|

市场调查报告书

商品编码

1439814

工业大麻 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Industrial Hemp - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

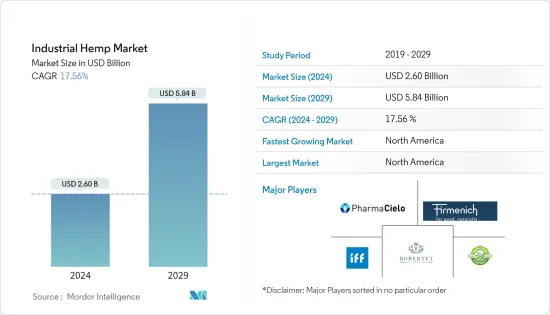

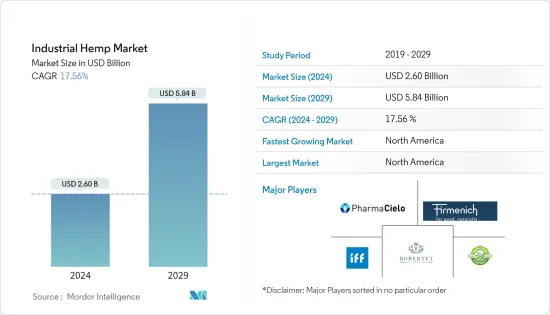

2024年工业大麻市场规模预计为26.0亿美元,预计到2029年将达到58.4亿美元,在预测期内(2024-2029年)CAGR为17.56%。

2020 年,市场受到了 COVID-19 的负面影响。製造和建筑活动因封锁而停止。 COVID-19的爆发也为建筑业带来了一些短期和长期的影响。据美国总承包商协会 (AGC) 称,2020 年前几个月,工作出现中断或项目被取消,因此对办公室、娱乐和体育设施等“非必要”项目的需求减少。2021 年,所研究市场的需求已经恢復,预计未来几年将大幅成长。

主要亮点

- 短期内,推动所研究市场的主要因素是医疗保健领域对工业大麻产品的不同应用和高功能应用的巨大需求。

- 另一方面,与大麻相关的严格法规阻碍了市场的成长。

- 大麻的环保性质、低碳足迹、广泛的研发活动以及最近与大麻相关的法规,预计将为市场的成长提供利润丰厚的机会。

- 北美地区预计将以全球最快的速度成长,其中美国和加拿大等国家的消费量最大。

工业大麻市场趋势

食品和饮料领域的需求不断增加

- 工业大麻是从大麻品种中获得的,该菌株是由于大麻基产品的多种用途而专门种植的。

- 大麻籽用于烘焙或可用于製作大麻奶等饮料。大麻种子也可以生吃,并且蛋白质含量高,因此它们被用于动物饲料和鸟类种子。

- 大麻种子经过压榨可生产富含不饱和脂肪酸的大麻油。大麻叶可以直接当作沙拉食用,也可以压榨製成果汁。

- 大麻籽富含两种必需脂肪酸:亚麻油酸 (omega-6) 和亚麻油酸 (omega-3)。它们也是维生素 E、维生素 B1、维生素 B2、维生素 B6 和维生素 D 的丰富来源,因此可用于即饮饮料、能量饮料、零食和谷物、汤、酱汁和麵包店产品。

- 人类不能产生必需脂肪酸。添加大麻籽可能对他们有用,因为它们是亚麻油酸(omega-6)和亚麻油酸(omega-3)的重要来源。它们的饱和脂肪含量较低,且不含反式脂肪。

- 此外,根据Statista的数据,全球食品和饮料产业预计2022年至2026年CAGR为9.11%,预计到2026年底价值将达到10.5亿美元。

- 光是巴西餐饮服务业2021年就创造了822亿美元的收入,比2020年成长26%。根据美国农业部的数据,该产业预计成长率为18%。它是世界上最大的企业之一,拥有 45,000 家公司,其中 86% 是中小企业。

- 根据巴西食品加工商协会(ABIA)统计,2021年该国食品加工行业收入为1710亿美元,比2020年增长16.9%。该国不断增长的食品产量可能会增加对工业大麻的需求。国家。

- 由于上述所有因素,食品和饮料领域对工业大麻的需求预计在预测期内将快速成长。

北美地区主导市场

- 预计北美地区在预测期内将以最快的速度成长。在美国和加拿大等国家,由于老年人口的不断增加和消费者意识的提高,对工业大麻的需求不断增加。

- 人们对皮肤病的日益关注和慢性病的增加预计将增加对工业大麻的需求。

- 2018 年农业法案通过后,大麻种植及其产品在各种最终用户产业中的应用出现了许多新的前景。然而,每个州仍需通过使大麻合法化的法律,并向美国农业部提交一份计划,概述指导大麻生产、测试、许可和运输的州法规和法律。

- 美国农业部在 2 月的调查报告中透露,2021 年美国农民生产了价值 8.24 亿美元的工业大麻。上一年,用于种子种植的大麻价值总计 4,150 万美元,用于纤维的大麻价值为 4,140 万美元,用于谷物的大麻价值为 599 万美元。

- 根据 2021 年大麻种植面积和产量调查收集的价值信息,露天种植的大麻的最大用途是花卉,价值 6.23 亿美元。保护下种植的大麻的最大用途是花卉,达 6,440 万美元。

- 根据美国农业部统计,美国露天种植的工业大麻种植面积总计54,152英亩。美国大麻露天生产价值总计 7.12 亿美元。美国受保护种植的大麻产值总计 1.12 亿美元。

- 美国的製药业是全球最大的,占全球药品收入的40%以上。儘管最近出现了低迷,但未来几年可能会上升。美国人口的成长和老化正在推动这种扩张。此外,美国有15%的人口年龄超过65岁,预计这一比例未来还会扩大。整体而言,医药产业不断增长的需求很可能带动工业大麻的市场需求。

- 此外,墨西哥的纺织业也受惠于北美自由贸易协定(NAFTA),该协定允许美国、加拿大和墨西哥之间进行自由贸易。在美国-墨西哥-加拿大协议(USMCA)(也称为 NAFTA 2.0)签署后,墨西哥处于最佳位置,可以进一步占领中国的製造业市场份额,特别是在纺织业。

- 上述因素加上政府的支持,导致预测期内工业大麻的需求增加。

工业大麻产业概况

全球工业大麻市场本质上是分散的。市场上的一些主要参与者包括 International Flavors & Fragrances Inc.、Firmenich SA、PharmaCielo Ltd、Manitoba Harvest (Tilray) 和 Robertet。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 工业大麻产品在不同应用领域的庞大需求

- 医疗保健领域的高功能应用

- 限制

- 与大麻相关的严格法规

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场区隔(市场价值规模)

- 类型

- 大麻籽(生吃、熟吃或烤吃)

- 大麻籽油

- 大麻二酚 (CBD) 大麻油

- 大麻蛋白(补充)

- 大麻萃取物(不含 CBD)

- 应用

- 食品和饮料

- 保健品

- 其他应用

- 地理

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 智利

- 南美洲其他地区

- 世界其他地区

- 北美洲

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)**/排名分析

- 领先企业采取的策略

- 公司简介

- Ilesol Pharmaceuticals doo

- Bulk Hemp Warehouse LLC

- International Flavors & Fragrances Inc

- GenCanna

- Robertet

- Firmenich SA

- Charlotte's Web Holdings Inc.

- True Terpenes

- Puricon

- PharmaCielo Ltd

- Silver Lion Farms

- Bomar Agra Estates LLC.

- Colorado Breeders Depot

- 33 Supply LLC

- Green Passion (Canway Schweiz GmbH)

- Victory Hemp Foods

- Hemp Oil Canada

- Manitoba Harvest (Tilray)

- HempFlax Group BV

- Entoura

- Bedrocan

- Signature Products

- Nutiva hemp Oil

- Temp Co. Canada

- Hemp Acres USA

第 7 章:市场机会与未来趋势

- 大麻的环保特性和低碳足迹

- 广泛的研发活动

- 与大麻相关的最新法规

The Industrial Hemp Market size is estimated at USD 2.60 billion in 2024, and is expected to reach USD 5.84 billion by 2029, growing at a CAGR of 17.56% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Manufacturing and construction activities have come to a halt as a result of the lockdowns. The outbreak of COVID-19 also brought several short-term and long-term consequences to the construction industry. According to the Associated General Contractors of America (AGC), there were disruptions to work or canceled projects and hence less demand for 'non-essential' projects, like offices, entertainment, and sports facilities, in the initial months of 2020. Furthermore, in 2021, the demand for the market studied has recovered and is expected to grow at a significant rate in the coming years.

Key Highlights

- Over the short term, major factors driving the market studied are the huge demand for industrial hemp products across diverse applications and highly functional applications in the healthcare sector.

- On the flip side, stringent regulations associated with hemp are hindering the growth of the market.

- The eco-friendly nature of hemp, with a low carbon footprint, extensive Research and Development activities, and recent regulations related to hemp, is expected to offer lucrative opportunities for the growth of the market.

- North America region is expected to grow at the fastest rate across the world, with the largest consumption from countries such as the United States and Canada.

Industrial Hemp Market Trends

Increasing Demand from the Food and Beverage Segment

- Industrial hemp is obtained from the strain of Cannabis sativa, which is grown specifically owing to the various uses of hemp-based products.

- Hemp seeds are used in baking or can be used to make beverages like hemp milk. Hemp seeds can also be eaten raw and are high in protein content, owing to which they are used in animal feed and bird seeds.

- Hemp seeds are pressed to produce hemp oil which is high in unsaturated fatty acids. The leaves of hemp can be consumed directly as salads or can be pressed to make juice.

- Hemp seeds are rich in two essential fatty acids, linoleic (omega-6) and linolenic (omega-3). They are also a rich source of vitamin E, vitamin B1, vitamin B2, vitamin B6, and vitamin D, owing to which they are used in ready-to-drink beverages, energy drinks, snacks and cereals, soups, sauces, and bakery products.

- Humans cannot produce essential fatty acids. The addition of hemp seeds could be useful to them, as they are a great source of linoleic (omega-6) and linolenic (omega-3). They are low in saturated fats and contain no trans fat.

- In addition, according to Statista, the global food and drink industry is expected to register a CAGR of 9.11% from 2022 to 2026 and is expected to be valued at USD 1.05 billion by the end of 2026.

- The Brazilian foodservice industry alone generated a revenue of USD 82.2 billion in 2021, a growth of 26% compared to 2020. According to the US Department of Agriculture, the industry is expected to register a growth rate of 18%. It is one of the largest in the world, with 45,000 companies, of which 86% are SMEs.

- According to the Brazilian Food Processors' Association (ABIA), the country's food processing sector registered revenues of USD 171 billion in 2021, an increase of 16.9 percent compared to 2020. The growing food production in the country may boost the demand for industrial hemp in the country.

- Owing to all the above-mentioned factors, the demand for industrial hemp from the food and beverage segment is expected to grow rapidly over the forecast period.

North American Region to Dominate the Market

- The North American region is expected to grow at the fastest rate over the forecast period. In countries like the United States and Canada, due to the growing geriatric population and increased consumer awareness, the demand for industrial hemp has been increasing.

- The growing concerns about skin diseases and an increasing number of chronic diseases are expected to boost the demand for industrial hemp.

- After the passing of the Farm Bill 2018, many new prospects have emerged for the cultivation of hemp and its products used across a variety of end-user industries. However, it is still up to each state to pass laws legalizing the crop and submit a plan to the USDA outlining the state regulations and laws guiding hemp production, testing, licensing, and transport.

- Farmers in the United States produced USD 824 million worth of industrial hemp in 2021, the US Department of Agriculture revealed in a survey-based report in February. The value of hemp grown for seed totaled USD 41.5 million, while hemp for fiber was valued at USD 41.4 million and hemp for grain at USD 5.99 million the previous year.

- According to the 2021 Hemp Acreage and Production Survey collected information by value, the top utilization for hemp grown in the open was floral at USD 623 million. The top utilization for hemp grown under protection was floral at USD 64.4 million.

- According to the United States Department of Agriculture, the planted area for industrial hemp grown in the open for all utilizations in the United States totaled 54,152 acres. The value of US hemp production in the open totaled USD 712 million. The value of production for hemp that was grown under protection in the United States totaled USD 112 million.

- The pharmaceutical industry in the United States is the largest in the world, accounting for more than 40% of worldwide pharmaceutical revenues. Despite a recent downturn, it is likely to rise in the following years. The expanding and aging population in the United States is fueling this expansion. Moreover, 15% of the people in the United States are over 65 years, and this percentage is predicted to expand in the future. Overall, the growing demand for the pharmaceutical industry is likely to drive the market demand for industrial hemp.

- In addition, the textile industry in Mexico is benefitted from the NAFTA agreement, which allows free trade between the United States, Canada, and Mexico. In the wake of the United States-Mexico-Canada Agreement (USMCA), also referred to as NAFTA 2.0, Mexico is optimally positioned to carve even further into China's manufacturing share of the market, particularly within the textile industry.

- The aforementioned factors, coupled with government support, are contributing to the increasing demand for industrial hemp during the forecast period.

Industrial Hemp Industry Overview

The global industrial hemp market is fragmented in nature. Some major players in the market include International Flavors & Fragrances Inc., Firmenich SA, PharmaCielo Ltd, Manitoba Harvest (Tilray), and Robertet.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Huge Demand of Industrial Hemp Products Across Diverse Applications

- 4.1.2 High Functional Application in Health Care Sector

- 4.2 Restraints

- 4.2.1 Stringent Regulations Associated with Hemp

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Hemp Seed (Consumed Raw, Cooked or Roasted)

- 5.1.2 Hemp Seed Oil

- 5.1.3 Cannabidiol (CBD) Hemp Oil

- 5.1.4 Hemp Protein (Supplement)

- 5.1.5 Hemp Extract (Without CBD)

- 5.2 Application

- 5.2.1 Food and Beverages

- 5.2.2 Healthcare Supplements

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 South America

- 5.3.3.1 Brazil

- 5.3.3.2 Chile

- 5.3.3.3 Rest of South America

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ilesol Pharmaceuticals doo

- 6.4.2 Bulk Hemp Warehouse LLC

- 6.4.3 International Flavors & Fragrances Inc

- 6.4.4 GenCanna

- 6.4.5 Robertet

- 6.4.6 Firmenich SA

- 6.4.7 Charlotte's Web Holdings Inc.

- 6.4.8 True Terpenes

- 6.4.9 Puricon

- 6.4.10 PharmaCielo Ltd

- 6.4.11 Silver Lion Farms

- 6.4.12 Bomar Agra Estates LLC.

- 6.4.13 Colorado Breeders Depot

- 6.4.14 33 Supply LLC

- 6.4.15 Green Passion (Canway Schweiz GmbH)

- 6.4.16 Victory Hemp Foods

- 6.4.17 Hemp Oil Canada

- 6.4.18 Manitoba Harvest (Tilray)

- 6.4.19 HempFlax Group BV

- 6.4.20 Entoura

- 6.4.21 Bedrocan

- 6.4.22 Signature Products

- 6.4.23 Nutiva hemp Oil

- 6.4.24 Temp Co. Canada

- 6.4.25 Hemp Acres USA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Eco-friendly Nature of Hemp with Low Carbon Footprint

- 7.2 Extensive R&D activities

- 7.3 Recent Regulations related to Hemp