|

市场调查报告书

商品编码

1439869

聚偏二氯乙烯 (PVDC) 涂布薄膜:市场占有率分析、产业趋势与统计、成长预测 (2024-2029)Polyvinylidene Chloride (PVDC) Coated Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

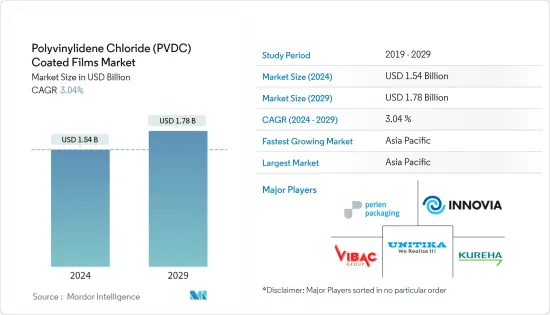

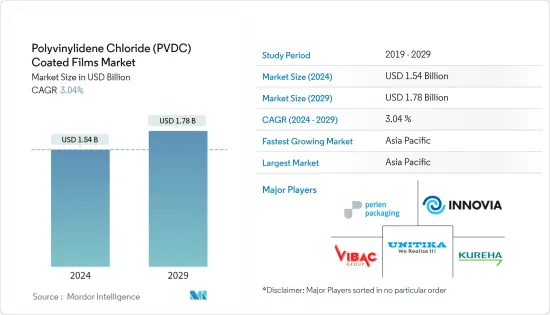

聚偏二氯乙烯(PVDC)涂层薄膜市场规模预计2024年为15.4亿美元,预计到2029年将达到17.8亿美元,预计在预测期内(2024-2029年)将以年复合成长率为3.04 %。

2020年,新型冠状病毒(COVID-19)对市场产生了负面影响。然而,目前估计市场已达到大流行前的水平,并预计将继续稳定成长。

主要亮点

- 推动所研究市场的主要因素是加工食品产业的成长以及食品包装中对 PVDC 涂层薄膜的需求不断增加。

- 另一方面,替代品的可用性预计将阻碍预测期内的市场成长。

- 回收含有 PVDC 的薄膜结构的新技术的开发预计将为市场成长提供各种有利可图的机会。

- 预计亚太地区将主导全球市场,最大的消费来自中国、日本和印度。

PVDC涂膜市场趋势

食品包装中的应用不断增加

- 食品包装领域占据了包装行业的大部分市场。由于 PVDC 涂层薄膜具有高耐化学性、惰性和低气味等优异性能,预计该细分市场将占据主导地位。

- PVDC 涂层薄膜光学透明、高光泽,并且具有与金属化薄膜相当的氧气和湿气阻隔性能。 PVDC 对许多化学物质(如油脂和油)也具有高度耐受性。

- PVDC 涂层薄膜因其低拉伸、良好的黏合强度和低吸水性而用于食品包装。它还具有出色的黏合强度,使其成为食品包装应用的理想选择。

- 根据美国农业部统计,2021年印度包装有机食品和饮料的总消费额为9,600万美国。美国农业部预测,2022年总消费量将增加至1.08亿美元。

- 食品包装在保存食品并将其运送到需要的地方而不影响味道或品质方面发挥着重要作用。保护内容物免受毒素和湿气的影响,防止溢出和篡改,并保持形状和品质。

- 根据联合国粮食及农业组织预测,2022年全球肉类产量将达到约3.6亿吨,较2021年增加1.2%。随着预测期内需求的增加,全球肉类供应量预计将扩大,到 2031 年将达到 3.77 亿吨。

- 因此,由于食品包装行业的成长,预计预测期内对 PVDC 涂层薄膜的需求将会增加。

亚太地区主导市场

- 预计亚太地区将在预测期内主导 PVDC 涂层薄膜市场。由于中国、印度和日本等国家的高需求,PVDC 涂层薄膜市场正在成长。

- 根据中国政府报告,中国包装产业预计将实现近 6.8% 的惊人成长率,到 2025 年将达到 2 兆元(2,900 亿美元)。中国拥有全世界最大的食品工业。

- 由于微波炉、零食和冷冻食品等食品行业的客製化和软包装兴起以及出口的增加,预计该国在预测期内将持续成长。这将增加对创新包装的需求,并在预测期内推动 PVDC 涂层薄膜市场的发展。

- 根据印度包装工业协会(PIAI)的数据,印度包装产业是印度经济的第五大产业。该协会预测,到2025年,包装产业的产值将达到2,048.1亿美元。这可能会增加预测期内对 PVDC 涂层薄膜的需求。

- 日本目前是全球第三大、成长最快的电子商务市场之一。日本政府预计,到2023年,日本电商市场收益预计将达2,322亿美元,2023年至2027年预计年增率为11.23%,市场规模预估为3,554亿美元。电子商务在该国的日益渗透预计将增加预测期内对 PVDC 涂层薄膜的需求。

- 上述因素和政府支持可能会导致预测期内 PVDC 涂层薄膜的需求增加。

PVDC涂布膜产业概况

聚偏二氯乙烯(PVDC)涂层薄膜市场本质上是分散的。市场主要企业包括(排名不分先后)Innovia Films、KUREHA CORPORATION、UNITIKA LTD、Vibac Group Spa、Perlen Packaging 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 不断发展的加工食品工业

- PVDC涂膜在生肉包装的应用

- 抑制因素

- 确保更换

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 片基类型

- 双轴延伸聚丙烯(BOPP)

- 聚对苯二甲酸乙二酯(PET)

- 聚氯乙烯(PVC)

- 其他薄膜基材类型

- 目的

- 食品包装

- 药品泡壳包装

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介

- ACG

- Cosmo Films

- Innovia Films

- Jindal Poly Films Limited

- Kaveri Metallising &Coating Ind. Private Limited

- Perlen Packaging

- POLINAS

- UNITIKA LTD

- Vibac Group Spa

- Glenroy Inc.

- KUREHA CORPORATION

- Asahi Kasei Corporation

- Huawei Pharma Foil Packaging

- Klockner Pentaplast

- Liveo Research

- Polyplex

- Qingdao Kingchuan Packaging

- RMCL

- Solvay

- Tekni-Plex Inc.

- Tipack Group

- Transparent Paper Ltd.

- Valtec Italia SRL

- Bilcare Limited

- Caprihans India Limited

第七章市场机会与未来趋势

- 扩大 PVDC 回收研究

The Polyvinylidene Chloride Coated Films Market size is estimated at USD 1.54 billion in 2024, and is expected to reach USD 1.78 billion by 2029, growing at a CAGR of 3.04% during the forecast period (2024-2029).

In 2020, COVID-19 had a detrimental effect on the market. However, the market has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the future.

Key Highlights

- The major factors driving the market studied are the growing processed food industry and the increasing demand for PVDC-coated films in food packaging.

- On the other hand, the availability of substitutes is expected to hinder the growth of the market during the forecast period.

- Developing new technologies to recycle film structures involving PVDC is expected to offer various lucrative opportunities for market growth.

- Asia-Pacific is expected to dominate the global market, with the largest consumption coming from China, Japan, and India.

PVDC Coated Films Market Trends

Increasing Application in Food Packaging

- The food packaging segment captures the major portion of the market regarding the packaging sector. This segment is expected to dominate the market, owing to the superior properties of PVDC-coated films, such as their high chemical resistance, inertness, and low odor.

- PVDC-coated films are optically clear with a high degree of gloss and have oxygen and moisture barrier properties comparable to metalized films. PVDC is also highly resistant to many chemicals, including grease and oil.

- PVDC-coated films are used for packaging food as they have low stretch, excellent bond strength, and low water absorption. They also have good cling properties, making them an ideal choice for food wrapping applications.

- According to the United States Department of Agriculture, the total consumption value of packaged organic food and beverages in India in 2021 was 96 million US dollars. In 2022, the USDA projected that the total consumption value would increase to 108 million dollars.

- Food packaging plays an essential role in preserving and transporting food items to the required location without affecting the taste or quality. It protects the contents from toxins and moisture, prevents spillage and tampering, and helps retain their shape and quality.

- According to the Food and Agriculture Organization, world meat production reached around 360 million metric tons in 2022, up by 1.2 percent from 2021. Global meat supply will expand to meet rising demand over the projection period, reaching 377 million tons by 2031.

- Hence, owing to the growing food packaging sector, the demand for PVDC-coated films is expected to increase over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market for PVDC-coated films during the forecast period. Due to the high demand from countries like China, India, and Japan, the market for PVDC-coated films is growing.

- The packaging industry in China is expected to register tremendous growth with a growth rate of nearly 6.8%, reaching CNY 2 trillion (USD 290 billion) by 2025, as per the report of the Chinese government. China has one of the largest food industries in the world.

- The country is expected to witness consistent growth during the forecast period due to the rise of customized and flexible packaging in the food segment, like microwave, snack, and frozen foods, along with increasing exports. This has increased the demand for innovative packaging, which in turn will boost the PVDC-coated films market during the forecasted period.

- According to the Packaging Industry Association of India (PIAI), the country's packaging sector is the fifth largest sector of India's economy. The association has predicted that the packaging sector will reach USD 204.81 billion by 2025. This will likely boost the demand for PVDC-coated films during the forecasted period.

- Japan is currently the world's 3rd-largest and one of the fastest-growing e-commerce markets globally. As per the government of Japan, revenue in the e-commerce market in Japan is expected to generate USD 232.20 billion by 2023 and is further expected to register a 11.23% annual rate between 2023 and 2027, resulting in a market volume of USD 355.40 billion by 2027. The increasing penetration of e-commerce in the country is anticipated to enhance the demand for PVDC-coated films during the forecasted period.

- The factors above, coupled with government support, may contribute to the increasing demand for PVDC-coated films during the forecast period.

PVDC Coated Films Industry Overview

The polyvinylidene chloride (PVDC) coated films market is fragmented in nature. Some of the major players in the market include Innovia Films, KUREHA CORPORATION, UNITIKA LTD, Vibac Group S.p.a., and Perlen Packaging, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Processed Food Industry

- 4.1.2 Usage Of PVDC Coated Films In Fresh Meat Packaging

- 4.2 Restraints

- 4.2.1 Availability of Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Film Substrate Type

- 5.1.1 Bi-axially Oriented Polypropylene (BOPP)

- 5.1.2 Polyethylene Terephthalate (PET)

- 5.1.3 Polyvinyl Chloride (PVC)

- 5.1.4 Other Film Substrate Types

- 5.2 Application

- 5.2.1 Food Packaging

- 5.2.2 Pharmaceutical Blister Packaging

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACG

- 6.4.2 Cosmo Films

- 6.4.3 Innovia Films

- 6.4.4 Jindal Poly Films Limited

- 6.4.5 Kaveri Metallising & Coating Ind. Private Limited

- 6.4.6 Perlen Packaging

- 6.4.7 POLINAS

- 6.4.8 UNITIKA LTD

- 6.4.9 Vibac Group S.p.a.

- 6.4.10 Glenroy Inc.

- 6.4.11 KUREHA CORPORATION

- 6.4.12 Asahi Kasei Corporation

- 6.4.13 Huawei Pharma Foil Packaging

- 6.4.14 Klockner Pentaplast

- 6.4.15 Liveo Research

- 6.4.16 Polyplex

- 6.4.17 Qingdao Kingchuan Packaging

- 6.4.18 RMCL

- 6.4.19 Solvay

- 6.4.20 Tekni-Plex Inc.

- 6.4.21 Tipack Group

- 6.4.22 Transparent Paper Ltd.

- 6.4.23 Valtec Italia SRL

- 6.4.24 Bilcare Limited

- 6.4.25 Caprihans India Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Research on Recycling PVDC