|

市场调查报告书

商品编码

1439759

无底纸标籤:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Linerless Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

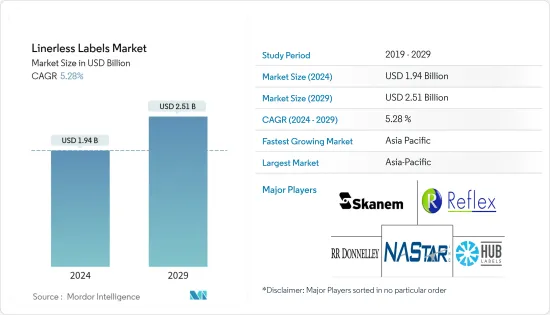

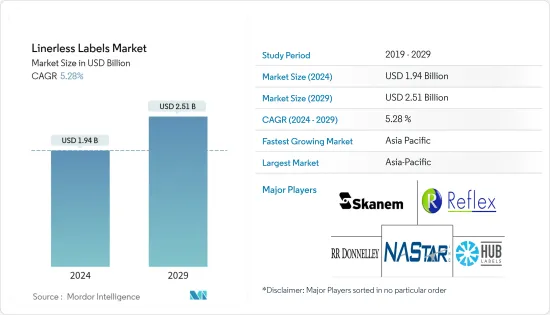

无底纸标籤市场规模预计到 2024 年为 19.4 亿美元,预计到 2029 年将达到 25.1 亿美元,在预测期内(2024-2029 年)增长 5.28%,复合年增长率增长。

主要亮点

- 无底纸标籤越来越受欢迎,因为它们消除了对不可回收离型纸的需求并降低了成本。无底纸标籤的持续产品创新将维持未来的市场开拓。无底纸还提供最佳的黏剂位置,即使在不太稳定的表面上也能实现无皱应用,并且透过热转印实现可变的印刷适性。与感压标籤相比,无底纸标籤的浪费最少,而且相同直径的捲筒可以承载更多的无底纸标籤容量。

- 无底纸标籤具有自黏标籤的所有优点,包括不使用载体底纸而提高的效率、大批量应用以及环境效益,但它们有一定的局限性,使其成为所有标籤生产的理想选择。解决方案。

- 所有列印的标籤都放置在连续的基材卷材上,直到它们被移除。如果您想将其分开,则需要在供应之前将其切割或打孔。在涂布彩色墨水之前使用透明基材并列印不透明的白色可能有助于克服几何限制。然而,这进一步限制了无衬标籤的使用范围。无底纸标籤的产品创新,包括面材、黏剂、可印刷有机硅胶涂层、涂布设备和转换设备的开发,将支持该领域的进一步成长。由于市场参与者的研究和开发,市场正在经历技术创新。预计此类创新将在预测期内推动无底纸标籤的采用。

- 包装食品和饮料行业的需求显着增加,增加了对无衬标籤的需求,从而推动了市场的成长。一些针对包装食品的政府产业指南也影响了对无衬标籤的需求。 FDA 表示,标籤很重要,因为包装和食品需要贴上营养标示。 《食品安全现代化法案》将要求消费包装商品至少识别产品的直接供应商和收件人(除了零售商到消费者之外),以监控产品的途径。这是强制性的。此类法规支援在包装食品中使用无衬标籤。

- 在传统有衬纸标籤上市很久之后,无衬纸标籤就进入了市场。儘管无衬标籤的采用已经取得了重大进展,但市场上仍然有许多替代品,包括各种类型的感压标籤,对所研究市场的成长构成了挑战。

- 由于食品和药品包装需求的增加,无衬标籤细分市场在 COVID-19 期间被认为保持稳定。冠状病毒感染疾病(COVID-19) 的爆发扰乱了食品和饮料、医疗保健和工业等各种最终用户行业的供应链。过去几个月,疫情为供应链和物流管理带来了前所未有的挑战。虽然罐头食品、厕所用卫生纸和清洁用品等产品的需求大幅增加,但其他最终用途产业的需求却大幅放缓。

无底纸标籤的市场趋势

食品和饮料预计将占据最大的市场占有率

- 由于劳动力短缺、客户期望、自动化困难和高昂的业务成本,电子商务公司面临许多挑战,流程优化成为首要任务。这在配送和履约配销中心尤其重要,因为许多管理人员正在寻找改善业务的方法,例如库存管理、订单拣选、订单发布和包装。使用无衬标籤是改善饮料行业包装流程并节省成本的简单方法。

- 无衬标籤酒精饮料市场受到非贸易销售增加、旅游业和餐旅服务业增长以及开发中国家不断扩大的中阶可支配收入增加的支持。市场也看到北美地区的需求不断增加。例如,2021 年,StatCan 发现居住在加拿大魁北克省的消费者是最常饮酒的人,约 57% 的受访者表示他们每周至少饮酒一次。在加拿大大西洋地区,这一数字下降至 28%。政党偏好似乎也会影响饮酒量,自由党支持者最有可能每週至少饮酒一次。

- 印度食品安全和标准局 (FSSAI) 强制所有酒精饮料贴有警告标籤,因为这些标籤受该国食品安全和标准(酒精饮料标准)法规的管辖。这些标准将促进所研究市场的成长。

- 食品快速都市化和工业化,包装和食品的消费量不断增加,正在推动所研究市场的成长。随着糖果零食糖果零食消费量的不断增加,一些包装供应商正在提供专门满足这一需求的包装解决方案,进一步增加销售额和收益。例如,根据美国人口普查局的数据,到 2023 财年,美国糖果零食业收益预计将达到 108.9 亿美元。

- 随着社会不断寻求新的方法来解决碳排放、生物多样性丧失、资源稀缺和废弃物等紧迫问题,消费者在选择品牌和光顾商店时永续性。提高效率和减少浪费的解决方案为零售商提供了一个重要机会,可以将其业务推向更永续的方向,并展示他们对解决这些问题的承诺。

亚太地区预计将录得最快的市场成长

- 无底纸标籤在亚太地区的成长主要是由于无底纸标籤在中国、印度和日本等经济体的食品、饮料和零售等最终用户行业中的使用不断增加。

- 快速的都市化和工业化正在增加该地区加工食品的消费量,并积极推动该地区研究市场的成长。例如,根据中国国家统计局的数据,2021年,约64.8%的总人口居住在城市。结果,食品需求增加,中国已成为世界上最大的食品和饮料工业之一。

- 无底纸标籤主要用于肉类、鱼类和家禽零售包装,也出现在冷藏、便利性和产品类型。据酵母,2021年中国食品饮料产业预计快速扩张。 2021年销售额预计将达到1,760亿美元,占全球食品和饮料收益的63%。预计2021年至2025年收益年增率为8.38%。

- 近年来,由于包装食品消费量的增加以及对优质产品的认识和需求的增加,印度的永续包装有所增长。消费者对包装食品的认识不断增强。

- 随着收入和可自由支配支出的增加,对食品便利性和品质的需求增加,这推动了国内加工食品产业的发展。由于生活方式的改变,印度人的消费习惯已经从传统的食品消费转向以包装食品和食品食品为主的城市饮食习惯。

无底纸标籤产业概述

竞争企业之间敌对的强度取决于其集中度、新进入者的进入障碍以及市场领导的控製程度。无底纸标籤市场的主要企业提供多样化的产品系列,重点是销售和研发活动,以提高其市场地位。

- 2022 年 1 月 - ProPrint Group 不断发展壮大,在 Wellingborough 增设了第三个办公地点。一个新的 33,000 平方英尺的办公室和仓库将作为客户支援中心,并提供更多的库存储存空间。 ProPrintGroup 目前在三个地点拥有总合78,000 平方英尺的空间。

- 2021 年 12 月 - 不干胶标籤製造商 Eticet Schiller 加入 Optimum Group 的德国平台。作为国际印刷集团 Optimum Company 的一部分,Eticet Schiller 能够透过额外的生产能力、更广泛的不干胶标籤和软包装解决方案选择以及更高的交付可靠性来更好地服务于客户。它一定会的。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 包装食品和饮料的需求增加

- 药品需求增加

- 市场挑战

- 确保替补人员

第六章市场区隔

- 透过印刷技术

- 凹版印刷

- 弹性凸版印刷

- 数位的

- 其他印刷工艺

- 按最终用户产业

- 食品

- 饮料

- 卫生保健

- 化妆品

- 家

- 产业

- 物流

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Hub Labels Inc.

- Reflex Labels Ltd

- Skanem AS

- NAStar Inc.

- Optimum Group

- SATO Europe GmbH

- ProPrint Group

- Innovia Films(CCL Industries)

- Coveris

- Lexit Group AS

- RR Donnelley &Sons Company

- Gipako UAB

第八章市场的未来

简介目录

Product Code: 67997

The Linerless Labels Market size is estimated at USD 1.94 billion in 2024, and is expected to reach USD 2.51 billion by 2029, growing at a CAGR of 5.28% during the forecast period (2024-2029).

Key Highlights

- Linerless labels have been gaining popularity because they eliminate the need for non-recyclable release liners and reduce costs. Continuous product innovation for linerless labels will sustain future market development. Linerless also offers optimum adhesive placement, wrinkle-free attachment on low-stability surfaces, and thermal transfer variable printability. Linerless labels generate minimum waste compared with pressure-sensitive labels, while the same diameter roll carries a much higher volume of linerless labels.

- Even though linerless labels provide all the benefits of self-adhesive labeling, with improved efficiencies, volume applications, and environmental advantages through their non-utilization of carrier backing paper, they are not an ideal solution for all label production as there are certain limitations.

- All printed labels are positioned on a continuous substrate web until dispensed. For separation, they must either be cut or supplied with a perforation line. The use of transparent substrates and the printing of opaque white prior to the application of the colored inks may contribute to overcoming the limitations in shape. However, this further restricts the range of use for linerless labels. Product innovation for linerless labels, including developments in face stock, adhesives, printable silicone coatings, application equipment, and converting equipment, will support further growth of the sector. The market is witnessing technological innovations owing to the research and development carried out by the players in the market. Such innovations are expected to boost the adoption of linerless labels over the forecast period.

- The packaged food and beverage industry has witnessed a significant increase in demand which is driving the need for liner-free labels and thereby aiding the growth of the market. Several industry guidelines by the government for packaged food have also shaped the demand for linerless labels. According to FDA, packaged and processed food items must have nutritional labeling that makes labeling important. The Food Safety Modernization Act mandates consumer packaged goods to be able to, at minimum, identify the immediate supplier and recipient (other than retailers to consumers) of a product to monitor the path of their products. Such regulations aid the use of linerless labels in packaged food.

- Linerless labels penetrated the market much after the traditional liner labels were made available in the market. Although linerless labels have made great strides in terms of adoption, the market still has a significant number of alternatives, including various kinds of pressure-sensitive labels, which have presented a challenge for the growth of the studied market.

- The linerless label segment has been considered stable in the COVID-19 period, owing to the increasing demand for food and pharmaceutical packaging. The COVID-19 outbreak disrupted the supply chain across various end-user industries, like food and beverage, healthcare, and industrial, among others. The pandemic created unprecedented challenges for supply chain and logistics management in the last few months. Products like canned food, toilet paper, and cleaning supplies have witnessed a significant rise in demand, while other end-use sectors have slowed dramatically.

Linerless Labels Market Trends

Food and Beverage Expected to Hold the Largest Market Share

- With labor shortages, customer expectations, automation quandaries, and the high cost of doing business, e-commerce companies face numerous challenges, and optimizing processes is a priority. This is especially important in distribution and fulfillment centers, where many executives look for ways to improve operations such as inventory management, order picking, order releasing, and packing. Using linerless labels is a simple way to improve the packing process and save money within the beverage sector.

- The alcoholic drinks market for linerless labels is backed by rising off-trade sales, a growing tourism and hospitality industry, and increasing disposable incomes among an expanding middle class in developing nations. The market is also witnessing an increased demand from the North American Region. For instance, in 2021, According to StatCan, consumers living in the Canadian province of Quebec drink the most frequently, with approximately 57% of respondents stating that they drink alcohol at least once a week. This figure decreases to 28% in Atlantic Canada. It appears that political party preference also affects alcohol intake, with those supporting the Liberal party most likely to drink at least once a week.

- The Food Safety and Standards Authority of India (FSSAI) implemented the mandatory attachment of warning labels to all alcoholic beverages, as these warning labels fall under the jurisdiction of the country's Food Safety and Standards (Alcoholic Beverages Standards) Regulations. Such standards would promote the growth of the studied market.

- The growing consumption of packaged and processed food due to rapid urbanization and industrialization has been driving the studied market's growth. With the rising consumption of sweets and confectionery, several packaging providers are offering packaging solutions, specifically catering to this demand, and are further driving their sales and revenues. For instance, according to the US Census Bureau, confectionery manufacturing industry revenue in the United States is expected to reach USD 10.89 billion by FY 2023.

- Consumers are increasingly demanding more sustainability initiatives from the brands they select and the stores they visit as societies continue to seek new ways to address pressing issues like carbon emissions, biodiversity loss, resource shortages, and waste. Any solution that improves efficiency and reduces waste gives a significant opportunity for retailers to advance their business in a more sustainable direction and demonstrate their commitment to addressing these issues.

Asia-Pacific Expected to Register Fastest Market Growth

- The growth of linerless labels in the Asia-Pacific region is mainly attributable to the growing applications of such labels in the end-user industries, like food and beverage and retail in economies like China, India, and Japan.

- The growing consumption of packaged and processed food in the region due to rapid urbanization and industrialization has been driving the studied market's growth positively in the region. For instance, according to the National Bureau of Statistics of China, in 2021, about 64.8% of the total population lived in cities. This has resulted in an increasing demand for food and made China one of the world's largest food and beverage industries.

- Linerless labels have been predominantly used for meat, fish, and retail poultry packaging and emerging in chilled, convenience, and product categories. According to Eastspring, in 2021, the food and beverage (F&B) sector in China was expected to be rapidly expanding. Sales were estimated to reach USD 176 billion in 2021, accounting for 63% of worldwide F&B revenue. Between 2021 and 2025, the yearly revenue growth rate is expected to be 8.38%.

- In recent years, India has witnessed sustainable packaging growth, owing to the increase in packaged food consumption and awareness and demand for quality products. Consumer awareness surrounding packaged food has heightened.

- With the increase in income and discretionary spending, there is a need for convenience and quality in food, which has been driving most of the packaged food industry in the country. Lifestyle changes have caused a shift in Indian consumer habits from the consumption of traditional food to more urban food habits consisting of packaged and processed foods.

Linerless Labels Industry Overview

The intensity of competitive rivalry is shaped by firm concentration ratio, barriers of entry for new entrants, and the extent of market leaders' domination. The major players in the linerless label market offer diverse product portfolios, with a focus on sales and R&D activities to improve their market positions.

- Jan 2022 - The ProPrint Group has grown by adding a third location in Wellingborough. The new 33,000-square-foot office and warehouse will serve as a customer support center and provide more storage for inventory. ProPrintGroup now has a total of 78,000 square feet spread across three locations.

- Dec 2021 - Etiket Schiller, a manufacturer of self-adhesive labels, joined the Optimum Group's German platform. Etiket Schiller will be able to better serve their clients as part of the Optimum Company, with additional capacity, a wider selection of self-adhesive labels and flexible packaging solutions, and higher delivery dependability as part of an international printing group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Packaged Foods and Beverages

- 5.1.2 Increasing Demand for Pharmaceutical Supplies

- 5.2 Market Challenges

- 5.2.1 Availability of Substitutes

6 MARKET SEGMENTATION

- 6.1 By Printing Technology

- 6.1.1 Gravure

- 6.1.2 Flexography

- 6.1.3 Digital

- 6.1.4 Other Processes of Printing

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Cosmetics

- 6.2.5 Household

- 6.2.6 Industrial

- 6.2.7 Logistics

- 6.2.8 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hub Labels Inc.

- 7.1.2 Reflex Labels Ltd

- 7.1.3 Skanem AS

- 7.1.4 NAStar Inc.

- 7.1.5 Optimum Group

- 7.1.6 SATO Europe GmbH

- 7.1.7 ProPrint Group

- 7.1.8 Innovia Films (CCL Industries)

- 7.1.9 Coveris

- 7.1.10 Lexit Group AS

- 7.1.11 R.R. Donnelley & Sons Company

- 7.1.12 Gipako UAB

8 Future of the Market

02-2729-4219

+886-2-2729-4219