|

市场调查报告书

商品编码

1439797

灌溉帮浦:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Irrigation Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

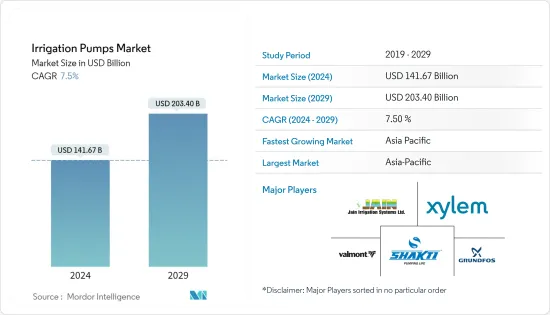

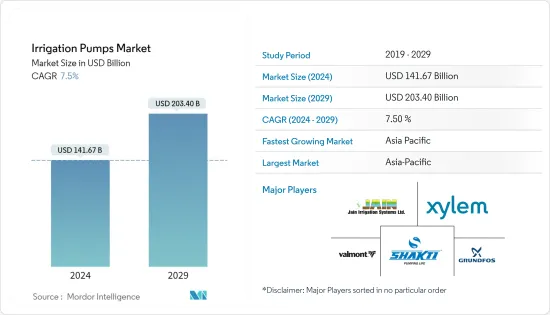

灌溉泵浦市场规模预计到2024年为1,416.7亿美元,预计到2029年将达到2,034亿美元,在预测期内(2024-2029年)复合年增长率为7.5%。

随着情况逐渐恢復正常,预计与2020年相比,对精准灌溉系统市场的影响会较小。此外,过去几个月进出口变得更加顺畅,这是市场復苏的好征兆。然而,COVID-19 在世界某些地区持续存在,来自其他国家的移民可能会导致疫情捲土重来。

水泵是灌溉系统中最重要的部分。为了使您的灌溉系统尽可能高效,您需要选择适合您的水源、配水系统和灌溉设备要求的泵浦。用于灌溉的泵浦包括离心式帮浦、涡流泵浦和潜水泵浦。许多新兴市场,如南美洲、中东和非洲,依赖石油、天然气和煤炭等传统能源来源来为水泵提供动力。亚太、欧洲和北美地区的电网并联型市场规模很大。这是因为它是以补贴价格提供给农民的。电动帮浦效率更高且更具成本效益。农业中使用的泵浦的尺寸各不相同,具体取决于需要抽水的土地深度以及距水源(例如水库、河流、湖泊或水坝)的距离。最常见的农用泵类型广泛用于中小型土地的灌溉活动,功率范围为 4 至 15 马力。大多数农业用地都是碎片化的,因此在该地区使用泵浦既方便又经济。

据粮农组织称,作物产量成长主要来自三个来源。这些措施包括扩大土地面积、增加耕作频率(通常透过灌溉)和提高产量。鑑于世界各地人口持续增长,粮食永续性日益受到关注,预计在预测期内对灌溉系统重要组成部分的需求将保持在较高水准。

灌溉水泵市场趋势

新兴国家引进灌溉系统

农业在大多数新兴国家发挥重要作用。例如,印度政府制定了有助于提高农业产量和永续的政策和措施。例如,2020年,其政策之一是推广太阳能灌溉水泵。由于为引入太阳能泵提供了大量补贴和计划(JNNSM、KUSUM 等),太阳能泵的可用性得到了改善。补贴后,太阳能水泵在拉贾斯坦邦变得更加流行,随着太阳能水泵的承受能力的提高,采用率也随之提高。根据粮农组织的研究,新兴国家的灌溉面积预计将从 1997/99 年的 2.02 亿公顷增加到 2030 年的 2.42 亿公顷。这种扩张大部分可能发生在南部和东部土地稀缺的地区。灌溉在亚洲已经很重要。该研究涵盖了全球93个新兴国家。中国和印度等国家受益于政府为增加灌溉面积而提供的各种补贴。新兴国家的总灌溉面积估计约为 4.02 亿公顷,其中一半目前正在使用。灌溉地区的耕作强度和产量整体高于雨养地区。因此,对高效灌溉系统的需求日益增长,并可能在预测期内推动灌溉泵浦市场。

亚太地区灌溉帮浦市场快速发展

亚太地区的农业国家,包括中国、印度等,对市场成长做出了巨大贡献。肥沃的土地和农业流程的改进支持了市场的扩张。面对水资源短缺,中国正在扩大高价值经济作物的种植面积,因为这些作物适合节水灌溉,产量更高。

此外,政府还推出了各种财政和非财政奖励来支持市场扩张。在印度,太阳能升降灌溉系统作为恰蒂斯加尔邦政府的旗舰计画于2016年11月推出,并于2020年10月开始运作。该灌溉系统使帕特尔帕拉的农民能够在夏季和冬季种植蔬菜。

此外,2019年,根据Pradhan-Mantri Kisan Urja Suraksha Evam Utthaan Mahabhiyaan (PM-KUSUM)计划,过去三年安装了超过181,000个太阳能灌溉装置,以满足灌溉的电力需求。据报道,水泵已在国内安装。它由新能源和可再生能源部(MNRE)实施。因此,政府措施的增加和人们对农业的依赖程度的增加预计将在预测期内推动该地区的市场。

灌溉水泵产业概况

由于主要企业占据了大部分市场,灌溉帮浦市场得到了整合。市场主要企业包括 Valmont Industries、Xylem Inc.、Shakti Pumps Ltd、Jain Irrigation Systems、Lindsay Corporation Grundfos Group 等。这些领先公司投资新产品和临时产品、扩张和收购来扩大业务。另一个主要投资领域是专注于研发,以更低的价格推出新产品。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 消费者议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 类型

- 水下帮浦

- 涡流泵

- 离心式帮浦

- 其他类型

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲休息

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- BurCam

- Davey Water Products Pty Ltd

- Leo Pumps

- Franklin Electric

- Shimge Pump Group

- Guangdong Lingxiao Pump Industry Co. Ltd

- Haicheng Suprasuny Pump Co. Ltd

- Ebara Corporation

- CNP Pumps India Pvt. Ltd

- Ace Pump Corporation

- Grundfos Group

- Zoeller Company

第七章市场机会与未来趋势

第 8 章 评估 COVID-19 疾病对市场的影响

The Irrigation Pumps Market size is estimated at USD 141.67 billion in 2024, and is expected to reach USD 203.40 billion by 2029, growing at a CAGR of 7.5% during the forecast period (2024-2029).

As the situation is slowly moving back to normal, there is less impact expected on the precision irrigation systems market compared to 2020. Also, imports and exports have become smoother over the past few months, which is a good sign for the recovery of the market. However, COVID-19 persists in some parts of the world, and there is a chance of the pandemic recurring due to migration from other countries.

A pump is the most important part of an irrigation system. To make an irrigation system as efficient as possible, the pump must be selected to match the requirements of the water source, the water distribution system, and the irrigation equipment. Pumps used for irrigation include centrifugal, Vortex, and submersible pumps. Many developing markets, such as South America, the Middle East, and Africa, rely on traditional energy sources like oil, gas, and coal to power pumps. The market for energy grid connections is higher in places such as Asia-Pacific, Europe, and North America, because it is offered at a subsidized rate to farmers. Electric pumps are more efficient and cost-effective. Pumps used in agriculture vary in size depending on the depth of the land from which water must be drawn or the distance from water sources such as reservoirs, rivers, lakes, and dams. Due to its widespread use in irrigation activities on small and medium-sized landholdings, the most common type of agricultural pump is in the 4hp -15hp range. Because the majority of accessible land in the agricultural industry is fragmented, using pumps in this range is both convenient and cost-effective.

According to the FAO, there are three main sources of growth in crop production: expanding the land area, increasing the frequency with which it is cropped (often through irrigation), and boosting yields. Increasing concern about food sustainability, given the continuous population hike across the globe, is likely to keep the demand for integral parts of an irrigation system high in the forecast period.

Irrigation Pumps Market Trends

Adoption of Irrigation Systems in Developing Countries

Agriculture plays an important role in most developing countries. For instance, the Government of India is formulating policies and initiatives that would help in increasing agriculture production along with sustainable development. For instance, in 2020, the promotion of solar irrigation pumps is among one those policies. The provision of heavy subsidies and schemes (JNNSM, KUSUM, etc.) for the adoption of solar pumps have increased their affordability. Because of the increased affordability of solar pumps after subsidies, the popularity of solar pumps has increased in Rajasthan, which has resulted in an increased rate of adoption. According to a study by FAO, the developing countries as a whole are expected to expand their irrigated area from 202 million hectares in 1997/99 to 242 million hectares by 2030. Most of this expansion will occur in land-scarce areas of southern and eastern Asia, where irrigation is already crucial. The study covered 93 developing countries across the globe. Countries such as China and India are benefited from various subsidies given by the government to increase the area under irrigation. It is estimated that a total irrigation potential of some 402 million hectares in developing countries, of which half is currently in use. Cropping intensities and yields are systematically higher in irrigated than in rain-fed areas. Thus, the demand for an efficient irrigation system is gaining momentum by the day and is likely to drive the Irrigation pumps market in the forecast period.

The Irrigation Pump Market Advancing Rapidly in Asia-Pacific

The Asia-Pacific region's agrarian countries, including China, India, and others, are among the major contributors to the market's growth. The market's expansion has been supported by the availability of fertile land and improvements in the farming process. In China, high-value cash crops acreage has been expanding in the face of water shortages since these are often more suited to water-saving irrigation practices, bringing higher productivity.

Furthermore, governments have implemented a variety of financial and non-financial incentives to aid the market's expansion. In India, a solar-powered lift irrigation system was introduced in November 2016 as a flagship scheme of the Chhattisgarh government, which got operational in October 2020. This irrigation system ensures that farmers in Patelpara can grow vegetables even in the summer and winter seasons.

Furthermore, in 2019 it was reported that more than 181,000 solar power irrigation pumps were installed in the country over the past three years for meeting the electricity demand for irrigation under the Pradhan-Mantri Kisan Urja Suraksha Evam Utthaan Mahabhiyaan (PM-KUSUM) scheme be being implemented by the Ministry of New and Renewable Energy (MNRE). Thus, increasing government initiatives coupled with the rising dependency of the population on agriculture will drive the market in the region during the forecast period.

Irrigation Pumps Industry Overview

The irrigation pumps market is consolidated due to a major share of the market being occupied by top players. Some of the key players in the market are Valmont Industries, Xylem Inc., Shakti Pumps Ltd, Jain Irrigation Systems, and Lindsay Corporation Grundfos Group, among others. These major players are investing in new products and improvisation of products, expansions, and acquisitions for business expansions. Another major area of investment is the focus on R&D to launch new products at lower prices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Submersible Pump

- 5.1.2 Vortex Pump

- 5.1.3 Centrifugal Pump

- 5.1.4 Other Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest od South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BurCam

- 6.3.2 Davey Water Products Pty Ltd

- 6.3.3 Leo Pumps

- 6.3.4 Franklin Electric

- 6.3.5 Shimge Pump Group

- 6.3.6 Guangdong Lingxiao Pump Industry Co. Ltd

- 6.3.7 Haicheng Suprasuny Pump Co. Ltd

- 6.3.8 Ebara Corporation

- 6.3.9 CNP Pumps India Pvt. Ltd

- 6.3.10 Ace Pump Corporation

- 6.3.11 Grundfos Group

- 6.3.12 Zoeller Company