|

市场调查报告书

商品编码

1439767

垃圾袋:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Trash Bags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

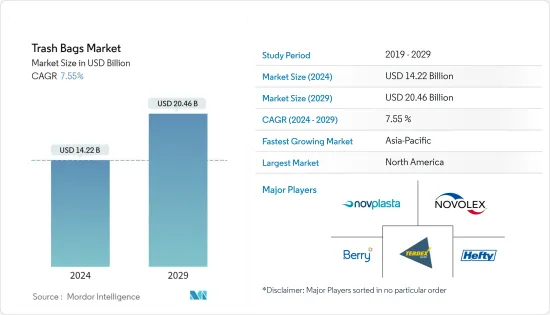

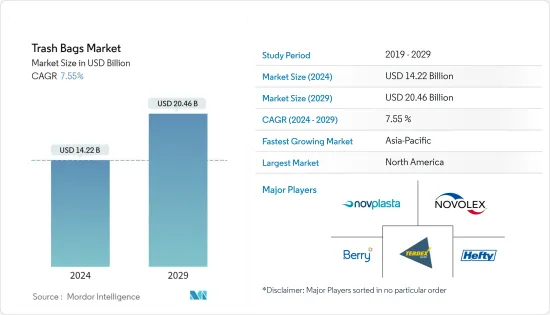

预计2024年垃圾袋市场规模为142.2亿美元,预计到2029年将达到204.6亿美元,在预测期内(2024-2029年)复合年增长率为7.55%。

通常由聚乙烯製成的垃圾袋耐用、重量轻,并且可以安全地容纳垃圾而不会洩漏或溢出,这就是为什么它们被零售、机构和工业等各种最终用户行业采用的原因。

主要亮点

- 随着人们越来越关注周围环境的卫生和清洁,垃圾袋的使用量在预测期内可能会增加。

- 快速的都市化正在增加废弃物的产生,并且在预测期内垃圾袋的使用可能会增加。报告也指出,到2050年,每年废弃物产生量预计将比2016年增加70%,达到34亿吨。这些案例显示垃圾袋市场将在预测期内成长。

- 由于材料供应挑战和对使用塑胶袋的製裁,製造商和消费者正在应对价格波动。由于COVID-19感染疾病的影响,原料和垃圾袋的价格会出现波动。

- 随着人们对环境的日益关注,消费者对环保产品的意识也越来越强。因此,对Oxo生物分解性袋的需求预计将受到客户对传统合成材料的环保和清洁替代品的偏好的推动。食品、饮料和製药业的持续成长也推动了全球对Oxo生物分解性袋的需求不断增长。

- 对于垃圾袋製造商来说,COVID-19感染疾病爆发的影响预计很小且短暂。封锁的影响包括供应链中断、製造过程原材料短缺、劳动力短缺以及可能影响最终产品生产的价格波动。

垃圾袋市场趋势

人们越来越关注永续性和对永续解决方案的需求。

- 为了减少塑胶排放,各国政府和相关监管机构实施了塑胶禁令,这可能会导致全国范围内的塑胶禁令,并影响垃圾袋市场。

- 2022年6月,加拿大政府宣布将在年终前禁止生产和进口一次性塑料,这是对抗塑胶废弃物和应对气候变迁的重要努力。该禁令包括由难以回收的塑胶製成或含有塑胶的塑胶购物袋、吸管、刀叉餐具和食品服务,但出于医疗原因有一些例外。该禁令计划于2022年12月生效,预计2023年12月将禁止销售这些塑胶製品。

- 根据乔治亚大学研究人员 2022 年 3 月发布的一项新分析,这些政策可能会增加当地对塑胶购物袋的购买量。当一次性塑胶购物袋课税或禁止时,人们会寻找替代品,这意味着购买小型塑胶垃圾袋。例如,研究发现,在加州有垃圾袋政策的地区,8加仑垃圾袋的销售量增加了87%到110%,4加仑垃圾袋的销售量增加了55%到75%,我做到了。因此,塑胶袋禁令最终也可能增加整个北美的垃圾袋销售量。

- 随着住宅、商业和零售等最终用户越来越多地采用垃圾袋,企业正在寻找替代方法来处理使用垃圾袋产生的废弃物。对塑胶垃圾袋的禁令将使製造商能够开发生物分解性或可回收的垃圾袋并支持商业活动,从而促进市场成长。

- 然而,这样的禁令将使垃圾袋製造商能够开发生物分解性或可回收的垃圾袋来支持其业务活动,从而促进市场成长。

预计北美将占据最大的市场占有率

- 政府和监管机构加强推广垃圾袋的使用是预测期间该地区垃圾袋普及可能增加的关键因素之一。

- 对易于一次性和环保垃圾袋的需求以及对环保产品的意识不断提高预计将推动市场成长。此外,人们卫生和清洁意识的提高主要推动了对此类产品的需求。

- 此外,世界各地住宅设施的增加可能会促进每个家庭垃圾桶和垃圾袋的消耗。美国住房与城市发展部数据显示,美国住宅销售较上季成长36.3%,至79.1万美元。此外,人口成长和全球都市化等其他因素正在创造对废弃物管理活动相关产品的长期需求。

- 《资源保护和回收法》(RCRA) 是一项公法,为妥善管理危险和无害固态废弃物建立了框架。该法律描述了国会授权的废弃物管理计划。据美国环保署称,塑胶正在迅速成为城市固态废弃物(MSW)的一部分。塑胶包含在所有重要的城市固体废弃物类别中。

- 儘管美国人口仅占世界人口的 4%,但其排放的都市固态废弃物(MSW) 却占全球的 12% 以上。除此之外,大量废弃物主要是由家庭用品製造等工业製程产生的。采矿、製造业和农业等活动会产生工业固态废弃物。儘管追踪不力,但它可能占美国废弃物总量的 97%(资料来源:美国PIRG 教育基金)。

- 美国环保署对家庭和工业废弃物进行监管,废弃物保护其废弃物危害。我们也努力节约能源和自然资源,减少和消除废弃物,并清理不当处置的废弃物。这可能会推动垃圾袋市场的成长。

- 2021 年 7 月,缅因州成为美国第一个通过包装和纸製品生产者责任法的州,将回收成本的责任从纳税人和负责生产这些产品的公司身上转移开。

- 除此之外,冠状病毒感染疾病(COVID-19)爆发的不确定性导致消费者对个人卫生和防护相关产品的需求激增,从而推动市场成长。然而,政府对塑胶垃圾袋使用的规定对市场发展有重大影响。

- 美国城市和州正朝着零废弃物政策迈进。大约 11 个州已通过一次性塑胶袋禁令,7 个州已通过发泡聚苯乙烯容器禁令。

垃圾袋产业概况

由于 Berry Global Inc.、Hefty (Reynolds Consumer Products LLC) 等主要企业的存在,垃圾袋市场竞争对手之间的竞争非常激烈。市场参与者参与策略合作伙伴关係,从而促进产品开发并推动市场成长。

- 2022 年 8 月 - Balenciaga 推出名为「Bin Bag」的新产品线。现在,这家法国时装屋推出了以垃圾桶袋为设计灵感的小包。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 快速都市化

- 提高卫生意识

- 市场限制因素

- 扩大塑胶禁令

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 按最终用户产业

- 零售

- 业务

- 产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争形势

- 公司简介

- Pack-It BV

- Kemii Garbage Bag Co. Ltd

- Cosmoplast Industrial Company LLC(Harwal Group of Companies)

- Luban Packing LLC

- Hefty(Reynolds Consumer Products LLC)

- International Plastics Inc.

- Novolex

- Novplasta sro

- Terdex GmbH

- Berry Global Inc.

第七章 投资分析

第八章市场机会及未来趋势

The Trash Bags Market size is estimated at USD 14.22 billion in 2024, and is expected to reach USD 20.46 billion by 2029, growing at a CAGR of 7.55% during the forecast period (2024-2029).

Trash bags typically made of polyethylene are tough, light, and hold garbage securely without leakage or spillover, thereby finding its adoption across various end-user industries such as retail, institutional, and industrial.

Key Highlights

- People are increasingly focusing on hygiene and the cleanliness of the surrounding environment, which could boost the adoption of trash bags over the forecast period.

- Rapid urbanization has resulted in an increased waste generation, which could fuel the usage of trash bags over the forecast period; it also stated that annual waste generation would increase by 70% from 2016 levels to 3.40 billion tonnes in 2050. Such instances indicate that the trash bag market would grow over the forecast period.

- Manufacturers and consumers are dealing with fluctuating prices due to material supply challenges and sanctions on using plastic bags. Raw materials and trash bag prices have been fluctuating due to the COVID-19 pandemic.

- Consumer awareness of environmentally friendly products is increasing with the rise in environmental concerns. Thus, the demand for oxo-biodegradable bags is expected to be fueled by customer preference for eco-friendly, clean alternatives to traditional synthetic items. Continuous growth in the food, beverage, and pharmaceutical industries also contributes to increased demand for oxo-biodegradable bags around the globe.

- For trash bag manufacturers, the COVID-19 virus outbreak had a negligible effect that was only expected to last a short time. Supply chain disruptions, a lack of raw materials for the manufacturing process, labor shortages, and price fluctuations that may affect the production of the finished product are a few effects of lockdowns.

Trash Bags Market Trends

Growing Concern Of Sustainablity and Demand for Sustainable Solution.

- To reduce the plastic footprint, governments and related regulatory bodies are imposing bans on plastics, resulting in the countrywide prohibition of plastics that could affect the trash bag market.

- In June 2022, the Government of Canada announced to ban on the manufacturing and import of single-use plastics by the end of 2022 in a significant effort to combat plastic waste and address climate change. The ban includes checkout bags, straws, cutlery, and food service made from or containing plastics that are difficult to recycle, with a few exceptions for medical reasons. The ban is expected to come into effect in December 2022, and the sale of these plastic items will be prohibited by December 2023.

- According to a new analysis by a University of Georgia researcher published in March 2022, these policies may cause more plastic bags to be purchased in their regions. When single-use plastic shopping bags are taxed or banned, people look for alternatives that indicate they buy small plastic trash bags. For instance, the study found out that California communities with bag policies witnessed sales of 8-gallon trash bags increase by 87% to 110%, and sales of 4-gallon trash bags increase by 55% to 75%. Thus, the plastic bags ban can eventually result in increased sales of trash bags in North America overall as well.

- As trash bags are increasing in adoption across end users, such as the residential, commercial, and retail sectors, companies are looking for alternatives to dispose of the waste generated by using bags. The bans on plastic trash bags allow manufacturers to develop biodegradable or recyclable trash bags that enable them to support their business activities, thereby boosting the market growth.

- However, such bans allow the trash bag manufacturers to develop a biodegradable or recyclable trash bag that enables them to support their business activities, thereby boosting the market growth.

North America is Expected to Hold the Largest Market Share

- The increasing initiatives by the government and regulatory bodies to promote the usage of trash bags are one of the significant factors that could boost the adoption of trash bags in the region over the forecast period.

- Increasing demand for easily disposable and eco-friendly garbage bags and awareness regarding environmentally sustainable products is expected to drive market growth. Additionally, growing awareness regarding hygiene and cleanliness among the people is mainly fuelling the demand for such products.

- Moreover, increasing housing facilities across the globe is likely to ease the consumption of trash cans among households and, thereby, trash bags. According to the US Department of Housing and Urban Development, US housing sales value rose up to USD 791,000, a 36.3% rise over the previous month. Additionally, other factors, such as the increasing population and the global urbanization rate, provide long-term demand for the products associated with waste management activities.

- The Resource Conservation and Recovery Act (RCRA) is the public law that creates the framework for properly managing hazardous and non-hazardous solid waste. The law describes the waste management program mandated by Congress. According to the United States Environmental Protection Agency, plastics have been a rapidly growing part of municipal solid waste (MSW). Plastic is found in all significant MSW categories.

- The United States produces more than 12% of the planet's municipal solid waste (MSW), though it is home to only 4% of the world's population. Apart from this, a large amount of waste is created by industrial processes, mainly from the household products manufacturing industry. Activities like mining, manufacturing, and agriculture create industrial solid waste, which is poorly tracked but may account for up to 97% of America's total waste (source: US PIRG Education Fund).

- The US Environmental Protection Agency regulates household and industrial waste to protect it from the hazards of waste disposal. It also seeks to conserve energy and natural resources, reduce and eliminate waste, and clean up the waste that has been improperly disposed of. This is likely to promote the growth of the trash bag market.

- In July 2021, Maine became the first state in the United States to pass a law that establishes the producer's responsibility for packaging and paper products, shifting responsibility for the costs of recycling away from the taxpayer and the corporations responsible for producing those products.

- Besides this, the uncertain occurrence of the COVID-19 outbreak has skyrocketed the consumer demand for personal hygiene and protection-related products, thereby driving the market growth. However, governmental regulations related to the usage of plastic garbage bags have significantly impacted the development of the market.

- US cities and states are taking strides toward a zero-waste policy. Around 11 states have passed bans on single-use plastic bags, seven have passed prohibitions on expanded polystyrene containers, and more.

Trash Bags Industry Overview

The competitive rivalry in the trash bags market is high owing to the presence of some key players such as Berry Global Inc., Hefty (Reynolds Consumer Products LLC), and many more. The player in the market is involved in strategic partnerships that have enabled them to come up with product developments, fueling the market growth.\

- August 2022 - Balenciaga launched a new line of products called 'bin bags.' This time, the French fashion house has launched a pouch inspired by the garbage bin bags' design.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Urbanization

- 4.2.2 Growing Awareness for Hygiene

- 4.3 Market Restraints

- 4.3.1 Increasing Plastic Bans

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By End-user Industries

- 5.1.1 Retail

- 5.1.2 Institutional

- 5.1.3 Industrial

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Pack-It BV

- 6.1.2 Kemii Garbage Bag Co. Ltd

- 6.1.3 Cosmoplast Industrial Company LLC( Harwal Group of Companies)

- 6.1.4 Luban Packing LLC

- 6.1.5 Hefty(Reynolds Consumer Products LLC)

- 6.1.6 International Plastics Inc.

- 6.1.7 Novolex

- 6.1.8 Novplasta s.r.o.

- 6.1.9 Terdex GmbH

- 6.1.10 Berry Global Inc.