|

市场调查报告书

商品编码

1438493

企业关键管理:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Enterprise Key Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

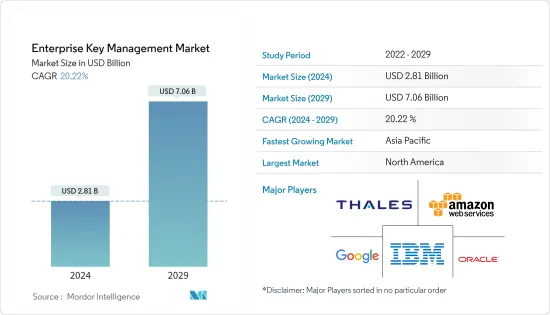

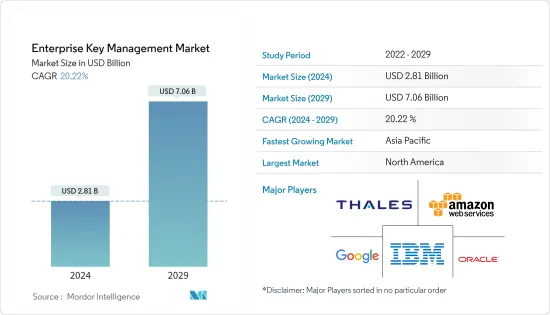

企业金钥管理市场规模预计到2024年为28.1亿美元,预计到2029年将达到70.6亿美元,在预测期内(2024-2029年)成长20.22%,复合年增长率成长。

资料外洩和身分盗窃的激增导致许多行业采用先进的企业安全解决方案。市场成长预计将由转向数位环境以提供数位服务的组织以及需要保护的敏感资料量的增加所推动。

主要亮点

- 企业金钥管理使用集中管理的解决方案来保护用于加密企业分散式 IT 环境中的敏感资料的加密金钥。组织内资料的成长、隐私法的扩展、资料外洩和骇客攻击的风险,以及保护哪些资料和成本的决策都会影响资料安全策略。资料保护需要具有强大架构和内建安全性的系统。当今的企业更频繁地使用资料保护技术,这产生了重大影响,增加了复杂性并增加了成本。

- 随着物联网的引入,产生的资料总量将会增加,工业资料将转化为工业巨量资料。由于物联网解决方案提供的人工智慧、机器学习和即时资料处理的结合,物联网设备的数量预计将显着增加。预计到 2023 年,亚洲将引领物联网设备新增数量超过目前估计的 35 亿台。由于采用物联网和云端技术而导致的大量资料成长预计将推动市场发展。

- 世界各国政府已开始透过颁布 GDPR 和 CCPA 等法律来报復备受瞩目的资料外洩事件。满足这些要求表明您的组织充分意识到威胁并采取措施解决它。这些标准旨在确保最低程度的安全性。因此,关键资料遗失和合规性问题推动了对企业金钥管理服务的需求。

- 缺乏熟练的专业人员可能会影响企业密钥管理解决方案的实施。云端基础的解决方案正在迅速被企业采用,并提供许多好处。儘管如此,仍然存在安全和隐私问题,例如储存资料的资料外洩、介面骇客攻击、凭证保护和 DoS 攻击。预计此类活动将阻碍市场成长。

- COVID-19感染疾病以及俄罗斯和乌克兰之间的衝突正在影响世界各地人们的生活。所有其他企业和市场均陷入低迷。然而,在疫情之后,企业金钥管理市场总体上取得了进展,规模、产品、模式和中心参与者和组织的兴趣都在扩大,这些参与者和组织将受益于先前的市场经验。

企业金钥管理市场趋势

由于采用物联网和云端技术,资料显着增加

- 全球范围内参与数位化趋势的公司不断涌入,大量资料被创建、储存、处理和通讯。同时, IT基础设施基础设施变得越来越开放和互联,使得资料更容易访问,因此更容易被窃取。加密是组织可用于保护敏感资料(无论其位于何处)的基本工具之一。组织必须提高关键管理能力,以满足不断增长的资料安全要求。

- 各种规模的组织对云端服务的需求和采用不断增加,以及各个最终用户行业对云端服务的需求不断增加,以最大限度地提高营运安全性,这肯定会增加企业金钥管理的市场价值。混合云端和资料中心基础设施已成为许多企业的新常态。根据 Thales 最近的全球威胁报告,全球 84% 的组织使用多个 IaaS 供应商,34% 使用 50 多个 SaaS 应用程式。同样,根据 CloudTech 的报告,84% 的组织使用混合云端平台。此外,随着 BYOD 和物联网的日益普及,许多端点设备都连接到企业网路。

- 云端基础的部署的增加和资料外洩的增加,加上保护敏感资料的法规和合规性的不断增加,预计将推动企业金钥管理市场的成长。网路用户的增加和数位服务的快速采用导致组织收集的敏感资料量呈指数级增长。进一步推测这将促进加密解决方案的采用。

- 对云端基础的服务和硬体安全模组的投资不断增加,以促进企业金钥管理和资料保护,预计将进一步推动市场成长。然而,与缺乏熟练劳动力、更换现有IT基础设施的成本以及使用企业金钥管理解决方案的复杂性相关的问题可能会限制市场成长。

预计北美市场占有率最高

- 由于IBM、甲骨文和惠普等全球知名企业管理市场主要企业的存在推动了采用率,预计北美将在整个预测期内保持最全面的市场占有率。该地区的优势在于其发达的IT基础设施基础设施以及云端服务的日益普及。

- 由于中小企业的扩张和成长,不断上升的网路威胁和安全问题导致各国采用企业金钥管理解决方案。政府支持IT基础设施基础设施发展的政策也拉动了企业金钥管理的需求。

- 网路威胁推动了区域对企业金钥管理解决方案的需求。预计美国和加拿大将在该地区保持重要的市场占有率。根据身分盗窃资源中心的资料,2021 年光是美国就发生了约 18.62 亿起资料外洩事件。

- 数位服务普及的提高和IT基础设施的快速扩张预计将在未来几年进一步推动市场扩张。此外,BFSI 行业预计将在未来推动该市场方面发挥重要作用。这项优势也可以归功于发达的IT基础设施和云端服务的日益普及。此外,区域和国际参与者之间不断增加的併购活动预计将在一定程度上支持该地区的市场成长。

企业金钥管理产业概况

企业密钥管理市场是一个高度分散的市场。然而,云端服务供应商中的主导者包括金雅拓(Thales)、微软、Google、AWS等。这些公司利用策略合作倡议来提高其产品、市场占有率和盈利。

- 2022 年 11 月,Zoom 宣布致力于打造企业级安全性和可靠性平台,提供您所需的隐私和安全功能,帮助小型企业和大型企业轻鬆连接并保持井井有条。我们宣布了一项重要更新。

- 2022 年 7 月,Axis Bank 与 Amazon Web Services (AWS) 合作,提供 AWS 金钥管理服务、加密作业 (KMS) 的完全託管服务、AWS CloudHSM、云端基础的硬体安全模组 (HSM) 和 AWS Identity。管理(IAM)、AWS 加密SDK 和用户端加密库可提高资料安全性、合规性和客户经验。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 市场驱动因素

- 优化安全的整体拥有成本,同时最大限度地提高营运效率和安全性

- 引人注目的资料遗失和合规性问题

- 由于采用物联网和云端技术,资料显着增加

- 市场限制因素

- 缺乏意识和熟练的劳动力

- 评估 COVID-19 对市场的影响

第五章市场区隔

- 部署类型

- 云

- 本地

- 公司规模

- 中小企业

- 大公司

- 目的

- 磁碟加密

- 文件和资料夹加密

- 资料库加密

- 通讯加密

- 云端加密

- 最终用户产业

- BFSI

- 卫生保健

- 政府和国防,

- 资讯科技和电信

- 零售

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争形势

- 公司简介

- Amazon Web Services Inc.

- Unbound Tech Ltd(Dyadic Security)

- Thales Group(Gemalto NV)

- Google Inc.(Alphabet)

- IBM Corporation

- Oracle Corporation

- Hewlett Packard Enterprise

- Quantum Corporation

- Winmagic Inc.

- Microsoft Corporation

- Townsend Data Security LLC

第七章 投资分析

第八章市场机会及未来趋势

The Enterprise Key Management Market size is estimated at USD 2.81 billion in 2024, and is expected to reach USD 7.06 billion by 2029, growing at a CAGR of 20.22% during the forecast period (2024-2029).

Many sectors have adopted advanced corporate security solutions due to the surge in data breaches and the theft of private information. Market growth is expected to be driven by the shift in organizations to a digital environment to offer digital services and the increasing volume of sensitive data to be protected.

Key Highlights

- Enterprise key management uses a centralized management solution to safeguard the cryptographic keys used to encrypt sensitive data throughout a distributed IT environment inside a business. The expansion of data within an organization, expanding privacy laws, the danger of data breaches and hacking, and decisions about which data to safeguard and at what expense all impact data security strategies. Data protection requires a system with a solid architecture and built-in security. Today's businesses use data protection techniques more frequently, which has substantial repercussions, added complexity, and expense.

- The adoption of IoT increases the total volume of the generated data transforming the industrial data into industrial Big Data. With the combination of AI, machine learning, and real-time data processes delivered by IoT solutions, the number of IoT devices is set to grow substantially. Asia is expected to lead the way in adding more IoT devices than the current estimate of 3.5 billion by 2023. The massive data growth due to the adoption of IoT and cloud technologies is anticipated to drive the market.

- Governments worldwide are starting to retaliate against high-profile data breaches by enacting laws like the GDPR and CCPA. Meeting these requirements demonstrates that the organization is fully aware of the threat and has taken action to address it. These standards are there to assure a minimum level of security. Thus, the necessity for enterprise key management services is driven by the loss of essential data and compliance problems.

- A lack of skilled professionals may impact the adoption of enterprise key management solutions. Cloud-based solutions are rapidly adopted by enterprises that provide numerous benefits. Still, it has security and privacy issues such as data breaches, hacked interfaces, credential protection, DoS attacks, etc., of stored data. Such activities are expected to hinder the growth of the market.

- The COVID-19 pandemic and the Russia-Ukraine conflict have affected people's lives worldwide. Every other business and market is in a downturn. However, post-pandemic, the enterprise key management market is advancing overall with expanding size, offers, patterns, and interests by central participants and organizations that would benefit from previous market experiences.

Enterprise Key Management Market Trends

Massive Growth of Data Due to the Adoption of IoT and Cloud Technologies

- With a constant influx of enterprises joining the digitization trend globally, vast amounts of data are being created, stored, processed, and communicated. At the same time, IT infrastructure is increasingly open and connected, making data more accessible and thus vulnerable to theft. Cryptography is one of the fundamental tools that organizations can use to protect sensitive data wherever it resides. Organizations must improve their crucial management capabilities to address increasing data security requirements.

- With the rising demand and adoption of cloud services by different sizes of organizations coupled with a rise in demand for cloud services by various end-user verticals to maximize operational security, the enterprise key management market value is bound to rocket up. Hybrid cloud and data center infrastructures are the new norms for many businesses. According to the Thales recent Global Threat Report, 84% of organizations globally use more than one IaaS vendor, and 34% use over 50 SaaS applications. Similarly, with the report from CloudTech, 84% of organizations use hybrid cloud platforms. In addition, many endpoint devices are connecting to corporate networks, with increasing adoption of BYOD and the internet of things.

- The increasing adoption of cloud-based deployment and a growing number of data breaches, coupled with the rising regulatory and compliance enforcements to protect sensitive data, are presumed to bolster the growth of the enterprise key management market. A rise in internet users and the rapid adoption of digital services has led to an exponential increase in the volume of sensitive data collected by organizations. This is further presumed to accelerate the adoption of encryption solutions.

- The growing investments in cloud-based services and hardware security modules to promote enterprise key management and data protection are supposed to expedite market growth further. However, issues concerning to shortage of skilled workforce, replacement costs of the existing IT infrastructure, and complexity of using enterprise key management solutions may limit the growth of the market.

North American is Expected to Have Highest Market Share

- North America is anticipated to maintain the most comprehensive market share over the forecast period, owing to the presence of globally notable enterprise key management market players, such as IBM, Oracle, and Hewlett Packard, which promote the adoption. This region also dominates because of a well-developed IT infrastructure coupled with the rising adoption of cloud services.

- Rising cyber threats and security concerns have further led to the adoption of enterprise key management solutions across countries, owing to the expansion and growth of small and medium-sized enterprises. Supportive government policies to develop the IT infrastructure are also promoting the demand for enterprise key management.

- Cyber threats trigger the local demand for enterprise key management solutions. The United States and Canada are expected to maintain significant market shares in this region. In 2021, nearly 1862 million data breaches were encountered in the United States alone, according to the data from Identity Theft Resource Center.

- The growing penetration rate of digital services and rapidly expanding IT infrastructure are expected to drive market expansion in the future years further. In addition, the BFSI sector will likely play an essential role in driving this market in the future. The dominance can also be attributed to well-developed IT infrastructure and the rising adoption of cloud services. In addition, rising merger and acquisition activities among regional and international players are supposed to further support the growth of the market in this region to a certain extent.

Enterprise Key Management Industry Overview

The enterprise key management market is a highly fragmented market. However, it is dominated by players, including Gemalto(Thales), among other cloud service providers, Microsoft, Google, and AWS. These companies are leveraging strategic collaborative initiatives to enhance their offerings, market share, and profitability.

- In November 2022, Zoom announced critical updates to the Enterprise-grade security and Reliability platform for easy connection and staying organized to fit the needs of small businesses or large enterprises, with the features of privacy and security needed.

- In July 2022, Axis bank partnered with Amazon Web Services (AWS) to use the AWS key management service, a fully managed service for cryptographic operations (KMS), AWS CloudHSM, a cloud-based hardware security module (HSM), AWS Identity and Access Management (IAM), AWS Encryption SDK, and a client-side encryption library to improve data security, compliance, and customer experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Optimizing Overall Ownership Cost for Security while Maximizing Operational Efficiency and Security

- 4.3.2 Loss of High Profile Data and Compliance Issues

- 4.3.3 Massive Growth of Data Due to the Adoption of IoT and Cloud Technologies

- 4.4 Market Restraints

- 4.4.1 Lack of Awareness and Skilled Workforce

- 4.5 Assessment of COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 Deployment Type

- 5.1.1 Cloud

- 5.1.2 On-Premises

- 5.2 Size of Enterprise

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 Application

- 5.3.1 Disk Encryption

- 5.3.2 File and Folder Encryption

- 5.3.3 Database Encryption

- 5.3.4 Communication Encryption

- 5.3.5 Cloud Encryption

- 5.4 End-user Verticals

- 5.4.1 BFSI

- 5.4.2 Healthcare

- 5.4.3 Government and Defense,

- 5.4.4 IT and Telecom

- 5.4.5 Retail

- 5.4.6 Other End-user Verticals

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 Amazon Web Services Inc.

- 6.1.2 Unbound Tech Ltd (Dyadic Security)

- 6.1.3 Thales Group (Gemalto NV)

- 6.1.4 Google Inc. (Alphabet)

- 6.1.5 IBM Corporation

- 6.1.6 Oracle Corporation

- 6.1.7 Hewlett Packard Enterprise

- 6.1.8 Quantum Corporation

- 6.1.9 Winmagic Inc.

- 6.1.10 Microsoft Corporation

- 6.1.11 Townsend Data Security LLC