|

市场调查报告书

商品编码

1439805

鱼菜共生:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Aquaponics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

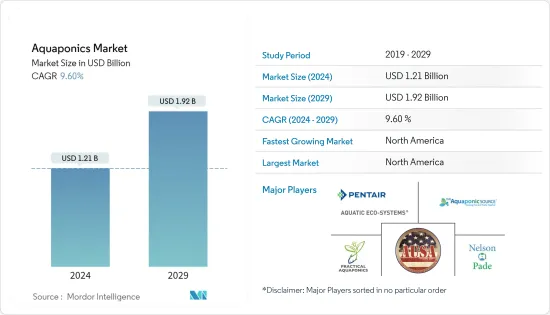

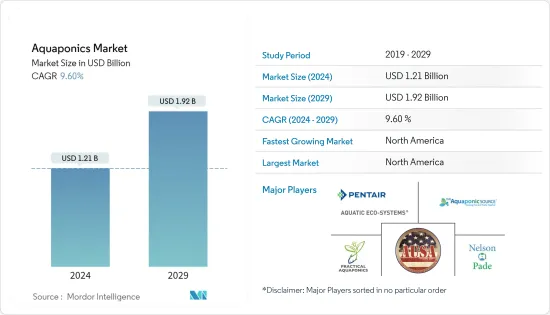

鱼菜共生市场规模预计到 2024 年为 12.1 亿美元,预计到 2029 年将达到 19.2 亿美元,在预测期内(2024-2029 年)增长 9.60%。复合年增长率为

COVID-19感染疾病对鱼菜共生市场供应链产生了重大影响。疫情期间的供应链中断迫使农民养殖更多的活鱼和其他水生生物,这对农民的成本、开支和风险产生了负面影响。

2021年,北美占据鱼菜共生市场最大份额。美国对该地区的贡献最大,其次是加拿大。鱼菜共生是该地区一个规模虽小但发展迅速的行业,教育和研究机构与私人公司之间有多个合作伙伴关係。这一因素在建立和提高鱼菜共生农场的认识方面发挥了至关重要的作用。不过,儘管像Superior Fresh Farm和Ouroboros Farm这样的农场处于商业性鱼菜共生生产的前沿,但该地区尚未形成鱼菜共生作物的大规模生产。

鱼菜共生市场趋势

对有机农产品的强劲需求推动市场

由于鱼菜共生不含化肥或作物保护化学品,而鱼类废物是植物的主要营养物质,因此对有机种植作物的需求潜力巨大,新兴的水产养殖对于鱼菜共生农场和鱼菜共生系统提供商来说是一个尚未开发的空间。根据有机贸易协会报告,2018 年有机水果和蔬菜销售额成长 5.6%,从去年的 164.2 亿美元增至 174 亿美元。因此,美国已成为有机种植水果和蔬菜的主要市场之一。此外,欧洲持有世界上最大的有机农业土地面积,其中西班牙占有机农业面积最大,为2,246,475.0公顷。由于鱼菜共生在有机农产品产业的基本范围,欧洲资助的成本行动 FA1305「欧盟鱼菜共生中心 - 实现欧盟永续的综合鱼类和蔬菜生产」是一项研究,加强了私营企业之间的网络部门和私人公司。玩家。因此,在预测期内,对有机种植农产品的需求预计将推动全球鱼菜共生产业的发展。

北美市场占据主导地位

儘管鱼菜共生在北美仍然是一个小产业,但预计未来几年将经历快速成长。 2014 年,威斯康辛大学史蒂文斯角分校、尼尔森分校和 Pade Aquaponics 建立了官民合作关係(PPP),建立鱼菜研发中心,作为威斯康辛大学系统经济发展补助金的一部分。此类措施在提高该地区对鱼菜共生等永续替代农业的认识方面发挥着至关重要的作用。此外,鱼菜共生有望帮助重组美国水产养殖业。根据2018年美国水产养殖大会透露,威斯康辛州的水产养殖场数量最近从2,300个增加到2,800个,其中500个新养殖场中有300个是鱼菜共生养殖场。有一点很清楚。目前,美国80.0%以上的水产品依赖进口。每年都要消费。从长远来看,增加国内鱼菜共生农场的数量可能有助于减少水产品进口。

鱼菜共生产业概况

鱼菜共生市场高度分散,主要是由于市场不断发展的性质。一些最活跃的鱼菜共生农场包括 Superior Fresh、Ouroboros Farms、Garden City Aquaponics Inc.、BIGH、Deep Water Farms 和 Madhavi Farms。领先的鱼菜共生投入供应商包括 Pentair Aquatic Eco-System Inc. (PAES)、Nelson &Pade Aquaponics、Practical Aquaponics、Aquaponics USA 和 The Aquaponic Source。由于市场仍在扩张,新兴企业正在策略性地推进产品发布并扩大产能,以确保在所研究的市场中占据重要份额。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 生长系统

- 媒体填充床

- 恆定流量

- 潮汐 (F&D)

- 营养膜技术(NFT)

- 筏式或 DWC

- 媒体填充床

- 设施类型

- 聚乙烯或玻璃温室

- 室内垂直农场

- 其他设施类型

- 鱼的种类

- 吴郭鱼

- 鲶鱼

- 鲤鱼

- 鳟鱼

- 观赏鱼

- 其他鱼类

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 马来西亚

- 印尼

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介 - 鱼菜共生投入供应商

- Pentair Aquatic Eco-System Inc.(PAES)

- Nelson &Pade Aquaponics

- Practical Aquaponics

- Aquaponics USA

- The Aquaponic Source

- 公司简介 - 鱼菜共生农场

- Superior Fresh

- Ouroboros Farms

- Garden City Aquaponics Inc.

- BIGH

- Deep Water Farms

- Madhavi Farms

- ECF Farm Berlin

第七章市场机会与未来趋势

第 8 章 评估 COVID-19 对市场的影响

The Aquaponics Market size is estimated at USD 1.21 billion in 2024, and is expected to reach USD 1.92 billion by 2029, growing at a CAGR of 9.60% during the forecast period (2024-2029).

The COVID-19 pandemic majorly impacted the supply chain of the aquaponics market. Supply chain disruptions amid the pandemic led farmers to rear many live fishes and other aquatic species, which negatively impacted the farmers' cost, expenditure, and risk.

In 2021, North America occupied the largest share in the aquaponics market. The United States contributed the largest share in the region, followed by Canada. Aquaponic is a small but rapidly growing industry in the region, with several partnerships among educational and research institutions and private companies. This factor played a pivotal role in establishing and increasing awareness about aquaponic farms. However, mass-scale production of aquaponic crops is yet to take form in the region, although farms such as Superior Fresh and Ouroboros Farms are at the forefront of commercial aquaponics production.

Aquaponics Market Trends

Substantial Demand for Organic Produce Driving the Market

As aquaponics are free from chemical fertilizers and crop protection chemicals, with fish waste serving as the prime nutrients for plants, the demand for organically grown crops holds high potential and an untapped space for emerging aquaponic farms and aquaponic system providers. As reported by the Organic Trade Association, sales of organic fruits and vegetables rose by 5.6% to USD 17.40 billion in 2018 from USD 16.42 billion in the previous year. Thus, the United States became one of the leading markets for organically grown fruits and vegetables. Moreover, Europe holds one of the largest organic farmland areas globally, with Spain accounting for the largest share with 2,246,475.0 ha of the area under organic farming. As a result of the underlying scope for aquaponic farming in the organic produce industry, the European-funded COST Action FA1305, 'The European Union Aquaponics Hub-Realising Sustainable Integrated Fish and Vegetable Production for the EU', strengthened the network between researchers and private players. Therefore, the demand for organically grown produce is expected to drive the global aquaponics industry during the forecast period.

North America Dominates the Market

Although still a small industry in North America, aquaponic farming is expected to witness exponential growth in the coming years. In 2014, the University of Wisconsin - Stevens Point and Nelson and Pade Aquaponics entered a Public-Private Partnership (PPP) to establish an Aquaponics Innovation Center as part of the UW-System Economic Development Incentive Grant. Such initiatives have played a pivotal role in raising awareness about sustainable farming alternatives, such as aquaponics, in the region. Additionally, aquaponics is expected to help rebuild the aquaculture industry in the United States. In Wisconsin, the number of aquaculture farms recently rose from 2,300 to 2,800, with 300 out of the 500 new farms being aquaponic farms, as revealed at the Aquaculture America Conference in 2018. Currently, the United States imports more than 80.0% of the seafood it consumes annually. The rising number of aquaponic farms in the country may help it reduce its seafood import over time.

Aquaponics Industry Overview

The aquaponics market is highly fragmented, primarily due to the evolving nature of the market. Some of the most active aquaponic farms are Superior Fresh, Ouroboros Farms, Garden City Aquaponics Inc., BIGH, Deep Water Farms, and Madhavi Farms. Some major aquaponic input providers are Pentair Aquatic Eco-System Inc. (PAES), Nelson & Pade Aquaponics, Practical Aquaponics, Aquaponics USA, and The Aquaponic Source. As the market is still expanding, emerging players are strategizing product launches and capacity expansions to secure a substantial share in the market studied.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Growing System

- 5.1.1 Media Filled Beds

- 5.1.1.1 Constant Flow

- 5.1.1.2 Ebb and Flow (Flood and Drain)

- 5.1.2 Nutrient Film Technique (NFT)

- 5.1.3 Raft or Deep Water Culture (DWC)

- 5.1.1 Media Filled Beds

- 5.2 Facility Type

- 5.2.1 Poly or Glass Greenhouses

- 5.2.2 Indoor Vertical Farms

- 5.2.3 Other Facility Types

- 5.3 Fish Type

- 5.3.1 Tilapia

- 5.3.2 Catfish

- 5.3.3 Carp

- 5.3.4 Trout

- 5.3.5 Ornamental Fish

- 5.3.6 Other Fish Types

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Malaysia

- 5.4.3.4 Indonesia

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.1.1 Aquaponics Input Providers

- 6.1.2 Aquaponic Farms

- 6.2 Market Share Analysis

- 6.2.1 Aquaponics Input Providers

- 6.2.2 Aquaponic Farms

- 6.3 Company Profiles - Aquaponics Input Providers

- 6.3.1 Pentair Aquatic Eco-System Inc. (PAES)

- 6.3.2 Nelson & Pade Aquaponics

- 6.3.3 Practical Aquaponics

- 6.3.4 Aquaponics USA

- 6.3.5 The Aquaponic Source

- 6.4 Company Profile - Aquaponic Farms

- 6.4.1 Superior Fresh

- 6.4.2 Ouroboros Farms

- 6.4.3 Garden City Aquaponics Inc.

- 6.4.4 BIGH

- 6.4.5 Deep Water Farms

- 6.4.6 Madhavi Farms

- 6.4.7 ECF Farm Berlin