|

市场调查报告书

商品编码

1439841

多晶硅:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Polysilicon - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

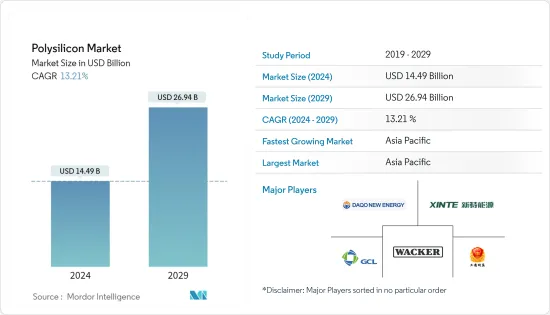

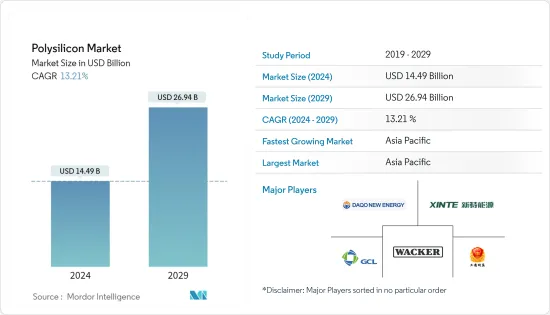

预计2024年多晶硅市场规模为144.9亿美元,预计2029年将达269.4亿美元,在预测期内(2024-2029年)复合年增长率为13.21%。

新型冠状病毒感染症 COVID-19 对 2020 年研究的市场产生了负面影响。鑑于政府实施的封锁,世界各地的太阳能发电工程在疫情期间暂时停止。然而,所研究市场的需求在 2021 年显着復苏,预计未来几年将显着成长。

主要亮点

- 短期内,推动所研究市场的主要因素是光伏(PV)安装数量的增加和半导体产业的成长。

- 然而,改进的冶金级硅(UMG-Si)太阳能电池和高资本支出等新竞争对手可能会阻碍市场发展。

- 在预测期内,生产过程中的技术进步可能代表全球多晶硅市场的重大机会。

- 亚太地区预计将主导全球多晶硅市场,并且由于中国和印度等国家消费量的成长,预计亚太地区也将成为预测期内成长最快的市场。

多晶硅市场趋势

太阳能发电产业需求不断成长

- 多晶硅是光电产业的关键材料,因为它是生产硅基太阳能电池的最重要原料之一。

- 多晶硅用于生产结晶和多晶太阳能板。结晶太阳能电池板是目前用于屋顶太阳能板安装的最受欢迎的太阳能电池板之一。硅晶型太阳能电池采用柴可拉斯基法製造。在此方法中,将硅籽结晶置于高温纯硅熔池中。

- 该过程形成称为硅锭的结晶,将其切成薄硅片并用于太阳能模组。

- 多晶板有时也称为多晶板。深受想要在预算内安装太阳能板的住宅的欢迎。

- 与结晶板类似,多晶电池板由硅太阳能电池製成。然而,由于冷却过程不同,形成的是多个结晶而不是一个。住宅中使用的多晶板通常包含 60 个太阳能电池。

- 太阳能产业是世界上成长最快的产业之一。根据国际能源总署(IEA)的数据,该产业几乎占全球净发电量的三分之二。

- 使用太阳能为迷你电网供电是为居住在电线附近的人们提供电力的好方法,特别是在太阳能资源丰富的新兴国家。

- 根据国际可再生能源机构 (IRENA) 的数据,太阳能仍然是世界上成长最快的可再生能源,2021 年全球可再生能源装置容量为 3,064 吉瓦,其中一半来自太阳能。

- 根据国际可再生能源机构(IRENA)的数据,2021年全球整体太阳能产能扩张成长19%,新增装置133吉瓦。此外,根据世界经济论坛预测,2021年,太阳能和风电合计发电量将首次超过全球总发电量的10%,其中太阳能将占约5%的份额。

- 2021 年,全球装置容量约为 850 吉瓦,而 2020 年为 770 吉瓦。 IEA表示,2021年再生能源容量成长将由290吉瓦的太阳能光电新委託推动,占3%。去年,太阳能发电占所有再生能源扩张的一半以上。

- 因此,不断增长的太阳能产业预计将在未来几年增加对多晶硅的需求。

亚太地区主导市场

- 由于中国、韩国和印度等国家消费量的增加,亚太地区已成为多晶硅的主要消费地区。

- 中国省最近公布了国内多晶硅产能,总合12.2万吨。

- 该国新的多晶硅扩建项目仍在建设中,预计到 2023 年运作产量将超过 120 万吨。全球大部分多晶硅生产(89%)预计将继续在中国境内进行,儘管大部分扩张(72%)计划在新疆以外进行。

- 韩国的太阳能发电装置规模排名世界第九。该国约4%的电力也来自太阳能,自2021年11月以来,太阳能发电量一直在稳定成长。此外,根据国际贸易组织的数据,韩国是第 14 个到 2050 年实现碳中和的国家,其中期目标是到 2030 年排放40%。

- 韩国90%以上的能源依赖进口,支撑着因国内能源资源匮乏而被视为高能源集中产业。 2021年,韩国发电量为576,316吉瓦时,其中可再生能源发电量(43,085吉瓦时)增加了18%。

- 2021年,塔塔电力太阳能公司将从国营能源效率服务有限公司(EESL)获得53.8亿印度卢比(约6,577万美元),用于在印度启动多个约100兆瓦的分散式地面太阳能发电工程。)我们收集了订单数量相当可观。

- 截至2021年6月,全球许多最大的太阳能发电设施位于印度和中国。在印度,位于拉贾斯坦邦焦特布尔地区的Bhadra太阳能发电厂总产能为2,245兆瓦。

- 因此,这种趋势加上最终用户的快速成长,预计将在预测期内推动亚太国家对多晶硅的需求。

多晶硅行业概况

全球多晶硅市场整合,前五名企业占全球产量的较大份额。主要参与者包括(排名不分先后)四川永祥(通威)、协鑫科技、大全新能源、瓦克化学和新特能源。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 太阳能发电装置数量增加

- 半导体产业的成长

- 抑制因素

- 新的竞争对手,例如昇级的冶金级硅 (UMG-Si) 太阳能电池

- 资金投入大

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

- 技术简介

第五章市场区隔(以金额为准的市场规模)

- 最终用户产业

- 太阳能

- 结晶太阳能板

- 多晶太阳能板

- 电子(半导体)

- 太阳能

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 合併、收购、合资、合作和协议

- 市场占有率(%)分析

- 主要企业采取的策略

- 公司简介

- Asia Silicon(Qinghai)Co. Ltd

- Daqo New Energy Co. Ltd

- GCL-TECH

- Hemlock Semiconductor Operations LLC And Hemlock Semiconductor LLC

- Mitsubishi Polycrystalline Silicon America Corporation

- OCI Company Ltd

- Qatar Solar Technologies

- REC Silicon ASA

- Sichuan Yongxiang Co. Ltd(Tongwei)

- Tokuyama Corporation

- Wacker Chemie AG

- Xinte Energy Co. Ltd

第七章市场机会与未来趋势

- 生产过程中的技术进步

The Polysilicon Market size is estimated at USD 14.49 billion in 2024, and is expected to reach USD 26.94 billion by 2029, growing at a CAGR of 13.21% during the forecast period (2024-2029).

COVID-19 negatively affected the market studied in 2020. Considering the government-imposed lockdowns, solar projects across the world were temporarily halted during the pandemic. However, the demand for the market studied recovered significantly in 2021 and is expected to grow at a significant rate in the coming years.

Key Highlights

- Over the short term, the major factor driving the market studied are the increasing number of solar photovoltaic (PV) installations and growth in the semiconductor industry.

- However, emerging competitors, such as upgraded metallurgical-grade silicon (UMG-Si) solar cells and high capital expenditure, are likely to hinder the market.

- Technological advancement in the production process is likely to be a major opportunity in the global polysilicon market over the forecast period.

- Asia-Pacific is expected to dominate the global polysilicon market and is also expected to be the fastest-growing market during the forecast period owing to the increasing consumption of countries such as China and India.

Polysilicon Market Trends

Growing Demand from the Solar PV Industry

- Polysilicon is a key material in the solar PV industry as it is one of the most important feedstock materials used to manufacture silicon-based solar cells.

- Polysilicon is used to produce monocrystalline solar panels and multi-crystalline panels. Monocrystalline solar panels are one of the most popular solar panels used in rooftop solar panel installations today. Monocrystalline silicon solar cells are manufactured through the Czochralski method, in which a seed crystal of silicon is placed into a molten vat of pure silicon at a high temperature.

- This process forms a single silicon crystal, called an ingot, which is sliced into thin silicon wafers, which are then used in solar modules.

- Polycrystalline panels are sometimes referred to as multi-crystalline panels. They are popular among homeowners looking to install solar panels on a budget.

- Like monocrystalline panels, polycrystalline panels are made of silicon solar cells. However, the cooling process is different, which causes multiple crystals to form instead of one. Polycrystalline panels used in residential homes usually contain 60 solar cells.

- The solar PV industry is one of the fastest-growing industries in the world. According to the International Energy Agency (IEA), this industry accounts for almost two-thirds of the net power capacity across the world.

- Using solar PV to power mini-grids is an excellent way to bring electricity access to people who do not live near power transmission lines, particularly in developing countries with excellent solar energy resources.

- Solar power remains the fastest-growing renewable energy across the world, therefore representing over half of the 3,064 GW (gigawatt) of renewable capacity installed internationally in 2021, as per the International Renewable Energy Agency (IRENA).

- According to International Renewable Energy Agency (IRENA), the total global solar capacity expansion increased by 19% in 2021, recording 133 GW additional installations. Furthermore, as per World Economic Forum, in 2021, for the first time, solar and wind together generated over 10% of the total electricity across the world, with solar power accounting for around 5% of the share.

- In 2021, the total global installed solar energy capacity was around 850 GW, compared to 770 GW in 2020. As per IEA, the additions in renewable power capacity in 2021 were driven up by 290 GW of solar PV new commissions, representing a 3% hike from 2020. Solar PV accounted for more than half of the total renewable power expansions the previous year.

- Therefore, the growing solar PV industry is expected to boost the demand for polysilicon in the coming years.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific was found to be the major consumer of polysilicon, owing to increasing consumption from countries such as China, South Korea, and India.

- The Chinese ministry recently released the polysilicon production capacity in the country, which totaled 122,000 tons.

- Sizeable pipelines for new polysilicon expansions in the country continue to be built, with over 1.2 million tons expected to be online by 2023. Although most expansions (72%) are planned outside of Xinjiang, the vast majority (89%) of global polysilicon production is still expected to take place within China.

- South Korea has the world's ninth-largest solar installation. The country also generates about 4% of its electricity from solar energy, and since November 2021, the amount of solar power has been steadily increasing. Furthermore, according to the International Trade Organization, South Korea is the 14th country to become carbon neutral by 2050, with an interim target of reducing emissions by 40% by 2030.

- South Korea imports more than 90% of its energy resources, sustaining industries deemed highly energy-intensive due to its lack of domestic energy resources. In 2021, South Korea generated 576,316 GWh of electricity, with an 18% increase in renewable energy (43,085 GWh).

- In 2021, Tata Power Solar bagged orders worth INR 538 crore (~USD 65.77 million) from state-run Energy Efficiency Services Ltd (EESL) to set up multiple distributed ground-mounted solar projects of approximately 100MW in India.

- As of June 2021, many of the world's largest solar power facilities were located in India and China. In India, Bhadla solar farm, located in Jodhpur district, Rajasthan, has a total production capacity of 2,245 megawatts.

- Hence, such trends, coupled with rapidly growing end users, are expected to boost the demand for polysilicon in countries of the Asia-Pacific region during the forecast period.

Polysilicon Industry Overview

The global polysilicon market is consolidated, with the top five players accounting for a significant share of global production. Some of the major players (not in any particular order) include Sichuan Yongxiang Co. Ltd (Tongwei Co. Ltd), GCL-TECH, DaqoNew Energy Co. Ltd, Wacker Chemie AG, and XinteEnergy Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Number of Solar PV Installation

- 4.1.2 Growth in the Semiconductor Industry

- 4.2 Restraints

- 4.2.1 Emerging Competitors, such as Upgraded Metallurgical-grade Silicon (UMG-Si) Solar Cell

- 4.2.2 High Capital Expenditure

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 End-user Industry

- 5.1.1 Solar PV

- 5.1.1.1 Monocrystalline Solar Panel

- 5.1.1.2 Multicrystalline Solar Panel

- 5.1.2 Electronics (Semiconductor)

- 5.1.1 Solar PV

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Asia Silicon (Qinghai) Co. Ltd

- 6.4.2 Daqo New Energy Co. Ltd

- 6.4.3 GCL-TECH

- 6.4.4 Hemlock Semiconductor Operations LLC And Hemlock Semiconductor LLC

- 6.4.5 Mitsubishi Polycrystalline Silicon America Corporation

- 6.4.6 OCI Company Ltd

- 6.4.7 Qatar Solar Technologies

- 6.4.8 REC Silicon ASA

- 6.4.9 Sichuan Yongxiang Co. Ltd (Tongwei)

- 6.4.10 Tokuyama Corporation

- 6.4.11 Wacker Chemie AG

- 6.4.12 Xinte Energy Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancement in Production Process