|

市场调查报告书

商品编码

1439733

永续包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Sustainable Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

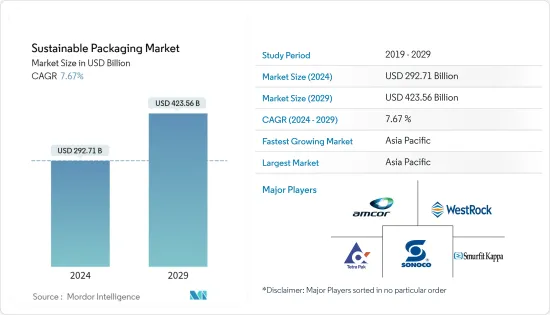

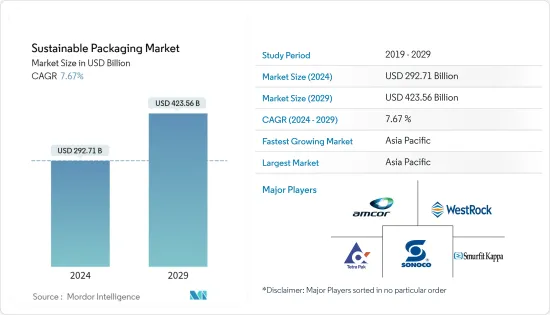

根据预测,2024年永续包装市场规模为2,927.1亿美元,2029年将达到4,235.6亿美元,在市场估算与预测期间(2024-2029年)复合年增长率为7.67%。

永续包装是指创造和使用能够提高永续的包装。永续包装是指创造和使用可提高永续的包装,更多地利用生命週期评估和库存来为包装决策提供资讯并减少对环境的影响。

主要亮点

- 近年来,人们对永续的兴趣(尤其是消费者层面)急剧上升。循环经济的概念正在蓬勃发展,永续包装也受到广泛关注。此外,各大洲政府都在回应民众对包装废弃物,特别是一次性包装废弃物的担忧。我们实施了相关法规,以最大程度地减少环境废弃物并改善废弃物管理流程。

- 法国、德国和英国等国家正在透过生产者延伸责任 (EPR) 超越欧盟 (EU) 严格的回收法规。在亚洲,泰国宣布从 2020 年 1 月 1 日起在全国范围内禁止在必需品商店使用一次性塑胶袋。为了减少塑胶洩漏到环境中,我们的目标是到 2021 年完全禁止使用塑胶。

- 根据海洋保护协会的一项研究,每年有 800 万吨塑胶进入海洋,估计已经有 1.5 亿吨塑胶扰乱了世界海洋。这大约相当于纽约市一辆垃圾车一年内每分钟倾倒到海洋中的塑胶量。研究预测,2025年将是环保包装的分水岭。超过 40% 的公司预计在未来五年内使用创新产品和永续技术。该公司计划使用永续包装来创建循环经济,包括可堆肥或生物分解性材料以及重新设计容器以减少或消除废弃物。

- 不可回收、非生物分解的塑胶包装解决方案的使用正在扩大,导致环境中的碳排放增加。因此,包括亚马逊、谷歌和利乐在内的许多大公司都致力于实现净零碳排放,预计这将导致资本支出。

- 由于 COVID-19 的爆发,许多公司已开始放弃塑胶禁令的永续目标。一些研究表明,该病毒可以透过纸板和塑胶传播,导致超级市场使用一次性材料包装产品的情况增加,例如用于水果和蔬菜的 Clinfilm。

永续包装市场趋势

永续塑胶包装解决方案占据主要市场份额

- 预计塑胶袋和塑胶袋在整个预测期内仍将是常见的包装型态,因为它们能够保持食品新鲜度并延长产品保质期。此外,由石油製成的塑胶袋和袋子美观且环保,使该产品具有行销优势。

- 由于消费者对环保包装的日益偏好,业界正关註生物基 PVC 的生产。 2021 年 10 月,嘉吉宣布将生物基塑化剂Biovero 加入其生物工业解决方案组合中。该产品广泛用于产品製造应用,包括为北美工业客户生产地板材料、服饰、电线、电缆以及塑胶薄膜和板材,并计划将其产品扩展到全球。这种情况预计将在未来几年促进永续聚氯乙烯的使用。

- 由于消费者对环保包装的偏好增加,我们专注于生物基 PVC 的生产。 2021 年 10 月,嘉吉宣布将生物基塑化剂Biovero 加入其生物工业解决方案组合中。该产品广泛用于产品製造应用,包括为北美工业客户生产地板材料、服饰、电线、电缆、塑胶薄膜和板材,并计划将其产品扩展到全球。这种情况预计将在未来几年增加可持续 PVC 的使用。

- 美国食品药物管理局已核准PLA 塑胶用于许多一次性包装应用,并确定它对所有食品包装应用都是安全的。 PLA 也用于汽车、纺织品、发泡体和薄膜。纯 PLA 袋、PLA 化合物、实验室和化合物服务以及永续包装解决方案均由 WeforYou 提供。将 PLA 塑胶与传统石油基塑胶进行比较,揭示了价格差异。另一方面,机械和物理素质较差。

- 在加拿大安大略省圭尔夫市圭尔夫大学作物科学大楼植物农业系进行的另一项研究中,科学家们开发了一种基于聚(3-羟基丁酸酯)(PHB)和龙舌兰纤维的永续绿色复合材料。来生产。

亚太地区预计将出现显着成长

- 中国最大的电子商务网站和加急运输公司正在积极减少包装材料的使用。例如,顺丰速运使用的包装平均可回收约10次。顺丰速运在全国一二线城市采用了超过10万个可回收包装箱,主要取代纸箱和塑胶袋,减少了发泡聚苯乙烯和胶带的使用。该公司补充说,其倡议响应了国家物流行业永续增长的需求。

- 2020年8月,国家邮政局等八部门发布指令,强制实施国家标准,确保2022年快递业使用无害化包装材料。这将建立一个重点明确、结构优化的永续包装标准体系。相关部门应依照指引要求,改善从设计、材料、回收到处置的全过程永续包装标准流程。

- 对环境污染的担忧导致北京发布指令,可能禁止使用传统塑料,包括刀叉餐具、塑胶购物袋和包装等一次性非生物分解塑料。因此,製造商正在增加玉米和砂糖等作物的使用,并专注于开发生物分解性塑胶。已宣布,到2021年中期,吉林省和热带岛屿海南省将全面禁止使用一次性塑胶和非生物分解的外食服务产品。

- 未来,印度不断壮大的中阶、有组织零售的快速扩张、出口的增加以及印度蓬勃发展的电子商务产业可能会推动进一步的发展。这就产生了对环保包装的需求,这种包装可以保证最高的质量,同时最大限度地减少对环境的负面影响。因此,企业采用减少环境污染的永续包装方法非常重要。

- Capgemini SA最近一项关于永续和消费行为变化的研究发现,79% 的消费者正在改变他们的购买习惯,以考虑社会责任、整体性和环境影响。此外,53% 的消费者和 57% 18 至 24 岁的消费者正在转向较不知名的品牌,因为它们更环保。此外,超过 52% 的客户声称与他们认为永续的公司和组织有情感联繫。

永续包装产业概述

全球永续包装市场高度分散。主要参与者包括 Amcor Limited、TetraPak International SA、WestRock Compan、Smurfit Kappa Group PLC、Sonoco Products Company 等。

2022 年 4 月,WestRock 宣布与 Recipe Unlimited 合作,推出一系列可回收纸板包装,旨在每年从加拿大各地的垃圾掩埋场转移 3,100 万个塑胶容器。该套餐将于 2021 年 10 月开始在 Swiss Chalet 餐厅推出,并在所有地点提供。

2022 年 4 月,Sealed Air 宣布合作开展一项先进的回收倡议,重点是回收食品供应链中的软塑胶,并将其转化为新的经过认证的循环食品级包装。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间敌对关係的强度

- 替代品的威胁

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 政府对永续包装的倡议

- 封装小型化

- 改变消费者对可回收和环保材料的偏好

- 市场限制因素

- 製造工厂产能限制

- 原料高成本

第六章市场区隔

- 按流程

- 可重复使用的包装

- 可降解包装

- 回收包装

- 依材料类型

- 玻璃

- 塑胶

- 金属

- 纸

- 按最终用户

- 药品/医疗保健

- 化妆品/个人护理

- 食品和饮料

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Amcor Limited

- Westrock Company

- TetraPak International SA

- Sonoco Products Company

- Smurfit Kappa Group PLC

- Sealed Air Corporation

- Mondi PLC

- Huhtamaki OYJ

- BASF SE

- Ardagh Group SA

- Ball Corporation

- Crown Holdings Inc.

- DS Smith PLC

- Genpak LLC

- International Paper Company

第八章投资分析

第九章市场展望

The Sustainable Packaging Market size is estimated at USD 292.71 billion in 2024, and is expected to reach USD 423.56 billion by 2029, growing at a CAGR of 7.67% during the forecast period (2024-2029).

Sustainable packaging is the creation and use of packaging that improves sustainability. It makes more use of life cycle assessments and inventories to inform packaging decisions and lessen its impact on the environment.

Key Highlights

- Over the past couple of years, the interest (particularly at a consumer level) in sustainability has surged. The concept of circular economics gained significant momentum, and this has also focused considerable attention on sustainable packaging. Furthermore, governments on all continents have responded to public concerns regarding packaging waste, especially single-use packaging waste. They are implementing regulations to minimize environmental waste and improve waste management processes.

- Countries like France, Germany, and the United Kingdom go above and beyond robust recycling regulations across the European Union with Extended Producer Responsibilities (EPRs). In Asia, Thailand announced a nationwide ban on single-use plastic bags at significant stores effective from January 1, 2020. It aimed for a complete ban by 2021 to reduce plastic leakage into the environment.

- According to a survey by the Ocean Conservancy, 8 million metric tonnes of plastic enter the ocean annually, adding to the estimated 150 million metric tonnes that are already churning around in the world's oceans. This is roughly equivalent to dumping one garbage truck from New York City's streets worth of plastic into the ocean every minute for a year. According to the survey, 2025 is predicted to be a watershed year for environmentally friendly packaging. Over 40% anticipate using innovative products and sustainable techniques during the next five years. Companies plan to use sustainable packaging to create a circular economy, including compostable or biodegradable materials and redesigning containers to cut or eliminate waste.

- The usage of non-recyclable, non-biodegradable plastic packaging solutions is expanding, resulting in increased carbon emissions in the environment. As a result, numerous large firms, such as Amazon, Google, and Tetrapak, among others, are aiming toward net-zero carbon emissions, which is predicted to be capital expenditure.

- With the outbreak of COVID-19, many companies began shifting away from banning plastic's sustainability goal. Some studies suggested that the virus can be passed on through cardboard and plastic, which resulted in increased usage of single-use materials across the supermarkets to wrap products, like cling film for fruits and vegetables.

Sustainable Packaging Market Trends

Sustainable Plastic Packaging Solutions to Hold Major Share in Market

- Due to their capacity to preserve the freshness of food products and increase product shelf life, plastic pouches and bags are anticipated to continue being a common form of packaging throughout the forecast period. Plastic bags and pouches made from petroleum also have a fantastic visible aesthetic and are environmentally friendly, increasing the products' marketing advantages.

- Due to consumers' rising preference for environmentally friendly packaging, industries are concentrating on creating bio-based PVCs. Cargill announced the addition of Biovero bio-based plasticizer to its portfolio of bio-industrial solutions in October 2021. This product is used for a wide range of product manufacturing applications, including the production of flooring, clothing, wires, cables, and plastic films and sheets for its industrial customers in North America, with plans to expand the offering globally. It is anticipated that situations like this will encourage the use of sustainable PVCs in the upcoming years.

- The businesses concentrate on creating bio-based PVCs due to consumers' rising preference for eco-friendly packaging. Cargill announced the addition of Biovero bio-based plasticizer to its portfolio of bio industrial solutions in October 2021. The product is used for a wide range of product manufacturing applications, including producing flooring, clothing, wires, cables, plastic films, and sheets for its industrial customers in North America, with plans to expand the offering globally. In the upcoming years, the use of sustainable PVCs is anticipated to increase due to situations like these.

- The United States Food and Drug Administration has approved PLA plastic for use in many disposable packaging applications and has determined it to be safe for all food packaging applications. PLA is also used in vehicles, textiles, foams, and films. Pure PLA bags, PLA compounds, a laboratory and compound service, and sustainable packaging solutions are all provided by WeforYou. Comparing PLA plastics to conventional petroleum-based plastics will reveal a price difference. In contrast, they have fewer mechanical and physical qualities.

- In another research study conducted by the Department of Plant Agriculture, Crop Science Building, University of Guelph, Guelph, Ontario, Canada, scientists were able to produce a sustainable green composite based on poly(3-hydroxybutyrate) (PHB) and agave fiber.

Asia-Pacific Expected to Have Significant Growth

- The largest Chinese e-commerce sites and rapid delivery providers have been actively reducing the use of packaging materials. For instance, recyclable packaging boxes, which can be recycled an average of around ten times, were being used by SF Express. In first-tier and several second-tier domestic cities, the corporation has adopted more than 100,000 such boxes, mainly to replace paper boxes and plastic bags and cut down on foam blocks and tape. The business added that its initiatives are in response to the nation's need for sustainable growth in the logistics sector.

- Eight departments, including China's State Post Bureau (SPB), issued a directive in August 2020 stating that the nation would implement mandatory national standards to ensure that the express delivery industry uses hazard-free packaging materials by 2022. This would establish a comprehensive sustainable packaging standard system with distinct priorities and an optimized structure. The relevant departments will need to improve their sustainable packaging standard processes throughout the entire process, from design, materials, and recycling to disposal, following the requirements of the guideline.

- Concerns over environmental pollution have prompted directives from Beijing and the possibility of a ban on conventional plastics, such as single-use non-biodegradable plastics like cutlery, plastic bags, and packaging. As a result, manufacturers have also been concentrating on the increased use of corn, sugar, and other crops to develop biodegradable plastics. It was announced that by mid-2021, the Jilin Province and the tropical island of Hainan would implement broader bans on single-use plastics and non-biodegradable food service goods.

- The future, the increase of the Indian middle class, the quick expansion of organized retailers, the growth of exports, and India's burgeoning e-commerce industry are likely to assist further development. This has created a need for environmentally friendly packaging that can guarantee the best quality while having minimal negative environmental impact. Thus, firms adopting sustainable packaging methods to ensure less environmental contamination have become significant.

- A recent survey by Capgemini on sustainability and shifting consumer behavior found that 79% of consumers are altering their purchasing habits mostly due to considerations of social responsibility, inclusivity, and environmental impact. Additionally, 53% of consumers and 57% of consumers aged 18 to 24 have moved to less well-known brands because they are more environmentally friendly. A little over 52% of customers claimed to have an emotional bond with companies or organizations they consider to be sustainable.

Sustainable Packaging Industry Overview

The global sustainable packaging market is highly fragmented. Some key players are Amcor Limited, TetraPak International SA, WestRock Compan, Smurfit Kappa Group PLC, and Sonoco Products Company.

In April 2022, WestRock Company announced a partnership with Recipe Unlimited to implement a series of recyclable paperboard packages aimed at diverting 31 million plastic containers from landfills across Canada each year. The package started appearing in Swiss Chalet restaurants in October 2021 and is available at all locations.

In April 2022, Sealed Air announced a collaboration on an advanced recycling initiative that will focus on recycling flexible plastics from the food supply chain and remaking them into new certified circular food-grade packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness: Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Initiatives toward Sustainable Packaging

- 5.1.2 Downsizing of Packaging

- 5.1.3 Shift in Consumer Preferences toward Recyclable and Eco-friendly Materials

- 5.2 Market Restraints

- 5.2.1 Capacity Constraint of Manufacturing Plants

- 5.2.2 High Cost of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Process

- 6.1.1 Reusable Packaging

- 6.1.2 Degradable Packaging

- 6.1.3 Recycled Packaging

- 6.2 By Material Type

- 6.2.1 Glass

- 6.2.2 Plastic

- 6.2.3 Metal

- 6.2.4 Paper

- 6.3 By End User

- 6.3.1 Pharmaceutical and Healthcare

- 6.3.2 Cosmetics and Personal Care

- 6.3.3 Food and Beverage

- 6.3.4 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Limited

- 7.1.2 Westrock Company

- 7.1.3 TetraPak International SA

- 7.1.4 Sonoco Products Company

- 7.1.5 Smurfit Kappa Group PLC

- 7.1.6 Sealed Air Corporation

- 7.1.7 Mondi PLC

- 7.1.8 Huhtamaki OYJ

- 7.1.9 BASF SE

- 7.1.10 Ardagh Group SA

- 7.1.11 Ball Corporation

- 7.1.12 Crown Holdings Inc.

- 7.1.13 DS Smith PLC

- 7.1.14 Genpak LLC

- 7.1.15 International Paper Company