|

市场调查报告书

商品编码

1689947

单向胶带:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Unidirectional Tape - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

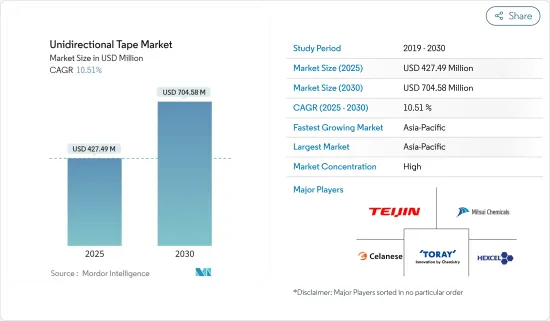

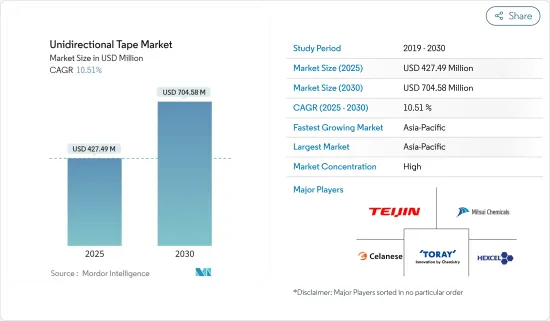

预计 2025 年单向胶带市场规模为 4.2749 亿美元,到 2030 年将达到 7.0458 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.51%。

2020 年,市场受到了新冠疫情的负面影响。目前市场已恢復至疫情前的水准。

主要亮点

- 中期推动市场发展的主要因素之一是航太工业的需求不断增长以及风能和汽车工业对单向胶带的使用不断增加。

- 另一方面,单向胶带的高製造和加工成本预计会阻碍市场成长。

- 全球主要企业加大对研发活动的投资,开发新的单向胶带产品,预计将为未来几年的市场发展提供有利机会。

- 由于航太工业製造业的不断增长,预计亚太地区将占据市场主导地位。

单向胶带的市场趋势

航太和国防工业的需求不断增长

- 单向带采用嵌入热塑性基质的玻璃或碳纤维製成,并根据特定应用进行客製化。

- 热固性 UD 胶带因其成本低、可接受性高、易于浸渍而被广泛应用于各个行业。碳纤维/环氧树脂复合材料在航太工业的广泛应用归功于其重量轻、品质高、弹性模量高、疲劳性能优异等特性。

- 由于飞机製造中复合材料的使用量不断增加,以及美国、中国、印度和英国等主要国家的政府在军事和国防方面的支出不断增加,预计全球航太材料市场将在估计和预测期内实现健康增长。

- 根据斯德哥尔摩国际和平研究所(SIPRI)的资料,2021年美国和中国的军事开支最高,分别约为8,010亿美元和2,930亿美元,其次是印度和英国,分别为766亿美元和684亿美元。

- 2021年全球军用飞机和航太製造市场价值约2,558亿美元,航太和国防领域包括波音、洛克希德、诺斯罗普·格鲁曼等主要企业。波音公司和空中巴士等多家航太相关企业加大对先进复合材料研发的投资,也支持了单向胶带市场的成长。

- 因此,由于上述因素,航太工业的单向胶带应用很可能在预测期内占据主导地位。

亚太地区占市场主导地位

- 预计亚太地区将在预测期内占据市场主导地位。中国和印度等国家的国防工业对单向磁带的需求不断增长,预计将推动该地区对单向磁带的需求。

- 单向胶带用于高性能汽车应用的轻盈、高抗衝击、高强度材料的设计。中国汽车製造业是全球最大的汽车製造业,2021 年的产量份额略高于 32.5%。该行业得到了在中国运营大型製造工厂的跨国公司的支持。

- 民航机数量的不断增长正稳步推动中国对单向带的需求。此外,未来20年,中国航空公司计划购买约7,690架新飞机,价值约1.2兆美元。

- 2021年,印度汽车产量增加了30%。这一显着增长得益于政府为促进工业生产而实施的改革以及该国终端消费者对汽车的强劲需求。根据印度汽车製造商工业(SIAM)的报告,2021 年 4 月至 2022 年 3 月期间,印度总合生产了 22,933,230 辆机动车,包括乘用车、商用车、三轮车、两轮车和四轮车。此外,「Aatma Nirbhar Bharat」和「印度製造」计画等政府改革可能会促进汽车产业的发展。

- 根据国际航空运输协会 (IATA) 的报告,预计到预测期末印度将成为世界第三大航空市场。据印度品牌股权基金会(IBEF)称,未来四年航太领域预计将吸引 3,500 亿印度卢比(约 49.9 亿美元)的投资。

- 此外,根据全球风力发电理事会(GWEC)的《2022年全球风能报告》,印度2022年及2023年的风电市场前景预计陆上风电装置容量分别为320千万瓦及410万千瓦。

- 亚太地区占据体育和休閒用品市场的大部分份额,预计在预测期内将大幅成长。

- 由于上述因素,亚太单向胶带市场预计在研究期间将大幅成长。

单向胶带产业概况

单向磁带市场本质上是整合的,五大主要企业占据了全球市场的巨大份额。主要企业(排名不分先后)包括帝人株式会社、赫氏株式会社、塞拉尼斯株式会社、东丽工业株式会社、三井化学株式会社。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 航太和国防工业的需求不断增长

- 单向胶带在风能和汽车产业的应用日益增多

- 限制因素

- 製造和加工成本高

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 加固类型

- 玻璃纤维

- 碳纤维

- 其他加固类型

- 背衬材料

- 聚醚醚酮(PEEK)

- 聚酰胺(PA)

- 聚丙烯(PP)

- 聚碳酸酯(PC)

- 聚苯硫(PPS)

- 其他背衬材料

- 黏合剂类型

- 环氧树脂

- 聚氨酯

- 其他黏合剂类型

- 最终用户产业

- 航太与国防

- 车

- 运动休閒

- 工业的

- 风力发电

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- BUFA Thermoplastic Composites GmbH & Co. KG

- Celanese Corporation

- Evonik Industries AG

- Hexcel Corporation

- Mitsui Chemicals Inc.

- Oxeon AB(TeXtreme)

- Plastic Reinforcement Fabrics Ltd

- SABIC

- SGL Carbon

- Solvay

- TCR Composites Inc.

- TEIJIN LIMITED

- TOPOLO New Materials

- TORAY INDUSTRIES INC.

- Victrex plc

第七章 市场机会与未来趋势

- 主要企业加大对新型 UD 胶带产品研发的投资

The Unidirectional Tape Market size is estimated at USD 427.49 million in 2025, and is expected to reach USD 704.58 million by 2030, at a CAGR of 10.51% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, one of the main factors driving the market is the growing demand from the aerospace and rising usage of unidirectional tape in the wind and automotive industries.

- On the flipside, high manufacturing and high processing costs of unidirectional tapes are expected to hinder the market's growth.

- Increasing Investment by major companies worldwide in R&D activities to develop new unidirectional tape products is likely to act as an opportunity for the market studied in the coming years.

- Asia-Pacific region is expected to dominate the market with increasing manufacturing from aerospace industry.

Unidirectional Tapes Market Trends

Growing Demand from the Aerospace and Defense Industry

- Unidirectional tapes are manufactured from glass or carbon fiber embedded in a thermoplastic matrix and are specifically customized based on their different applications.

- Thermoset UD tapes are generally utilized across different industries, as they are less expensive, exceptionally receptive, and have ease of impregnation. High utilization of carbon fiber/epoxy composites in the aerospace Industry inferable from their lightweight, high quality and modulus, and superb fatigue performance.

- The global aerospace materials market is estimated to witness healthy growth over the forecast period due to increasing composites' usage in aircraft manufacturing and increasing government spending on military and defense in the major countries like the United States, China, India, the United Kingdom, and so on.

- According to data by Stockholm International Peace Research Institute(SIPRI), US and China accounted for the largest military expenditure in 2021 which was valued at around USD 801.0 billion and USD 293.0 billion respectively followed by India and UK at USD 76.6 billion and USD 68.4 billionrespectively.

- The global military aircraft and aerospace manufacturing market for aerospace and defense in 2021 were valued at approximately USD 255.8 billion which includes dominant players such as Boeing, Lockheed, and Northrop Grumma. The increasing investments in the research and development (R&D) of advanced composite materials by several aerospace incumbents, like The Boeing Company, and Airbus SE, among others, is also supporting the growth of the unidirectional tapes market.

- Hence, owing to the above-mentioned factors, the application of unidirectional tape from aerospace industry is likely to dominate during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market during the forecast period. The rising demand for unidirectional tape from the defense industry in countries like China and India is expected to drive the demand for unidirectional tape in this region.

- Unidirectional tapes are used to design lightweight, high-impact, strong materials for high-performance automotive applications. The Chinese automotive manufacturing industry is the largest in the world, with a production share of just over 32.5% in 2021. The industry is supported by multinational players operating large manufacturing facilities in the country.

- The growing civil aircraft fleet steadily boosts the demand for unidirectional tape in China. Moreover, in the next 20 years, the Chinese airline companies plan to purchase about 7,690 new aircraft, which are valued at about USD 1.2 trillion.

- Automotive production in India witnessed a 30% growth in 2021. The significant growth was supported by government reforms to enhance industrial production and high demand for automobiles from the end consumers in the country. As per the reports by the Society of Indian Automobile Manufacturers, SIAM, the country produced a total of 22,933,230 vehicles, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles, between April 2021 to March 2022. Moreover, the government's reforms, such as "Aatma Nirbhar Bharat" and "Make in India" programs, are likely to boost the automotive industry.

- According to IATA (International Air Transport Association) report, India is poised to become the third-largest aviation market in the world by the end of the forecast period. In the aerospace sector, according to the India Brand Equity Foundation (IBEF), the country's aviation industry is expected to witness INR 35,000 crore (~USD 4.99 billion) investment in the next four years.

- Furthermore, according to the Global Wind Report, 2022, by the Global Wind Energy Council (GWEC), the Indian wind market outlook for 2022 and 2023 is projected at 3.2 GW and 4.1 GW of onshore wind installations respectively.

- Asia-Pacific holds a significant share in the sports and leisure equipment market, and it is expected to grow significantly during the forecast period.

- Owing to the above-mentioned factors, the market for unidirectional tape in the Asia-Pacific region is projected to grow significantly during the study period.

Unidirectional Tapes Industry Overview

The unidirectional tape market is consolidated in nature, with the top five players accounting for a significant share in the global market. Some of the major companies (not in any particular order) are TEIJIN LIMITED, Hexcel Corporation, Celanese Corporation, TORAY INDUSTRIES INC., and Mitsui Chemicals Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Aerospace and Defense Industry

- 4.1.2 Rising Usage of Unidirectional Tape in the Wind and Automotive Industries

- 4.2 Restraints

- 4.2.1 High Manufacturing and Processing Costs

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Reinforcement Type

- 5.1.1 Glass Fiber

- 5.1.2 Carbon Fiber

- 5.1.3 Other Reinforcement Types

- 5.2 Backing Material

- 5.2.1 Polyether Ether Ketone (PEEK)

- 5.2.2 Polyamide (PA)

- 5.2.3 Polypropylene (PP)

- 5.2.4 Polycarbonate (PC)

- 5.2.5 Polyphenylene Sulfide (PPS)

- 5.2.6 Other Backing Materials

- 5.3 Adhesive Type

- 5.3.1 Epoxy

- 5.3.2 Polyurethane

- 5.3.3 Other Adhesive Types

- 5.4 End-user Industry

- 5.4.1 Aerospace and Defense

- 5.4.2 Automotive

- 5.4.3 Sports and Leisure

- 5.4.4 Industrial

- 5.4.5 Wind Energy

- 5.4.6 Other End-user Industries

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BUFA Thermoplastic Composites GmbH & Co. KG

- 6.4.2 Celanese Corporation

- 6.4.3 Evonik Industries AG

- 6.4.4 Hexcel Corporation

- 6.4.5 Mitsui Chemicals Inc.

- 6.4.6 Oxeon AB (TeXtreme)

- 6.4.7 Plastic Reinforcement Fabrics Ltd

- 6.4.8 SABIC

- 6.4.9 SGL Carbon

- 6.4.10 Solvay

- 6.4.11 TCR Composites Inc.

- 6.4.12 TEIJIN LIMITED

- 6.4.13 TOPOLO New Materials

- 6.4.14 TORAY INDUSTRIES INC.

- 6.4.15 Victrex plc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Investment in R&D of Major Companies Across the Globe to Develop New UD Tape Products