shenzhen in 2020. It will take place at the China Import and Export Fair Complex in Guangzhou from November 16 to 18, 2022.

- The digital printing equipment across variable data print has served most functions across varying types. The presence of allied printers to print black and white or color, various specifications, and sizes across various printing materials hint at a relatively active market. Some large companies have been offering complete products, such as Fuji Xerox, Kodak Wanyin, and other companies, for digital printing, software processing, and entire digital printing process management. In contrast, the main equipment suppliers identified in the country are Fuji Xerox, HP, Kodak Wanyin, Epson, Xeikon, Nipson, Canon, Ricoh, and Konica Minolta, OKI. Multiple developments have been observed which have yet to launch those newest offerings in China.

Digital Printing Industry Overview

The digital printing market consists of several major players and is highly competitive. Some significant players currently dominate the market in terms of market share. The companies offer specialized products, increasing their market share and profitability by leveraging strategic collaborative initiatives. The companies operating in the market prefer mergers and acquisitions of start-ups to strengthen their product capabilities and improve the served market portfolio on digital printing devices.

- February 2022 - Canon launched a new, highly automated manufacturing facility for water-based polymer inks at its site in Venlo to meet the growing demand for water-based polymer inks for its inkjet production across the regions. With efficiency, the 1500 m2, along with the most up-to-date ink manufacturing equipment and levels of automation, are optimized to consistently deliver high-quality water-based, polymer CMYK inks and minimize waste.

- January 2022 - Smurfit Kappa Group announced an investment of more than USD 33 million in Brazil to expand its plant's capacity in Fortaleza to meet the growing demand for innovative and sustainable packaging. The company will install several high-end printers to provide the high precision and quality required for eCommerce packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Packaging and Textile Industries and Rising Demand for Digital Advertisements

- 5.1.2 Reduction in Per Unit Cost of Printing with Digital Printers

- 5.2 Market Restraints

- 5.2.1 Investment in R&D Activities and Additional Capital Expenditure

6 MARKET SEGMENTATION

- 6.1 By Printing Process

- 6.1.1 Electrophotography

- 6.1.2 Inkjet

- 6.2 By Application

- 6.2.1 Books

- 6.2.2 Commercial Printing

- 6.2.3 Packaging

- 6.2.3.1 Labels

- 6.2.3.2 Corrugated Packaging

- 6.2.3.3 Cartons

- 6.2.3.4 Flexible Packaging

- 6.2.3.5 Rigid Plastic Packaging

- 6.2.3.6 Metal Packaging

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Netherlands

- 6.3.2.7 Russia

- 6.3.2.8 Poland

- 6.3.2.9 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Smurfit Kappa Group PLC

- 7.1.2 Westrock Company

- 7.1.3 Southland Printing Company Inc.

- 7.1.4 IronMark Inc.

- 7.1.5 Xeikon NV

- 7.1.6 ARC Document Solutions LLC

- 7.1.7 Avery Dennison Corporation

- 7.1.8 Multi Color Corporation

- 7.1.9 Amcor PLC

- 7.1.10 Sato America

- 7.1.11 DS Smith PLC

- 7.1.12 Mondi PLC

- 7.1.13 CPI Corporate

- 7.1.14 Core Publishing Solutions

- 7.1.15 Command Companies

- 7.1.16 Quad/Graphics Inc.

- 7.1.17 Walsworth Publishing Company