|

市场调查报告书

商品编码

1439877

固化剂 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Curing Agent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

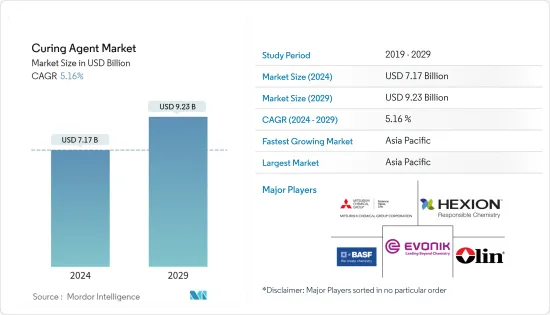

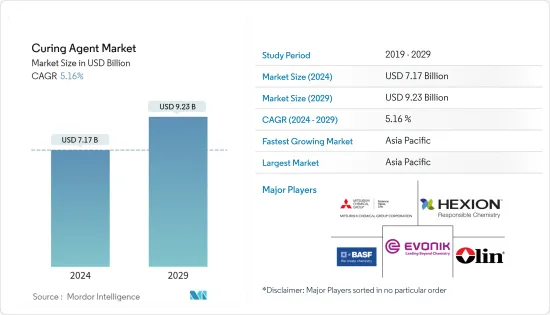

固化剂市场规模预计到2024年为71.7亿美元,预计到2029年将达到92.3亿美元,在预测期内(2024-2029年)CAGR为5.16%。

固化剂市场受到了 COVID-19 大流行的负面影响,因为生产和流动性放缓,其中油漆和涂料、建筑等行业由于遏制措施和经济状况而被迫推迟生产。干扰。目前,市场已从疫情中恢復过来。市场于2022年达到疫情前水平,预计未来将稳定成长。

油漆和涂料以及建筑行业不断增长的需求预计将推动市场成长。

然而,与固化剂相关的严格环境法规(旨在减少挥发性有机化合物(VOC)排放)预计将阻碍市场扩张。

环保型低挥发性有机化合物或无挥发性有机化合物製剂的开发预计将为市场蓬勃发展提供机会。

亚太地区主导了全球市场,其中中国、印度和日本等国家是最大的消费国。

固化剂市场趋势

建筑业对环氧固化剂的需求不断增长

- 在固化剂中,环氧固化剂用于多种应用,预计在预测期内将占据最大的市场份额。

- 在建筑业中,环氧固化剂用于生产具有耐环境性和卓越强度的热固性黏合剂。

- 环氧固化剂用于开发用于建筑的轻质复合材料,以提供建筑基础设施并克服施工挑战。

- 环氧树脂作为底漆、密封剂和防水剂被广泛用于保护混凝土免受潮湿。环氧树脂用于固化混凝土,因为它们为混凝土提供了良好的附着力、快速干燥和高机械强度。

- 根据牛津经济研究院的数据,到 2025 年,全球建筑业预计将达到 13.3 兆美元,从 2020 年起的五年增加产值 2.6 兆美元。

- 亚太地区的建筑业是世界上最大的。由于中国和印度住房建设市场的不断扩大,预计亚太地区的住房成长将达到最高。预计到 2030 年,这两个地区将占全球中产阶级的 43.3% 以上。

- 此外,根据中国国家统计局的数据,中国建筑业产值在2022年达到峰值,约4.11兆美元。结果,这些因素往往会增加市场需求。

- 因此,由于上述因素,预计所研究的市场在预测期内将显着增长。

亚太地区将主导市场

- 由于中国、印度、日本等主要国家的油漆涂料、黏合剂、建筑等行业不断扩大,预计亚太地区将在预测期内占据最大的固化剂市场。

- 固化剂用于底漆、粉末涂料和麵漆配方、轻质复合材料、砂浆、电气铸件等的生产。由于其水下固化,它们甚至适合海洋应用。

- 固化剂因其广泛的性能而可用于多种应用,例如低温或高温固化、可变的适用期、更高的强度和优异的耐腐蚀性。

- 据中国涂料工业协会称,亚太地区仍然是涂料行业的主要成长动力。中国拥有1000多家涂料企业,已成为该产业的主要参与者。

- 这种成长吸引了全球领先的涂料製造商的投资,如日本涂料、阿克苏诺贝尔、中国船舶涂料、PPG工业、巴斯夫和艾仕得涂料,这些製造商都在中国建立了製造基地。

- 2022年7月,巴斯夫欧洲公司透过其子公司巴斯夫涂料(广东)(BCG)在华南广东省江门市的涂料基地扩大了汽车修补漆的生产能力。透过本次扩建项目,公司产能达年3万吨。

- 此外,印度油漆和涂料行业在过去二十年也取得了显着成长。该产业拥有 3,000 多家涂料製造商,全球主要企业均在该国开展业务。

- 2023 年 1 月,亚洲涂料批准投资 200 亿印度卢比(2.4053 亿美元)在印度中央邦新建一座年产能 4 亿公升的水性涂料製造厂。该工厂的生产预计将在三年内投入使用。

- 因此,上述因素显示亚太市场建筑业的成长对预测期内的研究市场产生了正面影响。

固化剂产业概况

固化剂市场本质上是部分分散的。研究市场的主要参与者(排名不分先后)包括巴斯夫公司、瀚森公司、奥林公司、三菱化学公司和赢创工业公司等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 油漆和涂料行业的需求不断增长

- 建筑业对环氧固化剂的需求不断增长

- 其他司机

- 限制

- 严格的环境法规

- 其他限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场区隔(市场价值规模)

- 类型

- 环氧树脂

- 聚氨酯

- 橡皮

- 丙烯酸纤维

- 其他类型(硅胶等)

- 按应用

- 建筑与施工

- 复合材料

- 油漆和涂料

- 黏合剂和密封剂

- 电气和电子

- 其他应用(风能等)

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)**/排名分析

- 领先企业采取的策略

- 公司简介

- Alfa Chemicals

- BASF SE

- Cardolite Corporation

- DIC Corporation

- Evonik Industries AG

- Hexion

- Huntsman International LLC

- Mitsubishi Chemical Corporation

- Olin Corporation

- Supreme Polytech Pvt. Ltd.

第 7 章:市场机会与未来趋势

- 环保低VOC或无VOC固化剂的开发

- 其他机会

The Curing Agent Market size is estimated at USD 7.17 billion in 2024, and is expected to reach USD 9.23 billion by 2029, growing at a CAGR of 5.16% during the forecast period (2024-2029).

The curing agent market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility wherein industries, such as paints and coatings, building and construction, etc., were forced to delay their production due to containment measures and economic disruptions. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

The increasing demand from the paints and coatings and building and construction industries is expected to fuel market growth.

However, stringent environmental regulations associated with curing agents to reduce volatile organic compounds (VOC) emissions are anticipated to hamper market expansion.

The development of environmentally friendly low or non-VOC agents is expected to provide opportunities for the market to flourish.

The Asia-Pacific region dominated the market around the world, with countries like China, India, and Japan being the biggest consumers.

Curing Agent Market Trends

Growing Demand for Epoxy Curing Agents In Building and Construction Industry

- Among curing agents, epoxy curing agents are used for a variety of applications and are expected to account for the largest share of the market during the forecast period.

- In the construction industry, epoxy curing agents are used to produce thermosetting adhesives that provide environmental resistance and superior strength.

- Epoxy curing agents are used to develop lightweight composites for building and construction to provide architectural infrastructure and overcome construction challenges.

- Epoxy resins as primers, sealers, and waterproofing agents are extensively used to protect concrete from moisture. Epoxy resins are used in curing concrete as they provide great adhesion, fast drying, and high mechanical strength to concrete.

- According to Oxford Economics, the global construction industry is expected to reach USD 13.3 trillion by 2025 - adding USD 2.6 trillion to output in five years from 2020.

- The construction sector in the Asia-Pacific region is the largest in the world. The highest growth for housing is expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India. These two regions are expected to represent over 43.3% of the global middle class by 2030.

- Also, according to the National Bureau of Statistics of China, China's construction output peaked in 2022 at about USD 4.11 trillion. As a result, these factors tend to increase the market demand.

- Therefore, owing to such factors mentioned above, the studied market is expected to grow significantly during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to account for the largest market for curing agents during the forecast period owing to the expanding industries such as paints and coatings, adhesives, construction, etc., in major countries such as China, India, Japan, etc.

- Curing agents are used in primer, powder coating, and topcoat formulations, production of lightweight composites, mortars, electrical castings, and many more. They are even suitable for marine applications because of their underwater cure.

- Curing agents can be used for a variety of applications because of their wide range of properties, such as low or high-temperature cure, variable pot life, higher strength, and excellent corrosion resistance.

- According to the China Paint Industry Association, Asia-Pacific continues to be a major growth driver for the coatings industry. With more than 1000 coating companies in operation, China has become a major player in the industry.

- This growth has attracted investments from leading global coating manufacturers such as Nippon Paint, AkzoNobel, Chugoku Marine Paints, PPG Industries, BASF SE, and Axalta Coatings, which have established manufacturing bases in China.

- In July 2022, BASF SE, through its subsidiary BASF Coatings (Guangdong) Co., Ltd. (BCG), expanded its manufacturing capabilities for automotive refinish coatings at its coatings site in Jiangmen, Guangdong Province in South China. The company increased its production capacity to 30,000 tons annually through this expansion project.

- Further, the Indian paint and coatings industry also witnessed significant growth over the past two decades. The industry comprises more than 3,000 paint manufacturers, with the presence of major global players in the country.

- In January 2023, Asian Paints approved an investment of INR 20 billion (USD 240.53 million) for a new waterborne paint manufacturing plant with 400 million liters per annum capacity in Madhya Pradesh, India. The facility's manufacturing is expected to be commissioned in three years.

- Therefore, the factors mentioned above indicate a positive influence of the growing construction industry in the Asia-Pacific market on the studied market over the forecast period.

Curing Agent Industry Overview

The curing agent market is partially fragmented in nature. The major players in the studied market (not in any particular order) include BASF SE, Hexion, Olin Corporation, Mitsubishi Chemical Corporation, and Evonik Industries AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Paints and Coatings Industry

- 4.1.2 Growing Demand for Epoxy Curing Agents in Building and Construction Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Epoxy

- 5.1.2 Polyurethane

- 5.1.3 Rubber

- 5.1.4 Acrylic

- 5.1.5 Other Types (Silicone, etc.)

- 5.2 By Application

- 5.2.1 Building and Construction

- 5.2.2 Composites

- 5.2.3 Paints and Coatings

- 5.2.4 Adhesives and Sealants

- 5.2.5 Electrical and Electronics

- 5.2.6 Other Applications (Wind Energy, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alfa Chemicals

- 6.4.2 BASF SE

- 6.4.3 Cardolite Corporation

- 6.4.4 DIC Corporation

- 6.4.5 Evonik Industries AG

- 6.4.6 Hexion

- 6.4.7 Huntsman International LLC

- 6.4.8 Mitsubishi Chemical Corporation

- 6.4.9 Olin Corporation

- 6.4.10 Supreme Polytech Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Environmental Friendly Low or Non-VOC Curing Agents

- 7.2 Other Opportunities