|

市场调查报告书

商品编码

1439745

条码列印机:全球市场占有率分析、产业趋势与统计、成长预测(2024-2029)Global Barcode Printer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

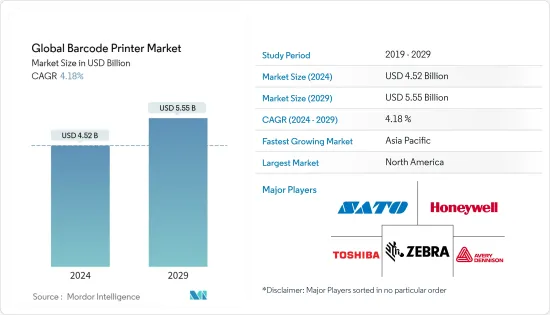

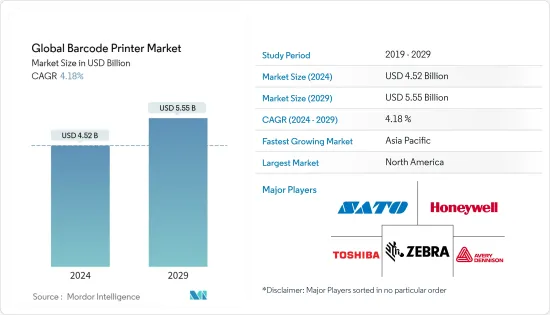

预计2024年全球条码列印机市场规模为45.2亿美元,预计2029年将达55.5亿美元,在预测期内(2024-2029年)市场规模将增加41.8亿美元,复合年增长率为% 。

资产追踪应用的成长以及列印和印表机技术的不断进步是推动全球条码列印机市场成长的一些关键因素。许多行业依靠标籤和条码来追踪资产并提供有关产品的资讯。

主要亮点

- 按产品类型划分,工业印表机预计将在预测期内占据主要市场占有率。然而,无线连接等最新技术进步也推动了行动印表机领域的发展。热感条码印表机被小型到大型企业广泛用于标记和追踪出货的产品。

- 除了越来越多地采用自动识别和资料撷取技术来提高生产力之外,对产品安全和防伪的日益关注也推动了热感印表机市场的发展。由于热感列印技术在现代客製印刷应用中的使用越来越多,热感式条码印表机的范围正在进一步扩大。

- 此外,直接热感技术利用热量在热敏基板上产生影像,主要服务于零售市场,例如定量食品标籤。它为短寿命应用提供了易用性和可靠性,并以合理的列印速度提供优质、低成本的条码。这些特性使热感技术成为运输产品上识别和追踪标籤的理想选择,例如小包裹递送以及标记外壳和托盘。

- 电子商务的兴起增加了对条码列印的需求。这是透过供应商和市场投资者的各种努力来实现的。开发范围广泛,从列印条码到条码印章,以最大限度地减少浪费。在某些情况下,可能会在小册子的外部列印条码,以识别内部邮票上的条码。

- 2021 年 7 月,International Security Printers (ISP) 投资了先进的混合印刷、印后加工和侦测系统,以加速条码印章的开发。这项投资正在多元化,以允许邮政当局在邮票上添加独特的彩色编码条码,透过穿孔分隔并沿着邮票放置。

- 此外,冠状病毒感染疾病(COVID-19)大流行的爆发增加了对医疗保健的需求,并预计受访市场将进一步推动需求。此外,由于多个地区的封锁,电子商务销售额以前所未有的速度激增,提振了所研究的市场。

条码列印机市场趋势

零售市场预计将占据最大份额

- 库存可用性和从电子商务到实体店的有效供应链至关重要。美国商务部预计,到年终零售额将达到27.73兆美元。随着易于访问的电子商务和行动平台领域的扩大,上述数字可能会进一步增加,从而加速预测期内的市场成长。

- 条码使零售商能够追踪库存、自动重新订购产品、比较国内品牌和自有品牌之间类似产品的销售情况、追踪对产品属性(如颜色和尺寸)的偏好,并根据客户购买情况定制有针对性的促销活动。分析习惯并确定特定客户的购买偏好。

- 全球最广泛接受的两种零售条码格式是 EAN-13(国际商品编号)和 UPC-A(通用产品代码)。 GS1 提供唯一的 12 位元 UPC(通用产品代码)或 EAN 公司识别号,必须输入到产品标籤上的 UPC-A 或 EAN-12 条码中。预计这将推动零售业参与者遵守此类标准并在预测期内推动市场成长。

- 一些满足这些要求的行业知名公司已经开发出可以推动市场成长的产品。例如,2021 年 12 月,总部位于班加罗尔的金融科技公司 FloBiz myBillBook 宣布推出零售商和专利权的 POS申请解决方案。零售业占印度GDP的10%。考虑到该行业的规模和特定需求,该解决方案旨在使用键盘快捷键和条码扫描提供更快的申请体验。

预计北美将占据最大的市场占有率

- 由于各行业条码和标籤的采用率很高,北美是所研究市场的主要投资者和创新者之一。此外,该地区不断成长的终端用户产业为供应商投资该地区市场提供了重要机会。许多主要市场供应商主要来自美国。因此,该地区在研究市场的创新率也很高。

- 电子商务行业和线上消费者数量的显着增长增加了对客製化和个人化行销策略的需求。根据美国人口普查,由于电子商务的蓬勃发展正在彻底改变零售业,零售额预计将大幅成长。报告也显示,2021年11月美国零售额较2020年同期成长13.1%,线上销售成长6.6%。电子商务零售额的成长预计将进一步增加对自动化和先进行销程序的需求,从而增加对 ABM 解决方案的需求。

- 同样,2021年,加拿大的电子商务用户超过2700万,占加拿大人口的72.5%。根据政府资料,预计到2025年这一比例将增加至77.6%。预计这将对条码和标籤产生巨大的需求。此外,亚马逊还在该国启动了一项透明度计划,透过使用 T 形二维码标籤来识别仿冒品产品,对在其平台上销售的产品进行序列化。

- 加拿大食品检验局于2016年12月实施了营养标籤修正案,要求受监管方在五年过渡期内满足新的标籤要求,在此期间他们将被要求遵守之前的或新的要求。符合。这些监管措施预计将在未来几年增加消费包装食品中条码和标籤的使用。

- 此外,美国农业部 (USDA) 已采用 Digimarc 条码作为核准的数位揭露方法,用于包装生物工程食品(通常称为基因改造生物 (GMO))。 Digimarc 条码是新一代视觉上看不见的条码,可以添加到产品包装、零售标籤和吊牌上。可使用相容的消费性行动电话、零售条码扫描器和电脑视觉系统进行扫描。它还消除了在产品包装设计中添加二维码技术的需要,并满足新的联邦法规。

条码列印机产业概况

条码列印机市场上的竞争公司之间的对抗已经加剧,一些主要企业,特别是斑马技术公司和艾利丹尼森公司。我们不断创新产品的能力使我们比竞争对手更具竞争优势。这些公司预计将透过策略合作伙伴关係和併购在市场上站稳脚跟。

- 2021 年 12 月 -Honeywell在「印度製造」倡议下推出了 IMPACT 系列条码列印机。 4吋桌上型条码印表机专为轻量标籤列印需求而打造,支援热转印/热感列印,让您以127mm/s的速度列印。 IMPACT by Honeywell 是专门为迎合印度不断成长的中阶市场而创建的品牌。

- 2021 年 3 月 - Brother Mobile Solutions 宣布扩展 Brother Titan 工业印表机系列,推出五款增强型 4 吋工业条码标籤印表机,配有内部回捲器,可扩大使用范围。该产品组合采用金属製成,包括增加的色带容量、双 Wi-Fi/蓝牙选项和 PLC 整合。扩展范围以接近 14 ips2 的速度提供高达 600 dpi1 的清晰条码标籤。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间敌对的强度

- 替代产品的威胁

- 评估新型冠状病毒感染疾病(COVID-19)对市场的影响

第五章市场动态

- 市场驱动因素

- 不断提高技术进步

- 电子商务和物流业快速成长

- 市场限制因素

- 列印品质

第六章市场区隔

- 依产品类型

- 桌上型印表机

- 行动印表机

- 工业印表机

- 按列印类型

- 热转印

- 直热感

- 其他印刷类型

- 按最终用户产业

- 製造业

- 零售

- 运输和物流

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Sato Holdings Corp.

- Zebra Technologies Corporation

- Honeywell International Inc.

- Toshiba Tec Corp.

- Avery Dennison Corporation

- Seiko Epson Corporation

- TSC Auto ID Technology Co. Ltd

- Primera Technologies Inc.

- Brother Mobile Solutions Inc

- Postek Electronics Co. Ltd

第八章投资分析

第9章市场的未来

The Global Barcode Printer Market size is estimated at USD 4.52 billion in 2024, and is expected to reach USD 5.55 billion by 2029, growing at a CAGR of 4.18% during the forecast period (2024-2029).

The growth of asset tracking applications and increasing technological advancements in printing and printer technology are some of the major factors driving the growth of the global barcode printer market. Many industries are adopting labels and barcodes for their asset tracking and providing information about their products.

Key Highlights

- By product type, industrial printers are expected to account for the major market share over the forecast period. However, recent technological advancements, like wireless connectivity, are also boosting the mobile printer segment. Thermal barcode printers are extensively used across small and large enterprises to label and subsequently track the products shipped.

- The rising adoption of automatic identification and data capture technologies for enhancing productivity, along with the growing concerns regarding product safety and anti-counterfeiting, is also boosting the market for thermal printers. The increasing utilization of thermal printing technology in the latest on-demand printing applications further increases the scope of thermal barcode printers.

- Furthermore, the direct thermal technology that produces images using heat on a heat-sensitive substrate primarily serves the retail market, mainly for catchweight food labeling. It offers easy-to-use and reliability for short-life applications and delivers good low-cost barcodes at reasonable print speeds. These characteristics make direct thermal technology a choice for transit product identification and tracking labels, for example, for parcel distribution and outer case and pallet markings.

- Increased e-commerce resulted in an increased demand for barcode printing. This was satisfied through various efforts made by vendors and market investors alike. The development has been widespread, with interests ranging from printing barcodes to barcoding postage stamps to minimize wastage. Sometimes, a barcode is printed outside the booklet to identify the stamp barcodes inside.

- In July 2021, International Security Printers (ISP) invested in advanced hybrid printing, finishing, and inspection systems to further the development of barcoding postage stamps. The investments are diversified toward enabling postal authorities to add distinctive color-coded barcodes to stamps, placed along the stamp and separated by a perforation line.

- Moreover, with the onset of the COVID-19 pandemic, the studied market is further expected to propel demand, with healthcare increasing in demand. Furthermore, with several regions operating in lockdown, e-commerce sales are surging at an unprecedented rate, thus boosting the studied market.

Barcode Printer Market Trends

Retail Market is Expected to Witness the Largest Share

- The availability of inventory and an effective supply chain from e-commerce to brick-and-mortar stores is essential. According to the US Department of Commerce, retail sales are expected to reach 27.73 trillion by the end of 2020. The above number is only likely to increase owing to the global expansion of easily accessible e-commerce and mobile platforms, thereby fueling market growth over the forecast period.

- The barcodes enable the retailers to keep track of inventory, automate product re-ordering, compare sales of similar products of national brands vs. private labels, track product attribute preferences such as color, size, etc., customize targeted promotions based on customer buying habits, and identify what buying preferences a particular customer has.

- The two most widely accepted formats of retail barcodes globally are the EAN-13 (International Article Number) and UPC-A (Universal Product Code). GS1 provides a unique 12-digit UPC (Universal Product Code) or EAN company identification number that has to be entered into a UPC-A or EAN-12 barcode on your product's label. This is expected to make the players in the retail industry comply with such standards, fueling the market growth over the forecast period.

- Some of the industry's prominent players to cater to such requirements are coming up with product developments that enable them to boost the market growth. For instance, in December 2021, myBillBook, the Bengaluru-based fintech FloBiz announced the launch of its Point-of-Sale Billing solution for retailers and franchises. The retail industry accounts for 10% of India's GDP. Keeping this industry's scale and specific needs in mind, the solution has been designed to provide a faster billing experience using keyboard shortcuts and barcode scanning.

North America Is Expected to Hold Largest Market Share

- North America is one of the major investors and innovators in the market studied, owing to the high adoption rate of barcodes and labels across various industries. Moreover, the growing end-user industries in the region provide massive opportunities for vendors to invest in the regional market. Many of the significant market vendors are mainly from the United States. Hence, the region also has a high rate of innovation in the market studied.

- The massive growth of the e-commerce industry and the number of online shoppers have increased the need for customized and personalized marketing strategies. According to the US Census, the e-commerce boom revolutionizing the retail sector is expected to boost retail sales significantly. It also suggested that US retail sales increased by 13.1% in November 2021, compared to the same period in 2020, and online sales increased by 6.6%. The growth in e-commerce retail sales is further expected to increase the need for automated and advanced marketing procedures, thereby increasing the demand for ABM solutions.

- Similarly, in 2021, there were over 27 million e-commerce users in Canada, accounting for 72.5% of the Canadian population. According to the government's data, this is expected to increase to 77.6% in 2025. This is expected to create a massive demand for barcodes and labels. Additionally, Amazon launched its transparency program in the country to serialize the products sold on its platform by using a T-shaped QR-style tag to identify counterfeit items.

- The Canadian Food Inspection Agency, in December 2016, made amendments to nutrition labeling, which mandated the regulated parties to meet the new labeling requirements within a five-year transition period, during which they must comply with either the former or the new requirements. Such regulatory initiatives are expected to increase the use of barcodes and labels in consumer-packaged foods over the coming years.

- Moreover, the US Department of Agriculture (USDA) adopted Digimarc Barcodes as an approved digital disclosure method for packaging containing bioengineered food, commonly known as genetically modified organisms (GMOs). Digimarc Barcode is a new-generation visually imperceptible barcode, which can be added to product packaging, retail labels, and hangtags. It may be scanned by compatible consumer phones, retail barcode scanners, and computer vision systems. It also eliminates the need to add a QR method to the product package design and fulfills the new federal regulations.

Barcode Printer Industry Overview

The competitive rivalry in the barcode printer market is high owing to some key players such as Zebra Technologies Corporation, and Avery Dennison Corporation, amongst others. Their ability to continually innovate their offerings has allowed them to gain a competitive advantage over their competitors. Through strategic partnerships and mergers and acquisitions, these players are expected to gain a strong foothold in the market.

- December 2021 - Honeywell launched its IMPACT series of barcode printers under the "Make in India" initiative. The four-inch desktop barcode printer is built for light-duty label printing requirements, and it supports thermal transfer/direct thermal printing, thereby enabling printing at 127mm/sec. IMPACT by Honeywell is a brand established specifically to cater to the growing mid-segment market in India.

- March 2021 - Brother Mobile Solutions announced the expansion of the Brother Titan Industrial Printer series with five enhanced four-inch industrial barcode label printers featuring internal rewinders for an increased use range. Built with metal, the portfolio includes an increased ribbon capacity, dual Wi-Fi/Bluetooth option, and PLC integration. The augmented range delivers clear barcode labels up to 600 dpi1 at speeds nearing 14 ips2.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Technological Advancement

- 5.1.2 Rapid Growth of E-Commerce and the Logistic Sector

- 5.2 Market Restraints

- 5.2.1 Printing Quality

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Desktop Printer

- 6.1.2 Mobile Printer

- 6.1.3 Industrial Printer

- 6.2 By Printing Type

- 6.2.1 Thermal Transfer

- 6.2.2 Direct Thermal

- 6.2.3 Other Printing Types

- 6.3 By End-user Industry

- 6.3.1 Manufacturing

- 6.3.2 Retail

- 6.3.3 Transportation and Logistics

- 6.3.4 Healthcare

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 South America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Sato Holdings Corp.

- 7.1.2 Zebra Technologies Corporation

- 7.1.3 Honeywell International Inc.

- 7.1.4 Toshiba Tec Corp.

- 7.1.5 Avery Dennison Corporation

- 7.1.6 Seiko Epson Corporation

- 7.1.7 TSC Auto ID Technology Co. Ltd

- 7.1.8 Primera Technologies Inc.

- 7.1.9 Brother Mobile Solutions Inc

- 7.1.10 Postek Electronics Co. Ltd