|

市场调查报告书

商品编码

1439856

热塑性聚氨酯 (TPU) 薄膜:市场占有率分析、产业趋势与统计、成长预测 (2024-2029)Thermoplastic Polyurethane (TPU) Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

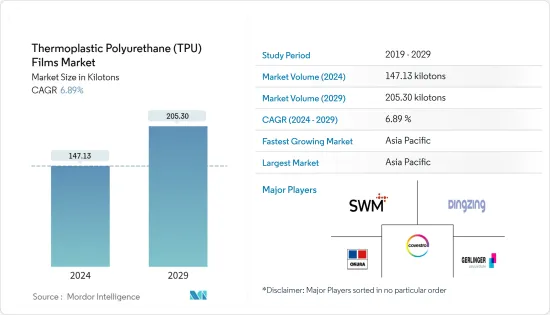

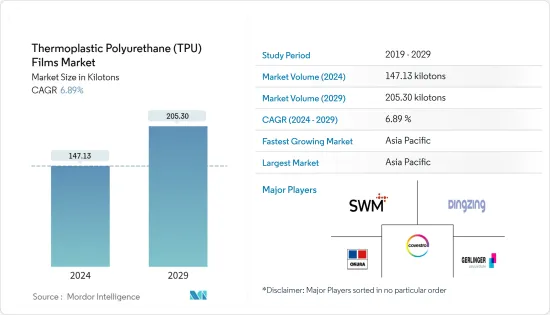

热塑性聚氨酯(TPU)薄膜市场规模预计到2024年为147,130吨,在预测期内(2024-2029年)预计到2029年将达到205,300吨,复合年增长率为6.89%。

TPU 薄膜市场受到 COVID-19感染疾病的负面影响,这对鞋类、服装和体育用品等关键最终用户产业产生了负面影响。然而,目前市场估计处于大流行前的水平,并预计将稳步增长。

主要亮点

- 推动市场成长的主要因素是鞋类和服装业的使用量不断增加。

- 同时,原材料价格上涨预计将影响未来几年的市场成长。

- 生物基 TPU 薄膜的潜力可以作为预测期内探索的市场机会。

- 亚太地区是最大的市场,预计在预测期内将以最高的复合年增长率成长。

热塑性聚氨酯(TPU)薄膜市场趋势

鞋类和服装主导市场

- TPU(热塑性聚氨酯)是一种极为耐用且弹性的塑胶。这种高品质材料具有无与伦比的耐磨性、减震性、光滑表面的抓地力和重量轻。

- 发泡TPU薄膜非常适合用作安全鞋、高山靴、登山靴等鞋子外侧的防滑、耐磨保护套。 TPU 是一种流行的整形外科鞋垫材料,因为即使在潮湿时它也能保持其独特的性能。

- 根据世界鞋业统计,2020年全球鞋类产量为205亿双,但2021年全球鞋类产量为222亿双。 2021年,中国成为全球最大的鞋类生产国,其次是印度、越南、印尼和巴西。

- 全球鞋业持续温和成长。许多主要鞋业公司正在将製造设施迁往亚洲,理由是亚太地区新兴国家拥有廉价劳动力和不断增长的需求。

- 鞋类业务高度集中在亚洲,近九成的鞋是在亚洲生产的。

- 品牌知名度的提高和对创新设计日益浓厚的兴趣是推动鞋类产业发展的主要因素。

- 欧洲鞋类生产和消费也逐渐增加,预计将推动TPU薄膜市场的成长。

- 亚洲新兴国家都市化水平的不断提高以及体育和音乐赛事的日益普及预计将在预测期内增加鞋类产量和 TPU 薄膜应用。

- 使用热塑性聚氨酯 (TPU) 薄膜黏合纤维和其他柔性材料。 TPU 薄膜适用于多种黏合剂应用。 TPU热熔膜,也称为黏剂,在纤维、不织布、泡棉等多种材料之间形成黏合层。

- 基于 TPU 的织物涂层广泛应用于纺织业,应用范围从无缝运动服到防弹聚酯夹克上的保护层。标籤、徽章内衬和黏剂只是 TPU 薄膜在纺织品和柔性材料中的一些可能性。 TPU薄膜用于纺织工业中的壁纸和装饰家具、工业围裙、防护外衣、医院罩衣、手套、医疗保健、商业、住宅床垫套、织物加固、装饰壁材、家具织物层压板,它还有效地用于各种应用,包括降落伞材料和用于粘合织物而不是缝纫的感压胶带。

- 根据 Industrievereinigung Chemiefaser 的数据,2021 年全球纺织纤维产量达 1.136 亿吨,而 2020 年为 1.083 亿吨。

- 中国、美国、美国等国家增加国内纺织品和服装生产的倡议预计将在预测期内促进 TPU 薄膜市场的成长。

考虑亚太地区主导市场的可能性

- 亚太地区在全球 TPU 薄膜市场中占有显着份额,预计在预测期内将主导市场。

- 中国在全球鞋业中占据主导地位,占全球鞋类总产量的60%以上。根据国家统计局数据,2021年从事皮革、毛皮和羽毛生产的企业实现收益11,057.2亿元人民币(约1,713.5亿美元),与前一年同期比较去年同期成长8.2%。

- 2022年中国鞋类市场价值为793.2亿美元,预计到2027年将达到1,068.5亿美元,预测期内复合年增长率为6.15%。

- 中国纺织品市场是全球最大的纺织品市场,2021年占全球纺织品服饰产量一半以上,占全球服装出口量30%以上。

- 印度纺织业是印度经济中最古老的产业之一。该行业高度多元化,由手纺和手织纺织部门和集中的资本密集型工厂部门组成。

- 2022财年(2021年4月至2022年3月)印度纺织品服装出口(包括手工艺品)达444亿美元,与前一年同期比较增长41%。根据印度品牌股权基金会(IBEF)预测,到2029年,印度纺织业的产值预计将达到2,090亿美元。

- 因此,在预测期内,各行业需求的成长预计将推动该地区的调查市场。

热塑性聚氨酯(TPU)薄膜产业概况

热塑性聚氨酯(TPU)薄膜市场的全球市场本质上是一体化的。市场参与者包括 Covestro AG、SWM、Gerlinger Industries GmbH、DingZing Advanced Materials Inc. 和 Oakura Industrial。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 增加在鞋类和服装业的使用

- 其他司机

- 抑制因素

- 原物料价格上涨

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争程度

第五章市场区隔(市场规模(数量))

- 化学课

- 聚酯纤维

- 聚醚

- 聚己内酯

- 最终用户产业

- 鞋类和服装

- 医疗用品

- 体育用品

- 建筑与建造

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 合併、收购、合资、合作和协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- 3M

- American Polyfilm Inc.

- Avery Dennison Corporation

- Covestro AG

- Ding Zing Advanced Materials Inc.

- Gerlinger Industries GmbH

- Huntsman International LLC

- Okura Industries Co. Ltd

- Permali Gloucester Ltd

- Schweitzer-Mauduit International Inc.

- Wiman Corporation

- The Lubrizol Corporation

第七章市场机会与未来趋势

- 生物基 TPU 的潜力

The Thermoplastic Polyurethane Films Market size is estimated at 147.13 kilotons in 2024, and is expected to reach 205.30 kilotons by 2029, growing at a CAGR of 6.89% during the forecast period (2024-2029).

The TPU films market was affected adversely by the COVID-19 pandemic owing to the negative impact on major end-user industries such as footwear and apparel and sports equipment. However, the market has been currently estimated to be at pre-pandemic levels, and it is expected to grow at a steady pace.

Key Highlights

- The major factor driving the growth of the market is the increasing usage in the footwear and apparel industry.

- On the other hand, the rising prices of raw materials are expected to impact the growth of the market during the coming years.

- The potential of bio-based TPU film is likely to act as an opportunity for the market studied in the forecast period.

- The Asia-Pacific region is the largest market, and it is expected to grow with the highest CAGR during the forecast period.

Thermoplastic Polyurethane (TPU) Films Market Trends

Footwear and Apparel to Dominate the Market

- TPUs (thermoplastic polyurethanes) are extremely durable and flexible plastics. The abrasion resistance, shock absorption, grip on slick surfaces, and low weight of this high-quality material are unrivaled.

- Foamed TPU film is ideal for use as a non-slip, wear-resistant protective covering for the outside of shoes, including safety shoes, alpine boots, and hiking boots. TPU keeps its unique qualities even when wet, making it a popular material for orthopedic insoles.

- According to World Footwear, 22.2 billion pairs of footwear were produced around the world in 2021, compared to 20.5 billion pairs of global production in 2020. China was the world's leading producer of footwear in 2021, followed by India, Vietnam, Indonesia, and Brazil.

- The footwear industry is growing at a moderate level across the world. Many major footwear companies are shifting their manufacturing facilities to Asia due to the availability of cheap labor and the increasing demand in developing countries of the Asia-Pacific.

- The footwear business is highly concentrated in Asia, where nearly nine out of ten pairs of shoes are produced.

- Increased brand awareness and growing interest in innovative designs are the major factors driving the footwear industry.

- Europe also sees a gradual uplift in footwear production and consumption, which is expected to drive the TPU film market's growth.

- The rising urbanization levels in emerging Asian countries and the increasing popularity of sporting and music events are expected to augment the footwear production and the application of TPU films during the forecast period.

- Textiles and other flexible materials are bonded using thermoplastic polyurethane (TPU) films. TPU films are suitable for a wide range of bonding applications. TPU hot-melt films, also known as hot melt adhesives, create an adhesive layer between various materials, such as textiles, nonwoven fabrics, and foam.

- TPU-based fabric coatings are widely utilized in the textile industry, with applications ranging from seamless sportswear to protective layers for bullet-proof polyester jackets. Labels, emblems backing, and adhesive are only a few possibilities for TPU films in textiles and flexible materials. TPU films have also been effectively used in various applications in the textile industry for wallcoverings or decorative furniture, industrial aprons, protective overwear, hospital gowns, gloves, healthcare, commercial, residential mattress covers, fabric reinforcement, decorative wall covering and furniture fabric lamination, parachute materials, pressure-sensitive tapes for fabric bonding instead of sewing, etc.

- According to the Industrievereinigung Chemiefaser, global production volume of textile fibers accounted for 113.6 million tons in 2021, compared to 108.3 million tons in 2020.

- Such increasing efforts toward the domestic production of textiles and apparel in countries like China, India, the United States, and Vietnam are anticipated to augment the TPU films market's growth during the forecast period.

Asia-Pacific to Dominate the Market Studied

- The Asia-Pacific region holds a prominent share of the TPU film market globally and is expected to dominate the market during the forecast period.

- China dominates the global footwear industry, accounting for over 60% of total footwear production worldwide. According to the National Bureau of Statistics, the revenues of enterprises engaged in the manufacturing of leather, fur, or feathers amounted to CNY 1,105.72 billion (~USD 171.35 billion) in 2021, which observed a growth of 8.2% Yo-Y.

- The Chinese footwear market is valued at USD 79.32 billion in 2022, and it is expected to reach USD 106.85 billion by 2027 while registering a CAGR of 6.15% in the forecast period.

- The textile market in China is the world's largest textile market accounting for more than half of the global textile and clothing production and more than 30% of worldwide apparel exports in 2021.

- India's textile sector is one of the oldest industries in the Indian economy. The industry is extremely varied and consists of hand-spun and hand-woven textile sectors as well as a capital-intensive sophisticated mills sector.

- India's textile and apparel exports (including handicrafts) stood at USD 44.4 billion in FY 2022 (April 2021 - March 2022) registering a 41% Y-o-Y increase. Morover, according to the India Brand Equity Foundation (IBEF), the textile industry in the country is expected to reach USD 209 billion by 2029.

- Thus, the rising demand from various industries is expected to drive the market studied in the region during the forecast period.

Thermoplastic Polyurethane (TPU) Films Industry Overview

The global market for thermoplastic polyurethane (TPU) films market is consolidated in nature. Some of the players in the market include Covestro AG, SWM, Gerlinger Industries GmbH, DingZing Advanced Materials Inc., and Okura Industrial Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage in the Footwear and Apparel Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Rising Prices of Raw Materials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Chemical Class

- 5.1.1 Polyester

- 5.1.2 Polyether

- 5.1.3 Polycaprolactone

- 5.2 End-user Industry

- 5.2.1 Footwear and Apparel

- 5.2.2 Medical Supplies

- 5.2.3 Sports Equipment

- 5.2.4 Building and Construction

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 American Polyfilm Inc.

- 6.4.3 Avery Dennison Corporation

- 6.4.4 Covestro AG

- 6.4.5 Ding Zing Advanced Materials Inc.

- 6.4.6 Gerlinger Industries GmbH

- 6.4.7 Huntsman International LLC

- 6.4.8 Okura Industries Co. Ltd

- 6.4.9 Permali Gloucester Ltd

- 6.4.10 Schweitzer-Mauduit International Inc.

- 6.4.11 Wiman Corporation

- 6.4.12 The Lubrizol Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential for Bio-based TPU