|

市场调查报告书

商品编码

1439840

包装泡棉:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Packaging Foams - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

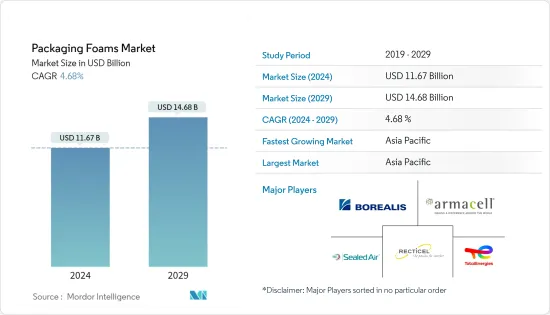

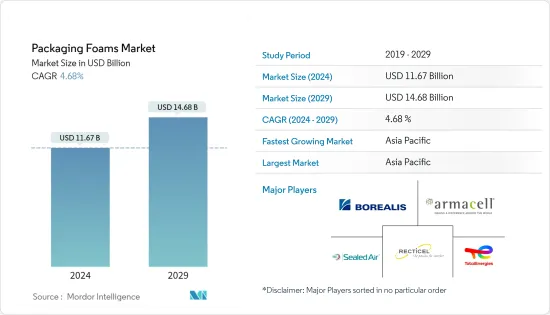

包装泡棉市场规模预估2024年为116.7亿美元,预估至2029年将达146.8亿美元,在预测期间(2024-2029年)成长4.68%,复合年增长率成长。

新型冠状病毒感染疾病(COVID-19)对2020年全球经济产生了负面影响。它扰乱了供应链并影响了包装行业等多个工业部门。封锁和关闭导致多个行业的零售关闭、国际供应链和购买行为发生重大变化。然而,2021年下半年限制解除后,网路购物和运输活动增加,为消费者提供了更多在线订购杂货和其他食品的机会,对便利性的需求增加,行业出现復苏迹象。 。

主要亮点

- 短期来看,工业包装产业需求的成长是推动所研究市场成长的关键因素。

- 然而,模塑纸浆作为环保替代品的可用性是预计在预测期内抑制目标产业成长的关键因素。

- 儘管如此,对环保包装泡沫的日益增长的需求可能很快就会为全球市场创造利润丰厚的成长机会。

- 预计亚太地区将主导全球包装泡沫市场,并且由于中国和印度等国家的市场应用不断增加,预计亚太地区也将成为预测期内成长最快的市场。

包装泡棉市场趋势

工业包装产业的需求不断增加

- 包装泡棉通常用作盒子的缓衝材料,这种包装解决方案以其多功能性和可自订性而闻名。

- 泡沫用于各种包装应用和行业,包括工业产品、消费性电器产品、汽车以及最佳保护和耐用性至关重要的其他应用。

- 汽车零件处理起来比较困难,有些零件在储存和运输过程中需要特别小心。这是由于某些零件的复杂性,特别是内装和引擎零件。

- 在研究期间,全球汽车产业录得显着成长。根据OICA统计,2021年汽车总产量为80,145,988辆,较2020年成长3%。亚太地区在全球汽车市场的产量份额最高,2021年产量为46,732,785辆。

- 根据美国人口普查局的数据,美国零售电子商务销售额达到 2,659 亿美元,较 2022 年第二季成长 3.0% (±0.5%)。

- 截至年终年底,欧洲电子商务产业价值为 77,180 亿欧元(79,023.2 亿美元),较去年增长 13%。该地区的主要贡献者是北欧,占电子商务总量的86%。

- 此外,军用发泡包装比商业包装需要更注重细节。大多数军用货物都具有敏感性,需要仔细包装和搬运。军事装备在世界各地频繁移动,因此必须使用高品质的防御性泡沫包装以确保安全运输。

- 因此,交通运输和电子商务行业的成长也带动了绿色包装意识和使用的不断提高,从而导致包装行业的快速增长。因此,预计这些趋势将在未来几年对包装泡棉市场产生潜在的正面影响。

亚太地区主导市场

- 亚太地区主导了全球包装泡棉市场,主要是由于物流、工业和汽车製造对包装的需求不断增加,以及其他製造业务的成长。

- 中国是对全球尤其是亚太地区包装泡棉市场做出重大贡献的国家之一。不断增长的食品和饮料、汽车、电子、个人护理和製药行业预计将推动市场成长。

- 中国拥有全世界最大的食品工业。根据中国国家统计局的数据,2021年,中国食品工业实现利润总额约6,187亿元人民币(863.3亿美元)。食品製造业贡献了约1,654亿元人民币(230.8亿美元)的利润总额。

- 根据日本经济产业省统计,2021年日本电子产业总产值约10.95兆日圆(800亿美元),为与前一年同期比较产值的110%。此外,2021年电子产品出口总额达到10.82兆日圆(790亿美元),光是2021年12月就达到1.4兆日圆(76亿美元),预计该地区对包装泡棉的需求庞大。

- 韩国电子商务市场每年规模超过920亿美元。这一建设和投资浪潮吸引了 GIC、APG、Angelo Gordon、Warburg Pincus 和 Blackstone 等国际投资者的极大兴趣和资金。韩国也是亚太地区第四大第三方物流(3PL)市场,每年成长近8%,快于日本、澳洲和新加坡。

- 因此,由于亚太地区包装产业的快速成长,预计在预测期内对包装泡棉的需求也将快速成长。

包装泡棉产业概况

包装泡棉市场本质上是细分的。主要企业包括(排名不分先后)Borealis AG、Sealed AIR、Armacell、TotalEnergies 和 Recticel NV/SA。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 包装产业需求不断成长

- 抑制因素

- 纸浆模塑作为环保替代品

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 材料

- 聚苯乙烯

- 聚氨酯

- 聚烯

- 其他材料

- 结构

- 灵活的

- 死板的

- 目的

- 食品包装

- 工业包装

- 运输

- 电气和电子

- 个人护理

- 药品

- 其他工业包装

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- Armacell

- Atlas Roofing Corporation

- Borealis AG

- Drew Foam

- Foamcraft Inc.

- TotalEnergies

- Huntington Solutions

- Recticel

- Sealed Air

- Williams Foam

- Zotefoams PLC

第七章市场机会与未来趋势

- 对环保包装泡棉的需求日益增长

The Packaging Foams Market size is estimated at USD 11.67 billion in 2024, and is expected to reach USD 14.68 billion by 2029, growing at a CAGR of 4.68% during the forecast period (2024-2029).

COVID-19 had a negative impact on the global economy in 2020. It affected several industrial sectors such as the packaging sector by hindering their supply chain. The lockdown and shutdown have changed the behavior of retail business shuttered, international supply chains, and purchase significantly across various sectors. However, the industry witnessed a recovery, with the growing demand for convenience as consumers are increasingly ordering groceries and other food products online owing to increased online shopping and transportation activities after the lifting of restrictions in the second half of 2021.

Key Highlights

- Over the short term, the rising demand from the industrial packaging industries is a major factor driving the growth of the market studied.

- However, the availability of molded pulp as a green alternative is a key factor anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the growing quest for eco-friendly packaging foam is likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific is expected to dominate the global packaging foams market, and it is also estimated to be the fastest-growing market over the forecast period due to the increasing market applications in countries such as China and India.

Packaging Foam Market Trends

Increasing Demand from the Industrial Packaging Sector

- Packaging foam is commonly used as a cushioning material for boxes, and this packaging solution is known for its versatility and ability to be customized.

- Foams are used in a wide variety of packaging applications and industries including industrial goods, consumer electronics, automotive, and other applications where optimum protection and durability are overriding considerations.

- Automotive spares are difficult to handle, and some parts necessitate extra caution during storage and transportation. This is due to the intricate nature of some parts, particularly those in the interior and engine.

- The global automotive industry registered huge growth in the studied period. According to OICA, the total number of vehicles produced in 2021 was 80,145,988 and witnessed a growth rate of 3% compared to 2020. The Asia-Pacific region holds the highest production share in the global automotive market with 46,732,785 units in 2021.

- According to the Census Bureau, United States retail e-commerce sales amounted to USD 265.9 billion, an increase of 3.0 percent (±0.5%) from the second quarter of 2022.

- The European e-commerce industry was valued at EUR 7718 billion (USD 7,902.32 billion) at the end of 2021, registering an increase of 13 % as compared to the situation last year. The major contribution in the region comes from Northern Europe, which accounts for 86% of the total e-commerce value.

- Moreover, Military foam packaging necessitates a higher level of attention to detail than commercial packaging. Because of the sensitive contents, a huge proportion of military cargo requires careful packing and handling. Military equipment is frequently moved around the world, which necessitates the use of high-quality defense foam packaging to ensure safe shipping.

- Thus, the growth in transportation and e-commerce industries has led to the exponential growth of the packaging sector, also taking support from the rising awareness and use of green packaging. Therefore, these trends are expected to have a potentially positive impact on the packaging foam market in the forecast years.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the global packaging foams market primarily due to the growing demand for packaging in logistics, the growing industrial and automotive manufacturing and other manufacturing operations.

- China is one of the major contributors to the packaging foams markets globally, especially in Asia-Pacific. The growing food and beverages, automotive, electronics, personal care, and pharmaceutical industry are expected to boost the growth of the market.

- China has one of the largest food industries in the world. As per the National Bureau of Statistics of China, in 2021, the food industry in China generated a total profit of about CNY 618.7 billion (USD 86.33 billion). The food manufacturing industry contributed approximately CNY 165.4 billion (USD 23.08 billion) to the total profits.

- As per METI (Japan), the total production value of the electronics industry in Japan is around JPY 10.95 trillion (USD 80 billion) in 2021, which is 110% of the production value compared to the last year. Furthermore, the total electronics exports in 2021 amount to JPY 10.82 trillion (USD 79 billion) with JPY 1.04 trillion (USD 7.6 billion) in December 2021 alone, thus providing huge demand for packaging foams in the region.

- The South Korean e-commerce market stands at over USD 92 billion per annum. A wave of building and investment has been drawing significant interest and capital from international investors, including GIC, APG, Angelo Gordon, Warburg Pincus, and Blackstone. South Korea is also the 4th-largest third-party logistics (3PL) market in Asia-Pacific and is growing at an annual rate of nearly 8%, faster than Japan, Australia, and Singapore.

- Hence, owing to the rapidly growing packaging industry in the Asia-Pacific region, the demand for packaging foams is also expected to increase rapidly over the forecast period.

Packaging Foam Industry Overview

The packaging foams market is partially fragmented in nature. The major companies include (not in any particular order) Borealis AG, Sealed AIR, Armacell, TotalEnergies, and Recticel NV/SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Packaging Industry

- 4.2 Restraints

- 4.2.1 Molded Pulp as a Green Alternative

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material

- 5.1.1 Polystyrene

- 5.1.2 Polyurethane

- 5.1.3 Polyolefin

- 5.1.4 Other Materials

- 5.2 Structure

- 5.2.1 Flexible

- 5.2.2 Rigid

- 5.3 Application

- 5.3.1 Food Packaging

- 5.3.2 Industrial Packaging

- 5.3.2.1 Transportation

- 5.3.2.2 Electrical and Electronics

- 5.3.2.3 Personal Care

- 5.3.2.4 Pharmaceutical

- 5.3.2.5 Other Industrial Packaging

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Armacell

- 6.4.2 Atlas Roofing Corporation

- 6.4.3 Borealis AG

- 6.4.4 Drew Foam

- 6.4.5 Foamcraft Inc.

- 6.4.6 TotalEnergies

- 6.4.7 Huntington Solutions

- 6.4.8 Recticel

- 6.4.9 Sealed Air

- 6.4.10 Williams Foam

- 6.4.11 Zotefoams PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Quest for Eco-friendly Packaging Foam