|

市场调查报告书

商品编码

1440065

专业电子代工服务:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Electronics Manufacturing Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

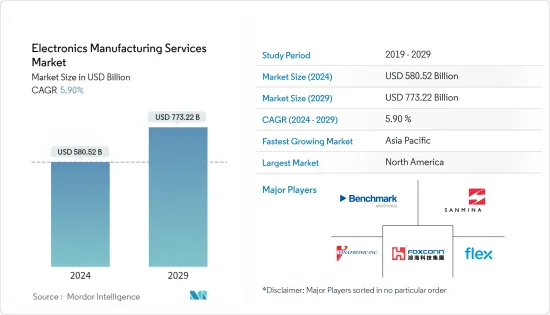

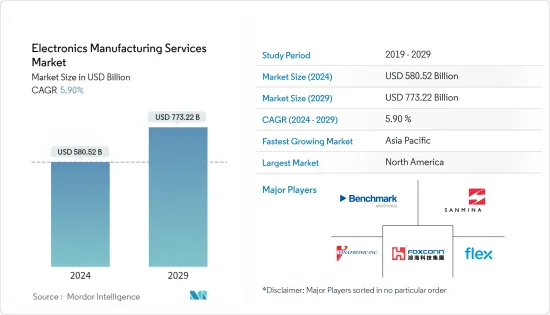

电子製造服务市场规模预计到2024年为5805.2亿美元,预计到2029年将达到7732.2亿美元,在预测期内(2024-2029年)增长5.90%,复合年增长率增长。

主要亮点

- 随着电子元件变得越来越小并采用工业物联网 (IIoT) 和透过 5G 增强通讯等新兴技术,电子元件的设计和组装正在经历一场革命。例如,5G通讯基地台开发了MIMO等卓越的天线技术,增加了辐射元件的数量和性能。

- 此外,对智慧型手机、智慧型手錶和其他设备等电子设备的需求正在推动市场成长。据 IBEF 称,印度家用电器和电器行业最近价值 98.4 亿美元,预计到 2025 年将增加一倍以上,达到 14.8 亿卢比(211.8 亿美元)。

- 此外,许多公司寻求减少製造活动中的库存、厂房和设备,将资本投资的重点转向销售、行销和研发。这增加了对第三方製造服务供应商外包的需求。

- 例如,一家航空电子设备公司决定将 PCBA 的生产转移给 EMS 合作伙伴,以扩大其产品和服务范围,而无需在製造方面进行额外投资。主要要求是符合 AS9100 标准以及 PCBA 上有多个 BGA(某些 PCB 上多达 16 层)。

- 多个地区政府不断采取的措施正在推动市场成长。例如,据 IBEF 称,政府已根据 IT 硬体生产挂钩奖励(PLI) 计划核准了14 家公司。未来四年,这些公司预计将带动总合216.4 亿美元。该计划将为印度电子製造业带来额外投资。

- 此外,印度政府已批准自动路线下电子系统设计和製造领域的 100% 外国直接投资。单一品牌零售业的 FDI 从 51% 增加到 100%。政府计划将多品牌零售业的 FDI 限制提高至 51%。这些发展可能会推动市场成长。

- 在世界各地,中小企业(SME)和中小微型企业(MSME)越来越多地僱用第三方製造服务,以避免对生产线进行大量资本投资,并利用服务供应商的设计专业知识和製造能力。国际金融公司 (IFC) 估计,新兴经济体中约 6,500 万(40%)的正规微企业融资需求未被满足。世界各地的大多数企业都是中小企业,特别是在新兴国家。这种对製造服务供应商的依赖将巩固 EMS 市场的未来成长。

- 此外,新冠肺炎 (COVID-19) 疫情的爆发严重影响了许多最终用户产业,包括电子製造业。 IPC的研究显示,消费性电器产品预计受到的影响最大,因为它们高度依赖中国的製造能力,供应链也高度依赖中国。

- 然而,许多电子製造和相关服务已被归类为基本服务供应商,因为它们执行许多关键任务,从组装产品到设计电路基板,再到为所需的医疗设备。在这次 COVID-19感染疾病期间,电子製造一直是经济和医疗保健产业不可或缺的一部分。

电子製造服务 (EMS) 市场趋势

工业应用推动 EMS 需求

- 随着环境革命的不断发展,工业马达控制需要更高的效率。此外,需要以最小的成本实现更大程度的集成,以支援新技术的市场渗透并提高安全性和可靠性。这将进一步增加对用于电压调节器操作的智慧型马达数位讯号控制器的电子产品的需求。

- 据 IBEF 称,到 2025 年,印度电动车 (EV) 市场规模预计将达到 5,000 亿印度卢比(70.9 亿美元)。此外,CEEW能源金融中心的一项研究发现,到2030年,印度电动车市场规模将达到2,060亿美元。

- 此外,工业4.0将显着提高工厂资料自动化的效率和生产力。工业物联网和人工智慧 (AI) 的平行进步将推动一些成长。儘管电子产业远未达到同等水准的智慧化和自动化,但工业 4.0 的发展正在引领潮流,电子製造服务市场的最新趋势就证明了这一点。

- 例如,2022 年 10 月,罗克韦尔自动化宣布已达成收购 CUBIC 的最终协议,该公司专门生产用于建造配电板的模组化系统。此次合作将缩短上市时间,使马达控制在工厂范围内得到更广泛的应用,并产生智慧资料,为广大客户提高永续性和生产力,预计将为公司带来利润。

- 工业自动化电子产品製造正在推动该产业的成长。工业自动化领域的参与者需要一致地存取其係统上产生的所有资料。然而,许多操作公共事业应用程式的广泛范围使这一级别的资料收集变得复杂。欧洲和北美地区越来越多地部署监控和资料采集 (SCADA) 以实现准确的资料收集。

- 此外,为工业市场提供高品质硬体和软体解决方案的开发商DYNICS 将于2022 年10 月被认可为致力于实施数位转型技术解决方案的墨西哥领先技术组织之一。该公司宣布与SINCI 建立独特的系统整合商合作伙伴关係。透过这种合作伙伴关係,该公司将继续与 SINCI 合作,为多个行业的客户提供工具,以增强他们获得自动化优势的机会。

- 大多数 SCADA 系统由单板远端终端装置(RTU) 组成,这是一种紧凑、耐用的产品,将所有输入/输出 (I/O) 模组放置在单一印刷基板。因此,公共产业部门越来越多地采用 SCADA 将进一步推动对 EMS 的需求。

亚太地区预计将出现显着成长

- 预计亚太地区在预测期内将显着成长。印度和中国由于在消费性电器产品、半导体和其他通讯设备及设备製造业的强势地位,在全球EMS市场上拥有强大的基础。例如,塔塔集团最近宣布计划进军半导体製造业务,以期在价值1兆美元的高科技电子製造领域分一杯羹。

- 此外,5G 网路和物联网部署等技术变革正在加速电子产品的采用。 「数位印度」和「智慧城市」计划等措施正在增加电子设备对物联网的需求。

- 此外,根据印度电子工业协会的数据,到 2025 年,印度的电子契约製造预计将成长六倍以上,达到约 1,520 亿美元。该国也设定了2025年仅行动电话出口额约1,000亿美元的目标。 ,这是在政府生产连结奖励计画(PLI)计划的支持下实现的。此外,2022 年 5 月,Voltas 宣布了一项 40 亿印度卢比(5,010 万美元)的资本投资计划,用于根据 PLI 计划生产白色家电零件。

- 据IBEF称,鼓励国内製造业的生产连结奖励计划(PLI)将针对14家企业,总投资额为30亿卢比(389.9亿美元),其中约80%将用于投资。据说集中仅在三个部门。 、电子、汽车、太阳能板製造等这项扩张支持了网路、5G、资料中心、汽车/雷射雷达、航太和国防市场新技术产品的快速成长。

- 亚太地区的供应链从产品设计、半导体製造和封装、零件和子系统、组装和测试开始,逐步延伸到印度和印尼等亚太地区的低成本国家,以降低製造成本,正在转型。

- 例如,成本上升和先前的贸易紧张局势迫使台湾昌硕将生产多元化到越南和印尼等国家。贸易紧张局势带来的不确定性已导致许多亚洲公司重新调整投资并转移製造地以避免关税。

电子製造服务 (EMS) 产业概览

由于整个行业越来越多地采用这些服务以及全球多个市场参与者的存在,电子製造服务市场正在走向碎片化。市场相关人员认为产品开发和创新是市场扩张的有利可图的途径。

2023年10月,塔塔电子私人有限公司(TEPL)宣布以1.25亿美元收购纬创在印度的业务。这使得该公司成为第一家生产苹果iPhone的印度公司,而纬创资通的收购很可能会促进印度电子製造生态系统的下一个投资週期,并标誌着该国契约製造製造商的成熟。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 市场驱动因素

- 小型化趋势日益明显

- 介绍 IIoT(工业物联网)、区块链和通讯增强的新兴技术

- 市场挑战

- 竞争加剧以及严格的政府法规和环境法规

- 侵害智慧财产权

- 评估新型冠状病毒感染疾病(COVID-19)对市场的影响

第五章市场区隔

- 按服务类型

- 电子设计与工程

- 组装电子元件

- 电子设备製造

- 其他服务类型

- 按用途

- 家用电器

- 车

- 工业的

- 航太和国防

- 卫生保健

- 资讯科技和电信

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 义大利

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 台湾

- 日本

- 韩国

- 印度

- 亚太地区其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争形势

- 公司简介

- Vinatronic Inc.

- Benchmark Electronics Inc.

- Hon Hai Precision Industry Co. Ltd(Foxconn)

- Flex Ltd

- Sanmina Corporation

- Jabil Inc.

- SIIX Corporation

- Nortech Systems Incorporated

- Celestica Inc.

- Integrated Micro-electronics Inc.

- Creation Technologies LP

- Wistron Corporation

- Plexus Corporation

- TRICOR Systems Inc.

- Sumitronics Corporation

第七章 投资分析

第八章市场的未来

The Electronics Manufacturing Services Market size is estimated at USD 580.52 billion in 2024, and is expected to reach USD 773.22 billion by 2029, growing at a CAGR of 5.90% during the forecast period (2024-2029).

Key Highlights

- With increasing miniaturization and adoption of emerging technologies in the Industrial Internet of Things (IIoT) and enhanced communication posed by 5G, electronic component design and assembly have been revolutionized. For instance, the communication base stations for 5G developed a superior antenna technology, such as MIMO, leading to a rise in the number and performance of radiating elements.

- Additionally, the demand for electronic devices, such as smartphones, smartwatches, and other devices, has boosted the market's growth. According to IBEF, the Indian appliances and consumer electronics industry stood at USD 9.84 billion recently, and it is anticipated to more than double to achieve INR 1.48 lakh crore (USD 21.18 billion) by 2025.

- Further, many companies seek to lower their inventory, facilities, and equipment in their manufacturing activities, shifting the focus of their capital investments toward sales and marketing and R&D. This has increased the demand for outsourcing to third-party manufacturing service providers.

- For instance, an avionics company decided to transfer its PCBA production to an EMS partner to broaden its product and service offerings and not make an additional investment in manufacturing. The primary requirements were compliance with AS9100 standards and multiple BGAs on the PCBAs, with up to 16 layers on some PCBs.

- The rising government initiatives in several geographies are driving the market's growth. For instance, according to IBEF, the government approved 14 companies under the IT hardware production-linked incentive (PLI) scheme. Over the next four years, these companies are expected to fuel total production of USD 21.64 billion. The project will bring additional investment in electronics manufacturing in India.

- Furthermore, The Government of India authorized 100% FDI in the electronics systems design and manufacturing sector under the automatic route. FDI into single-brand retail has increased from 51% to 100%; the government plans to hike the FDI limit in multi-brand retail to 51%. Such developments would likely drive the market's growth.

- Around the world, SMEs and MSMEs are adopting more and more third-party manufacturing services, so they can avoid huge capital investments in the production lines and take advantage of the service providers' design expertise and manufacturing capabilities. As per the International Finance Corporation (IFC) estimates, 65 million firms (approx.), or about 40% of formal micro, small, and medium enterprises in developing countries, have unfulfilled financial needs. The majority of businesses across the globe are small and medium enterprises, specifically in developing countries. This dependency on manufacturing service providers will solidify the future growth of the EMS market.

- Moreover, the COVID-19 outbreak severely impacted many end-user industries, including electronics manufacturing. According to the IPCs survey, consumer electronics were expected to be the most impacted because of their more substantial reliance on the manufacturing capacity of China and supply chains that rely more heavily on China.

- But many electronics manufacturing and related services were classified as essential service providers, as they carried out many critical tasks from product assembly to circuit board designs that power necessary medical equipment; electronics manufacturing was an integral part of the economy and the healthcare space during this COVID-19 outbreak.

Electronic Manufacturing Services (EMS) Market Trends

Industrial Applications to Drive the Demand for EMS

- With the rising trend of the environmental revolution, electric motor controls are demanding higher efficiency for industrial motors. Furthermore, increased integration at the lowest cost is required to support the market penetration of new technologies and improve safety and reliability. This further drives the demand for electronic products used in smart motors' digital signal controllers for voltage control operations.

- According to IBEF, India's electric vehicle (EV) market is estimated to reach INR 50,000 crores (USD 7.09 billion) by 2025. Further, a study by the CEEW Centre for Energy Finance recognized a USD 206 billion opportunity for electric vehicles in India by 2030.

- Furthermore, Industry 4.0 assures huge gains in factory data automation efficiency and productivity. The parallel advancements in industrial IoT and artificial intelligence (AI) drive growth to some extent. Even though the electronics industry is far from achieving the same level of intelligence and automation, the evolution toward Industry 4.0 is paving the way, as evident by recent trends in the electronics manufacturing services market.

- For instance, in October 2022, Rockwell Automation Inc. announced that it had signed a definitive contract to acquire CUBIC, which specializes in modular systems for constructing electrical panels. The collaboration is expected to benefit a company by offering faster time to market, enabling broader plant-wide applications for intelligent motor control, and generating smart data to increase sustainability and productivity for a wide range of customers.

- The manufacturing of electronics for industrial automation is fueling the growth of this segment. The players in the industrial automation segment need consistent access to all the data generated on the system. However, because of the scope of many operational utility applications, this level of data acquisition is complicated. Regions like Europe and North America are increasingly deploying Supervisory Control and Data Acquisition (SCADA) for accurate data collection.

- Further, in October 2022, DYNICS, a creator of quality hardware and software solutions for the industrial marketplace, announced a unique system integrator partnership with SINCI, one of Mexico's premier technology organizations dedicated to implementing technological solutions for digital transformation. Through this partnership, the company will continue working with SINCI to provide customers across multiple industries with the tools that enhance access to the benefits of automation.

- Most SCADA systems consist of single-board remote terminal units (RTUs), compact, ruggedized products that locate all input/output (I/O) modules on a single printed circuit board. Hence, the increasing deployment of SCADA in the utility sector further drives the demand for EMS.

Asia-Pacific Expected to Witness Major Growth

- The Asia-Pacific region is expected to grow significantly during the forecast period. India and China have strongly based markets for EMS worldwide, owing to their strong position in the consumer electronics, semiconductor, and other telecommunications devices and equipment manufacturing industries. For instance, Tata Group recently announced plans to enter the semiconductor manufacturing business, seeking a proportion of the USD 1 trillion high-tech electronics manufacturing sector.

- Moreover, technology changes, such as the rollout of 5G networks and IoT, are driving the accelerated adoption of electronic products. Initiatives such as 'Digital India' and 'Smart City' projects have increased the demand for IoT in electronic devices.

- Additionally, according to the Electronic Industries Association Of India, The country's electronic contract manufacturing sector is expected to more than sixfold to around USD 152 billion by 2025. The country has also set a target of approximately USD 100 billion in exports of mobiles alone by 2025, which was made possible with the support of the government's production-linked incentive (PLI) scheme. Furthermore, in May 2022, Voltas announced projects of INR 400 crores (USD 50.10 million) capex under the PLI scheme to manufacture components for white goods.

- According to IBEF, about 80% of the Production-Linked Incentive scheme (PLI) to encourage manufacturing in the country, which covers 14 enterprises and has a total investment of INR 3 lakh crore (USD 38.99 billion), is concentrated in only three sectors, such as electronics, automobiles, and solar panel production. This expansion supports rapid growth for new technology products across networking, 5G, data center, automotive/LIDAR, and aerospace and defense markets.

- APAC's supply chain starts with product design, semiconductor fabrication and packaging, components and subsystems, final assembly, and testing, which is also slowly moving toward low-cost countries in APAC, including India and Indonesia, for reducing the manufacturing costs.

- For instance, rising costs and previous trade tensions compelled Taiwan's Pegatron to diversify production to countries such as Vietnam and Indonesia. Such uncertainty due to trade tension led many companies in Asia to readjust investments and shift their manufacturing bases to avoid tariffs.

Electronic Manufacturing Services (EMS) Industry Overview

The electronics manufacturing services market is moving toward fragmentation, owing to the improved adoption of these services across industries and the presence of several market players globally. Market players view product developments and innovations as a lucrative path for market expansion.

In October 2023, Tata Electronics Pvt Ltd (TEPL) announced acquiring Wistron's operations in India for USD 125 million. That will make it the first Indian company to manufacture Apple iPhones., where The Wistron buy will spur the next cycle of investment in the Indian electronics manufacturing ecosystem and signal the maturing of the country's contract manufacturing companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Growing Trends of Miniaturization

- 4.3.2 Adoption of Emerging Technologies in IIoT (Industrial Internet of Things), Blockchain, and Enhanced Communication

- 4.4 Market Challenges

- 4.4.1 Intensifying Competition and Rigorous Government and Environmental Regulations

- 4.4.2 Intellectual Property Rights Infringements

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Electronics Design and Engineering

- 5.1.2 Electronics Assembly

- 5.1.3 Electronics Manufacturing

- 5.1.4 Other Service Types

- 5.2 By Application

- 5.2.1 Consumer Electronics

- 5.2.2 Automotive

- 5.2.3 Industrial

- 5.2.4 Aerospace and Defense

- 5.2.5 Healthcare

- 5.2.6 IT and Telecom

- 5.2.7 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Italy

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Taiwan

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 India

- 5.3.3.6 Rest of the Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 Vinatronic Inc.

- 6.1.2 Benchmark Electronics Inc.

- 6.1.3 Hon Hai Precision Industry Co. Ltd (Foxconn)

- 6.1.4 Flex Ltd

- 6.1.5 Sanmina Corporation

- 6.1.6 Jabil Inc.

- 6.1.7 SIIX Corporation

- 6.1.8 Nortech Systems Incorporated

- 6.1.9 Celestica Inc.

- 6.1.10 Integrated Micro-electronics Inc.

- 6.1.11 Creation Technologies LP

- 6.1.12 Wistron Corporation

- 6.1.13 Plexus Corporation

- 6.1.14 TRICOR Systems Inc.

- 6.1.15 Sumitronics Corporation