|

市场调查报告书

商品编码

1439838

夜视设备 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Night Vision Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

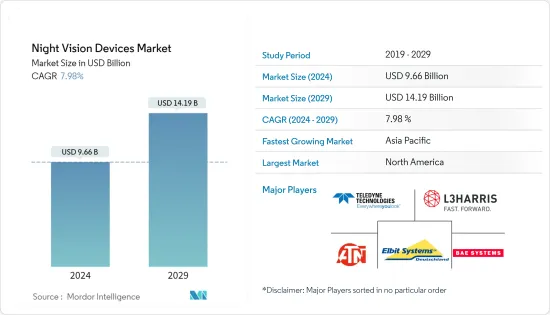

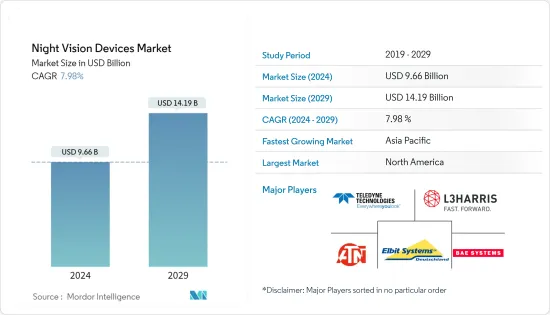

2024年夜视设备市场规模预计为96.6亿美元,预计到2029年将达到141.9亿美元,在预测期内(2024-2029年)CAGR为7.98%。

夜视仪为士兵在战场弱光环境下提供彩色影像。近年来,这些设备也受到野火研究人员的欢迎,预计将为此类设备带来更多需求。头戴式夜视仪等技术和应用的可行性,加上合理的成本,推动了需求。这些设备可在夜间提供超过 150 至 200 码的清晰视野。

主要亮点

- 夜视设备更主要应用于军事和国防工业。多年来,世界各国一直在大幅增加军事和国防预算,预计将推动夜视设备市场的发展。根据 SIPRI 的数据,美国在国防活动上的支出超过 7,780 亿美元,其次是中国,2020 年为 2,520 亿美元。

- 此外,执法机构越来越多地采用夜视设备进行训练活动,以确保军队做好任务准备状态。 2020 年 3 月,印度国防公司 MKU 宣布推出第三代适用于警察部队的夜视设备系列。这些设备采用非冷冻微测辐射热计技术开发,预计将在 2020 年 5 月举行的国际警察博览会上展示。

- 随着热成像和红外线技术的快速发展,光学元件製造商不断增强其产品,以在夜视设备等高需求领域竞争。随着技术的快速进步,穿戴式夜视设备,例如将热成像融入其设计的增强型夜视镜(ENVG),不断增加。头盔式护目镜、摄影机和其他热感设备一直处于市场的前沿。儘管如此,随着市场的发展,夜视镜预计将成为值得关注的应用。

- BAE Systems PLC 和 L3Harris Communication 等公司是少数与美国陆军签订合约的公司,它们正在开发夜视设备以增加收入。然而,由于这些设备的维护成本高昂,在一定程度上限制了市场的成长。

- 为了扩大不同地区的业务并占领广泛的市场份额,公司不断收购或与其他公司合作。例如,2022年1月,总部位于安娜堡的光学技术公司EOTECH以1亿美元从加州圣克拉拉收购了Intevac Inc.的光子部门。

- COVID-19 情境对市场成长产生了正面影响。随着大多数企业转向远端工作模式,对网路摄影机的需求大幅增加。员工发现网路摄影机是视讯会议中的重要配件,可以从低品质的笔记型电脑嵌入式摄影机进行升级。

夜视设备市场趋势

监控应用将占据重要份额

- 视讯监控系统的主要功能是撷取、处理、管理、储存和检视系统撷取的录影和影像。视讯监控产业的技术进步促进了专为在低光照区域工作而设计的夜视摄影机的发展。据世界卫生组织称,全球每年约有 125 万人死于道路交通事故。在道路网路中部署视讯监控可以帮助官员更好地管理交通并确定道路事故的原因。

- 随着COVID-19 在全球范围内持续社区传播,2020 年3 月,南迭戈丘拉维斯塔警察局宣布投资超过11,000 美元购买两架配备夜视摄影机的无人机,以降低这些地区警员面临的风险。该部门表示,其目的是在疫情爆发期间用这些无人机监视街道上的人们。

- 随着犯罪率的不断上升,视讯监控预计将在预防犯罪方面发挥重要作用,这主要是由于被发现的威胁。例如,根据伦敦警察厅的数据,2018-2019年伦敦警方记录的暴力犯罪案件约为21.57万起,比2017-2018年登记的数量增加了约1.38万起。

- 根据北卡罗来纳大学夏洛特刑事司法中心的数据,超过60% 的被定罪的窃贼同意,他们在进入住宅物业之前会先寻找安全摄像头,而40% 的窃贼则同意,他们会寻找另一个更容易的目标,以防监视器出现。展示。过去几年,智慧家庭的出现提高了视讯监控系统在住宅领域的重要性。在该领域实施的监控系统具有多种应用,例如监控和存取控制。这些系统还配备了运动侦测和夜视等功能。

北美预计将占据最大的市场份额

- 预计北美将在美国推动的夜视设备市场中占据最大的市场份额,美国是其军事和国防活动支出最高的国家,并且拥有市场上的主要供应商,包括 L3Harris Communication、Flir Systems Inc .、美国科技网路公司和BAE Systems PLC 等。

- 该地区各国政府正探索利用夜视设备等改良技术进行夜间消防活动,以提升夜间空中消防能力。夜视技术使飞机在夜间安全运行。 2019 年 7 月,橘郡消防局与 Coulson Aviation 合作,投资超过 400 万美元引进消防直升机,以回应加州的呼叫。这些直升机为飞行员配备了夜视装置,并具有 1,000 加仑的水容量。

- 随着技术的进步,夜视设备正在与机器学习和扩增实境技术结合,进一步增强设备的夜视能力。例如,2022 年 4 月,加州大学欧文分校安德鲁布朗 (Andrew Browne) 领导的团队最近进行了一项研究,使用可以检测可见光和部分红外光谱的相机拍摄了 140 张不同面孔的照片。

- 此外,美国陆军最近开始使用增强型双眼夜视镜(ENVG-B)训练其部队。这些护目镜将战场上的影像和资料直接提供给士兵的眼睛。该系统包括高解析度显示器、嵌入式士兵无线个人网路快速目标撷取系统以及增强战场上陆军人员夜视能力的扩增实境演算法。

- 市场上的公司也在开发航空等应用领域的新技术。 2022 年 3 月,加拿大科技公司 Baanto International 推出了专为国防军设计的 27 吋 ShadowSense 触控萤幕技术。此触控萤幕满足夜视成像系统 (NVIS) 的要求,无论环境光线水平如何,都可以在任务中部署。

夜视设备产业概况

市场整合,少数大公司主导市场。这些公司不断投资与政府建立战略合作伙伴关係和产品开发,以获得更多市场份额。严格的政府监管,加上高昂的製造成本,正在加剧这些参与者之间的竞争。总体而言,竞争的激烈程度仍然很高,这主要是由于所研究的市场中大型企业的强大存在所推动的。

- 2021 年 12 月 - 泰雷兹推出了 XTRAIM,这是一种新型武器瞄准具,提供日间/夜间伪装功能,而以前只能透过使用多个单独的设备才能实现。它相容于所有肩扛式突击步枪(HK416)和轻机枪(Minimi),为使用者提供无与伦比的精确夜间射击能力。

- 2021 年 5 月 - Ulefone 推出了新的夜视摄影机。这款高度便携的设备可作为智慧型手机配件,可用作可穿戴式随身相机,可快速连接到您的夹克、腰带、后袋等处。夜视相机采用Sony STARVIS IMX307 极光敏感 CMOS影像感测器,非常适合低光摄影、夜间摄影和摄影。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

- 研究框架

- 二次研究

- 初步研究

- 数据三角测量与洞察生成

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

- 评估 COVID-19 对市场的影响

第 5 章:市场动态

- 市场驱动因素

- 增加军费

- 执法部门越来越多地采用

- 市场限制

- 与维护相关的高成本

第 6 章:市场细分

- 按类型

- 相机

- 风镜

- 单筒望远镜与双筒望远镜

- 步枪瞄准镜

- 其他类型

- 依技术

- 热成像

- 影像增强器

- 红外线照明

- 其他技术

- 按应用

- 军事与国防

- 野生动物发现与保护

- 监视

- 导航

- 其他应用

- 按地理

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第 7 章:竞争格局

- 公司简介

- Teledyne Flir LLC

- L3harris Technologies Inc.

- American Technologies Network Corp.

- Elbit Systems Deutschland

- BAE Systems PLC

- Thales Group SA

- Raytheon Technologies Corporation

- Bushnell Inc. (vista Outdoor)

- Firefield

- Satir

- Luna Optics Inc.

- Opgaloptronic Industries Ltd

- Intevac Inc.

- Photonis Technologies Sas

- Panasonic Corporation

- Tak Technologies Private Limited

- Tactical Night Vision Company

- Sharp Corporation

- Nivisys LLC

- Excelitas Technologies Corp.

第 8 章:投资分析

第 9 章:市场机会与未来趋势

The Night Vision Devices Market size is estimated at USD 9.66 billion in 2024, and is expected to reach USD 14.19 billion by 2029, growing at a CAGR of 7.98% during the forecast period (2024-2029).

The night vision devices provide the soldiers with color images in the low light environment in the field. These devices have also gained popularity among wildfire researchers in recent years, which is estimated to create more demand for such devices. The technical and application feasibility, such as head-mounted night vision, coupled with reasonable cost, has propelled the demand. These devices enable clear visibility of over 150 to 200 yards at night.

Key Highlights

- Night vision devices are more dominantly applied in the military and defense industry. Over the years, countries around the world have been increasing their military and defense budgets significantly, which is estimated to drive the market for night vision devices. According to SIPRI, the United States spent over USD 778 billion on its defense activities, followed by China, with USD 252 billion in 2020.

- Additionally, night vision devices are increasingly being adopted by law enforcement agencies for conducting training activities to ensure the mission-ready status of military troops. In March 2020, MKU, an Indian defense company, announced to release of its range of gen-3 night vision devices for police forces. These devices are developed on uncooled microbolometer technology and are expected to showcase in the International Police Expo, to be held in May 2020.

- With the rapid advancement of thermal imaging and infrared technologies, optics manufacturers continue to enhance their products to compete in high-demand areas, such as night vision devices. Wearable night vision equipment, such as enhanced night vision goggles (ENVG), which incorporate thermal imaging into their design, continue to increase as technology advances rapidly. Helmet-mounted goggles, cameras, and other thermal devices have been at the forefront of the market. Still, night vision goggles are expected to be the application to watch as the market develops.

- Companies like BAE Systems PLC and L3Harris Communication, among others, are a few companies having a contract from the US Army and are developing night vision devices to gain increased revenue. However, as these devices are subjected to costly maintenance, it is restricting the market growth to an extent.

- To expand the business in different regions and capture a wide market share, companies are constantly acquiring or partnering with other firms. For instance, in January 2022, EOTECH, an optical technology company based in Ann Arbor, purchased Intevac Inc.'s photonics division from Santa Clara, Calif., for USD 100 million.

- The COVID-19 scenario has positively impacted the market growth. As most businesses are switching to remote working models, the demand for webcams has gone up significantly. Employees are finding webcams as a crucial accessory in video conferencing to upgrade from the low quality of laptop-embedded cameras.

Night Vision Devices Market Trends

Surveillance Applications to Hold Significant Share

- The primary functions of the video surveillance system are to capture, process, manage, store, and view recordings and images captured by the system. Technological advancements in the video surveillance industry have led to the development of night vision cameras that are designed to work in low-lit areas. According to WHO, around 1.25 million people die every year in road accidents globally. The deployment of video surveillance in road networks can help officials manage traffic in a better way and identify the causes of road accidents.

- Amid the ongoing community spread of COVID-19 across the world, in March 2020, the South Diego Chula Vista Police Department announced an investment of over USD 11,000 in acquiring two drones equipped with night vision cameras to mitigate the risk of the officers in these areas. The department has mentioned that it is aiming at watching over people living on the streets with these drones amid the outbreak.

- With the increasing rate of crimes, video surveillance is expected to play a significant role in preventing crime, primarily due to the threat of being detected. For instance, according to the Metropolitan Police, there were around 215.7 thousand violent crime offenses recorded by the police in London in 2018-2019, an increase of approximately 13.8 thousand as compared to the value registered in 2017-2018.

- As per the UNC Charlotte of Criminal Justice, more than 60% of convicted burglars agreed that they look for the presence of security cameras before entering a residential property, while 40% of burglars agreed that they look for another easier target in case surveillance cameras are present. The emergence of smart homes has increased the prominence of video surveillance systems in the residential segment in the past few years. The surveillance systems implemented in this sector have varied applications, such as monitoring and access control. These systems are also equipped with features such as motion detection and night vision.

North America is Expected to Hold Largest Market Share

- North America is expected to hold the largest market share in the night vision devices market driven by the United States, with the highest spending nation on its military and defense activities and by housing the key vendors in the market, including L3Harris Communication, Flir Systems Inc., American Technology Network Corp., and BAE Systems PLC, among others.

- The governments in the region are exploring nighttime firefighting activities with improved technologies, such as night vision devices, enhancing their nighttime aerial firefighting capabilities. Night vision technology enables the safe operation of aircraft at night. In July 2019, the Orange County Fire Authority teamed up with Coulson Aviation by investing over USD 4 million to introduce firefighting helicopters to respond to calls in California. These helicopters are equipped with night vision devices for pilots and have a capacity of 1,000 gallons of water.

- With the advancement in technologies, night vision devices are being integrated with machine learning and Augmented reality technologies further to enhance the night vision capabilities of the devices. For instance, in April 2022, a recent study at the University of California, Irvine, by a team led by Andrew Browne captured 140 pictures of different faces using a camera that can detect visible light and part of the infrared spectrum.

- Further, the United States Army has recently started training its forces using Enhanced Night Vision Goggle-Binocular (ENVG-B). These goggles provide imagery and data from the battlefield directly to the soldier's eye. The system includes a high-resolution display, an embedded soldier wireless personal network rapid target acquisition system, and Augmented reality algorithms that enhance the night vision capabilities of army personnel on the battlefield.

- Companies in the market are also developing new technologies in applications such as aviation. In March 2022, Canada-based technology firm Baanto International launched a 27-inch ShadowSense touch screen tech designed for defense forces. This touchscreen fulfills the Night Vision Imaging Systems (NVIS) requirements, which can be deployed in mission regardless of the level of ambient light.

Night Vision Devices Industry Overview

The market is consolidated, with the presence of a few major companies dominating the market. These companies are continuously investing in making strategic partnerships with governments and product developments to gain more market share. The stringent government regulation, coupled with high manufacturing costs, is increasing the competition among these players. Overall, the intensity of competitive rivalry remains high, mainly driven by the strong presence of the large players involved in the market studied.

- December 2021 - Thales launched XTRAIM, a new weapon sight offering day/night de camouflage capabilities that previously could only be achieved by using several separate pieces of equipment. It is compatible with all shoulder-fired assault rifles (HK416) and light machine guns (Minimi), providing users with an unparalleled precision night-firing capability.

- May 2021 - Ulefone has introduced a new Night Vision Camera. The highly portable device, which acts as a smartphone accessory, may be used as a wearable body camera that can be quickly attached to your jacket, belt, back pocket, etc. The Night vision camera features a Sony STARVIS IMX307 extremely light-sensitive CMOS image sensor, ideal for low-light photography, night photography, and videography.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Military Expenditure

- 5.1.2 Increasing Adoption from Law Enforcement

- 5.2 Market Restraints

- 5.2.1 High Costs Associated with Maintenance

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Camera

- 6.1.2 Goggles

- 6.1.3 Monoculars and Binoculars

- 6.1.4 Rifle Scope

- 6.1.5 Other Types

- 6.2 By Technology

- 6.2.1 Thermal Imaging

- 6.2.2 Image Intensifier

- 6.2.3 Infrared Illumination

- 6.2.4 Other Technologies

- 6.3 By Application

- 6.3.1 Military and Defense

- 6.3.2 Wildlife Spotting and Conservation

- 6.3.3 Surveillance

- 6.3.4 Navigation

- 6.3.5 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Laitn America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Teledyne Flir LLC

- 7.1.2 L3harris Technologies Inc.

- 7.1.3 American Technologies Network Corp.

- 7.1.4 Elbit Systems Deutschland

- 7.1.5 BAE Systems PLC

- 7.1.6 Thales Group SA

- 7.1.7 Raytheon Technologies Corporation

- 7.1.8 Bushnell Inc. (vista Outdoor)

- 7.1.9 Firefield

- 7.1.10 Satir

- 7.1.11 Luna Optics Inc.

- 7.1.12 Opgaloptronic Industries Ltd

- 7.1.13 Intevac Inc.

- 7.1.14 Photonis Technologies Sas

- 7.1.15 Panasonic Corporation

- 7.1.16 Tak Technologies Private Limited

- 7.1.17 Tactical Night Vision Company

- 7.1.18 Sharp Corporation

- 7.1.19 Nivisys LLC

- 7.1.20 Excelitas Technologies Corp.