|

市场调查报告书

商品编码

1439725

黏附包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Adherence Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

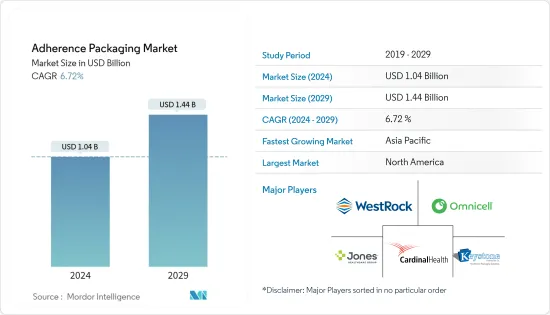

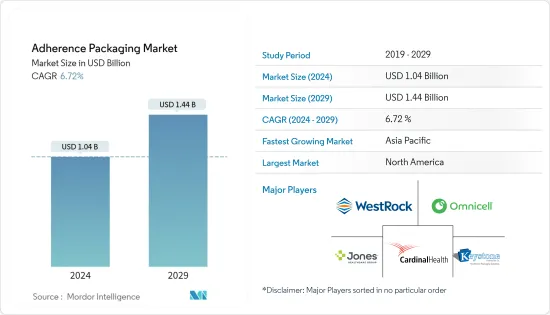

黏附包装市场规模预计到 2024 年为 10.4 亿美元,预计到 2029 年将达到 14.4 亿美元,预测期内(2024-2029 年)复合年增长率为 6.72%。

依从性包装主要用于医疗服务,以患者的方式组织药物摄入,而不是繁琐的药物负责人。它在白天或一段时间内向患者提供,以帮助他们按照医生的指示服用处方笺。

主要亮点

- 在慢性阻塞性肺病患者中,药物治疗和疾病管理依从性差与紧急住院有关。由于这些因素,依从性包装是此类患者日益增长的需求之一,预计在未来几年将显着增长。

- 人们日益渴望减少药物浪费,促进了黏附包装行业的发展。药品废弃物对医疗保健系统产生重大经济影响,并对环境产生负面影响。然而,另一方面,高昂的实施、安装和维护成本可能会限制全球整体市场的成长。

- 透过近场通讯(NFC) 或无线射频识别 (RFID) 数位化撷取分配事件的最新发展正在纳入包装中,以沿着类似的路线进行检验。单位剂量泡壳具有被动、主动和互动式能力,可以对抗鸦片类药物流行并提高药物安全性。被动元素是指图形或文字提醒和警报。如果给药週期缩短,动态功能会使用电子设备发送提醒和警报。此外,互动功能允许患者以记录剂量和时间的形式对包装上的说明做出反应,以抑製成瘾行为。

- 一些公司正在采取产品发布和合作伙伴关係等倡议,以提高其在所研究市场的竞争力。例如,2021 年 1 月,先进包装和药物解决方案开发商 Jones Healthcare Group 宣布在其 Qube 和 FlexRx 药物依从性产品线中添加永续包装,这对药局来说尚属首次。 Qube Pro、FlexRx One 和 FlexRx Reseal 有助于减少药局和患者的环境足迹。

- 同时,在供应商方面,基于技术的药物依从性提供者 Acute Technology 强调了 Hydra Communications Gateway 的使用。这可能使智慧型手机用户能够轻鬆地对剂量进行电子监控。这有效地解决了每週药物托盘供应的药物缺乏控制的问题。然而,在感染疾病COVID-19 的斗争中发挥核心作用的製药公司,如吉利德 (Gilead) 和礼来 (Eli Lilly),已经看到股市的积极增长,并核准新的 COVID-19感染疾病。随着竞争的持续,我们看到感染疾病形势新创新的爆发。 19 种疗法开始普及,预计将显着扩大黏附包装市场。

遵守包装市场趋势

多剂量包装预计将显着成长

- 药物依从性的重要性以及同步这些剂量的好处导致了多剂量包装的开发。多剂量泡壳卡的好处包括设定给药时间以消除混乱、更自然的自我治疗以及每月去药房的次数更少。多项研究证明,将多媒体泡壳包装与药物治疗管理 (MTM) 结合可以提高依从性和健康结果。

- Omnicel 进行的一项研究发现,分配到多药物包装组的患者最初的依从率为 80%,在研究结束时甚至达到了 90%。另外,分配到仅使用小瓶治疗组的患者的依从率为 56%。 Omnicell 向 Holyoke 健康中心提供 MultiMed泡壳卡。该健康中心使用了 Omnicell 的 SureMed+(7 天 4 张通行证,冷封,双折卡)。

- 2021 年 5 月,Euclid 推出了多剂量包装系统,以提高阿肯色州两家药局的合规性和满意度。该公司的 Axial多剂量袋包装机可包装药物并显示正确的给药时间,以促进患者的依从性并简化流程。 Axial RMD-144 的占地面积仅为 2 x 2 英尺,非常适合空间有限的药房。

- 此外,据观察,电子商务公司正在为老年人提供便利、合规和客製化的医疗保健套餐。亚马逊去年收购了线上药局 PillPack,这标誌着线上药品配送的需求,也显示了对多种药物包的潜在需求。在 COVID-19感染疾病期间,多剂量包装需要确保处理患者处方笺减少“接触点”,同时避免与自我用药相关的混乱。

北美市场占据主导地位

- 北美地区受到蓬勃发展的经济、老龄化人口和先进的医疗保健服务系统的推动。儘管如此,各国的人口规模、医疗保健支出集中、国内生产总值毛额(GDP)和医疗保险体系结构仍存在相当大的差异。美国是世界上最大的黏附包装产品地理市场,拥有发达的初级保健社区、广泛的医疗和生命科学研究活动、高度的医疗保健支出集中度以及庞大的製药和医疗用品及医疗设备行业。最大的市场。

- 此外,美国惩教机构的药物顺从性也有所改善。大多数惩教所里的囚犯都依赖外部药局来处方笺。根据情况,可能会有专职药剂师在场。然而,这类人员往往有限,依赖集中地点提供药物和现场护理人员管理人员等进行配药。这增强了药房管理系统的合法性,该系统需要更少的员工工作,并且管理良好以确保患者的依从性。

- 2022 年 2 月,家庭医疗保健领域药物依从性解决方案提供者 CuePath Innovation 宣布发布第二代远端患者照护药物依从性监测工具套件,其中包括智慧泡壳包装解决方案。该公告是在该公司与 Wellness Pharmacy Group推出重症监护计划的同时发布的,该计画为遵循复杂处方方案的患者提供药物监测和依从性支持。该计划的目标是确保患有复杂疾病的患者,例如肾臟病患者和移植患者,尽可能长时间地继续接受药物治疗。

- 此外,根据 Parata Systems 的数据,美国每年因不遵守药物治疗而造成的损失平均为 3,000 亿美元。袋装包装降低了治疗成本并改善了患者的治疗效果。随着市场上带状包装的增加,患者意识预计会给药店带来压力,迫使他们放弃适当的包装。该公司针对药局推出了「Parata PASSTM 36」。 Parata Systems 是一家药局自动化系统供应商,产品包括管瓶灌装、依从性包装、工作流程和病患体验解决方案,推出了一款名为 PASSTM 36 的袋装包装机。

黏合包装产业概述

黏附包装市场竞争适中,由一些重要的参与者组成。 Cardinal Health Inc.、WestRock Company、Omnicell Inc.、Parata Systems LLC 和 Keystone Folding Box Co. 等公司占有重要的市场占有率。市场上还有多种产品发布和合作关係。

- 2022 年 4 月 - Schreiner MediPharm 推出升级版智慧型泡壳 Wallet,这是一种数位化工具,可让製药商自动且更灵活地追踪临床试验参与者的合规性。

- 2021 年 7 月 - Cardinal Health 推出 Cardinal Health NavixRxTM 合规包装,为独立药房提供解决方案,为每天收到两份或更多处方笺的患者外包合规包装。此外,位于路易斯维尔的康德乐配销中心(靠近达拉斯沃斯堡机场和联盟机场)的包装设施正在满载运作,为全国药局提供供应和物流优势。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19感染疾病对产业的影响

第五章市场动态

- 市场驱动因素

- 减少药品废弃物的需求日益增加

- 不依从用药的比例很高

- 市场挑战

- 自动化系统的安装和维护成本高昂

- 缺乏对药物依从性包装的认识

- 市场机会

第六章 政府法规

第七章市场区隔

- 材料

- 塑胶(PE、PET、PVC、PP)

- 纸和纸板

- 铝

- 类型

- 单位剂量包装

- 多剂量包装

- 包装类型

- 泡壳

- 小袋

- 其他包装类型

- 最终用户产业

- 药局

- 医院

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第八章 竞争形势

- 公司简介

- Westrock Company

- Keystone Folding Box Co.

- Cardinal Health Inc.

- Omnicell Inc.

- Jones Healthcare Group

- Drug Package LLC

- Parata Systems LLC

- Manrex Limited

- Medicine-On-Time LLC

- Rx Systems Inc.

第九章投资分析

第10章市场的未来

The Adherence Packaging Market size is estimated at USD 1.04 billion in 2024, and is expected to reach USD 1.44 billion by 2029, growing at a CAGR of 6.72% during the forecast period (2024-2029).

Adherence packaging is primarily used in medical services to replace burdensome medication planners and organize drug consumption in the way patients do. It is given to the patient during the day or as time passes to make it easier to take their prescription as advised by their doctor.

Key Highlights

- Poor adherence to pharmacological therapy and illness management has been linked to emergency hospitalization in individuals with chronic obstructive pulmonary disease. Due to these factors, adherence packaging is one of the growing needs for such patients and is anticipated to witness significant growth in the coming years.

- The growing desire to reduce drug wastage is contributing to the growth of the adherence packaging industry. Medication waste has a significant financial impact on the healthcare system and has negative environmental consequences. However, high implementation, installation, and maintenance expenses, on the other hand, may limit the market's total growth at a global level.

- Recent developments about digital capturing dispense events via near-field communication (NFC) or radio frequency identification (RFID) is being incorporated into packaging for verification on similar lines. The unit-dose blisters allow passive, active, and interactive features to combat the opioid epidemic and improve pharmaceutical safety. Passive elements refer to graphic or text reminders and warnings. Dynamic features use electronics for reminders or alarms in case of a shortened dosing period. Moreover, interactive features enable the patients to respond to prompts from the packaging in the form of recording doses and timing to curb addictive behavior.

- Several companies are undertaking initiatives, such as product launches and partnerships, to gain a competitive edge in the studied market. For instance, in January 2021, Jones Healthcare Group, a developer of advanced packaging and medication dispensing solutions, announced the addition of first-of-its-kind sustainable packaging for pharmacies to its Qube and FlexRx medication adherence product lines. The Qube Pro, FlexRx One, and FlexRx Reseal help pharmacies and patients reduce their environmental footprints.

- Meanwhile, on the vendor front, Acute Technology, a tech-based medication adherence provider, has been stressing the use of Hydra Communications Gateway. This may enable smartphone users to facilitate the electronic monitoring of dosages. This effectively addresses the lack of control of the medication supplied through weekly medicine trays. However, pharmaceutical companies taking centre stage in the COVID-19 fight, such as Gilead and Eli Lilly, are seeing positive growth on the stock market and a new burst of innovation in the infectious disease landscape as the race for treatment approval for a COVID-19 therapy is taking off, which is expected to boost the adherence packaging market significantly.

Adherence Packaging Market Trends

Multi-dose Packaging is Expected to Witness Significant Growth

- The importance of medication adherence and the benefits of synchronizing those medications have led to the development of multi-dose packages. The benefits of multi-dose blister cards include setting up dosage time to eliminate confusion, more natural self-medication, and cutting down the number of visits to the pharmacy per month. Multiple studies have proven improved adherence and health outcomes, combined with multimed blister packs and medication therapy management (MTM).

- A survey conducted by Omnicell suggested that patients assigned to the multimed packaging groups accounted for medication adherence rates of 80% initially, and they even accounted for 90% adherence rates by the completion of the trial. Alternatively, patients assigned to the pill bottle-only group accounted for an adherence rate of 56%. Omnicell offered multimed blister cards to Holyoke Health Center. The health center used Omnicell's SureMed+, a seven-day, four-time pass, cold-seal, and bi-fold card.

- In May 2021, Euclid introduced a multi-dose packaging system that boosts adherence and satisfaction for two Arkansas pharmacies. The company's Axial multi-dose pouch packaging machines promote adherence and simplify the process for the patient by pouch packaging medications and labeling with appropriate consumption time. The Axial RMD-144 has only a 2-by-2-foot footprint, making it ideal for pharmacies with limited space.

- Furthermore, e-commerce players are observed to have been expanding convenience, compliance, and customized healthcare packaging for the elderly population. Last year's Amazon's purchase of the online pharmacy, PillPack, suggests the need for online medication delivery, thus indicating the potential for multimed packs to be demanded. The multi-dose packaging, amid the COVID-19 outbreak, has to ensure a reduced amount of 'touchpoints' for processing a patient's prescriptions while avoiding confusion associated with self-medicating.

North America Dominates the Market

- The North American region is developed with prosperous economies, aging population segments, and advanced medical delivery systems. Still, the countries vary measurably in population size, healthcare spending intensities, aggregate gross domestic product (GDP) levels, and the structure of health insurance plans. With an advanced primary medical community, extensive medical and life science research activities, high healthcare spending intensity, and large pharmaceutical and medical supply and device industries, the United States accounts for one of the world's largest geographical markets for adherence packaging products.

- Further, the United States is witnessing improved medication adherence in the correctional setting. The incarcerated population in most correctional facilities relies on an outside pharmacy to fill their prescriptions. An onsite pharmacist may be provided in some situations. However, such staff is often restricted, relying on a centralized location to supply drugs and an onsite nurse manager or similar to dispense. This strengthens the case for dispensing administration systems that are low-effort for personnel while yet being well-managed to ensure patient adherence.

- In February 2022, CuePath Innovation, a provider of medication adherence solutions for the home healthcare sector, announced the release of its second-generation suite of remote patient care medication adherence monitoring tools that include Smart Blister Packaging Solution. The announcement comes with the launch of the company's critical care project with Wellness Pharmacy Group, which will provide medication monitoring and adherence support for patients on complicated regimens. The program's purpose is to guarantee that patients with complex medical conditions, such as renal and transplant patients, stick to their medications as close as possible.

- Also, as per Parata Systems, non-adherence to medication, on average, costs USD 300 billion/year in the United States. Pouch packaging has reduced the cost of care and improved patient outcomes. With the growing presence of strip packaging in the market, patient awareness is expected to pressurize pharmacies without proper packaging to be left behind. The company launched Parata PASSTM 36, targeting pharmacies. Parata Systems, being a provider of pharmacy automation systems, including vial-filling, adherence packaging, and workflow and patient experience solutions, launched a pouch packager named PASSTM 36.

Adherence Packaging Industry Overview

The adherence packaging market is moderately competitive and consists of a few significant players. Companies like Cardinal Health Inc., WestRock Company, Omnicell Inc., Parata Systems LLC, and Keystone Folding Box Co., among others, hold substantial market shares. The market is also witnessing multiple product launches and partnerships.

- April 2022 - Schreiner MediPharm has launched its upgraded Smart Blister Wallet, a digitally-enabled tool that allows pharmaceutical manufacturers to track compliance in their clinical trial participants automatically and with greater flexibility.

- July 2021 - Cardinal Health launched Cardinal Health NavixRxTM Compliance Packaging, which provides independent pharmacies with a solution to outsource compliance packaging for patients taking two or more prescriptions daily. Furthermore, the packaging facility is fully operational in Lewisville with proximity to a Cardinal Health distribution center and the Dallas Fort Worth and Alliance airports, providing supply and logistical advantages for service to pharmacies nationwide.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Need to Minimize Medication Wastage

- 5.1.2 High Rate of Medication Non-adherence

- 5.2 Market Challenges

- 5.2.1 High Installation and Maintenance Costs of Automated Systems

- 5.2.2 Lack of Awareness Regarding Medication Adherence Packaging

- 5.3 Market Opportunities

6 GOVERNMENT REGULATIONS

7 MARKET SEGMENTATION

- 7.1 Material

- 7.1.1 Plastic (PE, PET, PVC, and PP)

- 7.1.2 Paper and Paperboard

- 7.1.3 Aluminum

- 7.2 Type

- 7.2.1 Unit-dose Packaging

- 7.2.2 Multi-dose Packaging

- 7.3 Packaging Type

- 7.3.1 Blisters

- 7.3.2 Pouches

- 7.3.3 Other Packaging Types

- 7.4 End-user Industry

- 7.4.1 Pharmacies

- 7.4.2 Hospitals

- 7.4.3 Other End-user Industries

- 7.5 Geography

- 7.5.1 North America

- 7.5.2 Europe

- 7.5.3 Asia-Pacific

- 7.5.4 Latin America

- 7.5.5 Middle-East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Westrock Company

- 8.1.2 Keystone Folding Box Co.

- 8.1.3 Cardinal Health Inc.

- 8.1.4 Omnicell Inc.

- 8.1.5 Jones Healthcare Group

- 8.1.6 Drug Package LLC

- 8.1.7 Parata Systems LLC

- 8.1.8 Manrex Limited

- 8.1.9 Medicine-On-Time LLC

- 8.1.10 Rx Systems Inc.