|

市场调查报告书

商品编码

1439852

大理石:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Marble - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

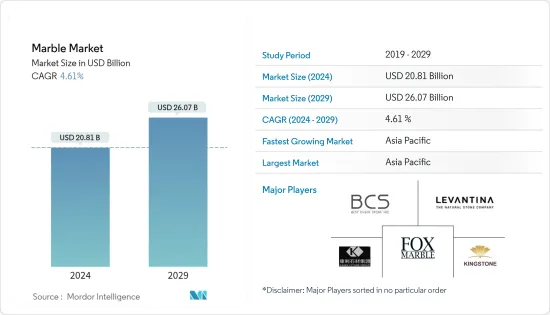

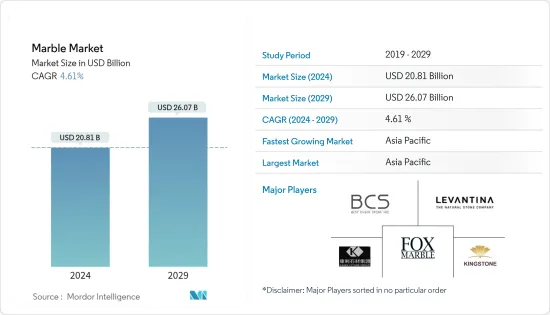

预计 2024 年大理石市场规模为 208.1 亿美元,预计到 2029 年将达到 260.7 亿美元,预测期内(2024-2029 年)复合年增长率为 4.61%。

冠状病毒感染疾病(COVID-19)大流行对2020年大理石市场产生了负面影响。然而,目前估计市场已达到大流行前的水平,并预计在未来几年将稳步成长。

主要亮点

- 短期内,建设产业的快速成长预计将增加全球对大理石的需求。

- 然而,与导致皮肤磨损和刺激的大理石粉尘相关的健康危害可能会阻碍市场成长。

- 儘管如此,大理石板和粉末的使用量的增加可能会在不久的将来为全球市场创造利润丰厚的成长机会。

- 亚太地区主导全球市场,消费量最高的国家是中国和印度等。

大理石市场趋势

建筑装饰产业主导市场

- 大理石广泛应用于建筑和建设产业的装饰和结构用途,从户外雕塑到墙壁、装饰层板、地板材料、装饰物品、楼梯和走道。

- 大理石可用于内外墙覆材、室内外铺路、壁炉表面和壁炉以及新奇物品。

- 不同类型的大理石被用作内部和外部垂直墙面覆层和地板材料。其用作结构构件(砖石)、雕像、碑刻、墓葬等数量较少,其中随葬艺术所占比例最大。大理石也广泛用于装饰和结构用途,从户外雕塑到墙壁、装饰层板、地板材料、装饰品、楼梯和走道。

- 大理石在各种应用中变得越来越受欢迎,从大型木工计划的使用到小型自己动手的住宅维修。

- 除了已经习惯使用大理石的传统市场之外,中东和东南亚的新兴市场也越来越意识到大理石的好处。

- 建筑业的兴起预计将在未来几年推动建筑和装饰应用中大理石的消费。 2030年,全球建筑业预计将达到8兆美元,主要由印度、美国和美国等国家推动。

- 根据美国人口普查局的数据,2021 年公共住宅支出达到 92.7 亿美元,而 2020 年为 95.3 亿美元。 2021 年私人商业建筑支出达 910.3 亿美元,而 2020 年为 855.7 亿美元。

- 根据联邦统计局的一项研究,2021年德国住宅和非住宅建筑的建筑许可数量达到158,000份,较2020年的153,000份增加。

- 中国正处于建设热潮之中。该国拥有全球最重要的建筑市场,占全球建筑投资总额的20%。

- 预计到 2030 年,中国将在建筑上花费近 13 兆美元,但随着中国摆脱大规模债务危机,这一数字可能会受到打击。

- 因此,建筑和装饰领域预计将主导市场。

亚太地区主导市场

- 由于政府对该地区建设产业的投资不断增加,预计亚太地区将成为预测期内成长最快的主导市场。

- 中国是建筑业成长的最大单一市场。中国拥有全球最大的新建筑市场,平均每年新增18亿至20亿平方公尺(190亿至210亿平方英尺)。预计到 2020 年,中国建筑总占地面积将达到约 690 亿平方公尺(7,420 亿平方英尺),到 2030 年预计将达到 800 亿平方公尺(8,610 亿平方英尺)。

- 根据中国国家统计局数据,2021年中国建筑付加为80138亿元人民币(约12418.7亿美元),而2020年为72445亿元人民币(约15033亿美元) 。

- 在印度,房地产业务的成长主要集中在住宅领域和商业房地产,一直是该领域成长的关键。不断增长的各个乡镇正在推动这一领域的发展。

- 帕尔瓦工业、扎希拉巴德综合工业以及其他涉及公共和私人投资总额达293.8亿美元的计划的开发正在推动该产业的发展。

- 由于持续的都市化和家庭收入的增加,印度的住宅需求迅速增加。印度政府还允许高达 100% 的外国直接投资 (FDI) 用于定居点开发和城镇计划。预计这将增加该国的住宅建设。

- 因此,所有这些市场趋势预计将在预测期内推动该地区大理石市场的需求。

大理石产业概况

大理石市场高度分散。主要参与者包括(排名不分先后)Fox Marble、Best Cheer Stone、Levantina y Asociados de Minerales, SA、康利石材集团、中国金石矿业控股有限公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建设产业快速成长

- 其他司机

- 抑制因素

- 大理石粉尘对健康的危害

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 贸易分析

第五章市场区隔(以金额为准的市场规模)

- 颜色

- 白色的

- 黑色的

- 黄色的

- 红色的

- 其他颜色

- 目的

- 建筑及装饰

- 雕像和纪念碑

- 家具

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 土耳其

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 合併、收购、合资、合作和协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- Antolini Luigi &C SpA

- BC Marble Products Ltd

- Best Cheer Stone

- China Kingstone Mining Holdings Limited

- Daltile

- Dimpomar

- FHL I Kiriakidis Marbles and Granites SA

- Fox Marble

- HELLENIC GRANITE Co.

- Hilltop Granite

- Indiana Limestone Company(A Polycor Inc. Company)

- Kangli stone group

- Levantina y Asociados de Minerales SA

- Mumal Marble

- Simsekler Mermer

- Santucci Group Srl

- Tekmar

- Temmer Marble

- Topalidis SA

- The Marble Factory

- Universal Marble &Granite Group Ltd

- Xishi Group Ltd

第七章市场机会与未来趋势

- 增加大理石板和粉末的使用

The Marble Market size is estimated at USD 20.81 billion in 2024, and is expected to reach USD 26.07 billion by 2029, growing at a CAGR of 4.61% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the marble market in 2020. However, the market has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the coming years.

Key Highlights

- Over the short term, the rapid growth in the construction industry is expected to drive the demand for marble worldwide.

- However, the health hazard related to marble dust that causes abrasion and irritation to the skin is likely to hinder the market's growth.

- Nevertheless, the growing use of marble slabs and powder will likely create lucrative growth opportunities for the global market soon.

- Asia-Pacific dominated the market worldwide, with the most significant consumption from countries such as China and India.

Marble Market Trends

Building and Decoration Segment to Dominate the Market

- Marble is widely used in the building and construction industry for decorative and structural purposes, ranging from outdoor sculptures to walls, veneers, flooring, ornamental features, stairways, and walkways.

- Marble finds its application in interior and exterior wall cladding, interior and exterior paving, fireplace facing and hearth, and novelty items.

- Different marble varieties are used as interior and exterior vertical wall cladding and flooring. Their use as structural elements (masonry), statues, epitaphs, graves, etc., is quantitatively less, with funeral art accounting for the most significant percentage. Marble is also widely used for decorative and structural purposes, from outdoor sculptures to walls, veneers, flooring, ornamental features, stairways, and walkways.

- Marble has become ever more popular for different applications, from use in large-scale construction projects to small do-it-yourself home renovations.

- In addition to traditional markets already accustomed to using marble, new markets in the Middle East and Southeast Asia are now increasingly aware of the benefits of marble.

- The rising building industry is expected to drive marble consumption in building and decoration applications in the years to come. The global construction industry is expected to reach USD 8 trillion by 2030, primarily driven by countries such as India, China, and the United States.

- According to the US Census Bureau, the value of public residential construction spending reached USD 9.27 billion in 2021, compared to USD 9.53 billion in 2020. The value of private commercial construction reached USD 91.03 billion in 2021, compared to USD 85.57 billion in 2020.

- As per the Statistisches Bundesamt survey, the number of building permits for residential and non-residential buildings in Germany reached 158 thousand in 2021 and registered growth compared to 153 thousand licenses in 2020.

- China is amid a construction mega-boom. The country has the most significant building market in the world, making up 20% of all construction investments globally.

- China is expected to spend nearly USD 13 trillion on buildings by 2030. Although this number may take a hit as China is reeling through the Evergrande debt crisis.

- Hence, the building and decoration segment is expected to dominate the market.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to be the dominating and fastest-growing market over the forecast period, owing to increasing government investment in the building and construction industry in the region.

- China is the largest single market for growth in the building sector. China has the largest new construction market globally, adding an average of 1.8-2.0 billion m2 (19 - 21 billion ft2) annually. The total floor area of Chinese buildings was expected to reach around 69 billion m2 (742 billion ft2) in 2020, and it is projected to be 80 billion m2 (861 billion ft2) by 2030.

- According to the National Bureau of Statistics of China, the value added to the Chinese construction industry accounted for CNY 8,013.8 billion (~USD 1,241.87 billion) in 2021, compared to CNY 7,244.5 billion (~USD 1,050.33 billion) in 2020.

- In India, the growing real estate business, which is mainly focused on the residential sector and commercial places, is key to the sector's growth. The growing individual townships are driving the sector.

- The development of Palva industrial township, Zaheerabad integrated industrial township, and many other projects involving public and private investments with a total of USD 29.38 billion are boosting the sector.

- Demand for residential housing in India has rushed due to increased urbanization and rising household income. Also, the Indian government has allowed foreign direct investment (FDI) of up to 100% for settlement development and townships projects. This, in turn, is projected to increase the residential housing construction in the country.

- Hence, all such market trends are expected to drive the demand for the marble market in the region during the forecast period.

Marble Industry Overview

The marble market is highly fragmented. The major players include Fox Marble, Best Cheer Stone, Levantina y Asociados de Minerales, S.A., Kangli stone group, and China Kingstone Mining Holdings Limited, among others (not in particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapid Growth in the Construction Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Health Hazard Related to Marble Dust

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

- 4.5 Trade Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Color

- 5.1.1 White

- 5.1.2 Black

- 5.1.3 Yellow

- 5.1.4 Red

- 5.1.5 Other Colors

- 5.2 Application

- 5.2.1 Building and Decoration

- 5.2.2 Statues and Monuments

- 5.2.3 Furniture

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Turkey

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Antolini Luigi & C SpA

- 6.4.2 BC Marble Products Ltd

- 6.4.3 Best Cheer Stone

- 6.4.4 China Kingstone Mining Holdings Limited

- 6.4.5 Daltile

- 6.4.6 Dimpomar

- 6.4.7 FHL I Kiriakidis Marbles and Granites SA

- 6.4.8 Fox Marble

- 6.4.9 HELLENIC GRANITE Co.

- 6.4.10 Hilltop Granite

- 6.4.11 Indiana Limestone Company (A Polycor Inc. Company)

- 6.4.12 Kangli stone group

- 6.4.13 Levantina y Asociados de Minerales S.A.

- 6.4.14 Mumal Marble

- 6.4.15 Simsekler Mermer

- 6.4.16 Santucci Group Srl

- 6.4.17 Tekmar

- 6.4.18 Temmer Marble

- 6.4.19 Topalidis SA

- 6.4.20 The Marble Factory

- 6.4.21 Universal Marble & Granite Group Ltd

- 6.4.22 Xishi Group Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Use of Marble Slabs and Powder