|

市场调查报告书

商品编码

1439723

位置感测器:市场占有率分析、产业趋势、成长预测(2024-2029)Position Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

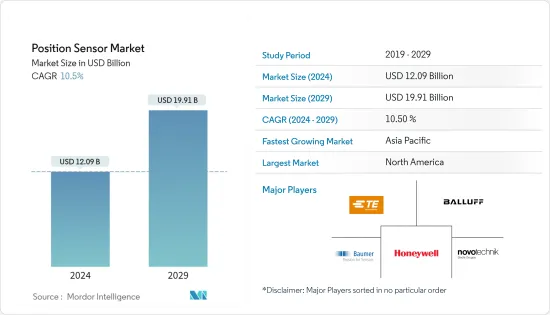

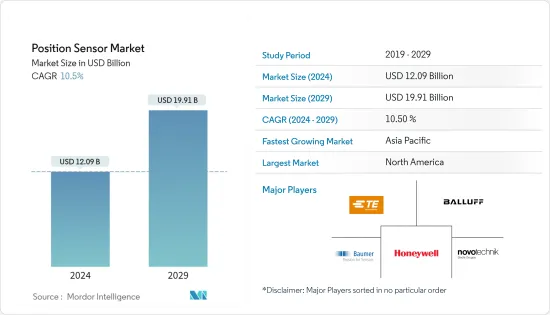

位置感测器市场规模预计到 2024 年为 120.9 亿美元,到 2029 年达到 199.1 亿美元,在市场估计和预测期间(2024-2029 年)复合年增长率为 10.5%。

由于COVID-19大流行的爆发,由于中国、义大利、德国、英国、美国、西班牙、法国和印度有所下降。因此,这些产业中营运的公司的收益大幅下降,对位置感测器製造商的需求也相应减少,从而影响了位置感测器市场的成长。透过精密农业的先进耕作方法的普及是位置感测器市场全球扩张的主要驱动力。 2019年,北美占据了整个市场的最大份额。美国和加拿大越来越多地采用精密农业,帮助其获得了该地区最大的市场份额。位置感测器市场得到整合,少数知名厂商占据了最大的市场占有率。农业领域位置感测器的主要企业包括 Honeywell International Inc.、TE Connectivity、Balluff Inc.、Baumer、Novotechnik 和 Sensor Solutions Corp.。

位置感测器市场趋势

智慧农业、精密农业和政府支持推动市场

农业 4.0 是在世界政府高峰会上以智慧农业实践和精密农业的形式创造的术语,正在日益推动全球位置感测器市场的发展。 2018 年,全球农业中安装的基于物联网 (IoT) 的蜂窝设备总数增至 140 万台。位置感测器也获得感知,感测器用于分析资料后产生即时讯息,引起施用率的相应变化。使用基于地图的方法的传统模型被认为更有效率。他们为问题分析提供了空间,然后在下一步中调整可变利率的应用。就工业研究而言,用于土壤监测目的整合的各种类型的感测器包括电磁、光学、机械、声学和电化学。 2019 年 8 月,一种名为 SoilSense 的技术出现,这是一种低成本智慧土壤监测系统,为面临农业决策困境的农民提供了潜在的帮助。 Soilens 产品系列由 Proximal Soilsens Technologies Pvt Ltd 开发,是新兴企业,并得到了科学技术部 (DST) 和电子和资讯技术部的支持(美蒂)。该系统包含土壤湿度感测器、土壤温度感测器、环境湿度感测器和环境温度感测器。根据这些参数,农民将透过行动应用程式获得有关最佳灌溉的建议。这些资料也可在云端取得。还有可携式土壤湿度系统。加拿大农业和农业食品部 2017 年进行的一项调查发现,75% 的受访者打算在未来实践精密农业。拖拉机和联合收割机,以及配备精密位置感测器来监测植物健康状况的无人机 (UAV) 和无人机,也越来越多地利用位置感测器技术来提高产量和长期农场利润。例如,约翰迪尔在 2019 年消费性电子展上推出了一款新型联合收割机,它使用 GPS、人工智慧和感测器解决方案来告诉农民何时、何地以及如何割草的决定。因此,预计精密农业将在预测期内在推动位置感测器市场方面发挥关键作用。

北美—位置感测器的最大市场

北美处于农业位置感测器部署的前沿。该地区占据整个位置感测器市场的最大份额。美国是北美地区最大的市场。根据美国农业部经济研究服务处的报告,大型农场更有可能采用精密农业技术,包括位置感测器。自 2012 年以来,每个农场的平均面积增加了 2 英亩,而 2017 年农场总数减少了 12,000 个,至 205 万个。在美国,大型农场越来越多地使用精密农业来扩大农场规模并克服实施的技术障碍。在占美国农场总人口85%以上的小规模农场中,只有一小部分采用了精密农业。据美国农业部称,在玉米种植中采用精密技术可以在美国玉米种植者赚取的 85 美元收入净额的基础上边际收益增加 3.73 美元。高盛的研究显示,过去十年感测器价格下降了 50%,为精密农业留下了广阔的发展机会。因此,自动化预计将推动精密农业在该国的引入,并推动位置感测器市场。

位置感测器产业概况

该市场高度整合,少数主导企业占了一半以上的市场占有率。该市场的主要企业包括霍尼韦尔国际公司、TE Connectivity、巴鲁夫公司、堡盟、Novotechnik 和 Sensor Solutions Corp.。广泛的研发活动和产品创新是企业在全球市场上站稳脚步最常采用的策略。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 市场驱动因素

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 类型

- 线性感测器

- 旋转感应器

- 接近感测器

- 其他类型

- 目的

- 农用车

- 牲畜定位与健康监测

- 室内农业

- 其他用途

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Honeywell International Inc.

- TE Connectivity

- Balluff Inc.

- Baumer

- Novotechnik

- Sensor Solutions Corp.

- Carlo Gavazzi Holding AG

- Pepperl+Fuchs

- Semtech

- Trimble Inc.

第七章 市场机会及未来趋势

第八章 COVID-19 市场评估

The Position Sensor Market size is estimated at USD 12.09 billion in 2024, and is expected to reach USD 19.91 billion by 2029, growing at a CAGR of 10.5% during the forecast period (2024-2029).

Due to the outbreak of the COVID-19 pandemic, end-user sectors that utilize position sensors saw a reduction in growth from January to May in a variety of nations, including China, Italy, Germany, the United Kingdom, the United States, Spain, France, and India, owing to a halt in operations. This led to a major decrease in the revenues of companies operating in these industries, as well as a subsequent decrease in demand for position sensor manufacturers, consequently influencing the growth of the position sensors market. The proliferation of advanced farming practices through precision agriculture is the major driving factor behind the expansion of the position sensor market globally. North America constituted the largest share of the overall market in 2019. The increasing rate of adoption of precision farming in the United States and Canada contributed to gaining the largest share in the region. The market for position sensors is consolidated, with a few notable players occupying the largest market share. The major players dealing in position sensors for the agricultural sector include Honeywell International Inc., TE Connectivity, Balluff Inc., Baumer, Novotechnik, and Sensor Solutions Corp.

Position Sensor Market Trends

Smart Farming Practices, Precision Agriculture, and Government Support Driving the Market

Agriculture 4.0, a term coined in the World Government Summit in the form of smart agricultural practices and precision farming, is increasingly driving the position sensor market globally. The total number of Internet-of-Things (IoT)-based cellular devices installed in agriculture rose to 1.4 million in 2018 globally. Position sensor also gains awareness, and sensors are used for generating real-time information after the analysis of the data and causes the corresponding changes in the application rate. Conventional models of the utilization of a map-based approach are considered to be more productive. They allow room for problem analysis and subsequently adjust the variable rate application in the following steps. The various type of sensors being integrated for soil monitoring purposes includes electromagnetic, optical, mechanical, acoustic, and electrochemical, as far as industrial research has reached. In August 2019, a technology called Soilsens, which is a low-cost smart soil monitoring system, has come as a potential help to farmers facing farming decision predicaments. Proximal Soilsens Technologies Pvt Ltd developed the Soilsens product line, a startup incubated at the Indian Institute of Technology Bombay (IITB), Mumbai, with support from the Ministry of Department of Science and Technology (DST) and Ministry of Electronics and Information Technology (Meity). The system is embedded with a soil moisture sensor, soil temperature sensor, ambient humidity sensor, and ambient temperature sensor. Based on these parameters, farmers are advised about optimum irrigation through a mobile app. This data is also available on the cloud. There is also a portable soil moisture system. A survey by Agriculture and Agri-Food Canada in 2017 found that 75% of the sampled respondents intend to practice precision farming in the future. Along with unmanned air vehicles (UAVs) or drones outfitted with precision positioning sensors for plant-health monitoring, tractors and combine harvesters are progressively using position sensor technology to increase harvest yields and long-term farm profits. For instance, John Deere launched its new combine harvester at the 2019 Consumer Electronics Show, which uses GPS, Artificial Intelligence, and sensor solutions to decide on how, where, and when to cut the farmer's field. As such, precision agriculture is expected to play a significant role in driving the position sensor market during the forecast period.

North America - The Largest Market for Position Sensors

North America has been at the forefront of the deployment of position sensors in the field of agriculture. The region contributed to the largest share of the overall position sensor market. The United States was the largest market in the North American region. According to a report by the Economic Research Services, USDA, large-holding farms are more likely to adopt precision agriculture technologies, including position sensors. The average farm size has been increasing at the rate of two acres per farm since 2012, with the total number of farms declining by 12,000 to 2.05 million in 2017. In the United States, larger farms are increasing their use of precision agriculture to cover the increased farm size and overcome technological barriers to implementing practices. Among the small farms in the United States, which make up greater than 85% of United States farm totals, only a few have adopted precision agriculture. According to USDA, the adoption of precision technology in corn cultivation can add marginal gains of USD 3.73 to the net returns of USD 85.0 fetched by the US corn farmers. A study by Goldman Sachs revealed that the overall sensor prices fell by 50% in the last decade, thereby leaving a wide opportunity for precision agriculture to grow. Thus, automation is expected to give a boost to the adoption of precision agriculture in the country, thus, driving the position sensor market.

Position Sensor Industry Overview

The market is fairly consolidated due to the presence of a few prominent players, accounting for more than half of the total market share. The key players in the market include Honeywell International Inc., TE Connectivity, Balluff Inc., Baumer, Novotechnik, and Sensor Solutions Corp. Extensive R&D activities and subsequent product innovations were the strategies most adopted by the companies to gain a stronger foothold in the market globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Market Drivers

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Linear Sensors

- 5.1.2 Rotary Sensors

- 5.1.3 Proximity Sensors

- 5.1.4 Other Types

- 5.2 Application

- 5.2.1 Agricultural Vehicles

- 5.2.2 Livestock Position and Health Monitoring

- 5.2.3 Indoor Farming

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Honeywell International Inc.

- 6.3.2 TE Connectivity

- 6.3.3 Balluff Inc.

- 6.3.4 Baumer

- 6.3.5 Novotechnik

- 6.3.6 Sensor Solutions Corp.

- 6.3.7 Carlo Gavazzi Holding AG

- 6.3.8 Pepperl+Fuchs

- 6.3.9 Semtech

- 6.3.10 Trimble Inc.