|

市场调查报告书

商品编码

1438553

草坪保护:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Turf Protection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

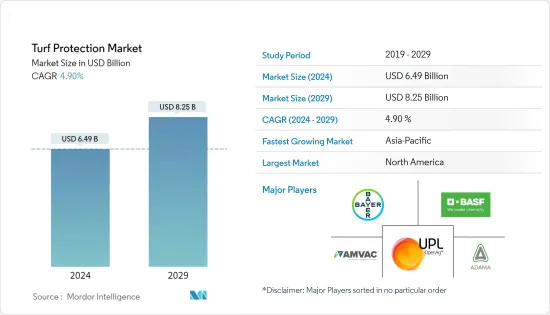

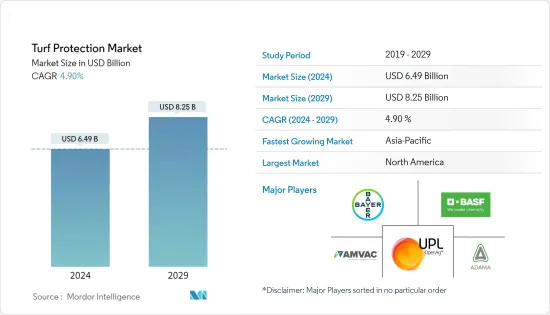

草坪保护市场规模预计2024年为64.9亿美元,预计到2029年将达到82.5亿美元,在预测期内(2024-2029年)复合年增长率为4.90%增长。

COVID-19感染疾病扰乱了多个市场的活动,包括全球草坪保护市场。疫情影响了供应链网络,对企业造成了损失。供给方面,由于流通瓶颈,短期内移工短缺,导致农药生产所需工人数量出现较大缺口。然而,COVID-19感染疾病对市场成长产生了短期影响,但可能会提振投资。由于强劲的成长和不断变化的趋势,草坪护理行业多年来已经发生了转变。

维护草坪是一项艰鉅的任务,因此您需要保护它以防止害虫和杂草造成的损失。对板球、高尔夫和足球等运动的高需求可能会在预测期内刺激市场。创新公司能够快速适应变化并获得高报酬率。草坪保护市场的主要企业见证了出口导向市场和国内市场的收益成长。然而,本土企业之间的竞争、买方议价能力的增强以及低成本高品质供应的竞争等挑战正在限制市场预测。

草坪保护市场趋势

拓展体育活动

所有体育赛事均由世界各地的城市主办,这表明根据规模、要求和目标并行组织不同规模的体育赛事的需求不断增长。因此,草坪维护对于商业体育用途至关重要。对住宅和商业草坪的需求不断增加也创造了对草坪保护市场的需求。从而推动预测市场在不久的将来的成长。根据美国体育活动委员会的数据,参与者人数从 2017 年的 2.169 亿增加到 2020 年的 229.7 人。因此,足球和高尔夫活动的增加可能会进一步增加草坪保护的要求。

例如,德国以其体育活动而闻名,更确切地说,是足球、德甲联赛和其他体育项目,这些体育场通常都是爆满的。这是令人鼓舞的,并可能导致体育场入场人数增加并推动预测期内的市场成长。

在草坪中采用综合害虫管理可以为草坪保护市场带来更多红利。为了减少健康危害和提高成本效益而对生物来源保护的需求不断增长,这可能会推动市场的发展。

北美市场占据主导地位

与其他区域市场相比,北美在产生收入方面主导草坪保护市场。该地区主要参与者的存在和运动场数量的增加是推动草坪保护成长的主要因素。根据美国体育活动委员会的数据,参与体育活动的比例从 2017 年的 72.7% 上升到 2020 年的 75.6%。其中包括一个大型住宅,设有游乐场、公共和众多高尔夫球场。定义区域市场范围的因素。美国占据该地区草坪和装饰化学原料的大部分市场占有率,其次是加拿大。由于气候条件恶劣,墨西哥仍处于早期阶段。然而,由于气候相对温暖,南部地区预计将大幅成长。

2021年,BASF专门针对高尔夫球场市场推出了Alucion 35 WG杀虫剂。这种新型双活性、开放式产品为高尔夫球场管理者提供了一种高效的解决方案,用于控制各种表麵食性昆虫。这种杀虫剂可以保护您的草坪免受蚂蚁、金龟子、甘蓝夜蛾和一年生绿象鼻虫等害虫的侵害。

草坪防护产业概况

草坪保护市场适度整合,主要厂商占较大市场份额。拜耳作物科学股份公司、安道麦有限公司、先正达股份公司、BASF股份公司、AMVAC 化学公司和 UPL 是市场上的主要企业,能够透过关键的产业策略来适应市场的快速变化。专注于跨区域业务扩张和产品创新的领导企业。报告中包含了领先的草坪保护製造商的业务概况,以提供有关营运公司的见解。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 目的

- 庭园绿化

- 高尔夫球

- 运动的

- 草坪种植者

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 市场占有率分析

- 最采用的策略

- 公司简介

- ADAMA Ltd

- AMVAC Chemical Corporation

- UPL

- BASF SE

- Bayer Cropscience AG

- Nufarm

- Marrone Bio Innovations

- Syngenta AG

- Sumitomo Chemical Australia

第七章市场机会与未来趋势

第 8 章 评估 COVID-19 疾病对市场的影响

The Turf Protection Market size is estimated at USD 6.49 billion in 2024, and is expected to reach USD 8.25 billion by 2029, growing at a CAGR of 4.90% during the forecast period (2024-2029).

The COVID-19 pandemic disrupted the working of several markets, including the turf protection market globally. The pandemic affected the supply chain networks, resulting in losses for companies. In terms of supply, a short-term shortage of migrant laborers amidst distribution bottlenecks created a wide gap between the number of workers required for pesticide production. However, the COVID-19 pandemic had a short-term effect on the market growth but is likely to boost investment. The turf protection industry has been transforming over the years, with robust growth and changing trends.

Maintaining a lawn is a difficult task, and thus it needs turf protection to prevent losses caused by pests and weeds. Increasing high demand for sports like cricket, golf, and football is likely to fuel the market during the forecast period. Companies with high innovation are quickly adapting to the changes and earning a high margin. An increase in both export-oriented and domestic market revenue is observed for major players in the turf protection market. However, challenges such as competition between local players, increasing buyer bargaining power, and competition for good quality supply with low cost are the restraints to the forecast market.

Turf Protection Market Trends

Expansion of Sports Activities

All of the sports events found host cities globally, indicating increasing parallel demand to stage sporting events of varying sizes depending on the scale, requirements, and objectives. Thus, maintaining turf is essential for commercial sports purposes. Increasing demand for turf for residential and commercial properties, in turn, creates demand for the turf protection market. Thus, driving the growth of the forecast market in the near future. According to the Physical Activity Council, United States, the number of participants increased from 216.9 million in 2017 to 229.7 in 2020. Thus, the turf protection requirements are likely to increase due to the increasing football and golf activities.

For instance, Germany is famous for its sports activities, more precisely for football, the Bundesliga League, and others for which the stadiums are usually jam-packed. This is encouraging and bringing a high entry of attendees to the stadium, which is likely to boost the market growth over the forecast period.

Adoption of integrated pest management in the turf is likely to add a bonus to the turf protection market. Growing demand for bio-based protections to reduce health hazards and cost-effectiveness are likely to gear up the market.

North America Dominates the Market

North America dominates the turf protection market in terms of revenue generation as compared to that of markets of other regions. The presence of major players and an increasing number of sports fields in the region are major factors to drive the growth of turf protection. According to the Physical Activity Council, US, the participation rate in sports activities increased to 75.6% in 2020 from 72.7% in 2017. Huge residential regions with plenty of play areas, public parks, and a large number of golf courses are some of the factors that define the extent of the market in the region. The United States occupies the majority of the turf and ornamental chemical inputs market share within the region, followed by Canada. Mexico, due to its harsh climatic conditions, is still in a nascent stage. However, it is expected to grow considerably due to comparatively warmer southern regions.

In 2021, BASF introduced Alucion 35 WG insecticide specifically for the golf course market. This new dual-active, non-restricted use product provides golf course superintendents with a highly effective solution for controlling a wide range of surface-feeding insects. The insecticide protects turf from insect pests, including nuisance ants, chinch bugs, cutworms, and annual bluegrass weevils.

Turf Protection Industry Overview

The turf protection market is moderately consolidated, with major players holding a significant share in the market. Bayer CropScience AG, ADAMA Ltd, Syngenta AG, BASF SE, AMVAC Chemical Corporation, and UPL are the major players in the market who are adaptable to quick changes in the market through key industry strategies. The leading companies focused on the expansion of the business across regions and product innovations. To provide insights into the operating companies, business profiles of leading turf protection manufacturers are included in the report.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Landscaping

- 5.1.2 Golf

- 5.1.3 Sports

- 5.1.4 Sod Growers

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Italy

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Adopted Strategies

- 6.3 Company Profiles

- 6.3.1 ADAMA Ltd

- 6.3.2 AMVAC Chemical Corporation

- 6.3.3 UPL

- 6.3.4 BASF SE

- 6.3.5 Bayer Cropscience AG

- 6.3.6 Nufarm

- 6.3.7 Marrone Bio Innovations

- 6.3.8 Syngenta AG

- 6.3.9 Sumitomo Chemical Australia