|

市场调查报告书

商品编码

1438483

塑胶薄膜:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Plastic Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

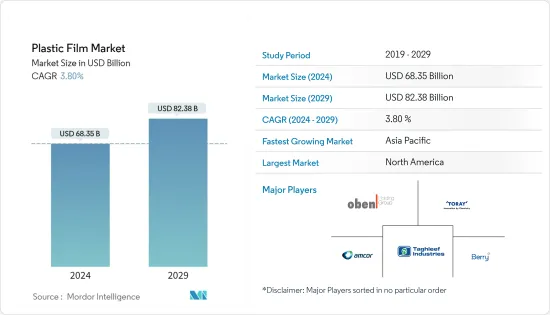

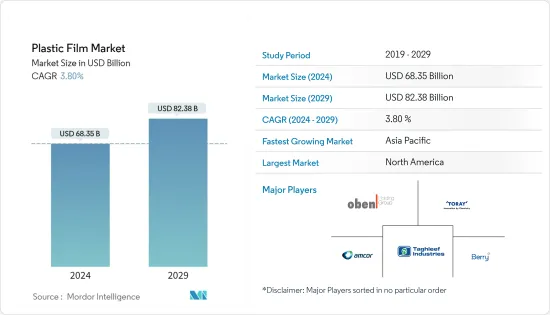

2024年塑胶薄膜市场规模预计为683.5亿美元,预计到2029年将达到823.8亿美元,在预测期内(2024-2029年)复合年增长率为3.80%增长。

根据软质包装委託委託的哈里斯民调的资料显示,83%的品牌商目前使用软质包装。这将推动市场成长。

主要亮点

- 在过去的几年中,包装食品和饮料行业在全球范围内经历了显着的扩张。加工食品产业受到多个宏观因素的推动,包括生活方式的演变、城市人口的增加、新兴市场经济活动的增加以及全球电子零售的渗透。与其他硬质包装材料相比,塑胶薄膜具有多种优势,因为它们重量轻、具有良好的阻隔性能,最重要的是可回收和可重复使用。

- 此外,对快速健康早餐产品的稳定需求预计将推动 HDPE 薄膜市场的成长。 HDPE 薄膜具有防潮性能,适合包装早餐用麦片谷类,尤其是谷物片。此外,随着电子商务的成长,塑胶薄膜和保鲜膜等保护性包装材料也出现了显着成长。预计这一趋势将支持未来的市场发展。

- 然而,对塑胶回收的更严格监管预计将阻碍未来市场的成长。市场上可用的替代品可能会阻碍市场发展。英国和美国有许多政府和非政府组织致力于支持包装和非包装产业禁止使用塑胶。在美国,一些政府和非政府组织也在努力阻止使用塑胶片和薄膜来包装有机产品。

- 该业务的成长主要受到食品和饮料、药品、个人和家用产品等关键应用产业规模不断扩大以及有组织的电子零售世界渗透率不断提高的推动。

- 冠状病毒感染疾病(COVID-19)大流行已将世界各地的工业和製造业推入未知的营运环境。政府对可以聚集在一个地方的人数的限制对每个部门都产生了严重影响。例如,製造业就受到病毒的严重打击。封锁期间,汽车、金属加工、石油和天然气、电子和航太产业的生产和工厂运作暂时停止。

- 大多数公司依赖中国的原料供应。因此,供应链中断也对工业生产产生重大影响。全球经济因疫情而萎缩。

塑胶薄膜市场趋势

各行业的高需求提供了成长潜力

- 强大的密封强度、弹性和真空整理是对塑胶薄膜产业发展产生有利影响的一些因素。此外,世界各地的研究人员正在开发可以延长包装食品保质期的新技术。

- 食品业是塑胶薄膜的最大终端用户,由于即食食品、零食、冷冻食品、蛋糕粉便利包装的增加,该行业正在经历显着增长。市场对乳製品和糖果零食产品的需求正在迅速增加。包装食品製造商正在采用新的包装材料来延长保质期并增加食品的吸引力。

- 饮食习惯的变化,例如对加工食品的日益偏好,预计将抵消对塑胶薄膜和片材的需求。此外,市场相关人员还致力于根据用户要求和食品易腐烂程度生产不同类型的塑胶。一些国家对塑胶薄膜和片材的使用有严格的规定。

- 此外,考虑到该产业在印度等新兴国家的扩张,加工食品产业有望蓬勃发展。例如,2016年美国有机加工食品消费额约为149.6亿美元,预计2019年将达到182.3亿美元,到2022年该金额将增加至210亿美元,预计将超过。

- 此外,由于欧洲对塑胶薄膜的需求不断增长,该行业正在扩张。製药业对于欧洲对抗疾病、为欧洲患者开发创新药物和治疗方法至关重要。由于科学技术的进步,该部门对于欧洲的经济扩张至关重要。以研究为基础的製药业务正在进入药物开发的一个有趣的新阶段。这些是支持所研究市场成长的一些驱动因素。

亚太地区将经历最快的成长

- 由于中国和印度这两个人口最多的国家的存在,预计亚太地区将经历最快的成长。在这两个国家,可支配收入的增加将补充食品和饮料、药品、宠物食品和化妆品等行业的成长,有助于塑胶薄膜市场蓬勃发展。

- 随着对包装食品的需求不断增长和塑胶产量的增加,一些消费者开始选择方便的包装解决方案,从而导致塑胶薄膜包装市场的成长。此外,该地区不断增长的人口和各种消费者的可支配收入导致了该地区软包装市场的发展。

- 食品和药品包装产业主要推动亚太地区塑胶薄膜产业的成长。庞大且不断增长的印度中产阶级以及该国越来越多的有组织零售企业正在推动塑胶包装行业的成长。另一个推动包装产业发展的因素是出口的快速成长,这需要符合国际市场的优质包装标准。因此,上述所有因素预计将推动亚太市场。

- 亚太地区製药业的成长主要是由于当今人们的医疗保健意识不断增强以及不受国界限制的最新治疗方法的可用性。不断成长的製药业预计将支撑塑胶薄膜市场。

- 亚太地区在疫情期间出现了大规模的风险投资和併购,这全部区域医疗保健服务的前景来说是一个非常积极的信号。因此,在亚洲营运的製药公司处于有利位置,可以抓住持续扩张的机会。

塑胶薄膜产业概况

由于全球公司和无证当地企业生产低品质塑胶袋的存在,塑胶薄膜市场本质上竞争激烈。合作、併购和收购是跨国公司为维持市场地位所采取的主要成长策略。

- 2022 年 10 月:Sucano 与化学品製造商 Emery Oleochemicals 合作,开发一种用于食品接触 PET 包装的透明 PET 防雾化合物,旨在满足对额外防雾涂层的需求。该材料专为刚性和拉伸 Coex 薄膜而设计,在薄膜挤出线 A/B 结构中的一层盖罩层中包含 Sucano 的共聚酯化合物,而 PET 则作为核心层。

- 2022 年 6 月:Innovia Films 推出适用于收缩、环绕标籤应用的 RayoWrap CMS 透明 BOPP 薄膜。 CMS30 在英国生产工厂製造,具有高收缩率。 CMS30 的技术性能意味着它适用于价值链的每一步,从易于列印到高速捲筒送纸环绕式标籤,以及最重要的报废和包装回收。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 市场驱动因素

- 各行业的高需求带来成长潜力

- 对轻量化包装解决方案的需求不断增长

- 各行业的高需求带来成长潜力

- 市场挑战

- 严格的政府法规

第五章 COVID-19对塑胶薄膜产业的影响

第六章市场区隔

- PP薄膜市场

- 按类型

- BOPP

- CPP

- 按最终用户产业

- 食品

- 饮料

- 药品

- 产业

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 波兰

- 比荷卢三国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东和非洲

- 按类型

- BOPET薄膜市场

- 按类型

- 薄型BOPET

- 厚型BOPET

- 按最终用户产业

- 封装和金属化

- 食品和饮料

- 药品

- 个人护理

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 波兰

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 印尼

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 按类型

- PE薄膜市场

- 按材质

- LDPE

- HDPE

- 按最终用户产业

- 食品

- 饮料

- 农业

- 建造

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 按材质

- PVC薄膜市场

- 按最终用户产业

- 食品和饮料

- 药品

- 电力/电子

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 按最终用户产业

- 其他塑胶薄膜类型

- 聚苯乙烯(PS)

- 生物基塑胶薄膜

- 聚偏二氯乙烯(PVDC)

- 乙烯 - 乙烯醇(EVOH)

第七章 竞争形势

- 公司简介

- Toray Advanced Film Co. Ltd

- Oben Holding Group

- Taghleef Industries

- Vitopel

- Cosmo Films Inc.

- Uflex Corporation

- Jindal Poly Film

- Dupont Tejin Films

- Amcor Plc

- Berry Global Inc.

- Tekni-Plex

第八章投资分析

第九章市场机会与未来趋势

The Plastic Film Market size is estimated at USD 68.35 billion in 2024, and is expected to reach USD 82.38 billion by 2029, growing at a CAGR of 3.80% during the forecast period (2024-2029).

Data from a Harris Poll commissioned by Flexible Packaging indicates that 83% of brand owners presently use flexible packaging. This encourages the market to grow.

Key Highlights

- Over the past few years, the packaged food and beverage industry has seen substantial expansion on a global scale. The packaged food sector is being driven by several macro factors, including evolving lifestyles, an increase in the urban population, increased economic activity in emerging markets, and greater penetration of e-retail globally. Plastic films offer several advantages over other rigid packaging materials as they are lightweight, provide good barrier properties, and, most importantly, are recyclable and reusable.

- Further, the steady demand for quick, healthy breakfast products is projected to increase the market growth of HDPE films. HDPE films have moisture barrier properties, making them suitable for packaging breakfast cereals, especially flakes. Additionally, with rising e-commerce, there is substantial growth for protective packaging, including plastic films, wraps, etc. This trend is expected to support the development of the market in the future.

- However, the rising stringent regulations against plastic recyclability are expected to hinder market growth in the future. Substitutes available in the market can hamper the development of the market. There are numerous governmental as well as non-governmental organizations in the UK and the US that are engaged in supporting the ban on the use of plastic in packaging and non-packaging industries. In the US, several governmental and non-governmental organizations are also involved in discouraging the usage of plastic sheets and films in packaging organic produce.

- Growth in the business is primarily driven by the growing scale of key application industries, such as food and beverage, pharmaceuticals, personal and household care, and the increasing penetration of organized e-retail globally.

- The COVID-19 pandemic has led the industrial and manufacturing sectors into an unknown operating environment globally. Government restrictions on the number of people that can gather in one place severely impacted the sectors. For example, the manufacturing industry was highly hit by the impact of the virus. The production and factory operations in the automotive, metal processing, oil and gas, electronics, and aerospace industries were temporarily shut down during the lockdown period.

- Most enterprises are dependent on China for raw material supply. Hence, supply chain disruptions also have had a significant impact on industrial output. The global economy had contracted due to the pandemic.

Plastic Films Market Trends

High Demand from Various Industries Offers Growth Potential

- Strong sealing strength, flexibility, and a vacuum finish are a few factors that have a beneficial impact on the growth of the plastic film industry. Additionally, researchers worldwide are developing new technologies that could lengthen the shelf life of packaged foods.

- The food industry is the largest end-user of plastic films and has seen strong growth due to a rise in convenient packaging for ready-to-eat foods, snacks, frozen meals, and cake mixes. The market is witnessing a surge in demand for dairy products and confectionery. The manufacturers of packaged food are adopting novel packaging materials to enhance the shelf-life and boost the appeal of the food product.

- Changing food habits, including the rising preference for processed food, will likely supplement the demand for plastic films and sheets. Moreover, market players are also engaged in manufacturing various types of plastics as per the user requirements and perishability of food. Stringent regulations on the use of plastic films and sheets have been imposed in several countries.

- Furthermore, it may be assumed that the packaged food industry will prosper, given the sector's expansion in developing countries like India. For instance, the value of organic packaged food consumption in the United States was approximately USD 14.96 billion in 2016, and it is expected to reach USD 18.23 billion in 2019. That amount is anticipated to surpass USD 21 billion by 2022.

- Furthermore, the industry is expanding due to the rising demand for plastic films in Europe. The pharmaceutical industry, which creates innovative medications and cures for patients all over Europe, is essential in Europe's fight against diseases. Due to advancements in science and technology, the sector is crucial to the economic expansion of Europe. The research-based pharmaceutical business is entering a fascinating new phase in developing medicines. These are some of the drivers that support the studied market's growth.

Asia- Pacific to Witness Fastest Growth

- The Asia Pacific region is expected to witness the fastest growth because of the presence of two highly populated countries, i.e., China and India. In these two countries, the increase in disposable income will supplement the growth of industries such as food and beverages, pharmaceuticals, pet food, and cosmetics, which will help the plastic film market flourish.

- With the growing demand for packaged food and the growth in plastic production, several consumers are opting for convenient packaging solutions, resulting in the growth of the plastic film packaging market. Additionally, the growing population and disposable income of the various consumers in the region have led to the development of the flexible packaging market in the area.

- The food and pharmaceutical packaging sectors mainly drive the growth in the plastic film industry in Asia Pacific. The large and growing Indian middle class and the increase in organized retailing in the country are fuelling growth in the plastic packaging industry. Another factor that has provided substantial stimulus to the packaging industry is the rapid growth of exports, which require superior packaging standards for the international market. Therefore, all the above factors are expected to drive the market in the Asia-Pacific region.

- The Asia-Pacific pharma industry is growing, primarily driven by rising awareness of healthcare in the current population and accessibility to modernized treatment regimens without border restrictions. The growing pharmaceutical industry is expected to support the plastic film market.

- The APAC region has witnessed major venture capitalism and M&A amidst the pandemic, which is a highly positive sign of a prospect in healthcare deliveries across the region. Thus, pharmaceutical companies operating in Asia can best navigate opportunities for continued expansion.

Plastic Films Industry Overview

The plastic film market is highly competitive in nature because of the presence of global players and unlicensed local units manufacturing low-grade plastic bags. Partnerships, mergers, and acquisitions are the prime growth strategies adopted by global players to sustain themselves in the market.

- October 2022: Sukano partnered with chemicals manufacturer Emery Oleochemicals to develop a transparent PET antifogging compound for food contact PET packaging, aiming to combat the necessity of extra antifogging coatings. Designed for rigid and oriented Coex films, the material contains Sukano's co-polyester compound in one cap layer of a film extrusion line A/B structure and PET as a core layer.

- June 2022: Innovia Films has launched RayoWrap CMS transparent BOPP film for shrink, wraparound label applications. Produced at its UK production facility, CMS30 provides high shrinkage. The technical performance of CMS30 means it performs at every stage of the value chain, from the ease of printing, through high-speed roll-fed wraparound labeling, to the all-important end-of-life and recycling of the packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 High Demand from Various Industries Offers Potential Growth

- 4.4.1.1 Growing Demand for Lightweight Packaging Solution

- 4.4.1 High Demand from Various Industries Offers Potential Growth

- 4.5 Market Challenges

- 4.5.1 Stringent Government Regulation

5 IMPACT OF COVID-19 ON THE PLASTIC FILMS INDUSTRY

6 MARKET SEGMENTATION

- 6.1 PP Films Market

- 6.1.1 By Type

- 6.1.1.1 BOPP

- 6.1.1.2 CPP

- 6.1.2 By End-user Industry

- 6.1.2.1 Food

- 6.1.2.2 Beverage

- 6.1.2.3 Pharmaceuticals

- 6.1.2.4 Industrial

- 6.1.2.5 Other End-user Industries

- 6.1.3 By Geography

- 6.1.3.1 North America

- 6.1.3.1.1 United States

- 6.1.3.1.2 Canada

- 6.1.3.2 Europe

- 6.1.3.2.1 United Kingdom

- 6.1.3.2.2 Germany

- 6.1.3.2.3 France

- 6.1.3.2.4 Italy

- 6.1.3.2.5 Spain

- 6.1.3.2.6 Poland

- 6.1.3.2.7 Benelux

- 6.1.3.2.8 Rest of Europe

- 6.1.3.3 Asia-Pacific

- 6.1.3.3.1 China

- 6.1.3.3.2 India

- 6.1.3.3.3 Japan

- 6.1.3.3.4 Rest of Asia-Pacific

- 6.1.3.4 Latin America

- 6.1.3.4.1 Brazil

- 6.1.3.4.2 Argentina

- 6.1.3.4.3 Mexico

- 6.1.3.4.4 Rest of Latin America

- 6.1.3.5 Middle East and Africa

- 6.1.1 By Type

- 6.2 BOPET Films Market

- 6.2.1 By Type

- 6.2.1.1 Thin BOPET

- 6.2.1.2 Thick BOPET

- 6.2.2 By End-user Industry

- 6.2.2.1 Packaging and Metallizing

- 6.2.2.1.1 Food and Beverage

- 6.2.2.1.2 Pharmaceuticals

- 6.2.2.1.3 Personal Care

- 6.2.2.1.4 Other End-user Industries

- 6.2.3 By Geography

- 6.2.3.1 North America

- 6.2.3.1.1 United States

- 6.2.3.1.2 Canada

- 6.2.3.2 Europe

- 6.2.3.2.1 United Kingdom

- 6.2.3.2.2 Germany

- 6.2.3.2.3 France

- 6.2.3.2.4 Italy

- 6.2.3.2.5 Spain

- 6.2.3.2.6 Poland

- 6.2.3.2.7 Rest of Europe

- 6.2.3.3 Asia-Pacific

- 6.2.3.3.1 China

- 6.2.3.3.2 India

- 6.2.3.3.3 Japan

- 6.2.3.3.4 South Korea

- 6.2.3.3.5 Thailand

- 6.2.3.3.6 Indonesia

- 6.2.3.3.7 Rest of Asia-Pacific

- 6.2.3.4 Latin America

- 6.2.3.5 Middle East and Africa

- 6.2.1 By Type

- 6.3 PE Films Market

- 6.3.1 By Material

- 6.3.1.1 LDPE

- 6.3.1.2 HDPE

- 6.3.2 By End-user Industry

- 6.3.2.1 Food

- 6.3.2.2 Beverage

- 6.3.2.3 Agriculture

- 6.3.2.4 Construction

- 6.3.2.5 Other End-user Industries

- 6.3.3 By Geography

- 6.3.3.1 North America

- 6.3.3.1.1 United States

- 6.3.3.1.2 Canada

- 6.3.3.2 Europe

- 6.3.3.2.1 United Kingdom

- 6.3.3.2.2 Germany

- 6.3.3.2.3 France

- 6.3.3.2.4 Italy

- 6.3.3.2.5 Spain

- 6.3.3.2.6 Rest of Europe

- 6.3.3.3 Asia-Pacific

- 6.3.3.3.1 China

- 6.3.3.3.2 India

- 6.3.3.3.3 Japan

- 6.3.3.3.4 South Korea

- 6.3.3.3.5 Rest of Asia-Pacific

- 6.3.3.4 Latin America

- 6.3.3.5 Middle East and Africa

- 6.3.1 By Material

- 6.4 PVC Films Market

- 6.4.1 By End-user Industry

- 6.4.1.1 Food and Beverage

- 6.4.1.2 Pharmaceuticals

- 6.4.1.3 Electrical/Electronics

- 6.4.1.4 Other End-user Industries

- 6.4.2 By Geography

- 6.4.2.1 North America

- 6.4.2.1.1 United States

- 6.4.2.1.2 Canada

- 6.4.2.2 Europe

- 6.4.2.2.1 United Kingdom

- 6.4.2.2.2 Germany

- 6.4.2.2.3 France

- 6.4.2.2.4 Rest of Europe

- 6.4.2.3 Asia-Pacific

- 6.4.2.3.1 China

- 6.4.2.3.2 India

- 6.4.2.3.3 Japan

- 6.4.2.3.4 Rest of Asia-Pacific

- 6.4.2.4 Latin America

- 6.4.2.5 Middle East and Africa

- 6.4.1 By End-user Industry

- 6.5 Other Plastic Film Types

- 6.5.1 Polystyrene (PS)

- 6.5.2 Bio-Based Plastic Films

- 6.5.3 Polyvinylidene Chloride (PVDC)

- 6.5.4 Ethylene Vinyl Alcohol (EVOH)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Toray Advanced Film Co. Ltd

- 7.1.2 Oben Holding Group

- 7.1.3 Taghleef Industries

- 7.1.4 Vitopel

- 7.1.5 Cosmo Films Inc.

- 7.1.6 Uflex Corporation

- 7.1.7 Jindal Poly Film

- 7.1.8 Dupont Tejin Films

- 7.1.9 Amcor Plc

- 7.1.10 Berry Global Inc.

- 7.1.11 Tekni-Plex