|

市场调查报告书

商品编码

1439850

富马酸:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Fumaric Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

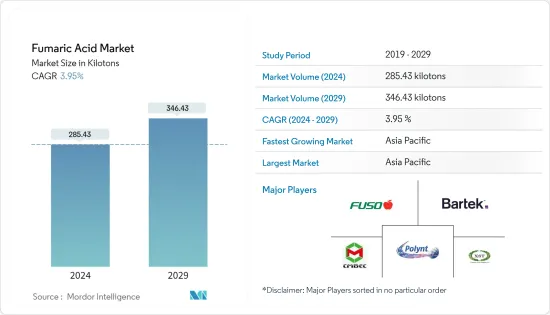

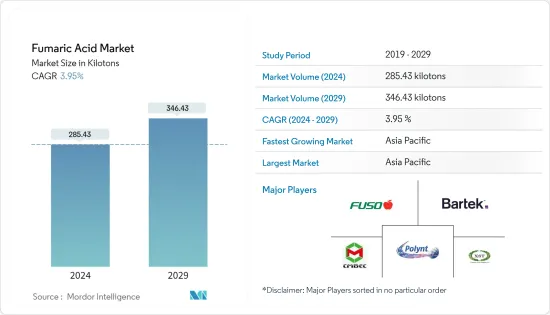

富马酸市场规模预计到2024年为285,430吨,预计到2029年将达到346,430吨,在预测期内(2024-2029年)复合年增长率为3.95%。

新型冠状病毒肺炎 (COVID-19) 的爆发导致世界各地的国家封锁,扰乱了製造活动和供应链,并导致生产停止,对 2020 年的市场产生了负面影响。然而,情况在 2021 年开始復苏,恢復了预测期内市场的成长轨迹。

主要亮点

- 食品和饮料产业应用的成长是推动所研究市场的关键因素。

- 与富马酸相关的健康危害是所研究市场的主要限制因素之一。

- 新的潜在应用领域的出现可能代表着所研究市场的机会。

- 亚太地区在市场上占据主导地位,预计在预测期内将继续保持主导地位。

富马酸市场趋势

食品和饮料主导需求

- 富马酸是一种固体有机食品酸,广泛用作食品和饮料行业的添加剂。它被认为是一种无毒食品添加剂,可用作食品和饮料中的香料、pH调节剂、抗菌剂或酸性清洁剂。

- 富马酸广泛用于麵包房、饮料和甜点,如小麦和玉米饼、冷冻饼干麵团、酸麵团和黑麦麵包、果汁、葡萄酒、果冻和果酱、海藻酸甜点、藻酸盐甜点、馅饼馅料等等。它一直。

- 根据联合国粮食及农业组织(FAO)的数据,2022/23年度全球粮食贸易量预计为4.696亿吨,比7月份的预测增加200万吨,但仍处于2021/22年度水平,下降1.9%。

- 根据粮农组织预测,2022/23年度(7月/6月)世界小麦贸易量为1.913亿吨,与7月基本持平,低于2021/22年度(7月/6月)水平,下降1.8% 。

- 粮农组织预测,2022/23年度全球稻米产量将为5.126亿吨(以碾米计),比2021年的历史最高产量低2.4%。

- 据农业和农民福利部称,印度粮食产量预计将创历史新高,达3.1451亿吨,比2020-21年粮食产量增加377万吨。

- 印度2021-22年的油籽总产量预计将达到创纪录的3850万吨,比2020-21年的3595万吨增加255万吨。

- 由于上述原因,预计市场在预测期内将出现正成长。

亚太地区主导市场

- 亚太地区可能主导全球富马酸供应。

- 根据联合国粮食及农业组织(FAO)预测,2022年亚洲粮食总产量预计为14.71亿吨,比五年平均高出2.2%。

- 在中国,加工水果、猪肉、乳製品以及一些特殊粮和豆类食品是可以带动国内食品加工业成长的食品。因此,食品和饮料行业提供了投资机会,预计将进一步创造对此类工厂使用的新设备的需求。

- 印度的食品加工产业主要以出口为导向。然而,由于都市化和消费者偏好,当地市场也在不断增长。印度出口了价值约37.701亿美元的食品,主要包括加工水果、蔬菜、肉类(包括鱼贝类)和大量酒精饮料。

- 据粮农组织称,2022年远东次区域粮食总产量预计为13.69亿吨(相当于稻米),略高于过去五年的平均水准。预计北韩、尼泊尔、缅甸,特别是斯里兰卡的产量将低于平均值。

- 据印度农业部称,预计稻米产量为1.3029亿吨。小麦产量可能增加至10684万吨,比五年平均产量10388万吨高296万吨。

- 日本化学工业是该国仅次于运输机械的第二大製造业。运输设备包括汽车,这是日本最着名的工业,严重依赖化学工业提供的原料。三菱化学公司、三井化学公司、住友化学公司、东丽工业公司和工业是化学品销售额排名全球前30的公司。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

富马酸产业概况

富马酸产业市场高度分散,前五大企业约占市占率的30%。市场上的知名企业包括(排名不分先后)Bartek Elements Inc.、XST Biological、Changmao Biochemical Engineering Company Limited、Fuso Chemical 工业、Polynt等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大在食品和饮料行业的应用

- 其他驱动因素

- 抑制因素

- 与富马酸相关的健康危害

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(市场规模(数量))

- 类型

- 食品级

- 技术级

- 目的

- 食品和饮料加工

- 松香纸施胶

- 不饱和聚酯树脂

- 醇酸树脂

- 个人护理和化妆品

- 其他用途

- 最终用户产业

- 食品和饮料

- 化妆品

- 药品

- 化学品

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 中东和非洲其他地区

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- Anmol Chemicals

- Bartek Ingredients Inc.

- Changmao Biochem

- ESIM Chemicals

- Fuso Chemical Co. Ltd

- Merck KGaA

- Polynt

- Thirumalai Chemicals Ltd

- UPC Group

- Yongsan Chemicals Inc.

- XST Biological Co. Ltd

第七章市场机会与未来趋势

- 新的潜在应用领域的出现

The Fumaric Acid Market size is estimated at 285.43 kilotons in 2024, and is expected to reach 346.43 kilotons by 2029, growing at a CAGR of 3.95% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period.

Key Highlights

- The growing application in the food and beverage industry is a major factor driving the market studied.

- Health hazard related to fumaric acid is one of the major restraining factors for the market studied.

- The emergence of new potential application areas will likely act as an opportunity for the market studied.

- Asia-Pacific dominated the market and is expected to continue its dominance during the forecast period.

Fumaric Acid Market Trends

Food and Beverage to Dominate the Demand

- Fumaric acid is solid organic food acid extensively used as an additive in the food and beverage industry. It is considered a non-toxic food additive, which can be used as a flavoring agent, a pH control agent, an antimicrobial agent, or a pickling agent in food products and beverages.

- Fumaric acid is widely used in bakeries, beverages, and desserts, like wheat, corn tortillas, refrigerated biscuit doughs, sourdough and rye bread, fruit juice, wine, jellies and jams, gelatin desserts, alginate-based desserts, pie fillings, etc.

- According to the Food and Agriculture Organization of the United Nations (FAO), world trade in cereals in 2022/23 is forecast at 469.6 million tonnes, up by 2 million tonnes since the July forecast but still 1.9 percent below the 2021/22 level.

- According to FAO, at 191.3 million tonnes, the forecast for world wheat trade in 2022/23 (July/June) remains nearly unchanged since July and still points to a 1.8 percent decline from 2021/22 (July/June) level.

- FAO predicted the world rice production in 2022/23 to be 512.6 million tonnes (milled basis), 2.4 percent below the 2021 all-time peak.

- According to the Ministry of Agriculture & Farmers Welfare, the production of food grains in India is estimated at a record 314.51 million tonnes, which is higher by 3.77 million tonnes than the production of foodgrain during 2020-21.

- Total Oilseeds production in India during 2021-22 is estimated at a record 38.50 million tonnes which is higher by 2.55 million tonnes than the production of 35.95 million tonnes during 2020-21.

- Due to the above reasons, the market is expected to have positive growth in the forecasted period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region may dominate the global fumaric acid, owing to demand from countries like India, China, and Japan.

- According to the Food and Agriculture Organization of the United Nations (FAO), Forecast at 1,471 million tonnes, the aggregate 2022 cereal output in Asia is 2.2 percent above the five-year average.

- In China, processed fruits, pork, dairy, and some specialty grains and legumes are the food products that may drive the growth of the food processing industry in the country. Thus, the food and beverage industry is offering opportunities for investment, which is further expected to create demand for new equipment used in such plants.

- The food processing sector in India has been primarily export-oriented. However, the local market is also growing, owing to urbanization and consumer preferences. India exported processed food valued at around USD 3770.1 million which mainly consists of processed fruits, vegetables, and meats, including seafood, along with a sizeable chunk of alcoholic beverages.

- According to FAO, the far east Asia subregional aggregate cereal output is forecast at 1,369 million tonnes (rice in paddy equivalent) in 2022, slightly above the previous five-year average. Below-average outputs are expected in the Democratic People's Republic of Korea, Nepal, Myanmar and especially in Sri Lanka,

- According to the agriculture ministry of India, rice production is expected to be 130.29 million tonnes. Wheat production could increase to 106.84 million tonnes, 2.96 million tonnes higher than the past five years' average of 103.88 million tonnes.

- The Japanese chemical industry is the country's 2nd largest manufacturing industry behind transportation machinery. Transportation machinery includes Japan's most notable industry, automotive, which is highly dependent on raw materials provided by the chemical industry. Mitsubishi Chemical Corp., Mitsui Chemicals Inc., Sumitomo Chemical Co. Ltd, Toray Industries Inc., and Shin-Etsu Chemical Co. rank among the world's top 30 chemical companies measured in chemical sales.

- Thus, the aforementioned factors are projected to significantly impact the market in the coming years.

Fumaric Acid Industry Overview

The fumaric acid industry market is highly fragmented, with the top five players accounting for around ~30% of the market. Some prominent players in the market include (not in any particular order) Bartek Ingredients Inc., XST Biological Co. Ltd., Changmao Biochemical Engineering Company Limited, Fuso Chemical Co. Ltd, and Polynt

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Application in the Food and Beverage Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Health Hazard Related to Fumaric Acid

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Food Grade

- 5.1.2 Technical Grade

- 5.2 Application

- 5.2.1 Food & Beverage Processing

- 5.2.2 Rosin Paper Sizing

- 5.2.3 Unsaturated Polyster Resin

- 5.2.4 Alkyd Resin

- 5.2.5 Personal Care & Cosmetics

- 5.2.6 Other Applications

- 5.3 End-user Industry

- 5.3.1 Food and Beverage

- 5.3.2 Cosmetics

- 5.3.3 Pharmaceutical

- 5.3.4 Chemical

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anmol Chemicals

- 6.4.2 Bartek Ingredients Inc.

- 6.4.3 Changmao Biochem

- 6.4.4 ESIM Chemicals

- 6.4.5 Fuso Chemical Co. Ltd

- 6.4.6 Merck KGaA

- 6.4.7 Polynt

- 6.4.8 Thirumalai Chemicals Ltd

- 6.4.9 UPC Group

- 6.4.10 Yongsan Chemicals Inc.

- 6.4.11 XST Biological Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence of New Potential Application Areas