|

市场调查报告书

商品编码

1439853

微型逆变器:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Micro Inverter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

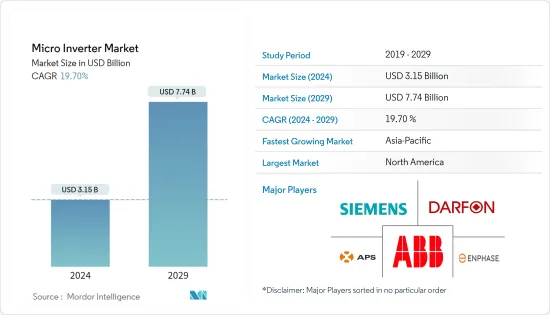

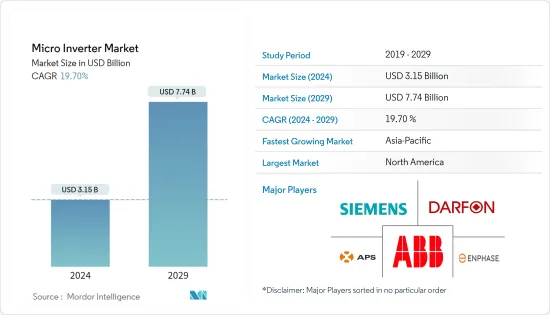

2024年微型变频器市场规模预估为31.5亿美元,预估至2029年将达77.4亿美元,预测期内(2024-2029年)复合年增长率为19.70%。

支援模组级监控、易于安装、提高设计弹性、无需直流开关点以及比传统逆变器更好的安全性等因素正在推动微型逆变器市场的成长,有几个因素。

主要亮点

- 持续的研发活动和微型逆变器成本的显着降低正在推动微型逆变器市场的发展。此外,由于其紧凑的尺寸和多功能性,市场也在显着增长。此外,基于模组化、安全性和最大能源采集的消费者需求的不断增长预计将在预测期内继续以相当大的速度推动市场。

- 对微型逆变器的需求使得该公司能够开发更多的电池储存。 2022年4月,能源储存提供商Yotta Energy(德克萨斯州)宣布获得一份价值197万美元的合同,在拉斯维加斯内利斯空军基地安装太阳能+储能微电网。

- 微型逆变器有多种用途,并在世界各地广泛采用。它们具有多种优势,包括设计弹性以及透过最大功率点追踪 (MPPT) 技术从太阳能电池板产生最大功率的能力。这些因素使微型逆变器市场在住宅和商业应用中比其他逆变器更具优势。

- 对微型逆变器的需求使得该公司能够开发更多的电池储存。 2022年4月,德克萨斯州奥斯汀的Yotta Energy获得了一份价值197万美元的合同,在拉斯维加斯内利斯空军基地安装太阳能发电+储存微电网。该公司相信电池也正朝着同一方向发展:模组级微储存。该公司在装有安定器的同一个太阳能模组货架设备中部署了 52 磅、1 千瓦时的磷酸锂铁电池。

- 据政府间组织国际能源署称,与石化燃料和核能发电相比,全球再生能源容量预计将比 2020 年增加 60% 以上,到 2026 年将超过 4,800(吉瓦)。据说这相当于相当于世界总发电量的总和。

微型逆变器市场趋势

住宅行业推动市场成长

- 美国和加拿大等国家的住宅领域越来越多地采用太阳能,主要是由于节省电费的承诺、对替代电力源的需求以及减少气候变迁风险的愿望。我是。因此,微型逆变器市场的成长机会增加。

- 在预测期内,推动微型逆变器市场的关键因素包括太阳能发电成本下降、政府对住宅太阳能发电的支持政策、FIT计划和激励措施以及各国政府设定的太阳能目标,从而导致屋顶光伏发电的份额太阳能发电预计将增加。

- 全球大多数微型逆变器企业都提供单相设备。此外,单相输电最适合国内应用,也是微型逆变器的主要市场,因此全球需求量大。例如,在美国和欧洲,住宅部门依赖单相电力传输。

- 持续的技术改进,例如提高光伏组件的效率,将推动成本降低。这些高度模组化技术的工业化正在带来令人印象深刻的好处,从规模经济和竞争加剧到製造流程和供应链的改进,进一步加速了微型逆变器市场的成长。

亚太地区创下最高市场成长纪录

- 在研究期间,亚太地区预计将成为微型逆变器成长最快的市场。中国、日本、印度和澳洲等多个国家正在努力透过先进的太阳能发电系统来扩大其太阳能发电装置容量,以提高电力可靠性。

- 亚太地区已为住宅、商业和太阳能发电厂安装了多个微型逆变器。日本和澳洲主要采用微型逆变器技术。此外,印度和日本住宅屋顶太阳能装置的增加正在鼓励製造商满足该地区潜在客户的需求。

- 在印度、中国和日本等国家,各自政府制定了法规、改革和倡议,以实现电力部门的现代化。

- 在印度,住宅光伏的安装成本估计为每千瓦 1,000 美元,高于商业光伏(每千瓦 692 美元)。然而,印度的住宅安装成本(每千瓦 1,638 美元)和商业安装成本(每千瓦 1,379 美元)均低于全球平均水平。这些因素推动了该地区的市场成长。

- 印度也计划在2021年对进口太阳能电池组件和逆变器征收20%的关税,取代目前的保障税。此次课税是印度电力部长在与产业代表的电话交谈中提案的,确认印度总理打算对进口商品征收20%的基本关税(BCD)。

微型逆变器产业概况

微型逆变器市场高度分散,主要参与者包括Enphase Energy Inc.、Altenergy Power System Inc.、DARFON、ABB Ltd和Siemens AG。这些市场参与者正在使用新产品发布、扩张、合作和收购等策略来扩大他们在这个市场的足迹。

- 2022 年 4 月 - Yotta Energy 宣布收购 350 万美元新资本,使 A 轮资金筹措总额达 1,650 万美元。本轮资金筹措和奖项使 Yotta 的总资金超过 2550 万美元。

- 2021 年 10 月 - 全球领先的微型逆变器太阳能和电池系统製造商 Enphase Energy, Inc. 宣布为北美客户推出采用 IQ8TM 太阳能微型逆变器的 Enphase 能源系统。 IQ8 是 Enphase 迄今为止最先进的微型逆变器。与竞争产品不同,IQ8 可以在停电期间利用阳光创建微电网,无需电池即可提供备用能源。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 随着采用率的增加,再生能源来源的好处和意识不断增强

- 提高成本效益并开发这些产品

- 市场限制因素

- 安装和维护成本高

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间敌对的强度

- 评估 COVID-19感染疾病对微型逆变器市场的影响

第五章市场区隔

- 按类型

- 单相

- 三相

- 透过通讯技术

- 有线

- 无线的

- 按销售管道

- 直接地

- 间接

- 按用途

- 住宅

- 商业的

- 太阳能发电厂

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争形势

- 公司简介

- Enphase Energy Inc.

- Altenergy Power System Inc.

- DARFON

- ABB Ltd

- Siemens AG

- Zhejiang Envertech Corporation Limited

- Omnik New Energy

- Sunpower Corporation

- ReneSolaPower

- AEconversion GmbH &Co. KG

- SMA Solar Technology AG

- Sparq Systems

- Sensata Technologies Inc.

- EnluxSolar Co. Ltd

- Delta Energy Systems

- SolarEdge Technologies Inc.

第七章 投资分析

第八章市场机会及未来趋势

The Micro Inverter Market size is estimated at USD 3.15 billion in 2024, and is expected to reach USD 7.74 billion by 2029, growing at a CAGR of 19.70% during the forecast period (2024-2029).

The factors like enabling module-level monitoring, easier installation, enhanced design flexibility, removing the need for DC switching points, and better safety than conventional inverters are some factors that are fueling the growth of the micro inverter market.

Key Highlights

- Constant R&D activities and significant reductions in the costs of microinverters drive the micro inverter market. Furthermore, the market also receives a considerable boost due to its compact size and versatility. Additionally, the increasing requirement of consumers, based on modularity, safety, and maximum energy harvest, will continue to drive the market at a considerable pace in the forecast period.

- The demand for micro inverters has enabled companies to develop increased battery storage. In April 2022, energy storage provider Yotta Energy, Austin, Texas, announced that it had been awarded a USD 1.97 million contract to install a solar + storage microgrid at Nellis Air Force Base in Las Vegas.

- Due to the varying use of micro inverters, they are widely adopted worldwide. They provide various benefits such as design flexibility and capabilities like producing the maximum power from solar panels through maximum power point tracking (MPPT) technology. These factors have helped the micro-inverter market gain an advantage over other inverters in residential and commercial applications.

- The demand for micro inverters has enabled companies to develop increased battery storage. In April 2022, Yotta Energy of Austin, Texas, was awarded a USD 1.97 million contract to install a solar + storage microgrid at Nellis Air Force Base in Las Vegas. The company believes batteries are headed in the same direction: module-level microstorage. The business is deploying a 52lb, 1kWh lithium-iron-phosphate battery on the same solar module racking gear, which holds the ballast.

- Worldwide renewable electricity capacity is predicted to expand by more than 60% from 2020 to over 4,800 (GW) by 2026, equaling the total global power capacity of fossil fuels and nuclear power combined, according to the International Energy Agency (an intergovernmental agency).

Micro Inverter Market Trends

Residential Segment to Drive the Market Growth

- The increasing adoption of solar photovoltaics in the residential sector in countries such as the United States and Canada is primarily driven by expected savings in electricity costs, the need for an alternative source of electricity, and the desire to mitigate climate change risk. Therefore, boosting the growth opportunities for the micro inverter market.

- During the forecast period, the share of the rooftop solar PV is expected to increase, on account of decreasing solar PV costs, supportive government policies for residential solar PV, FIT programs and incentives, and targets set by various governments for solar energy are some of the critical factors that are driving the micro inverter market.

- The majority of micro-inverter businesses throughout the world provide single-phase devices. Furthermore, considerable demand is observed globally because single-phase power transmission is best adapted for domestic applications, which is likewise among the primary marketplaces for micro-inverters. For example, the residential sector relies on single-phase power transmission in the United States and Europe.

- Continuous technological improvements, including higher solar PV module efficiencies, drive cost reductions. The industrialization of these highly modular technologies has yielded impressive benefits, from economies of scale and greater competition to improved manufacturing processes and supply chains, further accelerating the micro-inverter market growth.

Asia-Pacific to Register Highest Market Growth

- Asia-Pacific is expected to be the fastest-growing market for micro-inverters over the study period. Several countries, such as China, Japan, India, and Australia, are striving to boost their solar PV installation capacity through advanced solar PV systems that could, in turn, enhance electric stability.

- Asia-Pacific has several micro-inverter installations for residential, commercial, and PV power plant applications. Japan and Australia have been the major adopters of micro-inverter technology. Additionally, the growth in residential rooftop solar PV installations in India and Japan encourages manufacturers to cater to the needs of potential customers in this region.

- In countries such as India, China, and Japan, respective governments have laid regulations, reforms, and initiatives for modernizing the power sector.

- In India, the residential PV installation cost is estimated to be USD 1000 per KW, which is higher when compared to its commercial counterpart (USD 692 per KW). However, the Indian installation costs are cheaper than the global average for both residential (USD 1638 per KW) and commercial (USD 1379 per KW). These factors fuel the market growth in the region.

- India is also set to impose a 20% levy on imported solar module cells and inverters in 2021, replacing the current safeguard duty. The levy was proposed by the Indian power minister during a call with industry representatives, confirming that the Prime Minister of India intended to impose a Basic Custom Duty (BCD) of 20% on imports.

Micro Inverter Industry Overview

The micro-inverter market is highly fragmented, and the major players such as Enphase Energy Inc., Altenergy Power System Inc., DARFON, ABB Ltd, and Siemens AG, among others. These market players are using strategies such as new product launches, expansions, partnerships, acquisitions, and others to increase their footprints in this market.

- April 2022 - Yotta Energy announced obtaining USD 3.5 million in new capital, bringing its total Series A funding to USD 16.5 Million. Yotta's total funding is now over USD 25.5 million due to the current funding round and award.

- October 2021 - Enphase Energy, Inc., the world's premier microinverter-based solar and battery system manufacturer, unveiled the Enphase Energy System with IQ8TM solar microinverters for clients in North America. IQ8 is Enphase's most advanced microinverter to date. Unlike rival gadgets, IQ8 can build a microgrid using sunlight throughout a power outage, delivering backup energy without a battery.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in benefits and awareness about the renewable energy sources along with increased adoption

- 4.2.2 Cost-effectiveness and increased developments of these products

- 4.3 Market Restraints

- 4.3.1 High installation and maintenance costs

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of Covid-19 on the Micro Inverter Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Single Phase

- 5.1.2 Three Phase

- 5.2 By Communication Technology

- 5.2.1 Wired

- 5.2.2 Wireless

- 5.3 By Sales Channel

- 5.3.1 Direct

- 5.3.2 Indirect

- 5.4 By Application

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 PV Power Plant

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Enphase Energy Inc.

- 6.1.2 Altenergy Power System Inc.

- 6.1.3 DARFON

- 6.1.4 ABB Ltd

- 6.1.5 Siemens AG

- 6.1.6 Zhejiang Envertech Corporation Limited

- 6.1.7 Omnik New Energy

- 6.1.8 Sunpower Corporation

- 6.1.9 ReneSolaPower

- 6.1.10 AEconversion GmbH & Co. KG

- 6.1.11 SMA Solar Technology AG

- 6.1.12 Sparq Systems

- 6.1.13 Sensata Technologies Inc.

- 6.1.14 EnluxSolar Co. Ltd

- 6.1.15 Delta Energy Systems

- 6.1.16 SolarEdge Technologies Inc.