|

市场调查报告书

商品编码

1439717

林业机械:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Forestry Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

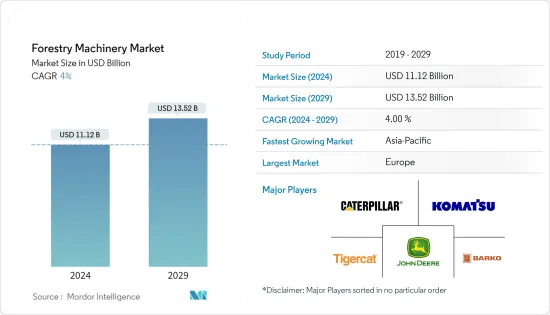

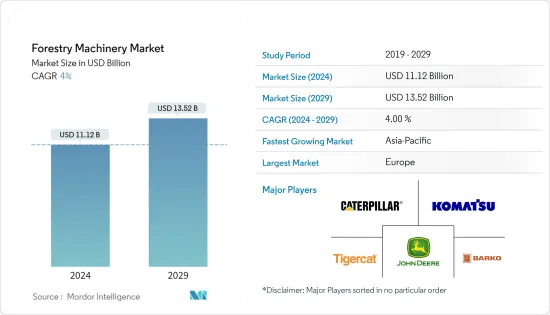

林业机械市场规模预计2024年为111.2亿美元,预计到2029年将达到135.2亿美元,在预测期内(2024-2029年)复合年增长率为4%增长。

主要亮点

- 由于森林保护和管理意识的增强以及机械使用的增加,对林业机械的需求不断增加。木材和木製品需求的快速成长催生了机械化砍伐树木的需求,从而产生了对林业机械的需求。

- 将GPS控制系统纳入林业机械是透过提供即时追踪和永续营运来提高产量的根本驱动力之一,导致北美和欧洲的需求将大幅增加。此外,欧洲和北美等已开发国家对木质颗粒作为发电厂燃料的需求不断增加,预计将推动市场扩张。

森林资源支撑着全球林业机械的强劲市场。据美国林务局称,2021年美国将生产约119.7亿工业圆木。最常见的含有工业原木的产品是锯材、纸浆产品、胶合板和单板。过去十年,世界各地的木製品价格要不是保持不变,就是上涨。木浆和纸板的需求也在增加,这将对林业机械的需求产生正面影响,在预测期内增加其需求。

林业机械市场趋势

林业机械化不断进步

开发中国家伐木业机械化率不断提高以及已开发国家机器密集型定长切割伐木技术的使用增加等因素也促进了所研究市场的成长。森林覆盖率最高的国家是一些最强大的林业机械市场,其中森林覆盖率最高的国家是俄罗斯。根据世界银行统计,俄罗斯国土面积约49%被森林覆盖。

用森林木材生产木製品是最盈利的林业形式,对许多森林覆盖率高的国家的各种工业做出了重大贡献。为了提高生产力,多年来对机械化森林砍伐方法的依赖不断增加。使用收割机等高性能设备,可以在一分钟之内将树木从根部砍下来,剥去树皮,然后切成所需的长度。

此外,许多公司正在考虑在林业领域实施自动驾驶车辆,因为它具有提高生产力、消除机器操作员瓶颈、显着节省成本和环境支援等好处。预计自动化将在预测期内支持林业的新方面,使工作变得更轻鬆,提高生产力和效率并更快地实现预期结果。

欧洲主导市场

欧盟拥有约1.82亿公顷森林,占其地理面积的43%,是欧洲最有价值的可再生资源之一。欧盟的森林高度多样化,具有广泛的森林类型、特征和所有权安排。它们为社会和经济带来许多好处,也是生物多样性的重要来源。此外,它也是提高生活品质和创造就业机会的重要资源。由于这些社会经济效益,欧盟特别是透过通用农业政策来促进林业发展。

欧洲是最大的市场,预计将继续成为林业机械的主要市场和成长最快的市场。透过通用农业政策(CAP)对农村地区的财政支持以及欧盟国家在国家发展计划的支持下鼓励林业活动所采取的措施将继续维持该地区林业机械的销售。我是。欧盟对木质生物质用于工业和能源用途的需求预计在未来几十年将显着增加,以满足生物经济的材料和能源需求。由于劳动投入与收穫产量的比率下降,转向更多机械收割技术增加了对收割机械的投资。世界对粮食的需求不断增加,导致了积极的耕作活动,导致森林转变为耕地。这导致了更多机械化工作的引入,并在全球范围内创造了对林业机械的巨大需求。

林业机械行业概况

儘管产品系列多样化且不断成长,但林业机械市场仍较为分散,主要参与者包括迪尔公司、日本小松公司、巴科液压有限责任公司、卡特彼勒和 Tigercat 国际公司。在快速成长的林业机械市场中,企业不仅在产品品质和产品推广上竞争,还采取其他策略措施来占领更大的份额,扩大所占领的市场规模。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 替代产品的威胁

- 新进入者的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 机器的种类

- 集材机

- 货运代理

- 番茶

- 摇摆机

- 收割机

- 装载机

- 其他林业机械

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 市场占有率分析

- 併购

- 公司简介

- Deere and Company

- Komatsu

- Barko Hydraulics LLC

- Tigercat International Inc

- Caterpillar

- Kubota Corporation

- Rottne Industri AB

- Kawasaki Heavy Industries Ltd

- Volvo

- Hitachi

第七章市场机会与未来趋势

The Forestry Machinery Market size is estimated at USD 11.12 billion in 2024, and is expected to reach USD 13.52 billion by 2029, growing at a CAGR of 4% during the forecast period (2024-2029).

Key Highlights

- The growing awareness of forest preservation and management, combined with the increased use of machinery, has increased demand for forestry equipment.Rapid growth in demand for wood and wood-based products has led to the need for mechanized tree felling, creating opportunities for forestry equipment.

- The incorporation of GPS control systems into forestry equipment is one of the fundamental drivers for enhancing production by providing real-time tracking and sustainable operations, consequently significantly increasing its demand in North America and Europe. Additionally, increased demand for wood pellets as a fuel for power plants in developed economies such as Europe and North America is expected to drive market expansion.

Forest resources help to support a strong market for forestry machinery in different parts of the world. According to the United States Forest Service, in 2021, the United States will have generated around 11.97 billion cubic feet of industrial roundwood. Lumber, pulp products, plywood, and veneer are the most common products containing industrial roundwood. Timber product prices have stayed steady or increased during the last decade worldwide. Wood pulp and paperboard demand are also increasing, which has had a positive impact on demand for forestry machinery, thereby increasing demand during the forecast period.

Forestry Machinery Market Trends

Increasing Mechanization in the Forestry Machineries

Factors such as rising mechanization rates in the logging sectors of developing nations and the increasing use of cut-to-length logging techniques, which are more machine intensive, in industrialized countries are also contributing to the growth of the market studied. Countries with the highest forest cover are some of the most potent markets for forestry machinery, and Russia is the country with the highest forest cover. According to the World Bank's statistics, Russia has a forest cover covering approximately 49% of the total land area of the country.

The manufacturing of wood products by harvesting forest wood is the most profitable of the forestry industries, and it contributes significantly to various industries in many countries with high forest cover. To improve productivity, dependence on mechanized methods for forest harvesting has increased steadily over the years. High-performance equipment, such as harvesters, can cut a tree from the base, debark it, and cut it into the required lengths within a minute.

Moreover, many companies consider autonomous vehicles for the forestry sector as they provide benefits such as increased productivity, the elimination of the machine operator bottleneck, significant cost reductions, and support for environmental aspects. Automation is expected to aid in new dimensions during the forecast period in the forest industry by making the task easy, productive, efficient, and achieving the desired result quickly.

Europe Dominates the Market

The European Union has about 182 million hectares of forest, covering 43% of its geographical area, making it one of Europe's most valuable renewable resources. The forests of the European Union are extraordinarily diversified, with a wide range of forest kinds, characteristics, and ownership arrangements. They provide numerous benefits to society and the economy while also being a significant source of biodiversity. Furthermore, they are an important resource for enhancing the quality of life and creating jobs. These socioeconomic benefits are why the EU promotes forestry, specifically through the Common Agricultural Policy.

Europe is the largest market and is expected to remain the leading as well as the fastest-growing market for forestry machinery. Financial support from the common agricultural policy (CAP) to rural areas and the measures taken by the EU countries to encourage forestry activities with the help of national development programs continue to maintain the sales of forestry machinery in the region. The demand for woody biomass for industrial and energy use in the European Union is expected to rise significantly in the coming decades to meet the material and energy needs of the bio-based economy. Moving toward more mechanical harvesting technology has resulted in increased investment in harvesting machinery as the labor input/harvested volume ratio has decreased. Growing food demand globally has resulted in aggressive cultivation activities, which in turn have led to the conversion of forest lands into arable lands. This has further resulted in the adoption of mechanized practices, which has created a significant demand for forestry machinery globally.

Forestry Machinery Industry Overview

The Forestry Machinery Market is fragmented, with major companies such as Deere & Company, Komatsu, Barko Hydraulics L.L.C. Caterpillar, Inc, and Tigercat International Inc in spite of having diverse and increasing product portfolios. In the fast-growing forestry machinery market, companies are not only competing on the basis of product quality or product promotion but are also focused on other strategic moves, in order to acquire a larger share and expand their acquired market size.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of Substitute Products

- 4.4.4 Threat of New Entrants

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Machine Type

- 5.1.1 Skidders

- 5.1.2 Forwarders

- 5.1.3 Bunchers

- 5.1.4 Swing Machines

- 5.1.5 Harvesters

- 5.1.6 Loaders

- 5.1.7 Other Forestry Machinery

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 US

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 UK

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Deere and Company

- 6.3.2 Komatsu

- 6.3.3 Barko Hydraulics L.L.C.

- 6.3.4 Tigercat International Inc

- 6.3.5 Caterpillar

- 6.3.6 Kubota Corporation

- 6.3.7 Rottne Industri AB

- 6.3.8 Kawasaki Heavy Industries Ltd

- 6.3.9 Volvo

- 6.3.10 Hitachi