|

市场调查报告书

商品编码

1438548

喷墨印刷:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Inkjet Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

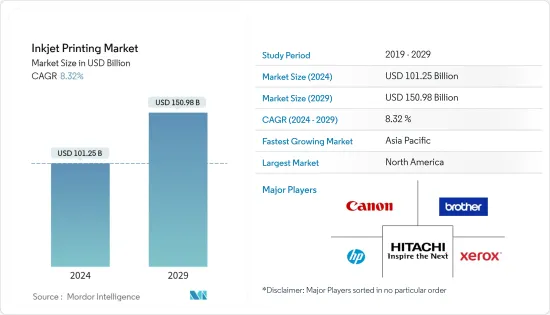

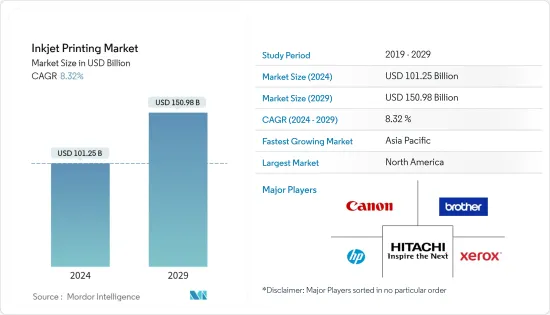

喷墨印刷市场规模预估2024年为1,012.5亿美元,预估至2029年将达1,509.8亿美元,在预测期间内(2024-2029年)复合年增长率为8.32%成长。

主要亮点

- 喷墨印刷涉及将微小的液体墨水液滴喷射到指定的表面(例如纸张)上,并帮助开发了数位印刷。这种方法产生的影像可与照片品质相媲美。喷墨列印是其他列印製程的一种经济高效的替代方案,因为它具有完整的多功能性、较低的设定成本,并且允许小批量列印一份。

- 使用喷墨的主要优点是能够有效地小批量生产独特的产品。透过网路印刷技术进行的线上订购和规格的兴起正在推动商业印刷的发展。喷墨印表机的小批量和一次性生产能力巩固了其作为此生态系统中关键推动者的地位。此外,智慧生产、速度、弹性和成本控制也将推动喷墨印刷的采用,推动喷墨印刷市场的成长,因为数位印刷的采用将使企业能够更灵活地回应客户的要求。儘管改用喷墨印表机具有潜在的好处,但也存在局限性,例如长期印刷的印刷成本较高,尤其是与模拟印刷相比。

- 随着喷墨印刷产业创造对墨水的需求,墨水生态系统也有望发展。目前广泛使用的是溶剂型、水性、UV型油墨。另一方面,LED墨水也在不断发展。混合紫外线/水系统正在市场上兴起。然而,墨水的高成本仍然是一个主要问题,导致供应商从类比到数位的转换率较低。由于应用的增加和规模经济,在预测期内墨水价格可能会下降。另一方面,与类似产品相比,墨水成本预计仍然较高。

- 近年来,数位广告媒体越来越受欢迎,对印刷业的成长提出了挑战。媒体播放机是数位广告的关键组成部分,并且在技术、连接性和易用性方面正在经历快速变化。例如,美国数位广告媒体播放机供应商BrightSign LLC于2021年5月推出了BrightSign Mobile,这是将媒体播放机连接到云端的新解决方案,这是传统网路连线方式难以实现的。该解决方案包括一个 USB 区域数据机,并安装了用于连接的 SIM 卡。这些发展和创新进一步限制了市场的成长。

- 由于食品和药品包装需求增加,包装、标籤和印刷业在 COVID-19 期间保持相当稳定。然而,冠状病毒感染疾病(COVID-19) 的爆发扰乱了食品和饮料、医疗保健和工业等各个最终用户行业的供应链。虽然这场流行病对经济产生了重大影响,但喷墨印刷公司正在透过使用网路印刷技术向符合条件的企业提供与冠状病毒相关的印刷广告来帮助满足要求。这些资讯将用于传达与 COVID-19感染疾病相关的所有企业客户问题。

喷墨列印市场趋势

广告预计将占据压倒性的市场份额

- 广告包括销售点 (POS) 和展示,被认为是成长最快的领域之一。软指示牌是一个常见的行业术语,用于描述数位印刷的布指示牌。软标誌仅限于特定的油墨组,但通常印刷在聚酯基织物上,有时印刷在棉或棉混纺等天然纤维上。

- 横幅因其多功能性和可用于多种应用程式的能力而在广告媒体中占据巨大份额。市场上有许多不同类型的材料,包括织物横幅、乙烯基横幅和网膜横幅。

- 随着对印花纺织品的需求和所需尺寸的不断增加,数位印刷机供应商开始推出可处理3米宽或以上材料的数位纺织品印表机。虽然该领域历来以传统印刷方法为主,但 EFI、d.gen、Durst 和 Mimaki 等公司正透过大幅面数位纺织品印表机进入该领域。

- 数位化是印刷业的重大变革,其中包括与数位印刷能力的成长并进的产品个人化、创新和沟通。消费者希望产品具有互动性,并包含他们想了解的有关产品的所有资讯。这些设备配备了技术功能,例如带有社交媒体连结的二维码、虚拟实境等。

- 在註射印刷中实施物联网将进一步减少物理干预并提高自动化程度。定期监控和记录设备的实际运作状态和系统效能有助于分析预期的停机时间。随着时间的推移,对这些资料进行分析,使公司能够预测机器故障并识别需要更换的零件,以避免代价高昂的意外停机。

预计亚太地区在预测期内成长最快

- 在中国、印度和许多快速成长国家的推动下,亚太地区已成为全球最大的印刷油墨地区。另一方面,许多最大的跨国油墨製造商都位于该地区。 DIC、SAKATA INX CORPORATION、东洋油墨和 T&K TOKA 总部位于日本,其余主要公司也在该地区拥有大规模业务。

- 此外,许多欧洲印刷公司依赖中国供应新化学品,例如油墨和溶剂成分,这些都是印刷程序中所需的投入。除此之外,智慧型手机公司增加对製造这些印表机的投资是推动该国销售的关键因素。

- 就新冠肺炎 (COVID-19) 而言,亚太地区(尤其是印度)的冠状病毒感染疾病数量史无前例地增加,导致工业喷墨印表机製造活动暂停。

- 然而,Etiquettes Pierre Foucher 和商业胶印公司 Imprimerie Coste &Films 推出了采用喷墨技术的基于碳粉的 AccurioLABel 230 印表机,以满足客户对短交付时间和周转时间的需求。 Accurio 的新设计型号提供 76 英尺/分钟的最大列印速度、缩短的预热时间以及可选的套印套件。

- 亚太地区也主导着自订服装印花市场,例如自订T 恤印花。预计该地区在未来几年也将出现显着的成长。因此,大尺寸喷墨印表机的需求预计将持续增加。

喷墨印刷业概况

根据行业分析,喷墨列印供应商之间存在着激烈的竞争。由于有大量参与者,市场高度分散。市场渗透率正在不断提高,大型企业在成熟市场中拥有强大的影响力。鑑于市场产品的同质化,许多在市场上经营的企业进一步被迫进行价格竞争。公司采取许多成长和扩大策略来获得竞争优势。企业参与企业也遵循价值链价值链联盟。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 产业价值链分析

- 评估新型冠状病毒感染疾病(COVID-19)对市场的影响

第五章市场动态

- 市场驱动因素

- 巨量资料、物联网、印刷包装数位化

- 智慧生产、速度、弹性和成本控制

- 市场挑战

- 数位广告媒体日益普及

- 高价以及投资和技术的限制

- 弹性凸版印刷和丝网印刷等成熟技术之间的激烈竞争

- 市场机会

- 向永续性的过渡可以推动市场成长

第六章市场区隔

- 按用途

- 书籍/出版

- 商业印刷

- 广告

- 交易

- 标籤

- 包装

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 东欧洲

- 西欧

- 亚太地区

- 亚洲

- 澳洲

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- HP Development Company LP

- Jet Inks Private Limited

- Brother Industries Ltd

- Xerox Corporation

- Canon Inc.

- Hitachi Industrial Equipment Systems Co. Ltd

- Lexmark International Inc.

- Videojet Technologies Inc.

- Inkjet Inc.

- Fujifilm Holdings Corporation

第八章投资分析

第9章市场的未来

The Inkjet Printing Market size is estimated at USD 101.25 billion in 2024, and is expected to reach USD 150.98 billion by 2029, growing at a CAGR of 8.32% during the forecast period (2024-2029).

Key Highlights

- Inkjet printing involves spraying tiny droplets of liquid ink onto designated surfaces, such as paper, which aided the development of digital printing. This method produces images that are photo-quality equivalents. Inkjet printing is a cost-effective alternative to other print processes since it offers full versatility and inexpensive set-up costs, allowing for low-volume printing of single copies.

- The major advantage of using inkjets is due to its capability to produce short runs and unique products effectively. The rise of online ordering and specification via web-to-print technology is propelling commercial printing forward. Inkjet printers' capacity to produce small runs and one-off products solidified their position as a key enabler in such an ecosystem. Moreover, smart production, speed, flexibility, and cost control also drive the adoption of inkjet printing as the businesses can become more flexible and responsive to customer requirements through the adoption of digital print, thus fueling the growth of the Inkjet Printing Market. While switching to inkjet brings potential advantages, there are also restrictions - such as the higher cost of printing when it comes to long runs, particularly when compared to analog printing.

- Since the inkjet printing industry creates demand for inks, the ecosystem of inks is expected to evolve too. Currently, solvent, water-based, and UV-based inks are widely used. LED inks, on the other hand, are constantly evolving. Hybrid UV/water systems are making their way onto the market. High ink costs, on the other hand, remain a major problem, resulting in lower vendor conversion rates, from analog to digital. During the projection period, rising applications and economies of scale are likely to lower ink prices. Ink costs, on the other hand, are projected to remain higher than in analog.

- Digital advertising media has been gaining popularity lately, challenging the growth of the printing industry. The media player is the crucial component for digital advertising, experiencing a rapid transformation in technology, network connectivity, and ease of use. For instance, in May 2021, BrightSign LLC, a US provider of digital advertising media players, launched BrightSign Mobile, a new solution to connect media players to the cloud where traditional network connectivity methods are challenging to achieve. This solution includes a USB regional modem with an installed SIM card for connectivity. These developments and innovations further suppressed the market's growth.

- The packaging, labeling, and printing segments are considerably stable in the COVID-19 period, owing to the increasing demand for food and pharmaceutical packaging. However, the COVID-19 outbreak disrupted the supply chain across various end-user industries like food and beverage, healthcare, and industrial. Even though the pandemic had a massive impact on the economy, inkjet printing companies are supplying this requirement by offering those in requirement COVID-19-related printed advertisements with web-to-print technology. These are used for communicating all business-customer matters concerning the COVID-19 pandemic.

Inkjet Printing Market Trends

Advertisement is Anticipated to Hold a Dominant Share of the Market

- Advertising constitutes the point of sales (POS) and displays and is considered one of the fastest-growing segments. Soft signage is a common industry term that is used to describe digitally printed fabric signage. Although soft signs are limited to a particular ink set, they are typically printed on a polyester-based textile and, on occasion, natural fiber such as cotton or a cotton blend.

- Banners hold a significantly large share in advertising media due to their versatility and use across several applications. Various types of materials are available in the market, including fabric banners, vinyl banners, and mesh banners.

- As the demand for printed textiles and requested size continues to increase, digital press vendors are beginning to introduce digital textile printers that are capable of handling substrates up to and beyond 3 meters wide. Although this area has historically been dominated by traditional printing methods, companies like EFI, d.gen, Durst, and Mimaki are entering with grand format digital textile printers.

- Digitization has been a major game-changer in the printing industry, which includes product personalization, innovation, and communication that aligns closely with the growing capabilities of digital printing. As consumers want the products to be interactive and contain everything there is to know about them. The devices are equipped with technology features, such as QR codes with links to social media, virtual reality, etc.

- The implementation of IoT in inject printing further reduces physical intervention and increases automation. It helps to analyze the probable downtime by regularly monitoring and recording the actual operating conditions of the equipment and its system performance. This data is analyzed over a period of time, allowing companies to predict machine failure and identify parts that need replacement, avoiding costly unexpected downtime.

Asia-Pacific is Expected to Register the Fastest Growth During the Forecast Period

- Driven by China, India, and a host of fast-growing countries, the Asia-Pacific region has become the world's largest region for printing ink. On the other hand, The region is home to many of the largest multinational ink manufacturers. DIC, Sakata INX, Toyo Ink, and T&K Toka call Japan home, and the rest of the major leaders have large operations in the region.

- Also, numerous printing companies based in Europe are dependent on China for the supply of novel chemicals, such as constituents of inks and solvents, which are required in printing procedures as input materials. On top of that, increasing investment by smartphone companies in the manufacturing of these printers is a significant factor pushing sales in the country.

- In the case of COVID-19, the Asia-Pacific, especially India, witnessed an unprecedented rise in the number of coronavirus cases, which led to the discontinuation of industrial inkjet printer manufacturing activities.

- However, Etiquettes Pierre Foucher and commercial offset printer Imprimerie Coste & Films shifted from inkjet technology to install toner-based AccurioLAbel 230 printers to meet the demand for shorter runs and quick turnaround times from their customers. The new design model of Accurio offers a maximum print speed of 76ft/min, shorter warm-up times, and an optional over-print kit.

- The Asia-Pacific region also dominates the custom apparel printing market, which includes custom t-shirt printing. Also, the region is expected to witness a significant growth rate over the coming years. Therefore, the demand for large format inkjet printers is expected to increase.

Inkjet Printing Industry Overview

Based on industry analysis, intense rivalry exists within the inkjet printing providers. The market is highly fragmented due to the presence of a large number of players. Market penetration is growing, with a strong presence of major players in established markets. Considering the homogenous nature of market products, many firms operating in the market are further driven to compete on price. The companies are involved in many growth and expansion strategies to get a competitive advantage. Business participants also follow the value chain alliance with business transactions in various steps of the value chain.

- February 2022 - Canon announced the expansion of its MAXIFY Ink Efficient GX Series lineup with a new ink tank business printer. The printer combines low color printing costs with speed, paper handling, and networking capabilities to give offices and businesses a boost in efficiency and productivity.

- October 2021 - Roland DG Corporation, a manufacturer of wide-format inkjet printers and printer/cutters, announced the launch of D-BRIDGE, a support website that provides a variety of helpful information about the benefits of digitalization and secrets of success for anyone engaged in creating, especially those involved in printing or manufacturing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Big Data, IoT, and Digitalization of Print Processing and Packaging

- 5.1.2 Smart Production, Speed, Flexibility, and Cost Control

- 5.2 Market Challenges

- 5.2.1 Growing Popularity of Digital Advertising Media

- 5.2.2 High Price and Investment and Technological Limitations

- 5.2.3 Cut-Throat Competition among Established Technologies, such as Flexographic Printing and Screen Printing

- 5.3 Market Opportunities

- 5.3.1 Shift Toward Sustainability can Increase the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Books/Publishing

- 6.1.2 Commercial Print

- 6.1.3 Advertising

- 6.1.4 Transaction

- 6.1.5 Labels

- 6.1.6 Packaging

- 6.1.7 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.2.1 Eastern Europe

- 6.2.2.2 Western Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 Asia

- 6.2.3.2 Australia

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 HP Development Company LP

- 7.1.2 Jet Inks Private Limited

- 7.1.3 Brother Industries Ltd

- 7.1.4 Xerox Corporation

- 7.1.5 Canon Inc.

- 7.1.6 Hitachi Industrial Equipment Systems Co. Ltd

- 7.1.7 Lexmark International Inc.

- 7.1.8 Videojet Technologies Inc.

- 7.1.9 Inkjet Inc.

- 7.1.10 Fujifilm Holdings Corporation