|

市场调查报告书

商品编码

1439782

厌氧黏合剂 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Anaerobic Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

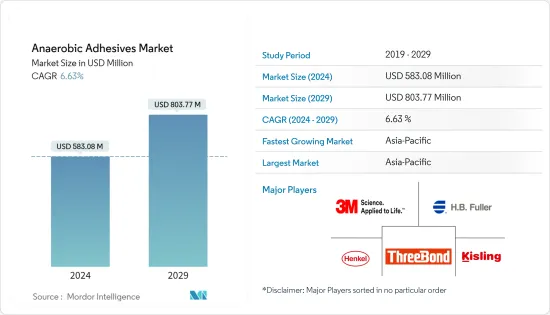

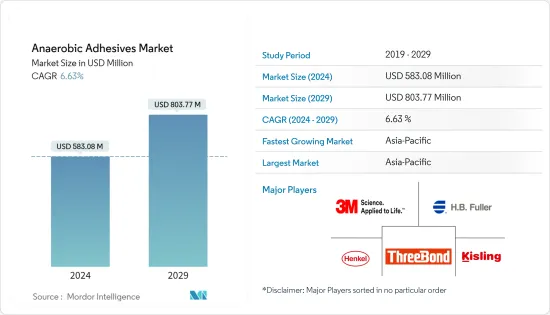

厌氧黏合剂市场规模预计到2024年为5.8308亿美元,预计到2029年将达到8.0377亿美元,在预测期内(2024-2029年)CAGR为6.63%。

COVID-19 对 2020 年的市场产生了负面影响。然而,由于电气和电子、建筑和其他行业等各个最终用户行业的消费增加,市场在 2021 年显着復苏。

主要亮点

- 从中期来看,汽车行业的復苏以及电气和电子行业需求的增加正在推动所研究市场的成长。

- 另一方面,厌氧胶的高成本阻碍了厌氧胶市场的成长。

- 儘管如此,不断增加的研发和生物基原料,加上再生能源市场的日益突出,可能会成为所研究市场的利润丰厚的机会。

- 亚太地区可能主导全球厌氧黏合剂市场,并且在预测期内可能以最高的CAGR成长。

厌氧胶市场趋势

汽车和运输业的需求不断增长

- 在汽车工业中,广泛使用固持剂、管道密封剂、垫片密封剂和螺纹锁固黏合剂。

- 它们用于引擎和防火墙密封、引擎监测感测器、引擎插头密封剂、螺纹软管连接器密封剂、用于引擎室管道和直螺纹的螺纹软管接头密封剂、用于螺纹锁紧螺丝、螺栓的内部密封应用,和螺母、车轮轴承、汽车锁定应用、汽车车身/车架螺栓、悬吊区域、煞车、后端和变速箱以及许多其他应用。

- 厌氧黏合剂也用于航空航太工业的维护、修理和操作 (MRO) 应用,包括螺纹锁固、固定、垫片和螺纹密封。这些黏合剂可帮助製造商避免在 MRO 期间对各种机械部件进行不必要的加工。

- 最近从内燃机到电动车的转变正在推动自动化技术的创新。厌氧黏合剂取代了机械紧固件,因为它们可以适应热膨胀引起的运动并且不易腐蚀。

- 黏合剂也优于传统的连接方法,因为它们可以防止接触腐蚀并提供抗衝击性,这对于承受电动马达的高动态力至关重要。

- 全球主要汽车製造商已宣布计划透过开发新产品线和改造现有製造设施来加速电动车的未来发展。例如:

- 丰田宣布到 2030 年推出 30 款纯电动车 (BEV) 车型。

- 沃尔沃致力于在 2030 年成为一家全电动汽车公司。

- 通用汽车的目标是到2025年在北美推出30款电动车,装置产能达100万辆。

- 2021年,全球汽车产量8,014万辆。与2020年相比成长了3%。欧洲汽车产量与2020年相比减少了4%,至1633万辆。美国产量较2020年成长3%,达1,615万台。

- 亚太地区2021年较2020年成长6%,达4,673万台,而非洲2021年较2020年大幅成长16%,达93万台。

- 2022年,合资公司广汽本田在中国广州开始兴建新汽车工厂。该厂预计年产12万辆电动车,预计2024年投产。投资额预计为34.9亿元人民币(约5亿美元)。

- 这些趋势正在推动厌氧黏合剂市场的发展。

亚太地区将主导市场

- 由于该地区存在多个新兴市场,特别是中国和印度等国家,亚太地区占据了市场主导地位。

- 中国是全球最大的汽车製造国。根据OICA的数据,2021年该国汽车产量达2,608万辆,较2020年的2,523万辆成长3%。

- 与2020年同期相比,2021年11月插电式电动车成长了106%。2021年11月,全国电动车销量达到约413,094辆。此外,市占率也增加至19% %,其中包括15%的纯电动车和4% 的插电式混合动力车。

- 中国也是最大的飞机製造商之一,也是国内航空旅客最大的市场之一。此外,中国的飞机零件和组装製造业一直在快速成长,超过200家小型飞机零件製造商对厌氧胶的使用和需求不断增加。根据波音《2021-2040年商业展望》,到2040年,中国将新增交付飞机约8,700架,市场服务价值达1.8兆美元。由于该国的此类新交付,对所研究市场的需求可能会增加。

- 此外,根据 OICA 的数据,印度 2021 年生产了约 43,99,112 辆汽车,比 2020 年生产的 3,381,819 辆增长了 30%。

- 在航空航太领域,根据印度品牌股权基金会 (IBEF) 的数据,该国航空业预计在未来四年内将获得 3,500 亿印度卢比(约 49.9 亿美元)的投资。预计未来二十年该国将需求 2,100 架飞机,销售额将超过 2,900 亿美元。由于这些因素,预计未来航空航太领域对厌氧胶的需求将会增加。

- 预计到 2025 年,印度将成为全球第五大消费性电子和电器产业。此外,在印度,4G/LTE 网路和 IoT(物联网)的推出等技术转型正在推动电子产品的采用。 「数位印度」和「智慧城市」计画等措施提高了该国对物联网的需求。

- 印度庞大的建筑业预计到2022年将成为全球第三大建筑市场。印度政府实施的各项政策,如智慧城市计画、2022年全民住宅等,预计将为印度建筑业带来所需的动力。建筑业放缓。例如,在 Pradhanmantri Awas Yojana 中,印度政府决定分别为最高 120 万印度卢比(约 1,455 万美元)和 90 万印度卢比(1,092 万美元)的贷款提供 3% 和 4% 的利息补贴,为社会下层购买和建造房屋提供协助。

- 总体而言,所有这些因素都将影响预测期内该地区对厌氧黏合剂的需求。

厌氧胶产业概况

全球厌氧胶市场是半整合的,全球和国内的参与者遍布不同地区。然而,市场前五名参与者控制着全球市场的大部分份额。厌氧黏合剂市场的主要参与者包括 Henkel AG & Co. KGaA、3M、HB Fuller Company、Kisling AG 和 ThreeBond Holdings 等(排名不分先后)。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 汽车产业復苏

- 电气和电子产业的需求不断增长

- 限制

- 厌氧胶成本高

- 其他限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场区隔(市场价值规模)

- 产品类别

- 螺纹锁固剂

- 螺纹密封剂

- 固位化合物

- 垫片密封剂

- 最终用户产业

- 汽车和交通

- 电气和电子

- 工业的

- 建筑与施工

- 其他最终用户产业

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 合併、收购、合资、合作和协议

- 市场排名分析

- 领先企业采取的策略

- 公司简介

- 3M

- Anabond Limited

- Asec Co., Ltd

- HB Fuller Company

- Henkel AG and Co. KGaA

- Hi-Bond Chemicals

- Kisling AG

- Krylex (Chemence)

- Metlok Private Limited

- Novachem Corporation ltd

- Parson Adhesives, Inc.

- Permabond LLC.

- ThreeBond Holdings Co., Ltd

第 7 章:市场机会与未来趋势

- 加大生物基原料的研发与使用力度

- 再生能源市场日益突出

The Anaerobic Adhesives Market size is estimated at USD 583.08 million in 2024, and is expected to reach USD 803.77 million by 2029, growing at a CAGR of 6.63% during the forecast period (2024-2029).

COVID-19 negatively impacted the market in 2020. However, the market recovered significantly in 2021, owing to rising consumption from various end-user industries such as electrical and electronics, building and construction, and others.

Key Highlights

- Over the medium term, recovering the automotive industry and increasing demand from electrical and electronics industries are driving the growth of the studied market.

- On the flip side, the high cost of anaerobic adhesives hinders the growth of the anaerobic adhesives market.

- Nevertheless, increasing research and development and bio-based raw materials, coupled with growing prominence in the renewable energy market, are likely to act as lucrative opportunities for the studied market.

- Asia-Pacific is likely to dominate the global anaerobic adhesives market and is likely to grow with the highest CAGR during the forecast period.

Anaerobic Adhesives Market Trends

Increasing Demand from the Automotive and Transportation Industry

- In the automotive industry, retaining compounds, pipe sealants, gasket sealants, and thread-locking adhesives are widely used.

- They are used in the applications of engine and firewall sealing, engine monitor sensors, engine plug sealants, threaded hose connector sealants, threaded hose nipple sealants for pipes and straight threads of engine compartments, for interior sealing applications of thread-locking screws, bolts, and nuts, wheel bearings, automotive locking applications, automotive body/frame bolts, suspension areas, brakes, rear end, and transmission and many other applications.

- Anaerobic adhesives are also used in aerospace industry maintenance, repair, and operation (MRO) applications for applications including thread-locking, retaining, gasketing, and thread sealing. These adhesives help manufacturers avoid unnecessary machining of a wide range of mechanical components during MRO.

- The recent shift from Internal Combustion Engines to electric vehicles is driving innovation in automation technologies. Anaerobic adhesives replace mechanical fasteners as they may accommodate movements caused by thermal expansion and are not susceptible to corrosion.

- Adhesives are also preferred over conventional joining methods as they can prevent contact corrosion and provide impact resistance that is essential for withstanding the high dynamic forces of electric motors.

- The major automakers globally have announced plans to accelerate their electric vehicle future by developing new product lines and converting existing manufacturing facilities. For example:

- Toyota announced the roll-out of 30 Battery Electric Vehicles (BEV) models by 2030.

- Volvo is committed to becoming a fully electric car company by 2030.

- General Motors aims for 30 EV models and an installed production capacity of 1 million units in North America by 2025.

- In 2021, globally, 80.14 million automobile units were produced. This was an increase of 3% compared to 2020. The production of automobiles in Europe reduced by 4% compared to 2020, to 16.33 million units. The production increased by 3% compared to 2020 in America to 16.15 million units.

- The Asian-Pacific region witnessed a growth of 6% in 2021 compared to 2020 to 46.73 million units, while Africa witnessed a significant growth of 16% in 2021 compared to 2020 to reach 0.93 million units.

- In 2022, the joint venture company GAC Honda started the construction of a new car plant in Guangzhou, China. The plant is expected to have a capacity to produce 120,000 electric vehicles per year and is expected to start production by 2024. The investment amount is expected to be CNY 3.49 billion (~USD 0.5 billion).

- Such trends are driving the market for anaerobic adhesives.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominates the market owing to various emerging markets in the region, specifically in countries like China and India.

- China is the largest manufacturer of automobiles globally. In 2021, according to the OICA, the automotive production in the country reached 26.08 million, which increased by 3%, compared to 25.23 million vehicles produced in 2020.

- A growth of 106% in battery-plugged-in electric vehicles was witnessed in November 2021 compared to the same period in 2020. The country's sales of electric vehicles reached around 413,094 units in November 2021. In addition, the market share also increased to 19%, including 15% of all-electric and 4% of plug-in hybrid cars.

- China is also one of the largest aircraft manufacturers and one of the largest markets for domestic air passengers. Moreover, the country's aircraft parts and assembly manufacturing sector has been growing rapidly, with over 200 small aircraft parts manufacturers increasing the usage and demand for anaerobic adhesives. According to the Boeing Commercial Outlook 2021-2040, in China, around 8,700 new deliveries will be made by 2040, with a market service value of USD 1,800 billion. Owing to such new deliveries in the country, the demand for the market studied is likely to rise.

- Furthermore, in India, according to OICA, around 43,99,112 vehicles were produced in 2021, which increased by 30% compared to 3,381,819 units manufactured in 2020.

- In the aerospace sector, according to the India Brand Equity Foundation (IBEF), the country's aviation industry is expected to witness INR 35,000 crore (~USD 4.99 billion) investment in the next four years. The country is projected to have a demand for 2,100 aircraft over the next two decades, amounting to over USD 290 billion in sales. Owing to these factors, the demand for anaerobic adhesives from the aerospace sector is expected to rise in the future.

- India is expected to become the global fifth-largest consumer electronics and appliances industry by 2025. Additionally, in India, technology transitions, such as the rollout of 4G/LTE networks and IoT (Internet of Things), are driving the adoption of electronic products. Initiatives, such as 'Digital India' and 'Smart City' projects, raised the demand for IoT in the country.

- India's huge construction sector is expected to become the global third-largest construction market by 2022. Various policies implemented by the Indian government, such as the Smart Cities project, Housing for all by 2022, etc., are expected to bring the needed impetus to the slowing construction industry. For instance, in the Pradhanmantri Awas Yojana, the Indian government has decided to provide interest subvention of 3% and 4% for loans of up to INR 12 lakhs (~USD 14.55 thousand) and INR 9 lakhs (USD 10.92 thousand), respectively, for the lower strata of society concerning buying and building homes.

- Overall, all such factors will affect the demand for anaerobic adhesives in the region over the forecast period.

Anaerobic Adhesives Industry Overview

The global anaerobic adhesives market is semi-consolidated, with various global and domestic players across different regions. However, the top five players in the market control a majority share of the global market. Key players in the anaerobic adhesives market include Henkel AG & Co. KGaA, 3M, H. B. Fuller Company, Kisling AG, and ThreeBond Holdings Co., Ltd, among others ( not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Recovering Automotive Industry

- 4.1.2 Increasing Demand From The Electrical And Electronics Industries

- 4.2 Restraints

- 4.2.1 High Cost Of Anaerobic Adhesives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products And Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Threadlockers

- 5.1.2 Thread Sealants

- 5.1.3 Retaining Compound

- 5.1.4 Gasket Sealants

- 5.2 End-user Industry

- 5.2.1 Automotive and Transportation

- 5.2.2 Electrical and Electronics

- 5.2.3 Industrial

- 5.2.4 Building and Construction

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Anabond Limited

- 6.4.3 Asec Co., Ltd

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG and Co. KGaA

- 6.4.6 Hi-Bond Chemicals

- 6.4.7 Kisling AG

- 6.4.8 Krylex (Chemence)

- 6.4.9 Metlok Private Limited

- 6.4.10 Novachem Corporation ltd

- 6.4.11 Parson Adhesives, Inc.

- 6.4.12 Permabond LLC.

- 6.4.13 ThreeBond Holdings Co., Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Research And Development and Usage of Bio-based Raw Materials

- 7.2 Growing Prominence in Renewable Energy Market