|

市场调查报告书

商品编码

1439742

MBE(详细设计):市场占有率分析、产业趋势与统计、成长预测(2024-2029)Model-based Enterprise - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

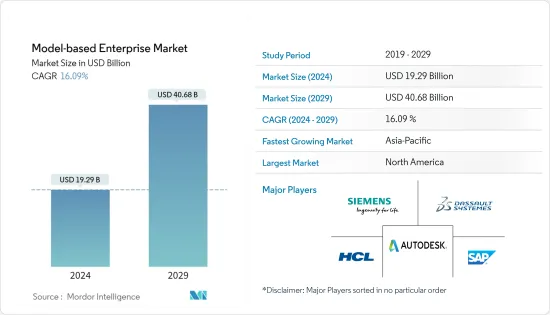

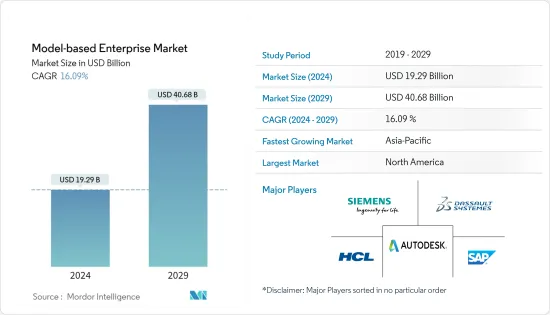

MBE(详细工程)市场规模预计到 2024 年为 192.9 亿美元,预计到 2029 年将达到 406.8 亿美元,在预测期内(2024-2029 年)市场规模增加 160.9 亿美元。%。

主要亮点

- 多个产业越来越多地采用 3D 技术,以满足形状分析、3D 建模等新兴应用不断增长的需求,从而导致可测量产品的 MBE(详细工程)解决方案的开发和采用不断增加。即时改变形状。

- 这项技术为新建筑形式、建筑系统等的设计和製造过程以及性能提供了许多机会。这是一种创新、更快、更灵活的产品开发和生产方式。

- 由于软体功能快速发展,数位技术正在各个製造业中采用,进一步推动了市场成长。

- 由于逆向工程在製造新零件时具有快速原型製作能力和准确性,该行业越来越多地采用逆向工程。逆向工程需要强大且稳健的影像撷取系统,能够高精度地撷取资料。 3D 技术和解决方案的引入可能使製造商能够实现这些目标,从而推动市场成长。

- 从传统的本地企业资料仓储迁移到云端的目标是降低成本。总成本包括拥有或许可资料中心设备、第三方服务成本、维护和管理、培训和政策。这些间接成本可能占本地资料中心营运价格的很大一部分。

- 此外,维护本地运算基础设施需要空间、建筑、能源、冷却、硬体采购、作业系统、网路、实体安全等。相反,MBE(详细工程)供应商将这些成本外包给云端服务供应商以节省资金。许多拥有内部资料基础设施的公司都担心安全性。将资料中心置于外围会带来安全和控制挑战,导致人们转向云端 MBE(详细工程)平台。

- COVID-19感染疾病导致整个最终使用领域的数位化程度不断提高,机器学习、人工智慧和物联网得到了更多采用,逐渐将应用程式和资料传播到多个云端。因此,各个最终用户垂直领域越来越多地采用云端 MBE(详细工程)平台,主要专注于简化储存在多个云端中的资料。

MBE(详细工程)市场的趋势

汽车产业预计将占据最大的市场占有率

- 汽车作为人类生活不可或缺的主要交通途径。全球道路上有超过 13 亿辆汽车,预计到 2035 年将增加至 18 亿辆。小客车约占这些统计数据的 74%,轻型商用车、大型卡车、巴士、大客车和小型客车占剩余的 26%(来源:Worldometers)。

- 基于模型的设计可实现更强大的设计、更快的发布并提高汽车嵌入式系统的可靠性。此外,软体建模和模拟工具可以改进汽车系统,因为它们的优势不断被证明并在行业中变得更加普遍。

- 此外,在全球范围内,汽车製造商越来越多地采用基于模型的设计来开发车辆电子设备,从变速箱和引擎控制器到车身控制器和电池管理模组。

- 此外,汽车产业目前正处于快速新兴技术和模糊相关人员之间的界线之中,产业形势正在迅速变化。此外,该行业面临的关键挑战是对个人化产品和丰富体验的需求不断增加,提高品质标准并降低营运成本。

- 市场上的一些参与者面临着持续的挑战,主要是为了保持竞争力并在竞争对手中脱颖而出。如今,汽车製造商可以透过实施技术和改进业务流程来引领市场。

预计北美将占据重要市场占有率

- 北美地区预计将在整个 MBE(详细工程)市场中占据主要份额,这主要是由于该地区存在 GE、PTC、Autodesk 和 Aras 等各种主要企业。这些公司采取了各种旨在加强其市场地位的成长策略。

- 此外,数位製造和设计创新研究所 (DMDII) 等机构正在透过能力、创新精神和协作来支持组织和数位革命,这些能力、创新精神和协作正在用于改变美国製造业。

- 美国的现代製造设施依靠更新的技术和创新来更快、更低成本地生产高品质的产品。作为物联网、巨量资料、3D建模、DevOps和行动性等先进技术的早期采用者,国内製造商已经整合了这些先进技术来简化流程并利用更深入的见解。

- 美国也是世界上最大的汽车市场之一,拥有超过 13 家主要汽车製造商。汽车製造业是该国製造业最大的收益来源之一,进一步推动了该地区的市场成长。

- 加拿大是一个正在采取重大步骤实施工业 4.0 的主要国家,预计将在预测期内为市场成长做出贡献。

- 加拿大政府宣布,该国的目标是到2030年製造业销售额成长50%,达到1兆美元,出口成长50%,到2030年达到5,400亿美元。我就是这个意思。预计这将重振製造业。因此,先进自动化技术的渗透预计将推动市场成长。

MBE(详细工程)产业概述

由于国内和国际市场上存在多家主要公司,MBE(详细工程)市场竞争非常激烈。市场集中度中等,市场主要企业主要追求产品创新、併购和策略合作伙伴关係,以增强产品供应、扩大地域覆盖范围并保持竞争优势。我们正在采取以下策略: :该市场的主要企业包括西门子股份公司、达梭系统股份公司、SAP 股份公司和欧特克公司。

- 2022 年 2 月,Siemens Digital Industries Software 推出了最新版本的业界领先的 NX 软体,该软体是 Xcelerator 软体和服务组合的一部分。新的 NX 拓扑优化器可协助您完全根据功能和设计空间要求来建立零件,从而产生完全可编辑的融合体,而这几乎不可能手动设计和工程。您可以获得它。

- 2021 年 11 月,GE 电气公司在 Formnext 2021 上发布了 Amp 流程管理软体平台。该公司还宣布从 2021 年 11 月中旬开始,限量发布 Concept Laser M2 机器前两个模组的列印模型、模拟和修改。计划于 2022 年第二季发布更广泛的版本。

- 2021年11月,印度公司iBASEt宣布推出MBE(详细工程)产品,可加速製造商的工业4.0之旅。第一个版本基于 Solumina iSeries i050,为製造商提供了一种开始作为「检验的、以模型为中心」的公司运作的方式。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估新型冠状病毒感染疾病(COVID-19)对市场的影响

第五章市场动态

- 市场驱动因素

- 不断发展的软体功能

- 越来越多采用物联网和云端基础的平台

- 市场限制因素

- 从本地迁移到基于云端基础的平台需要时间

第六章市场区隔

- 按报价

- 解决方案

- 服务

- 依部署方式

- 本地

- 云

- 按最终用户

- 航太和国防

- 车

- 建造

- 电力和能源

- 零售

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Siemens AG

- General Electric Company

- PTC Inc.

- Dassault Systemes SE

- SAP SE

- Autodesk Inc.

- HCL Technologies Limited

- Oracle Corporation

- Aras Corporation

- Anark Corporation

第八章投资分析

第九章市场机会与未来趋势

The Model-based Enterprise Market size is estimated at USD 19.29 billion in 2024, and is expected to reach USD 40.68 billion by 2029, growing at a CAGR of 16.09% during the forecast period (2024-2029).

Key Highlights

- The increasing adoption of 3D technology across multiple industry verticals for catering to the growing demand for emerging applications, ranging from shape analysis, 3D modeling, and many more, has given rise to the development and adoption of model-based enterprise solutions that can gauge product shapes in real-time.

- The technology offers many opportunities in the design and production processes and performance of novel architectural forms, construction systems, and many more. It is an innovative, faster, and more agile product development and production method.

- Digital technologies are being adopted across various manufacturing industries due to the rapidly evolving capabilities of the software, further boosting the market growth.

- The industries are witnessing increased adoption of reverse engineering for its rapid prototyping abilities and accuracy for producing new parts. Reverse engineering requires a strong and robust image acquisition system that can acquire data with high accuracy. The deployment of 3D technology and solutions could enable manufacturers to achieve such objectives, thus, boosting market growth.

- The objective for migrating from a traditional on-premise enterprise data warehouse to the cloud is cost savings. The total cost includes owning or licensing data center equipment and third-party service costs, maintenance and management, training, and policy. These indirect costs can account for a large amount of the price of operating on-premise data centers.

- Further, space, construction, energy, air conditioning, hardware procurement, operating systems, networking, physical security, and more are required to maintain on-premise computing infrastructure. Instead, model-based enterprise vendors are outsourcing these expenses to a cloud service provider and saving costs. Many companies that have data infrastructure on their premises are concerned about security. Having a data center within the perimeter gives rise to challenges in terms of safety and control, thus, resulting in a shift to cloud model-based enterprise platforms.

- The COVID-19 pandemic increased digitalization across end-use verticals with a more significant deployment of Machine Learning, Artificial Intelligence, and the Internet of Things, which has caused applications and data to spread across multiple clouds progressively. Thus, increased adoption of cloud model-based enterprise platforms across various end-user verticals primarily focuses on rationalizing the data stored on multiple clouds.

Model-Based Enterprise Market Trends

Automotive Segment Expected to Hold Largest Market Share

- Automobiles are an essential part of human lives as a primary mode of transportation. There are over 1.3 billion motor vehicles on the road globally, which is expected to rise to 1.8 billion by 2035. Passenger cars comprise roughly 74% of these statistics, while light commercial vehicles and heavy trucks, buses, coaches, and mini-buses make up the remaining 26% (Source: Worldometers).

- The model-based design allows enhanced design, faster releases, and better reliability in automotive embedded systems. Also, software modeling and simulation tools can improve automotive systems if they continue demonstrating benefits and becoming more common in the industry.

- Moreover, globally, automobile manufacturers are increasingly adopting model-based design to develop vehicle electronics, ranging from the transmission and engine controllers to the body controllers and battery management modules.

- Further, the automotive sector is currently in flux with rapidly emerging technology and blurring boundaries between stakeholders, rapidly transforming the industrial landscape. Moreover, the industry's significant challenges are the increasing demand for personalized products and rich experiences, increasing quality standards, and the reduction of operating costs.

- Several players in the market are facing an ongoing challenge primarily to remain competitive and set themselves apart to move ahead of competitors. Automotive manufacturers can currently adopt technology and improve their business processes, thus, driving the market.

North America Expected to Hold a Significant Market Share

- North American region is anticipated to hold a significant share of the overall model-based enterprise market, primarily due to various major players in the area, including GE, PTC, Autodesk, and Aras, among others. These companies have adopted different growth strategies focusing on strengthening their market position.

- Moreover, institutes such as the Digital Manufacturing and Design Innovation Institute (DMDII) possess the ability, innovative spirit, and collaborative expertise that is being used to transform the American manufacturing sector by aiding organizations and helping in the digital revolution.

- Modern manufacturing facilities in the US have relied on newer technologies and innovations to produce high-quality products faster and at lower costs. Owing to the early adoption of these advanced technologies, such as IoT, big data, 3D modeling, DevOps, and mobility, manufacturers in the country have been integrating these advanced technologies to streamline their processes and use their deeper insights.

- The US is also one of the biggest automotive markets globally and is home to more than 13 major automotive manufacturers. Automotive manufacturing has been one of the largest revenue generators for the country in the manufacturing sector, further helping the market's growth in the region.

- Canada is a major country taking significant steps toward implementing Industry 4.0 and is expected to contribute to the market growth during the forecast period.

- As stated by the Canadian government, the country aims to increase manufacturing sales by 50%, to reach USD 1 trillion by 2030, and exports by 50%, reaching USD 540 billion by 2030. This is expected to boost the manufacturing sector; therefore, the penetration of advanced automated technologies is set to boost market growth.

Model-Based Enterprise Industry Overview

The model-based enterprise market is competitive owing to the presence of several large players operating in the domestic and international markets. The market appears to be moderately concentrated, with the major players in the market adopting strategies like product innovation, mergers, and acquisitions, and strategic partnerships primarily to enhance their product offerings, extend their geographical reach, and stay ahead of the competition. Some of the major players in the market are Siemens AG, Dassault Systemes SE, SAP SE, and Autodesk Inc., among others.

- In February 2022, Siemens Digital Industries Software launched the latest release of its industry-leading NX software, part of the Xcelerator portfolio of software and services. The new NX Topology Optimizer helps create parts based purely on functional and design space requirements, resulting in fully editable convergent bodies that would be almost impossible to design and engineer manually.

- In November 2021, in Formnext 2021, GE Electric Company announced the Amp process management software platform. From mid-November 2021, the company also announced a limited release of print models, simulations, and corrections for the first two modules for the Concept Laser M2 machine. A broader release is planned for the second quarter of 2022.

- In November 2021, iBASEt, an Indian company, announced the launch of a Model-based Enterprise (MBE) offering that could accelerate a manufacturer's Industry 4.0 journey. Based on Solumina iSeries i050, the first version provides a way for manufacturers to start operating as a "Validated, Model-Centric" enterprise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolving Software Capabilities

- 5.1.2 Rising Adoption of IoT and Cloud-based Platforms

- 5.2 Market Restraints

- 5.2.1 Slow Transition from On-premise to Cloud-based Platform

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By End User

- 6.3.1 Aerospace and Defense

- 6.3.2 Automotive

- 6.3.3 Construction

- 6.3.4 Power and Energy

- 6.3.5 Retail

- 6.3.6 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 General Electric Company

- 7.1.3 PTC Inc.

- 7.1.4 Dassault Systemes SE

- 7.1.5 SAP SE

- 7.1.6 Autodesk Inc.

- 7.1.7 HCL Technologies Limited

- 7.1.8 Oracle Corporation

- 7.1.9 Aras Corporation

- 7.1.10 Anark Corporation