|

市场调查报告书

商品编码

1439843

二乙二醇 (DEG) - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Diethylene Glycol (DEG) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

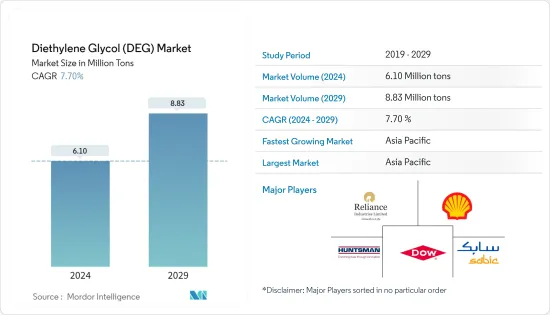

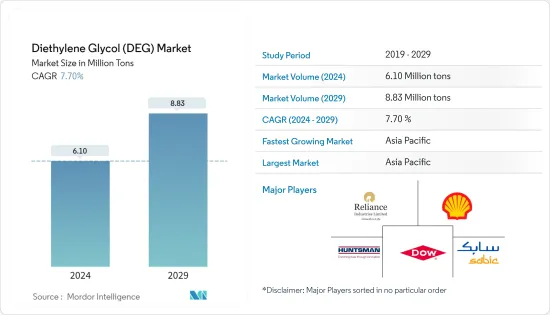

预计2024年二乙二醇市场规模为610万吨,预计2029年将达到883万吨,在预测期间(2024-2029年)CAGR为7.70%。

COVID-19 大流行对市场产生了负面影响。这是因为封锁和限制导致製造设施和工厂关闭。供应链和运输中断进一步对市场造成了障碍。然而,2021年该产业出现復苏,使研究市场的需求反弹。

主要亮点

- 短期内,印度和中国等新兴经济体建筑、油漆和涂料行业需求的增加是推动市场成长的因素。

- 另一方面,由于二甘醇的毒性和原材料价格波动而限制其使用的法规是限制所研究市场成长的一些因素。

- 然而,由于PET树脂和纺织业下游用途的增加,二甘醇作为化学工业的化学中间体的需求不断增加,是未来推动市场的主要机会。

- 由于基础设施建设的加强和工业化的快速发展,亚太地区在全球占据主导地位,并将成为成长最快的市场。

二甘醇 (DEG) 市场趋势

塑胶产业需求不断成长

- 二甘醇是环氧乙烷部分水解产生的有机化合物。它是一种无色、无臭、低挥发性、低黏度、有甜味的液体。

- 随着二甘醇作为生产纸张、软木和合成海绵增塑剂原料的使用不断增加,塑胶产业对二甘醇的需求不断增加。预计它将在预测期内推动其市场。

- 二甘醇也用于生产聚氨酯等塑胶材料。用于冰箱和冰柜的隔热以及汽车工业中的涂层和密封材料。例如,根据OICA的数据,2022年美国汽车产量为1,00,60,339辆,较2021年增长10%。因此,汽车产量的增加预计将创造需求用于二甘醇 (DEG)。

- 中国是全球市场上最大的聚氨酯原料及产品生产国。例如,根据中国国家统计局的数据,2021年,中国塑胶製品总产量为8,000万吨,比上年(2020年)增加5.27%。因此,该国塑胶产品产量的增加预计将为该国二乙二醇(DEG)市场创造需求。

- 由于上述所有因素,二乙二醇市场预计将在预测期内快速成长。

亚太地区主导市场

- 在中国和印度等国家,由于政府在基础设施发展和快速工业化方面的支出增加,该地区对二甘醇的需求正在增加。

- 建筑、塑胶和汽车等各种最终用户产业对聚酯树脂和聚氨酯等产品的需求不断增长,预计将推动该地区对二甘醇的需求。它充当其生产的化学中间体。此外,亚太国家各种化学品产量的增加影响了市场的成长。

- 据印度工商联合会称,印度政府将农化行业视为实现全球领先地位的 12 大行业之一,到 2025 年将增长 8-10%。因此,预计印度农化行业将在 2025 年实现增长。预测期。

- 据中国涂料工业协会称,在中国,在建筑业和汽车製造业的支持下,国内涂料需求可能增加8%。例如,根据OICA的数据,2022年中国汽车产量为2,70,20,615辆,较2021年增长3.3%。因此,中国汽车产量的增加预计将消耗更多的涂料和涂料,为二甘醇(DEG )市场创造了上行空间。

- 中国和印度是人口最多的两个国家,但仍处于发展中。因此,农业化学品、油漆和涂料以及个人护理行业预计将出现巨大增长。例如,2022 年,印度住宅市场推出了超过 32.8 万套房屋。儘管该国对住房的需求很高,但过去几年住宅的推出量仍处于相对较高的水平。因此,建筑涂料需求的增加预计将提振二甘醇市场。

- 由于上述因素,预计二甘醇(DEG)市场在研究期间将显着成长。

二甘醇 (DEG) 产业概况

二甘醇市场高度分散。市场上的一些主要参与者包括(排名不分先后)信实工业有限公司、SABIC、陶氏化学、亨斯曼国际有限责任公司和壳牌等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 各行业对塑胶的需求不断成长

- 油漆和涂料的需求不断增加

- 其他司机

- 限制

- 二甘醇的毒性

- 其他限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场区隔(市场规模按数量计算)

- 应用

- 增塑剂

- 个人护理

- 化学中间体

- 润滑剂

- 其他应用(溶剂等)

- 最终用户产业

- 塑胶

- 农业化学品

- 化妆品和个人护理

- 油漆和涂料

- 其他最终用户产业(纺织、石油和天然气等)

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)**/排名分析

- 领先企业采取的策略

- 公司简介

- Crystal India

- Dow

- PTT Global Chemical Public Company Limited (GC Glycol Company Limited)

- Huntsman International LLC

- India Glycols Limited

- Indorama Ventures Public Company Limited

- Mitsubishi Chemical Corporation

- NIPPON SHOKUBAI CO., LTD

- Petroliam Nasional Berhad (PETRONAS)

- Reliance Industries Limited

- SABIC

- Shell

- Tokyo Chemical Industry Co., Ltd.

第 7 章:市场机会与未来趋势

- 作为化学中间体的二甘醇的需求不断增长

- 其他机会

The Diethylene Glycol Market size is estimated at 6.10 Million tons in 2024, and is expected to reach 8.83 Million tons by 2029, growing at a CAGR of 7.70% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market. It was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, increasing demand from the construction and paints and coatings industries in emerging economies such as India and China are factors driving the market's growth.

- On the flip side, regulations restricting DEG use due to its toxic nature and volatile prices of raw materials are some of the factors restraining the growth of the market studied.

- However, increasing demand for diethylene glycol as a chemical intermediate in the chemical industry due to increased downstream uses in PET resins and the textile industry are the major opportunities to drive the market in the future.

- The Asia-Pacific region dominates the world and will be the fastest-growing market due to increased infrastructure development and rapid industrialization.

Diethylene Glycol (DEG) Market Trends

Increasing Demand in the Plastics Industry

- Diethylene glycol is an organic compound produced by partial hydrolysis of ethylene oxide. It is a colorless, odorless, low volatility, and low viscosity liquid with a sweet taste.

- Increasing the use of diethylene glycol as raw material in producing plasticizers for paper, cork, and synthetic sponges, the demand for diethylene glycol is rising in the plastic industry. It is expected to drive its market during the forecast period.

- Diethylene glycol is also used for producing plastic materials like polyurethane. It is used for the insulation of refrigerators and freezers and as a coating and sealant material in the automobile industry. For instance, according to OICA, in 2022, automobile production in the United States amounted to 1,00,60,339 units, which showed an increase of 10% compared to 2021. As a result, an increase in automobile production is expected to create demand for Diethylene glycol (DEG).

- China is the largest polyurethane raw materials and product producer in the global market. For instance, according to the National Bureau of Statistics of China, in 2021, China's total production of plastic products amounted to 80 million metric tons, which showed an increase of 5.27% compared to the previous year (2020). Therefore, an increase in the production of plastic products in the country is expected to create demand for the Diethylene glycol (DEG) market in the country.

- Owing to all the factors mentioned above diethylene glycol market is expected to grow rapidly over the forecast period.

The Asia-Pacific Region to Dominate the Market

- In countries like China and India, the demand for diethylene glycol is increasing in the region due to increasing government spending on infrastructure development and rapid industrialization.

- The increasing need for products, such as polyester resins and polyurethanes, in various end-user industries, like construction and building, plastic, and automotive, is projected to boost the demand for diethylene glycol in the region. It acts as a chemical intermediate for their production. Moreover, the rising production of various chemicals in Asia-Pacific countries impacted the market growth.

- According to the Federation of Indian Chambers of Commerce and Industry, the Indian government recognizes the agrochemical industry as one of its top 12 industries to achieve global leadership, growing 8-10% through 2025. Thus, India's agrochemical sector is projected to grow during the forecast period.

- According to the China National Coatings Industry Association, in China, the demand for coatings in the country is likely to grow by 8% with the support of building and construction and automotive manufacturing. For instance, according to OICA, in 2022, automobile production in China amounted to 2,70,20,615 units, which showed an increase of 3.3% compared to 2021. Therefore, increasing the production of automobiles in the country is expected to consume more paints and coatings, creating an upside for the diethylene glycol (DEG) market.

- China and India are the top two largest populated countries, which are still developing. So, huge growth is expected in the agrochemicals, paints and coatings, and personal care industries. For instance, in 2022, over 328 thousand housing units were launched across India's residential market. Even though there is high demand for housing in the country, residential launches are on a comparatively high level over the past few years. Therefore, increasing demand for architectural coatings is expected to boost the diethylene glycol market.

- Owing to the abovementioned factors, the Diethylene glycol (DEG) market is projected to grow significantly during the study period.

Diethylene Glycol (DEG) Industry Overview

The diethylene glycol market is highly fragmented. Some of the major players in the market include (not in any particular order) Reliance Industries Limited, SABIC, Dow, Huntsman International LLC, and Shell, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Plastic Demand from Various Industries

- 4.1.2 Increasing Demand in Paints and Coatings

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Toxic Nature of Diethylene Glycol

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Plasticizers

- 5.1.2 Personal Care

- 5.1.3 Chemical Intermediates

- 5.1.4 Lubricant

- 5.1.5 Other Applications (Solvent, etc.)

- 5.2 End-user Industry

- 5.2.1 Plastics

- 5.2.2 Agrochemicals

- 5.2.3 Cosmetic and Personal Care

- 5.2.4 Paints and Coatings

- 5.2.5 Other End-user Industries (Textiles, Oil and Gas, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Crystal India

- 6.4.2 Dow

- 6.4.3 PTT Global Chemical Public Company Limited (GC Glycol Company Limited)

- 6.4.4 Huntsman International LLC

- 6.4.5 India Glycols Limited

- 6.4.6 Indorama Ventures Public Company Limited

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 NIPPON SHOKUBAI CO., LTD

- 6.4.9 Petroliam Nasional Berhad (PETRONAS)

- 6.4.10 Reliance Industries Limited

- 6.4.11 SABIC

- 6.4.12 Shell

- 6.4.13 Tokyo Chemical Industry Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Diethylene Glycol as a Chemical Intermediate

- 7.2 Other Opportunities