|

市场调查报告书

商品编码

1439857

碘:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Iodine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

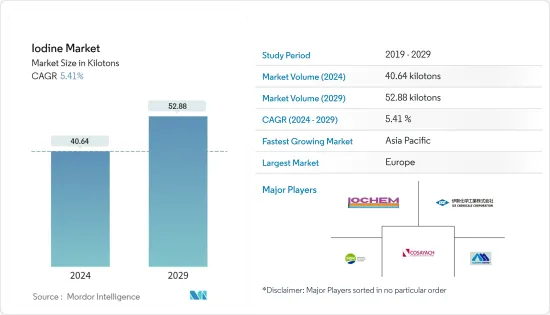

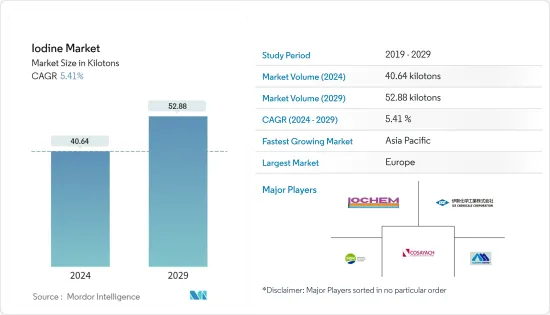

预计2024年碘市场规模为40.64千吨,预计2029年将达到52.88千吨,在预测期间(2024-2029年)复合年增长率为5.41%。

COVID-19 大流行、全球封锁、製造活动和供应链中断以及生产停顿对市场产生了负面影响。然而,由于医疗产业的需求和 2021 年的復苏情势,预测期内的市场成长轨迹已经恢復。

主要亮点

- 短期内,X射线显影剂需求的增加、碘缺乏发生率的增加以及碘衍生物的广泛应用预计将推动碘需求。

- 然而,碘毒性和过量摄取导致的健康相关问题是市场研究的主要限制因素。

- 然而,对除生物剂不断增长的需求预计将是一个机会。

- 从应用来看,由于越来越多地使用碘来治疗甲状腺肿等疾病,医疗领域预计将主导市场。

- 欧洲主导全球碘市场,德国、英国和法国等国主要消费碘。

碘市场趋势

医疗领域占市场主导地位

- 碘是稳定卤素中最重的化学元素。在标准状态下,它是一种闪亮的紫黑色非金属固体,在温和的热量下很容易昇华。

- 在医疗领域用于X光显影剂、药品、碘剂、优碘(消毒剂)等。近年来,由于对 X 光显影剂、低毒性、高原子序数以及易于与有机化合物结合的需求不断增加,对碘的需求增加。

- 此外,带碘化合物是含有碘和增溶剂的溶液。这会缓慢地将少量碘释放到溶液中。最广泛使用的碘剂之一是优碘,通常用于酿酒厂和乳品加工业对錶面进行消毒。

- 医疗技术的进步正在推动这项应用对碘的需求。含碘的 X 光显影剂可提高 X 光成像过程中血管结构和器官的可见度。

- 放射性碘是治疗方法甲状腺癌的有效方法。这是因为饮料和胶囊释放的放射性碘被吸收到体内并被甲状腺癌细胞吸收。然后辐射会破坏癌细胞。

- 欧洲製药工业和协会联合会 (EFPIA) 肿瘤学平台支持欧洲的医疗创新,并提供有利的环境,为癌症患者提供新的治疗方法。该平台正在开发1,400多种癌症药物,计划于2021年启动1,300多项癌症临床试验。

- 此外,碘在医药上用于製备消毒剂、杀菌剂、镇痛剂等(例如碘酊),以及用于合成碘化钠、碘化钾、碘溶液等。

- 此外,製药业在北美最大,其次是欧洲和亚太地区。目前,在印度、中国、印尼等亚太国家,学名药生产在地区药品生产中占据主导地位,製药业的成长正在快速发展。

- 根据IBEF预测,印度国内医药市场预计2021年将达420亿美元,2030年将达120-1300亿美元。

- 由于此类倡议、研究和开发以及医疗部门的强劲需求,预计预测期内对碘的需求将增加。

欧洲主导市场

- 由于德国、英国、英国等国消费量的增加,欧洲已成为碘消费的主要市场。

- 德国是世界上最大的经济强国之一。医疗技术的进步和对饲料的巨大需求正在推动该国的碘需求。

- 根据Altech Agri-Food Outlook 2022,2021年中国饲料产量约2,451万吨,而2020年为2,493万吨。

- 该国的公司包括 AGRAVIS Raiffeisen AG、DTC Deutsche Tiernahrung Cremer GmbH &Co.KG、H. Broring GmbH &Co.KG、MEGA Tierernahrung GMBH &Co.KG 和 Rothkotter-Mischfutterwerk。

- 然而,2021年,配合饲料生产受到畜禽传染性疾病禽流感(AI)蔓延的严重影响。总体而言,该国饲料产业成长保持平稳,预计 2022 年将实现成长。因此,这样的趋势也影响了年内国内的碘需求。

- 预计在预测期内,老年人口的增加和对治疗慢性病的医疗保健设施的需求不断增加将支持该国製药业和药品製造碘消耗的增长。

- 此外,英国製药业正在加速投资研发、创新和建立更多国内製造地。

- 英国医药市场位居全球前10位,约占全球医药产业的2.5%。在英国生产的药品中,41% 用于出口,30% 用于国内市场,其余 (28%) 是用于生产其他药品的材料。

- 英国国家统计局数据显示,2022年5月基本药物产量较上季成长3.2%。此外,2021年第四季度,基本药物和药物製剂产量较2021年第三季成长12.5%。

- 截至2021年6月1日,英国绵羊和羔羊数量持续年减2.7%至1463万头。然而,生猪(424万头)和家禽(14,108万头)分别成长5.4%和5%。因此,随着饲料成分的增加,动物饲料的消费量也预计会增加。

- 法国国内药品市场监管严格,符合报销资格的药品约占销售额的30%。学名药製造商与品牌药製造商之间存在着激烈的竞争。

碘工业概况

市场趋于整合,前四家公司约占全球市场的 70%。市场主要企业(排名不分先后)包括 SQM SA、ISE CHEMICALS CORPORATION、Cosayach、Iochem Corporation 和 Algorta Norte。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- X射线显影剂需求增加

- 碘缺乏症增加

- 碘衍生物的广泛应用

- 抑制因素

- 碘毒性和健康问题

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 酱

- 地下卤水

- 卡利甚矿石

- 回收

- 海藻

- 型态

- 无机盐和错合

- 有机化合物

- 元素和同位素

- 目的

- 动物饲料

- 医疗用途

- 除生物剂

- 光学偏光片

- 氟化学

- 尼龙

- 其他用途(人类营养和催化剂)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- ACF Minera SA

- American Elements

- Algorta Norte SA

- Calibre Chemicals Pvt. Ltd

- Cosayach

- Deep Water Chemicals

- Eskay Iodine

- Glide Chem Private Limited

- GODO SHIGEN Co. Ltd

- Infinium Pharmachem Pvt. Ltd

- Iochem Corporation

- Iofina PLC

- ISE Chemicals Corporation

- Itochu Chemical Frontier Corporation

- Kanto Natural Gas Development Co. Ltd

- NIPPOH CHEMICALS CO. LTD

- Parad Corporation Pvt. Ltd

- Protochem

- Salvi Chemical Industries Ltd

- Samrat Pharmachem Limited

- SQM SA

- Toho Earthtech inc.

- Unilab Chemicals & Pharmaceuticals Pvt. Ltd.

第七章 市场机会及未来趋势

- 除生物剂使用需求不断成长

The Iodine Market size is estimated at 40.64 kilotons in 2024, and is expected to reach 52.88 kilotons by 2029, growing at a CAGR of 5.41% during the forecast period (2024-2029).

The COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market. However, the demand from the medical industry and recovery conditions in 2021 restored the market's growth trajectory during the forecast period.

Key Highlights

- Over the short term, the increasing demand for X-ray contrast media, growing iodine deficiency among people, and vast applications of iodine derivatives are expected to drive the demand for iodine.

- However, the toxicity of iodine and health-related issues due to excessive consumption pose major restraints in the market studied.

- Nevertheless, the rising demand for biocides is expected to act as an opportunity.

- By application, the medical sector is expected to dominate the market, owing to the increase in the usage of iodine to cure diseases like goiter.

- Europe dominates the global iodine market, with major consumption in countries such as Germany, the United Kingdom, and France.

Iodine Market Trends

Medical Segment to Dominate the Market

- Iodine is a chemical element that is the heaviest among all stable halogens. It is a lustrous, purple-black, non-metallic solid at standard conditions, sublimating easily with gentle heat.

- In the medical sector, the application of iodine includes X-ray contrast media, pharmaceuticals, iodophors, and povidone-iodine (disinfectants). Demand for iodine has increased over the past few years due to the rising need for X-ray contrast media, its low toxicity, high atomic number, and ease of adjunction with organic compounds.

- Further, iodophors are solutions that contain iodine and a solubilizing agent. This way, a small amount of iodine is slowly released into the solution. One of the most widely used iodophors is povidone-iodine, often used to disinfect surfaces in breweries and dairy industries.

- The development of medical technologies has propelled the demand for iodine in this application. The radiographic contrast media containing iodine enhances the visibility of vascular structures and organs during radiographic procedures.

- Radioactive iodine is an effective type of treatment for cancer of the thyroid gland. This is because the radioactive iodine from the drink or capsule is absorbed into the body and picked up by the thyroid cancer cells, even if they have spread to other parts of the body. The radiation then destroys the cancer cells.

- The European Federation of Pharmaceutical Industries and Associations' (EFPIA) oncology platform provides an environment to support medical innovation in Europe and help deliver new treatments to benefit of people living with cancer. Under this, research continues at pace with over 1,400 cancer medicines in development and over 1,300 oncology clinical trials started in 2021.

- Moreover, iodine is used in pharmaceuticals to prepare disinfectants, bactericides, and analgesics, among others (for example, tincture of iodine), which is used in synthesizing sodium iodide, potassium iodide, and iodine solution.

- Furthermore, the pharmaceutical industry stands to be the largest in North America, followed by Europe and Asia-Pacific. Currently, in Asia-Pacific countries, such as India, China, and Indonesia, the pharmaceutical industry's growth is fast-paced and quickly evolving, with generic drug production dominating regional pharmaceutical production.

- According to the IBEF, India's domestic pharmaceutical market is USD 42 billion in 2021 and is expected to reach USD 120-130 billion by 2030.

- With such initiatives, research and development, and heavy demand from the medical sector, the demand for iodine is expected to increase in the forecast period.

Europe to Dominate the Market

- Europe is the major market for iodine consumption, owing to increasing consumption from countries such as Germany, the United Kingdom, and France, among others.

- Germany is one of the world's largest and most powerful economies. The development of medical technologies and the huge demand for animal feed have propelled the demand for iodine in the country.

- According to Altech Agri-Food Outlook 2022, the country produced around 24.51 million metric tons of feed in 2021, compared to 24.93 million metric tons in 2020.

- The country is home to about five of the world's largest animal feed manufacturers, including AGRAVIS Raiffeisen AG, DTC Deutsche Tiernahrung Cremer GmbH & Co. KG, H. Broring GmbH & Co. KG, MEGA Tierernahrung GMBH & Co. KG, and Rothkotter-Mischfutterwerk.

- However, in 2021, compounded feed production has been severely affected due to the spread of the animal disease Avian Influenza (AI). Overall, the country was likely to experience flattened growth in the feed industry, with expectations of growth in 2022. Hence, such trends have also impacted the demand for iodine in the country during the year.

- The increasing geriatric population and the increasing requirement for medical facilities for the treatment of chronic diseases are expected to support the growth of the pharmaceutical sector and the consumption of iodine for the production of medicines in the country over the forecast period.

- Further, the pharmaceutical industry in the United Kingdom is accelerating with investments in research and development or innovations and in the addition of manufacturing sites in the country.

- The United Kingdom's pharmaceutical market is among the global top 10 national markets, holding some 2.5% of the global pharmaceutical sector. Of all the pharmaceutical products produced in the United Kingdom, 41% are exported, 30% are for the domestic market, and the remaining (28%) are substances that are used in the production of other pharmaceutical products.

- According to Office for National Statistics (United Kingdom), the manufacturing of basic pharmaceutical products increased by 3.2% in May 2022, compared to the previous month. Moreover, in Q4 2021, the manufacturing of basic pharmaceutical products and pharmaceutical preparations has increased by 12.5% compared to Q3 2021.

- As on June 1, 2021, the United Kingdom continued to observe a decline in the population of sheep and lambs by 2.7% to 14.63 million compared to the same period last year. However, the population of pigs (4.24 million) and poultry (141.08 million) recorded growth of 5.4% and 5%, respectively. Hence, the consumption of animal feed is also expected to increase in the country with growth in feedstock.

- The French domestic pharmaceutical market is highly regulated, particularly for reimbursable drugs, which account for approximately 30% of sales. Generic drug manufacturers compete fiercely with brand-name drug manufacturers.

Iodine Industry Overview

The market studied is consolidated, with the top four players accounting for about ~70% of the global market. Major companies (not in any particular order) in the market include SQM SA, ISE CHEMICALS CORPORATION, Cosayach, Iochem Corporation, and Algorta Norte.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand in X-ray Contrast Media

- 4.1.2 Growing Iodine Deficiency among People

- 4.1.3 Vast Applications of Iodine Derivatives

- 4.2 Restraints

- 4.2.1 Toxicity of Iodine and Health-related Issues

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Source

- 5.1.1 Underground Brine

- 5.1.2 Caliche Ore

- 5.1.3 Recycling

- 5.1.4 Seaweeds

- 5.2 Form

- 5.2.1 Inorganic Salts and Complexes

- 5.2.2 Organic Compounds

- 5.2.3 Elementals and Isotopes

- 5.3 Application

- 5.3.1 Animal Feeds

- 5.3.2 Medical

- 5.3.3 Biocides

- 5.3.4 Optical Polarizing Films

- 5.3.5 Fluorochemicals

- 5.3.6 Nylon

- 5.3.7 Other Applications (Human Nutrition and Catalysts)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACF Minera SA

- 6.4.2 American Elements

- 6.4.3 Algorta Norte SA

- 6.4.4 Calibre Chemicals Pvt. Ltd

- 6.4.5 Cosayach

- 6.4.6 Deep Water Chemicals

- 6.4.7 Eskay Iodine

- 6.4.8 Glide Chem Private Limited

- 6.4.9 GODO SHIGEN Co. Ltd

- 6.4.10 Infinium Pharmachem Pvt. Ltd

- 6.4.11 Iochem Corporation

- 6.4.12 Iofina PLC

- 6.4.13 ISE Chemicals Corporation

- 6.4.14 Itochu Chemical Frontier Corporation

- 6.4.15 Kanto Natural Gas Development Co. Ltd

- 6.4.16 NIPPOH CHEMICALS CO. LTD

- 6.4.17 Parad Corporation Pvt. Ltd

- 6.4.18 Protochem

- 6.4.19 Salvi Chemical Industries Ltd

- 6.4.20 Samrat Pharmachem Limited

- 6.4.21 SQM SA

- 6.4.22 Toho Earthtech inc.

- 6.4.23 Unilab Chemicals & Pharmaceuticals Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand in Usage of Biocides