|

市场调查报告书

商品编码

1439862

交联剂 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Crosslinking Agents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

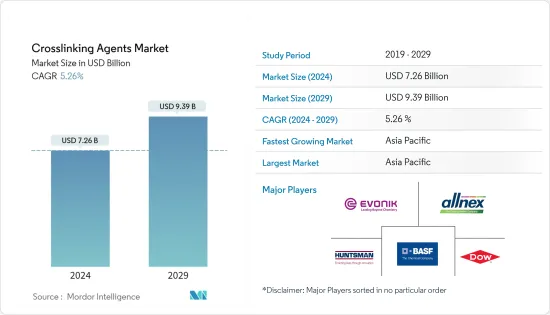

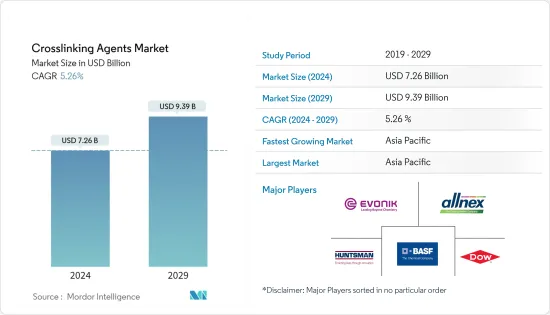

交联剂市场规模预计到2024年为72.6亿美元,预计到2029年将达到93.9亿美元,在预测期内(2024-2029年)CAGR为5.26%。

COVID-19 大流行对市场产生了负面影响,但由于全球建筑和汽车行业的强劲增长,预计在预测期内将稳步增长。

主要亮点

- 推动市场的主要因素是对各种涂料的需求不断增长以及对高性能交联剂的日益重视。

- 另一方面,自交联剂的存在可能会阻碍市场成长。

- 在预测期内,对创新涂料的需求不断增长是全球交联剂市场的重大机会。

- 亚太地区占据了市场主导地位,预计在预测期内将以最高的CAGR成长。

交联剂市场趋势

对装饰涂料的需求不断增加

- 装饰涂料适用于住宅、商业、机构和工业建筑的内部和外部表面。全球建筑业的成长反过来又增加了装饰涂料中各种交联剂的需求。

- 亚太地区的建筑业是世界上最大的。由于人口增长、中产阶级收入增加和城市化,这一数字正在以健康的速度增长。

- 中国是购物中心建设领先的国家之一。中国是购物中心建设的领先国家之一。中国拥有近 4,000 家购物中心,预计到 2025 年还将开幕 7,000 家购物中心。

- 此外,据国家发展和改革委员会称,2019年中国政府批准了26个基础设施项目,预计投资约1,420亿美元,预计将于2023年完工并正在进行中。不断增长的住房需求可能会推动该国公共和私营部门的住宅建设。

- 美国拥有世界上最大的建筑业之一。根据美国人口普查局的数据,2021 年美国新建工程年价值为 16,264.44 亿美元,而 2020 年为 14,995.70 亿美元。

- 在加拿大,各种政府项目,包括经济适用住房计划 (AHI)、加拿大新建筑计划 (NBCP) 和加拿大製造,一直在支持该行业的扩张。

- 根据 AIA(美国建筑师协会)建筑共识预测小组的数据,非住宅建筑支出预计将在 2022 年增长 5.4%,并在 2023 年增长至 6.1%。到 2023 年,所有主要商业、工业和机构预计类别将至少出现相当健康的成长。

- 预计所有这些因素都将在预测期内推动装饰涂料的需求。

亚太地区将主导市场

- 由于中国高度发展的汽车产业,加上多年来该地区为推动建筑和各种工业领域的持续投资,预计亚太地区将主导全球市场。

- 中国政府预计,到2025 年,电动车的渗透率将达到20%。中国拥有全球最大、成长最快的电动车市场,2022 年上半年,中国大陆向客户交付了超过240 万辆电动车,相当于全球电动车销量的26%。中国的所有汽车销售。随着国内汽车产量的增加,对汽车涂料的需求可能会上升,预计这将影响交联剂市场。

- 中国汽车製造业对全球汽车产量做出了重要贡献。根据OICA统计,中国拥有全球最大的汽车生产基地,2021年汽车总产量为2,608万辆,比去年的2,523万辆成长3%。根据中国汽车工业协会统计,2022年前7个月,全国汽车产量1,457万辆,较去年同期成长31.5%。

- 在印度,根据「印度製造」改革,该国政府为跨国公司在印度设立基地提供了有利的法规。此外,製造业中外国直接投资份额的增加也可能进一步吸引外国企业的投资。因此,预计将在未来几年支持工业生产。

- 根据经济产业省(METI)的报告,2021年日本工业生产成长超过3%。该国拥有大型电子和其他零件生产基地,其中大部分出口到经济体在北美、欧洲和亚太地区。日本电子资讯科技协会(JEITA)公布的资料显示,预计到2022年底,日本电子和IT企业的全球产量将实现年比2%的正成长。

- 各种应用的油漆和涂料行业的持续成长预计将在未来几年推动交联剂市场的发展。

交联剂产业概况

就收入而言,交联剂市场本质上是部分分散的,许多参与者在市场上竞争。市场上一些主要的参与者包括(排名不分先后)赢创工业股份公司、巴斯夫、陶氏化学、亨斯曼国际有限责任公司和湛新有限公司等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 对多种涂料的需求不断增加

- 越来越关注高性能交联剂

- 限制

- 自交联剂的存在

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争程度

第 5 章:市场区隔(市场价值规模)

- 类型

- 酰胺

- 胺

- 氨基

- 碳二亚胺

- 异氰酸酯

- 其他类型

- 应用

- 汽车涂料

- 装饰涂料

- 工业涂料

- 包装涂料

- 其他应用

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 领先企业采取的策略

- 公司简介

- BASF SE

- Aditya Birla Chemicals

- Allnex GMBH

- Covestro AG

- Evonik Industries AG

- Hexion

- Huntsman International LLC

- Dow

- Wanhua Chemical Group Co. Ltd

- Nisshinbo Chemical Inc.

- NIPPON SHOKUBAI CO. LTD

- Mitsubishi Chemical Corporation

- KUMHO P&B CHEMICALS INC.

第 7 章:市场机会与未来趋势

- 对创新涂料的需求

The Crosslinking Agents Market size is estimated at USD 7.26 billion in 2024, and is expected to reach USD 9.39 billion by 2029, growing at a CAGR of 5.26% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market but is projected to grow steadily in the forecast period owing to strong global growth in the construction and automotive sectors.

Key Highlights

- The major factors driving the market are rising demand for various coatings and an increased emphasis on high-performance crosslinking agents.

- On the other hand, the presence of self-crosslinking agents might hamper the market growth.

- During the forecast period, the increasing demand for innovative coatings is a major opportunity in the global crosslinking agent market.

- Asia-Pacific has dominated the market and is expected to grow with the highest CAGR during the forecast period.

Crosslinking Agents Market Trends

Increasing Demand for Decorative Coatings

- Decorative coatings are applied to the interior and exterior surfaces of residential, commercial, institutional, and industrial buildings. The increase in the construction sector worldwide is, in turn, boosting the demand for various crosslinking agents in decorative coatings.

- The construction sector in the Asia-Pacific region is the largest in the world. It is increasing at a healthy rate, owing to the rising population, increase in middle-class income, and urbanization.

- China is one of the leading countries concerning the construction of shopping centers. China is one of the leading countries in shopping-center construction. China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025.

- Moreover, according to National Development and Reform Commission, the Chinese government approved 26 infrastructure projects at an estimated investment of about USD 142 billion in 2019, which are estimated to be completed by 2023 and are ongoing. The growing demand for housing is likely to drive residential construction in the country, both in the public and private sectors.

- The United States has one of the world's largest construction industries. According to the United States Census Bureau, the annual value for new construction put in place in the United States accounted for USD 1,626,444 million in 2021, compared to USD 1,499,570 million in 2020.

- In Canada, various government projects, including the Affordable Housing Initiative (AHI), New Building Canada Plan (NBCP), and Made in Canada, have been supporting the expansion of the sector.

- According to the AIA (American Institute of Architects) Construction Consensus Forecast Panel, nonresidential building construction spending is expected to expand by 5.4% in 2022 and strengthen to a 6.1% expansion in 2023. By 2023, all the major commercial, industrial, and institutional categories are projected to witness at least reasonably healthy gains.

- All such factors are anticipated to drive the demand for decorative coating during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the global market, owing to the highly developed automotive sector in China, coupled with the continuous investments done in the region to advance the architectural and various industrial sectors through the years.

- The government of China estimates a 20% penetration rate of electric vehicles by 2025. China has the largest and fastest-growing EV market in the world, In H1 2022, over 2.4 million EVs were delivered to customers in mainland China equating to 26% of all car sales in China. With the increasing production of vehicles in the country, the demand for automotive coating is likely to ascend, which is anticipated to influence the market for crosslinking agents.

- Automobile manufacturing in China is a significant contributor to global automobile production. According to OICA, China has the largest automotive production base in the world, with a total vehicle production of 26.08 million units in 2021, registering an increase of 3% compared to 25.23 million units produced last year. Further, according to the China Association of Automobile Manufacturers (CAAM), in the first 7 months of 2022, the country has produced 14.57 million units of cars, registering a growth rate of 31.5% Year on Year.

- In India, under the Make in India reform, the government of the country has offered favorable regulations for multinationals to set up their bases in India. Moreover, an increase in FDI share in the manufacturing industry is further likely to attract investments by foreign players. Thereby, it is expected to support industrial production in the upcoming years.

- As per the reports by the Ministry of Economy Trade and Industry (METI), industrial production in Japan increased by over 3% in 2021. The country has a large production base for electronics and other components, the majority of which is exported to the economies in North America, Europe, and Asia-Pacific. According to the data published by the Japan Electronics and Information Technology (JEITA), Global production by Japanese electronics and IT companies is expected to record positive growth of 2% year on year by the end of 2022.

- Continuous growth in the paint and coatings industry for various applications is expected to drive the market for crosslinking agents through the years to come.

Crosslinking Agents Industry Overview

The crosslinking agents market is partially fragmented in nature in terms of revenue with many players competing in the market. Some of the major players in the market include (not in any particular order) Evonik Industries AG, BASF SE, Dow, Huntsman International LLC, and Allnex GMBH, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demad for Numerous Coatings

- 4.1.2 Increasing Focus on High-Performance Crosslinking Agents

- 4.2 Restraints

- 4.2.1 Presence of Self-Crosslinking Agents

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Amide

- 5.1.2 Amine

- 5.1.3 Amino

- 5.1.4 Carbodiimide

- 5.1.5 Isocyanate

- 5.1.6 Other Types

- 5.2 Application

- 5.2.1 Automotive Coatings

- 5.2.2 Decorative Coatings

- 5.2.3 Industrial Coatings

- 5.2.4 Packaging Coatings

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Aditya Birla Chemicals

- 6.4.3 Allnex GMBH

- 6.4.4 Covestro AG

- 6.4.5 Evonik Industries AG

- 6.4.6 Hexion

- 6.4.7 Huntsman International LLC

- 6.4.8 Dow

- 6.4.9 Wanhua Chemical Group Co. Ltd

- 6.4.10 Nisshinbo Chemical Inc.

- 6.4.11 NIPPON SHOKUBAI CO. LTD

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 KUMHO P&B CHEMICALS INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Demand for Innovative Coatings