|

市场调查报告书

商品编码

1439876

3D 列印长丝:市场占有率分析、产业趋势与统计、成长预测(2024-2029 年)3D Printing Filament - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

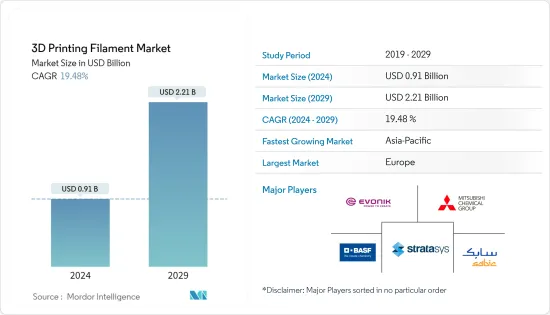

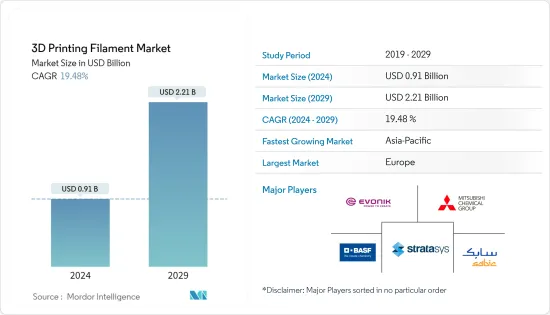

3D列印耗材市场规模预估至2024年为9.1亿美元,预估至2029年将达22.1亿美元,预测期间(2024-2029年)复合年增长率为19.48%

冠状病毒感染疾病(COVID-19)的传播导致世界各地国家封锁、製造活动和供应链中断以及生产停顿,所有这些都对 2020 年的市场产生了负面影响。它影响了我。然而,情况在 2021-2022 年开始有所改善。预计将在预测期内推动市场成长。

主要亮点

- 短期内,3D列印耗材在製造应用中的使用增加以及与3D列印相关的大规模客製化将成为预测期内推动市场需求的因素。

- 另一方面,3D列印过程中的高资本投资要求阻碍了市场成长。

- 医疗领域3D列印的创新和3D列印材料的进步可能为未来3D列印耗材市场提供成长机会。

- 预计欧洲将在预测期内获得最大的市场占有率,从而主导市场。

3D列印耗材市场趋势

医疗和牙科行业的需求增加

- 医疗和牙科行业是使用3D列印耗材的主要行业。该产业约占所有 3D 列印耗材应用的 30-35%。

- 使用各种细丝的 3D 列印技术可以创建组织和类器官、手术器械、患者特定手术模型以及用于医疗和牙科行业的自订义肢。这些3D列印物件为产业的进步和发展做出了巨大贡献。

- 透过 3D 列印製造的医疗设备包括整形外科和颅骨植入、手术器械、牙冠等牙科修復体以及外部假体。

- 2022 年 8 月,工业 3D 列印解决方案公司 Nexa3D 宣布了一项倡议,透过针对牙科行业应用的 3D 列印流程的新扩展和安装来发展其数位牙科产品组合。

- 2022年8月,3D陶瓷列印公司Lithoz报告称,由于其产品订单增加,今年上半年是该公司历史上最成功的上半年。该公司提供广泛的陶瓷 3D 列印机,用于各种应用,包括医疗、牙科和工业应用。

- 由于3D列印耗材的上述所有因素,预计其市场在预测期内将快速成长。

欧洲地区主导市场

- 预计欧洲地区将主导市场。在该地区,以国内生产毛额计算,德国是最大的经济体。德国、英国和法国是世界上发展最快的新兴国家之一。

- 截至 2021 年 6 月,欧洲人均卫生技术支出为 265 欧元(约 278.47 美元)。此外,截至 2021 年 6 月,欧洲平均将国内生产总值(GDP) 的约 11% 用于医疗保健。

- 根据 MedTech Europe 的数据,欧洲有超过 33,000 家医疗科技公司。其中大多数在德国,其次是义大利、英国、法国和瑞士。大约 95% 的医疗科技产业由中小企业 (SME) 组成。

- 德国航太全国有2,300多家公司,其中最集中在德国北部。该国拥有多个飞机内装零件和材料生产基地,主要位于巴伐利亚州、不来梅州、巴登-符腾堡州和梅克伦堡-前波莫瑞州。

- 根据英国国际贸易部统计,英国电子业每年为当地经济贡献160亿英镑(约195.3亿美元)。目前,该国拥有欧洲电子设计业40%的份额。目前该行业的专业知识主要集中在积体电路 (IC)、RFID、光电子学和电子元件。

- 近年来,法国的飞机製造和组装业务有所增加,因为它是空中巴士、赛峰、巴西航空工业公司和 Daher Socata 等製造商的主要製造地。

- 法国继续计划从2019年到2025年每年增加国防预算17亿欧元(约20.8亿美元),并承诺到2025年将国防预算增加到GDP的2%。我们正在履行这项承诺。

- 所有上述因素预计将增加该地区对 3D 列印耗材的需求。

3D列印长丝产业概况

全球 3D 列印耗材市场本质上高度分散,少数大型企业控制着很大一部分市场。主要企业包括(排名不分先后)Stratasys Ltd、SABIC、 BASF SE、Evonik Industries AG 和 Mitsubishi Chemical Corporation。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 增加在製造应用的使用

- 与3D列印相关的大规模定制

- 抑制因素

- 3D列印过程需要大量资金投入

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 类型

- 金属

- 钛

- 不銹钢

- 其他金属

- 塑胶

- 聚对苯二甲酸乙二酯(PET)

- 聚乳酸(PLA)

- 丙烯腈丁二烯苯乙烯 (ABS)

- 尼龙

- 其他塑料

- 陶瓷

- 其他类型

- 金属

- 目的

- 航太和国防

- 车

- 医疗和牙科

- 电子产品

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- BASF SE

- Covestro Ag

- DOW

- DSM

- Evonik Industries Ag

- Keene Village Plastics

- Mitsubishi Chemical Corporation

- SABIC

- Solvay

- Shenzhen Esun Industrial Co. Ltd

- Stratasys

第七章市场机会与未来趋势

The 3D Printing Filament Market size is estimated at USD 0.91 billion in 2024, and is expected to reach USD 2.21 billion by 2029, growing at a CAGR of 19.48% during the forecast period (2024-2029).

The COVID-19 outbreak caused nationwide lockdowns around the world, disruption in manufacturing activities and supply chains, and production halts, all of which had a negative impact on the market in 2020. However, conditions began to improve in 2021-2022, which is expected to boost market growth during the forecast period.

Key Highlights

- Over the short term, the growing usage of 3D printing filament in manufacturing applications along with mass customization associated with 3D printing are the factors driving the market demand during the forecast period.

- On the flip side, high capital investment requirements in the 3D printing process is hindering the market's growth.

- 3D printing innovation in the medical sector and advancements in 3D printing materials may likely act as growth opportunities for the 3D printing filament market in the future.

- Europe is expected to dominate the market with largest market share in the forecast period.

3D Printing Filament Market Trends

Increased Demand from the Medical and Dental Segment

- The Medical and Dental Industry is the leading industry that uses 3D printing filaments. The industry contributes to around 30-35% of the total applications of 3D printing filaments.

- 3D printing technology using different filaments allowed the creation of tissues and organoids, surgical tools, patient-specific surgical models, and custom-made prosthetics as applications in the medical and dental industry. These 3D printed objects are significantly contributing to the advancement and development of the industry.

- Medical devices produced by 3D printing include orthopedic and cranial implants, surgical instruments, dental restorations such as crowns, and external prosthetics.

- In August 2022, Nexa3D, an industrial 3D printing solution company, announced its work on advancing its digital dentistry portfolio by making new expansions and installations for the 3D printing processes for applications in the dental industry.

- In August of 2022, Lithoz, a 3D ceramic printing reported the first half of the year as the most successful first half in its history due to the increased order of its products. The company offers a wide range of ceramic 3D printers used for various applications, including medical, dental, and industrial applications.

- Owing to all the above-mentioned factors for 3D printing filaments, its market is expected to grow rapidly over the forecast period.

Europe Region to Dominate the Market

- The European region is expected to dominate the market. In the region, Germany is the largest economy in terms of GDP. Germany, United Kingdom and France are among the fastest emerging economies globally.

- As of June 2021, in Europe, expenditure on medical technology per capita accounted for EUR 265 (~USD 278.47). Moreover, as of June 2021, an average of ~11% of gross domestic product (GDP) is spent on healthcare in Europe.

- According to MedTech Europe, over 33,000 medical technology companies are present in Europe. Most of them are located in Germany, followed by Italy, the United Kingdom, France, and Switzerland. Small and medium-sized companies (SMEs) make up around 95% of the medical technology industry.

- The German aerospace industry includes more than 2,300 firms located across the country, with northern Germany recording the highest concentration of firms. The country hosts many production bases for aircraft interior components and materials, largely in Bavaria, Bremen, Baden-Wurttemberg, and Mecklenburg-Vorpommern.

- According to the Department for International Trade, the electronics sector in the United Kingdom contributes GBP 16 billion (~USD 19.53 billion) each year to the local economy. The country currently holds 40% of the share in the available electronics design industry in Europe. Current expertise within the industry is focused on integrated circuits (ICs), RFIDs, optoelectronics, and electronic components.

- France has been witnessing an increase in aircraft manufacturing and assembly operations in recent times as it is a major manufacturing base for manufacturers such as Airbus, Safran, Embraer, and Daher-Socata.

- France is continuing with its plan to increase its defense budget by EUR 1.7 billion (~ USD 2.08 billion) per year between 2019-2025 and to fulfill its commitment to increase the defense budget to 2% of its GDP by 2025.

- All the factors mentioned above are expected to boost the demand for 3D printing filament in the region.

3D Printing Filament Industry Overview

The global 3D printing filament market is highly fragmented in nature with a few major players dominating a significant portion of the market. Some of the major companies are Stratasys Ltd, SABIC, BASF SE, Evonik Industries AG, and Mitsubishi Chemical Corporation, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage in Manufacturing Applications

- 4.1.2 Mass Customization Associated with 3D Printing

- 4.2 Restraints

- 4.2.1 High Capital Investment Requirement in 3D Printing Process

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Metals

- 5.1.1.1 Titanium

- 5.1.1.2 Stainless Steel

- 5.1.1.3 Other Metals

- 5.1.2 Plastics

- 5.1.2.1 Polyethylene Terephthalate (PET)

- 5.1.2.2 Polylactic Acid (PLA)

- 5.1.2.3 Acrylonitrile Butadiene Styrene (ABS)

- 5.1.2.4 Nylon

- 5.1.2.5 Other Plastics

- 5.1.3 Ceramics

- 5.1.4 Other Types

- 5.1.1 Metals

- 5.2 Application

- 5.2.1 Aerospace and Defense

- 5.2.2 Automotive

- 5.2.3 Medical and Dental

- 5.2.4 Electronics

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Covestro Ag

- 6.4.3 DOW

- 6.4.4 DSM

- 6.4.5 Evonik Industries Ag

- 6.4.6 Keene Village Plastics

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 SABIC

- 6.4.9 Solvay

- 6.4.10 Shenzhen Esun Industrial Co. Ltd

- 6.4.11 Stratasys