|

市场调查报告书

商品编码

1439842

聚羟基烷酯(PHA):市场占有率分析、产业趋势与统计、成长预测(2024-2029)Polyhydroxyalkanoate (PHA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

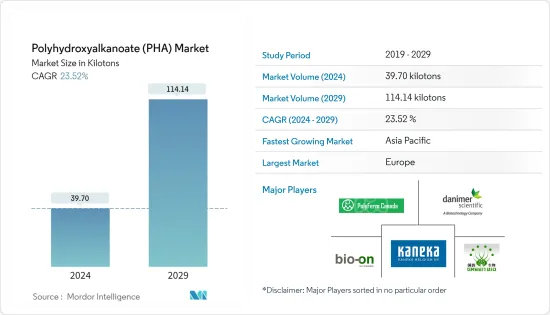

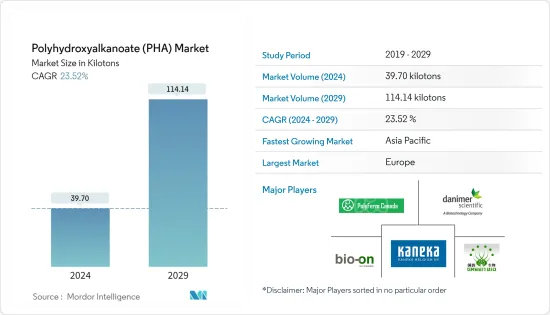

聚羟基烷酯(PHA)的市场规模预计到2024年为39,700吨,在预测期内(2024-2029年)预计到2029年将达到114,140吨,复合年增长率为23.52%。

推动所研究市场的主要因素是对环保材料的需求不断增长。另一方面,与传统聚合物相比,PHA 的高价格以及冠状病毒感染疾病(COVID-19)爆发带来的不利条件阻碍了市场成长。

预计包装应用将在预测期内主导调查市场。

由于德国、法国和英国等国家消费量的增加,预计欧洲将主导全球 PHA 市场。

聚羟基烷酯(PHA)市场趋势

包装应用需求增加

- 聚羟基烷酯(PHA)被认为是用于包装应用的有前途的材料。它有多种用途,包括塑胶袋、薄膜、盒子、床单以及一次性汤匙和叉子。

- 对生物分解性塑胶的需求不断增长以及政府的倡议预计将推动包装和食品服务应用中对 PHA 的需求。

- 包装是製造公司考虑的关键因素之一,以确保其产品在视觉上对消费者有吸引力。随着製造业、食品加工厂和工业生产数量的不断增加,全球包装产业正经历强劲成长。

- 近年来,包装产业经历了一场变革,製造业和工业部门纷纷适应软包装。为此,全球包装产业对软包装的需求正在迅速增长。

- 此外,由于电子零售企业和食品和饮料行业的需求,包装要求近年来显着增加。

- 因此,对包装和食品服务的需求不断增长预计将在未来几年增加对 PHA 的需求。

欧洲地区主导市场

- 预计欧洲地区在预测期内将占据聚羟基烷酯(PHA)市场的最大份额。

- 由于国内电子商务的大幅成长和海外出口的增加,德国包装业正在快速成长。此外,对包装食品和饮料日益增长的偏好也推动了其成长。

- 由于包装行业的积极发展,德国对先进包装的需求不断增加,预计这将在未来几年对调查市场的需求做出贡献。

- 英国个人护理和食品饮料行业对小型优质包装的需求不断增长。该国正致力于提供更环保的包装,这增加了国内包装产业对 PHA 的需求。

- 在法国,食品製造业约占法国製造业的20%。与其他产业相比,食品业的包装设计创新率为 43%。这促进了该国食品包装的需求。

- 因此,欧洲国家对 PHA 的需求预计在预测期内将会增加。

聚羟基烷酯产业概况

全球聚羟基烷酯(PHA)市场本质上是部分一体化的。主要企业包括 Bio-on SpA、PolyFerm Canada、Danimer Scientific、Tianjin GreenBio Materials 和 Kanika 公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对环保材料的需求不断增长

- 其他司机

- 抑制因素

- 与传统聚合物相比价格较高

- 由于COVID-19感染疾病的爆发,情况不利

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔

- 类型

- 单体

- 共聚物

- 三元聚合物

- 目的

- 包装

- 农业

- 生物医学

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)/排名分析

- 主要企业采取的策略

- 公司简介

- Bio-on SpA

- CJ CheilJedang Corp.

- Danimer Scientific

- Full Cycle Bioplastics

- Genecis Bioindustries Inc.

- Kaneka Corporation

- PolyFerm Canada

- RWDC Industries

- Tepha Inc.

- TerraVerdae Inc.

- Tianjin GreenBio Materials Co., Ltd.

第七章市场机会与未来趋势

The Polyhydroxyalkanoate Market size is estimated at 39.70 kilotons in 2024, and is expected to reach 114.14 kilotons by 2029, growing at a CAGR of 23.52% during the forecast period (2024-2029).

The major factor driving the market studied is the growing demand for eco-friendly materials. On the flip side, the higher prices of PHA compared to the conventional polymers and unfavorable conditions arising due to the COVID-19 outbreak are hindering the growth of the market.

Packaging application is expected to dominate the market studied during the forecast period.

Europe is expected to dominate the global PHA market owing to the increasing consumption from countries such as Germany, France, and United Kingdom.

Polyhydroxyalkanoate Market Trends

Increasing demand from Packaging Application

- Polyhydroxyalkanoates (PHA) are considered as promising materials that are used for packaging applications. They are used in various applications such as plastic bags, films, boxes, sheets, disposable spoons and forks among others.

- Increasing demand for biodegradable plastics along with governments initiatives of various countries are expected to boost the demand for PHA from packaging and food services application.

- The packaging is one of the key aspects considered by the firms engaged in the manufacturing industry, to ensure aesthetic appeal to the consumers. With the growing number of manufacturing units, food processing plants, and increasing industrial production, the global packaging industry is witnessing robust growth.

- In the last few years, the packaging industry has been experiencing a transition, where the manufacturing and industrial sector has been adapting to flexible packaging. Owing to this, the demand for flexible packaging is rapidly growing in the global packaging industry.

- Additionally, the e-retail business and demand from the food and beverage industry are substantially increasing the packaging requirement in recent times.

- Therefore, the growing demand for packaging and food services is expected to boost the demand for PHA in coming years.

Europe Region to Dominate the Market

- Europe region is expected to account for the largest share of Polyhydroxyalkanoate (PHA) market during the forecast period.

- The packaging industry in Germany has been growing at a rapid pace, owing to the huge increases in domestic e-commerce and rising foreign exports. In addition, the increasing preference for packaged food and beverages has also aided its growth.

- Owing to the positive development in the packaging industry, the demand for advanced packaging has increased in Germany, which is expected to contribute to the demand for the market studied in the coming years.

- There is a growing demand for small size and premium packaging from the personal care and food and beverage sectors in the United Kingdom. The country has been focusing on offering more environmentally friendly packaging, which has increased the demand for PHA from the packaging sector in the country.

- In France, the food manufacturing industry represents about 20% of the French manufacturing industry. The packaging design innovation in the food industry is 43%, compared to other industrial sectors. This has been contributing to the demand for the food packaging in the country.

- Therefore, the demand for PHA in European countries is expected to grow during the forecast period.

Polyhydroxyalkanoate Industry Overview

The global Polyhydroxyalkanoate (PHA) market is partially consolidated in nature. The major companies are Bio-on SpA, PolyFerm Canada, Danimer Scientific, Tianjin GreenBio Materials Co., Ltd., and Kaneka Corporation among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Eco-Friendly Materials

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Higher Price Compared to the Conventional Polymers

- 4.2.2 Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Monomers

- 5.1.2 Co-Polymers

- 5.1.3 Terpolymers

- 5.2 Application

- 5.2.1 Packaging

- 5.2.2 Agriculture

- 5.2.3 Biomedical

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Bio-on SpA

- 6.4.2 CJ CheilJedang Corp.

- 6.4.3 Danimer Scientific

- 6.4.4 Full Cycle Bioplastics

- 6.4.5 Genecis Bioindustries Inc.

- 6.4.6 Kaneka Corporation

- 6.4.7 PolyFerm Canada

- 6.4.8 RWDC Industries

- 6.4.9 Tepha Inc.

- 6.4.10 TerraVerdae Inc.

- 6.4.11 Tianjin GreenBio Materials Co., Ltd.