|

市场调查报告书

商品编码

1438481

溅镀设备阴极:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Sputtering Equipment Cathode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

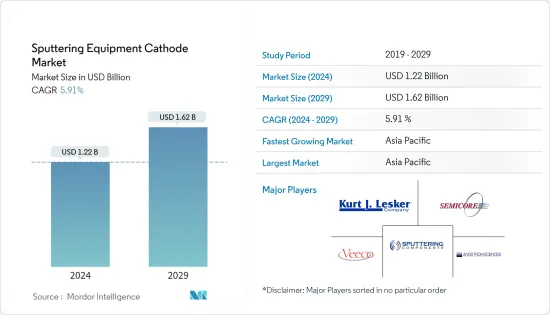

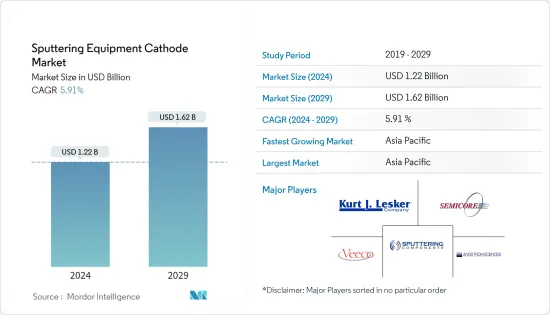

溅镀设备阴极市场规模预计2024年为12.2亿美元,预计到2029年将达到16.2亿美元,在预测期内(2024-2029年)增长5.91%,以复合年增长率增长。

在快速成长的半导体产业中,溅镀在涂层部件中的应用不断增加,预计将成为预测期内推动此类设备需求的主要因素之一。

主要亮点

- 人工智慧在航太和电子等各种最终用户行业的出现预计将增加对半导体的需求并推动市场成长。此外,越来越多地使用半导体在游戏中实现虚拟实境预计将进一步推动市场成长。

- 随着公司转向利用下一代製造方法,半导体製造公司越来越多地采用磁控溅镀技术等製程来提高半导体效率和品质。

- 磁控溅镀技术具有高沉积速率、高纯度薄膜、非常高的薄膜附着力、出色的台阶和小特征覆盖能力、能够涂覆热敏基板、易于自动化、能够涂覆大面积基板。优点包括高均匀性且易于涂布。它可以溅镀金属、合金、化合物等。这些优点导致磁控溅镀技术在半导体溅镀的应用越来越多。

- 技术进步以及半导体製造中新技术和替代技术研发投资的增加将带来诸如改进性能、提高生产率以及减少物理气相淀积(PVD)方法的使用等好处。这会影响正在研究的市场。

- 2020 年初,冠状病毒感染疾病(COVID-19) 在全球范围内的爆发严重扰乱了市场的供应链和产品生产。由于劳动力短缺,各地许多包装和检验工厂纷纷缩小规模甚至关闭。手术。对于依赖此类后端包和测试能力的公司来说,这也是一个瓶颈。

- 此外,领先公司加大力度,包括持续投资研发以开发新的製造工艺,预计将进一步提高製程产量。

溅镀设备阴极市场趋势

半导体使用的增加预计将推动市场发展

- 对半导体的需求是由消费性电器产品、工业工具和设备、汽车产品以及网路和通讯产品不断增长的需求所推动的。 ETC。这些产业受到无线技术 (5G)、人工智慧和自动化等技术转型的启发。

- 随着物联网(IoT)设备数量趋于增加,预计半导体产业将被迫投资该设备以增强产能。

- 例如,根据半导体製造设备国际公司(SEMI)最近的预测,到2025年,用于半导体应用的硅晶圆出货量预计将超过176亿平方英吋(MSI),高于2019年的11,810 MSI。

- 在汽车产业,每辆车的半导体产品数量不断增加,自动驾驶汽车和电动车等趋势正在增加对半导体製造的需求。

- 物联网应用数量的不断增加预计将增加对半导体的需求。此外,随着5G网路的发展,无线通讯产业也有望成长。第五代网路也为消费者提供了升级行动电话和设备以推动全球半导体应用的潜力。

- 由于全球各种设备中半导体产量的增加,市场在预测期内将出现积极成长。

预计亚太地区将占据最高市场占有率

- 亚太地区预计将成为溅镀设备的最大市场,这主要是由于中国、韩国、印度和台湾等国家半导体产量的增加。此外,太阳能电池和医疗设备产业对 PVD 涂层的需求不断增加,预计也将在预测期内积极推动市场成长。

- 作为世界製造地的中国预计将在预测期内透过增加各种产品(特别是电子产品和汽车)的产量来推动市场。汽车工业也使用溅镀设备来建构各种涂层部件。电动/混合动力汽车产量的增加预计也会对市场产生影响。

- 日本在半导体产业中占有重要地位,是多家重要IC晶片组製造商和电子产业的所在地。根据WSTS统计,2021年日本半导体产业收益为436.9亿美元,2022年达到479.3亿美元,预计将持续稳定成长。

- 此外,中国和日本等国家机器人产业的技术创新预计将增加对半导体涂料的需求。机器人产业需求的增加预计将支持半导体晶片需求的增加。

- 印度拥有强大的半导体生态系统,全球大多数领先的半导体公司都在印度设立了研发中心。然而,由于政府的扶持政策,国内半导体製造设施并没有太大发展。研究的市场存在重大机会。

- 印度电子和半导体协会表示,到2025年,该地区半导体元件市场预计价值323.5亿美元,复合年增长率为10.1%(2018-2025年)。这表明该国电子产业的活动潜力很大,这为所研究的市场带来了一些机会。

- 2021年1月,产业通商资源部宣布,2020年韩国ICT出口和进口分别成长3.8%和3.9%,达1836亿美元和1126亿美元。政府在 2020 年也报告:该国半导体出口总额达1002.5亿美元。 2020年上半年出口下降1.5%。但下半年成长约12.3%。其中,系统晶片出口成长17.8%,达到303亿美元,创历史新高。记忆体晶片出口成长1.5%,达639亿美元。

溅镀设备阴极产业概况

由于向国内和国际市场供应设备的各种领先公司的存在,溅镀设备阴极市场竞争非常激烈。由于目前很少有公司主导市场,因此市场似乎正在整合。市场上的主要企业正在采取产品创新和合作伙伴关係等策略来扩大影响力并在竞争中保持领先地位。市场上主要企业包括 Semicore Equipment, Inc.、Sputtering Components, Inc.、Angstrom Sciences Inc. 和 Veeco Instruments, Inc.。

- 2022 年 1 月 - Kurt J. Lesker Company (KJLC) 宣布透过资产购买协议收购了 KDF Electronics & Vacuum Services (KDF Technologies) 的几乎所有资产。从 2022 年初开始,KDF Electronics &Vacuum Services 将更名为 KDF Technologies。 KDF 将继续独立于 KJLC 运营,同时利用一些共用服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19感染疾病对市场的影响

第五章市场动态

- 市场驱动因素

- 半导体应用的兴起

- 磁控溅镀技术等技术进步

- 市场限制因素

- 热沉淀等替代技术的兴起

第六章市场区隔

- 副产品

- 线性

- 圆形的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Kurt J. Lesker Company

- Veeco Instruments, Inc.

- Semicore Equipment Inc.

- Impact Coatings AB

- AJA International Inc.

- Soleras Advanced Coatings

- Sputtering Components, Inc.

- KDF Technologies

- Angstrom Sciences, Inc.

- Angstrom Engineering Inc.

第八章投资分析

第九章市场机会与未来趋势

The Sputtering Equipment Cathode Market size is estimated at USD 1.22 billion in 2024, and is expected to reach USD 1.62 billion by 2029, growing at a CAGR of 5.91% during the forecast period (2024-2029).

The increasing applications of sputtering in the coating of components in the rapidly growing semiconductor industry is expected to be one of the primary factors that will drive the demand for these types of equipment over the forecast period.

Key Highlights

- The emergence of Artificial Intelligence across various end-user industries, such as aerospace and electronics, is expected to increase the demand for semiconductors, which will drive the market's growth. Moreover, the increasing use of semiconductors for implementing virtual reality in gaming is further expected to drive market growth.

- As companies move toward leveraging next-generation manufacturing methods, the processes such as magnetron sputtering technology are increasingly adopted by semiconductor manufacturing companies for enhanced efficiency and quality of semiconductors.

- Magnetron sputtering technology offers advantages such as high deposition rates, high purity films, extremely high adhesion of films, excellent coverage of steps and small features, ability to coat heat-sensitive substrates, ease of automation, high uniformity on large-area substrates, ease of sputtering any metal, alloy, or compound, and many more. These advantages lead to increased use of magnetron sputtering technology in the sputtering of semiconductors.

- The advancement in technology and increased investment in the research and development of new and alternate techniques in the manufacturing of semiconductors provide advantages such as enhanced performance, increased production rate, and many more, reducing the use of physical vapor deposition (PVD) methods. This impacts the market studied.

- The outbreak of the COVID-19 pandemic across the world significantly disrupted the supply chain and production of products in the market during the initial phase of 2020. Due to labor shortages, many of the package and testing plants in the various region reduced or even suspended operations. This also created a bottleneck for companies that depend on such back-end packages and testing capacity.

- Furthermore, the increased number of initiatives taken by major players, such as continuous investments in R&D to develop new manufacturing processes, is further expected to enhance the volume output of the process.

Sputtering Equipment Cathode Market Trends

Rise in the Application of Semiconductors is Expected to Drive the Market

- The demand for semiconductors is being driven by the increase in demand for consumer electronics, industrial tools & equipment, automotive products, networking, and communication products. And many more. These industries have been inspired by technology transitions such as wireless technologies (5G), Artificial intelligence, automation, etc.

- The trend of increasing numbers of Internet of Things (IoT) devices is expected to force the semiconductor industry to invest in this equipment for enhanced production capabilities.

- For instance, according to the recent forecasts of Semiconductor Equipment and Materials International (SEMI), silicon wafer shipments for semiconductor applications are expected to exceed 17,600 million square inches (MSI) by 2025 from 11,810 MSI in 2019.

- In the automotive industry increasing number of semiconductor products per vehicle and trends like autonomous and electric vehicles are increasing the demand for semiconductor manufacturing.

- The increase in applications of the Internet of Things is expected to boost the demand for semiconductors. Moreover, the wireless communications sector is expected to grow with the growth in 5G networks. Fifth-generation networks also indicate the likelihood of consumers upgrading their handsets/devices to drive applications of semiconductors globally.

- With the increasing production of semiconductors in various devices worldwide, the market will witness positive growth over the forecast period.

Asia-Pacific is Expected to Occupy Highest Market Share

- The Asia-Pacific region is expected to be the largest market for sputtering equipment, primarily owing to the increased semiconductor production in countries like China, South Korea, India, and Taiwan. Moreover, the increasing demand for PVD coatings from solar photovoltaic cells and the medical equipment industry is also expected to positively push the market growth during the forecast period.

- China, a global manufacturing hub, is expected to witness an increase in the production of various products such as electronics and automotive, among others, over the forecast period, which is expected to drive the market. Also, the automotive industry comprises various coated components using sputtering equipment. Also, the growth in the production of electric/hybrid vehicles is expected to impact the market.

- Japan holds a significant position in the semiconductor industry as it is home to some of the important IC chipset manufacturers and the electronics industry. According to WSTS, the semiconductor industry revenue in Japan for 2021 stood at USD 43.69 billion, and it is expected to reach USD 47.93 billion in 2022 and grow steadily in the future.

- Furthermore, technological innovations in the robotics industry in countries like China and Japan are projected to boost the demand for semiconductor coatings. The increasing demand for semiconductor chips is expected to be supported by the increased demand from the robotics industry.

- The Indian semiconductor ecosystem is robust, with most major global semiconductor players having their R&D centers in India. However, with supportive government policies, semiconductor manufacturing facilities are not significantly developed in the country. There are massive opportunities for the studied market.

- The India Electronics and Semiconductor Association stated that the semiconductor component market in the region is expected to be worth USD 32.35 billion by 2025 while witnessing a CAGR of 10.1% (2018 -2025). This indicates high potential activity in the country's electronics sector, leading to several opportunities for the market studied.

- In January 2021, the Ministry of Trade, Industry, and Energy announced that South Korea's ICT exports and imports increased by 3.8% and 3.9% to USD 183.6 billion and USD 112.6 billion, respectively, in 2020. The government also reported that in 2020, the country's semiconductor exports totaled USD 100.25 billion. The exports decreased by 1.5% in the first half of 2020; however, they increased by around 12.3% in the second half. Especially, system-on-chip exports increased by 17.8% to an all-time high of USD 30.3 billion. Memory chip exports increased by 1.5% to USD 63.9 billion.

Sputtering Equipment Cathode Industry Overview

The Sputtering Equipment Cathode Market is highly competitive owing to the presence of various large players supplying equipment in domestic and international markets. The market appears to be consolidated as few of the players currently dominate the market. Major players in the market are adopting strategies like product innovation and partnerships to expand their reach and stay ahead of the competition. Some of the major players in the market are Semicore Equipment, Inc., Sputtering Components, Inc., Angstrom Sciences Inc., and Veeco Instruments, Inc., among others.

- January 2022 - Kurt J. Lesker Company (KJLC) has announced that it has substantially acquired all of the KDF Electronics & Vacuum Services (KDF Technologies) assets through an asset purchase agreement. From the beginning of 2022, KDF Electronics & Vacuum Services will become known as KDF Technologies. KDF will continue to operate independently of KJLC while leveraging some shared services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assesment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in the Applications of Semiconductors

- 5.1.2 Advancement in Technology Such as Magnetron Sputtering Technology

- 5.2 Market Restraints

- 5.2.1 Rise of Alternative Technologies Such as Thermal Evaporation

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Linear

- 6.1.2 Circular

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia-Pacific

- 6.2.4 Rest of the World

- 6.2.4.1 Latin America

- 6.2.4.2 Middle-East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kurt J. Lesker Company

- 7.1.2 Veeco Instruments, Inc.

- 7.1.3 Semicore Equipment Inc.

- 7.1.4 Impact Coatings AB

- 7.1.5 AJA International Inc.

- 7.1.6 Soleras Advanced Coatings

- 7.1.7 Sputtering Components, Inc.

- 7.1.8 KDF Technologies

- 7.1.9 Angstrom Sciences, Inc.

- 7.1.10 Angstrom Engineering Inc.