|

市场调查报告书

商品编码

1851208

智慧显示器:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Smart Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

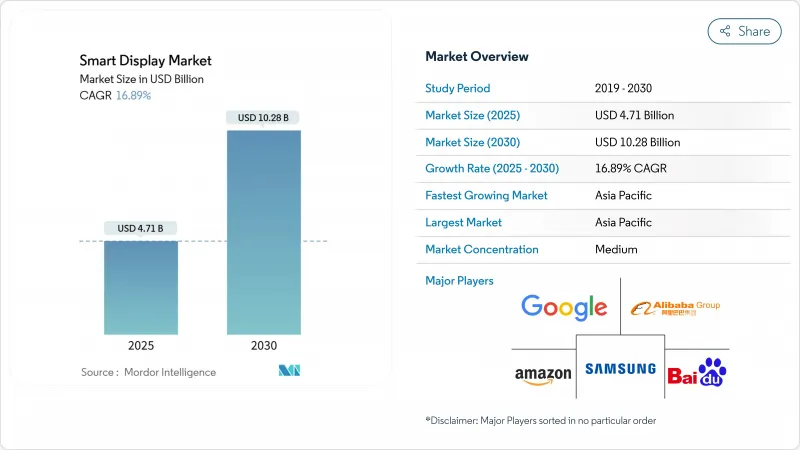

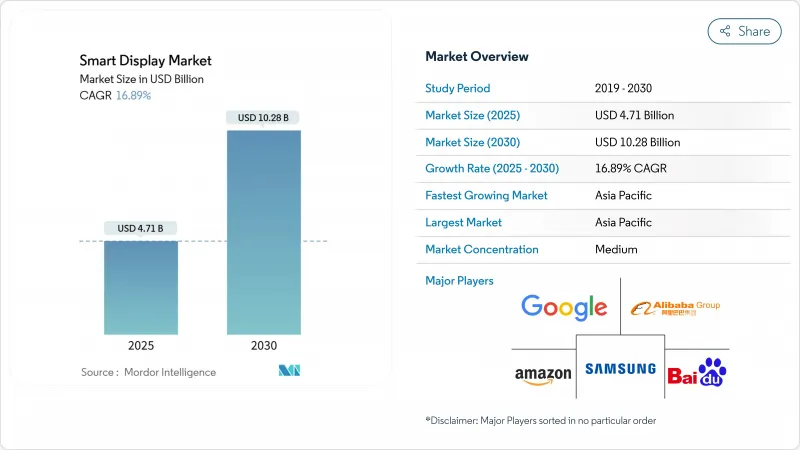

预计到 2025 年,智慧显示器市场规模将达到 47.1 亿美元,到 2030 年将达到 102.8 亿美元,复合年增长率为 16.89%。

从纯语音萤幕到人工智慧主导的多模态中心的升级週期正在扩大装置量,同时也推高平均售价。 Matter 通讯协定 的普及正在消除平台锁定,使竞争重心从生态系统独占转向硬体创新。汽车驾驶座、OLED 的普及以及人工智慧增强的 10 吋及以上尺寸机型正在推动收入成长。儘管 8-10 吋液晶面板短缺,垂直整合的面板製造商仍能维持利润率。另一方面,由于担心麦克风始终开启的风险,企业买家正在延长采购週期,这抑制了近期的出货动能。

全球智慧显示市场趋势与洞察

北美地区多模态语音优先智慧家庭中心的普及率不断提高

智慧显示器正朝着视觉和语音混合型设备的方向发展,可透过单一介面控制照明、安防和娱乐系统。预计到2026年,美国语音助理用户将达到1.571亿,这将推动设备升级,以处理更丰富的指令并提供情境化的视觉效果。生成式人工智慧(AI)能够提供主动式提案,例如根据通勤资料预热恆温器,进而提升使用者体验价值。三星的Vision AI显示器在2024年占据了高阶产品28.3%的出货量份额。零售商将显示器与订阅服务捆绑销售,从而提高经常性收入和用户黏性。随着苹果即将推出首款智慧家庭显示器,竞争日益激烈,促使生态系统参与者每年更新产品线。

Matter相容设备的普及将加速平台互通性。

Matter 1.4 引进了整合 Wi-Fi 和 Thread 的认证家用路由器,减少了部署失败率,节省了安装人员的时间。预计到 2025 年中,将有超过 1000 款 Matter 认证产品上市,消费者可以放心混用不同品牌的产品,无需担心被厂商锁定。企业将该通讯协定的安全性能验证视为满足零信任要求的重要一步,从而促进了更广泛的商业部署。公共产业正在探索基于 Matter 的能源仪表板,以支援需量反应计划。该标准也为酒店业带来了维修机会,现有的 Wi-Fi 基础设施无需重新布线即可承载 Thread 边界路由器。

始终开启的麦克风的安全漏洞导致B2B采购延迟。

金融机构和医院暂停部署,直到供应商提供资料路径文件并证明设备端处理能力足够。由于首席资讯安全长 (CISO) 要求按照 ISO 27001 标准进行渗透测试,采购週期最多延长了 45 天。 Matter 的可选离线模式缓解了一些担忧,但也使中央设备管理更加复杂,并促使人们需要混合架构,从而增加了成本和整合复杂性。拥有 FedRAMP 同等授权的供应商更早赢得了合同,从而获得了先发优势。

细分市场分析

预计到2025年,智慧语音助理设备的市场规模将达到42亿美元。亚马逊Alexa凭藉着Fire TV和Ring的交叉销售势头,在2024年占据了33.7%的市场份额。谷歌助理随后推出了Nest Hub,而阿里巴巴旗下的天猫精灵则以18.7%的复合年增长率增长,这主要得益于其集成的AI聊天机器人,能够将内容本地化以适应中文方言。预计到2025年,智慧语音助理设备的市场规模将达到42亿美元,这主要得益于生成式模型能够记忆过往对话,从而带动了设备的更换需求。苹果将于2025年3月发布一款6吋的Home Display,这预示着新的竞争即将到来,并可能将iOS用户引入HomeKit的世界。

在中国,儘管市占率下降了10.3个百分点,百度DuerOS仍占了41.1%的行动智慧萤幕市场。各大品牌透过视觉搜寻、儿童安全模式以及与二维码结帐相连的多模态购物车来区分彼此。这些倡议凸显了智慧显示市场在区域体验层级上的分散程度,儘管Matter公司一直在努力实现连结性的统一。

5-10吋的萤幕尺寸预计将在2024年占据52.7%的销售份额,因为它既能节省檯面空间,又能提供舒适的观看体验。厨房食谱、卧室闹钟和办公桌视讯通话等应用大多采用此尺寸,从而降低了组件成本。然而,随着零售、医院和汽车仪錶板对更丰富视觉效果的需求,10吋以上尺寸的萤幕正以19.3%的复合年增长率快速增长。更大的萤幕尺寸支援智慧家庭仪錶板的同步视讯聊天和分割萤幕模式,从而提升用户参与度。

对角线尺寸超过10吋的智慧显示器,平均售价大幅上涨,提高了製造商的利润率。 OLED萤幕在该尺寸区间渗透率很高,助力智慧显示器市场占据高端价格分布。面板製造商正将产能转向8.6代玻璃基板,以满足大尺寸尺寸萤幕的需求。同时,5吋以下的智慧显示器仍属于低成本小众市场或床头伴侣,但由于穿戴式装置的竞争,它们在智慧显示器市场的份额正在萎缩,可穿戴设备已经占据了小萤幕通知功能。

凭藉成熟的供应链和具有竞争力的价格,LCD预计在2024年仍将保持81.8%的市场份额。汽车仪錶板通常采用LTPS LCD,因为其具有良好的热稳定性和亮度。然而,OLED的复合年增长率高达21.8%,这主要得益于供应商利用其深邃的黑色和柔韧性,实现了曲面和旋转性外形规格。豪华饭店的智慧镜子采用OLED层压板,将非工作显示器隐藏在反射玻璃后,从而获得更高的每位用户平均收入(ARPU)。

预计到2030年,基于OLED的智慧显示器市场规模将超过30亿美元,这主要得益于韩国和中国第六代柔性製造厂的蓬勃发展。随着印刷转移技术成本的逐步降低,MicroLED技术有望带来更高的亮度和更长的使用寿命。製造商正透过交叉授权专利和建构面板产品组合来规避单一技术带来的风险。

区域分析

预计亚太地区将在2024年以37.6%的市占率引领智慧显示器市场,并在2030年之前维持17.3%的复合年增长率。为因应2024年智慧音箱出货量25.6%的下滑,百度和阿里巴巴等中国厂商已透过将大型语言模型整合到显示器中来重塑其提案主张。政府支持的人工智慧晶片计画将降低物料清单成本,从而推动售价低于100美元的大萤幕显示器上市,并扩大其在农村地区的渗透率。韩国品牌将专注于OLED创新,并利用本土面板生态系统向全部区域出口高阶产品。

由于近乎普及的宽频和语音助理的高普及率,北美继续引领科技潮流。随着家庭用户将第一代萤幕设备更换为配备更高级麦克风和边缘人工智慧的智慧型设备,更换週期成为成长的主要驱动力。亚马逊占据美国智慧音箱市场29%的份额,并正在为Alexa推出生成式人工智慧升级,从而促进用户提升销售更大尺寸的Echo Show机型。苹果计划于2025年推出新产品,可能会重塑厂商格局,并吸引一部分富裕的iOS用户。

在欧洲,对隐私和永续性的日益重视推动了对设备端处理和采用回收材料製成的设备的需求。预计到2024年,欧洲智慧家庭市场规模将达到221.1亿美元,即将推出的生态设计法规强制要求具备能源管理功能,这将促使企业采购经Matter认证的、能够监控消费量维修补贴有望释放潜在需求。在南美和中东/非洲等新兴地区,随着智慧型手机厂商为促进生态系统融合而推出小萤幕产品,智慧型手机的普及率预计将逐步提高,但价格敏感度和网路连线的不稳定性限制了其普及。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 北美地区多模态语音优先智慧家庭中心的普及率不断提高

- Matter技术的普及将加速平台互通性。

- 汽车OEM厂商整合智慧后视镜与贯穿式驾驶座显示器

- 人工智慧驱动的上下文使用者介面推动了10英寸以上萤幕产品的高端定价,亚洲地区主导

- 零售商需要便捷的结帐流程和动态货架指示牌

- 智慧床边设备可提高病人参与和HCAHPS评分

- 市场限制

- 始终开启的麦克风的安全漏洞导致B2B采购延迟。

- 8-10吋液晶面板工厂持续面临面板短缺问题,限制了供应弹性。

- 区域资料隐私碎片化推高了在地化成本。

- 语音助理语言支援方面的不足阻碍了北欧和加勒比地区的普及。

第五章:生态系分析

第六章:技术展望

第七章 波特五力分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第八章 市场规模与成长预测

- 透过语音助手

- Amazon Alexa

- Google Assistant

- Baidu DuerOS

- Alibaba TmallGenie

- Apple Siri

- 其他的

- 按萤幕尺寸

- 小于5英寸

- 5到10英寸

- 10吋或以上

- 透过显示技术

- 液晶显示器

- 有机发光二极体

- 其他(微型LED、电子纸)

- 通过决议

- HD(720p)

- 全高清 (1080p)

- 4K 或更高

- 按安装类型

- 独立式智慧显示器

- 整合智慧显示器(智慧镜子、自助服务终端、货架边缘)

- 连结性别

- 仅限 Wi-Fi

- Wi-Fi + 蜂窝网络

- Wi-Fi+Zigbee/Thread/Matter

- 按最终用户行业划分

- 住宅智慧家居

- 车

- 零售与饭店

- 卫生保健

- 企业和教育机构

- 其他(交通枢纽、公共部门)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家(丹麦、瑞典、挪威、芬兰)

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 东南亚

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第九章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amazon.com Inc.

- Google LLC

- Baidu Inc.

- Alibaba Group Holding Ltd.

- Xiaomi Corp.

- Lenovo Group Ltd.

- LG Electronics Inc.

- Samsung Electronics Co., Ltd.

- Meta Platforms Inc.(Portal)

- Sony Corp.

- TCL Tech. Group

- Hisense Group

- Sharp Corp.

- Koninklijke Philips NV

- Panasonic Holdings Corp.

- Huawei Tech. Co. Ltd.

- BOE Technology Group Co. Ltd.

- Vizio Inc.

- JBL(Harman Int'l)

- Apple Inc.

第十章:市场机会与未来展望

- 閒置频段与未满足需求评估

The smart display market stood at USD 4.71 billion in 2025 and is projected to reach USD 10.28 billion by 2030, reflecting a 16.89% CAGR.

The upgrade cycle from voice-only screens to AI-driven multimodal hubs is widening average selling prices while enlarging the installed base. Matter protocol adoption is dismantling platform lock-in, shifting competition toward hardware innovation rather than ecosystem exclusivity. Automotive cockpits, OLED diffusion, and AI-enhanced above 10-inch models are intensifying revenue upside. Vertically integrated panel makers have preserved margins despite 8-10-inch LCD shortages. Conversely, enterprise buyers have prolonged procurement cycles because of always-on-microphone risks, tempering short-term shipment momentum.

Global Smart Display Market Trends and Insights

Rising adoption of multimodal voice-first smart-home hubs in North America

Smart displays are evolving into visual-voice hybrids that orchestrate lighting, security, and entertainment systems from a single interface. Voice-assistant penetration is expected to reach 157.1 million U.S. users by 2026, underpinning device upgrades that handle richer commands and provide contextual visuals. Generative AI is enabling proactive suggestions-such as pre-warming thermostats based on commute data-raising perceived value. Samsung's Vision AI-equipped displays helped the company capture 28.3% of premium category shipments in 2024. Retailers are bundling displays with subscription services, driving recurring revenue and stickiness. Competitive intensity is heightening as Apple prepares its first smart home display, prompting ecosystem players to refresh line-ups annually.

Proliferation of Matter-compliant devices accelerating platform interoperability

Matter 1.4 introduced certified home routers that unify Wi-Fi and Thread, slashing onboarding failures and cutting installer time. By mid-2025 more than 1,000 Matter-certified products are expected, giving consumers confidence to mix brands without fearing lock-in. Enterprises view the protocol's secure commissioning as a step toward meeting zero-trust mandates, encouraging broader commercial rollouts. Utilities are exploring Matter-based energy dashboards to support demand-response programs. The standard also unlocks retrofit opportunities in hospitality, where existing Wi-Fi infrastructure can host Thread border routers without rewiring.

Security vulnerabilities in always-on microphones causing B2B procurement delays

Financial institutions and hospitals are pausing deployments until vendors document data pathways and prove on-device processing sufficiency. Procurement cycles have stretched by up to 45 days as CISOs demand penetration tests aligned with ISO 27001 requirements. Matter's optional offline mode eases some concerns but complicates central device management, prompting requests for hybrid architectures that add cost and integration complexity. Vendors that achieve FedRAMP-equivalent attestations are winning contracts faster, creating early-mover advantages.

Other drivers and restraints analyzed in the detailed report include:

- Automotive OEM integration of smart mirrors and pillar-to-pillar cockpit displays

- AI-powered contextual UI driving premium price mix in more than 10-inch category

- Persistent panel shortage in 8-10-inch LCD fabs limiting supply elasticity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The smart display market size for voice-assistant devices reached USD 4.2 billion in 2025. Amazon Alexa held 33.7% market share in 2024, riding cross-sell momentum from Fire TV and Ring. Google Assistant followed through Nest hubs, while Alibaba's TmallGenie grew at 18.7% CAGR, buoyed by AI chatbot integration that localizes content for Chinese dialects. The smart display market size for voice-assistant devices reached USD 4.2 billion in 2025, and replacement demand is strengthening as generative models enable memory of prior conversations. Apple's March 2025 six-inch Home Display announcement signals fresh competition that may draw iOS households into its HomeKit universe.

Continued expansion of Mandarin-optimized large language models is eroding Alexa's edge in China, where Baidu DuerOS controlled 41.1% of mobile smart screens despite a 10.3 percentage-point decline. Brands are differentiating via visual search, kid-safe modes, and multimodal shopping carts that link QR-based checkout. These moves illustrate how the smart display market is fragmenting into region-specific experience layers even as Matter attempts to harmonize connectivity.

The 5-10-inch category dominated with 52.7% revenue in 2024 because it balances countertop space and viewing comfort. Kitchen recipes, bedroom alarms, and desk video calls mostly fit this diagonal, keeping BOM costs low. Yet the >10-inch cohort is expanding at a 19.3% CAGR as retailers, hospitals, and vehicle dashboards demand richer visuals. Wider panels invite split-screen modes for simultaneous video chats and smart-home dashboards, elevating user engagement metrics.

Average selling prices jump when diagonal exceeds 10 inches, improving manufacturer margins. OLED penetration is higher in this tier, helping the smart display market command premium price points. Panel makers are shifting capacity toward Gen 8.6 glass substrates to serve the large-format rush. Meanwhile, <5-inch devices remain in budget niches and as bedside companions, but their slice of the smart display market is shrinking under competition from wearables that already occupy the small-screen notification role.

LCD retained 81.8% share in 2024, thanks to mature supply chains and competitive pricing. Automotive instrument clusters often favor LTPS LCD for thermal stability and brightness. However, OLED's 21.8% CAGR is accelerating as vendors exploit its deep blacks and flexibility to fashion curved or rollable form factors. Smart mirrors in luxury hotels use OLED laminates to hide inactive displays behind reflective glass, commanding higher ARPU.

The smart display market size for OLED-based units is forecast to exceed USD 3 billion by 2030, aided by Gen 6 flexible fabs in South Korea and China. MicroLED research promises even higher luminance and lifespan, with printed transfer techniques edging closer to cost targets. Manufacturers are hedging by cross-licensing patents and mixing panel portfolios to avoid single-technology risk.

The Smart Display Market Report is Segmented by Voice Assistant (Amazon Alexa, and More), Screen Size (5 - 10 Inches, and More), Display Technology (LCD, and More), Resolution (Full HD, and More), Installation Type (Stand-Alone, and More), Connectivity (Wi-Fi Only, and More), End-User Industry (Automotive, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific led the smart display market with 37.6% revenue share in 2024 and is set to compound at 17.3% CAGR through 2030. Chinese vendors such as Baidu and Alibaba responded to a 25.6% slump in 2024 smart-speaker shipments by layering large language models onto displays, resetting value propositions. Government-backed AI chip initiatives are lowering BOM costs, enabling sub-USD 100 large-screen models that widen rural penetration. South Korean brands focus on OLED innovation, leveraging local panel ecosystems to export premium units across the region.

North America remains a technology trendsetter with near-ubiquitous broadband and high voice-assistant uptake. Replacement cycles dominate growth as households swap first-generation screens for Matter-capable variants with superior microphones and edge AI. Amazon retained 29% of U.S. smart-speaker units, rolling out generative AI upgrades to Alexa that encourage upsells to larger Echo Show models. Apple's 2025 entry could lure a slice of the affluent iOS base, reshuffling vendor rankings.

Europe emphasizes privacy and sustainability, stimulating demand for devices with on-device processing and recycled materials. The European Smart Home market reached USD 22.11 billion in 2024, and energy-management features mandated by upcoming Ecodesign rules are steering procurement toward Matter-certified hubs that monitor consumption. Nordic adoption lags owing to voice-assistant language gaps, but regulatory clarity and subsidies for energy retrofits are expected to unlock latent demand. Emerging regions in South America, the Middle East, and Africa witness gradual uptake as smartphone OEMs bundle smaller screens to drive ecosystem stickiness, although price sensitivity and patchy connectivity temper volumes.

- Amazon.com Inc.

- Google LLC

- Baidu Inc.

- Alibaba Group Holding Ltd.

- Xiaomi Corp.

- Lenovo Group Ltd.

- LG Electronics Inc.

- Samsung Electronics Co., Ltd.

- Meta Platforms Inc. (Portal)

- Sony Corp.

- TCL Tech. Group

- Hisense Group

- Sharp Corp.

- Koninklijke Philips N.V.

- Panasonic Holdings Corp.

- Huawei Tech. Co. Ltd.

- BOE Technology Group Co. Ltd.

- Vizio Inc.

- JBL (Harman Int'l)

- Apple Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of multimodal voice-first smart-home hubs in North America

- 4.2.2 Proliferation of Matter-compliant devices accelerating platform interoperability

- 4.2.3 Automotive OEM integration of smart mirrors and pillar-to-pillar cockpit displays

- 4.2.4 AI-powered contextual UI driving premium price mix in Above 10-inch category, Asia-led

- 4.2.5 Retail demand for frictionless checkout and dynamic shelf-edge signage

- 4.2.6 Hospital bedside smart terminals improving patient engagement and HCAHPS scores

- 4.3 Market Restraints

- 4.3.1 Security vulnerabilities in always-on microphones causing B2B procurement delays

- 4.3.2 Persistent panel shortage in 8-10-inch LCD fabs limiting supply elasticity

- 4.3.3 Fragmented regional data-privacy mandates raising localisation costs

- 4.3.4 Voice-assistant language support gaps curbing uptake across Nordics and Caribbeans

5 INDUSTRY ECOSYSTEM ANALYSIS

6 TECHNOLOGICAL OUTLOOK

7 PORTER'S FIVE FORCES ANALYSIS

- 7.1 Porter's Five Forces

- 7.1.1 Bargaining Power of Suppliers

- 7.1.2 Bargaining Power of Buyers

- 7.1.3 Threat of New Entrants

- 7.1.4 Threat of Substitutes

- 7.1.5 Intensity of Competitive Rivalry

8 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 8.1 By Voice Assistant

- 8.1.1 Amazon Alexa

- 8.1.2 Google Assistant

- 8.1.3 Baidu DuerOS

- 8.1.4 Alibaba TmallGenie

- 8.1.5 Apple Siri

- 8.1.6 Others

- 8.2 By Screen Size

- 8.2.1 Less than 5 Inches

- 8.2.2 5 - 10 Inches

- 8.2.3 Above 10 Inches

- 8.3 By Display Technology

- 8.3.1 LCD

- 8.3.2 OLED

- 8.3.3 Others (Micro-LED, E-Paper)

- 8.4 By Resolution

- 8.4.1 HD (= 720p)

- 8.4.2 Full HD (1080p)

- 8.4.3 4K and Above

- 8.5 By Installation Type

- 8.5.1 Stand-alone Smart Displays

- 8.5.2 Integrated Smart Displays (smart mirrors, kiosk, shelf-edge)

- 8.6 By Connectivity

- 8.6.1 Wi-Fi Only

- 8.6.2 Wi-Fi + Cellular

- 8.6.3 Wi-Fi + Zigbee/Thread/Matter

- 8.7 By End-user Industry

- 8.7.1 Residential Smart Home

- 8.7.2 Automotive

- 8.7.3 Retail and Hospitality

- 8.7.4 Healthcare

- 8.7.5 Corporate and Education

- 8.7.6 Others (Transportation Hubs, Public Sector)

- 8.8 By Geography

- 8.8.1 North America

- 8.8.1.1 United States

- 8.8.1.2 Canada

- 8.8.1.3 Mexico

- 8.8.2 Europe

- 8.8.2.1 Germany

- 8.8.2.2 United Kingdom

- 8.8.2.3 France

- 8.8.2.4 Italy

- 8.8.2.5 Spain

- 8.8.2.6 Nordics (Denmark, Sweden, Norway, Finland)

- 8.8.2.7 Rest of Europe

- 8.8.3 Asia-Pacific

- 8.8.3.1 China

- 8.8.3.2 Japan

- 8.8.3.3 South Korea

- 8.8.3.4 India

- 8.8.3.5 Southeast Asia

- 8.8.3.6 Australia

- 8.8.3.7 Rest of Asia-Pacific

- 8.8.4 South America

- 8.8.4.1 Brazil

- 8.8.4.2 Argentina

- 8.8.4.3 Rest of South America

- 8.8.5 Middle East

- 8.8.5.1 Gulf Cooperation Council Countries

- 8.8.5.2 Turkey

- 8.8.5.3 Rest of Middle East

- 8.8.6 Africa

- 8.8.6.1 South Africa

- 8.8.6.2 Nigeria

- 8.8.6.3 Rest of Africa

- 8.8.1 North America

9 COMPETITIVE LANDSCAPE

- 9.1 Market Concentration

- 9.2 Strategic Moves

- 9.3 Market Share Analysis

- 9.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 9.4.1 Amazon.com Inc.

- 9.4.2 Google LLC

- 9.4.3 Baidu Inc.

- 9.4.4 Alibaba Group Holding Ltd.

- 9.4.5 Xiaomi Corp.

- 9.4.6 Lenovo Group Ltd.

- 9.4.7 LG Electronics Inc.

- 9.4.8 Samsung Electronics Co., Ltd.

- 9.4.9 Meta Platforms Inc. (Portal)

- 9.4.10 Sony Corp.

- 9.4.11 TCL Tech. Group

- 9.4.12 Hisense Group

- 9.4.13 Sharp Corp.

- 9.4.14 Koninklijke Philips N.V.

- 9.4.15 Panasonic Holdings Corp.

- 9.4.16 Huawei Tech. Co. Ltd.

- 9.4.17 BOE Technology Group Co. Ltd.

- 9.4.18 Vizio Inc.

- 9.4.19 JBL (Harman Int'l)

- 9.4.20 Apple Inc.

10 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 10.1 White-space and Unmet-Need Assessment