|

市场调查报告书

商品编码

1440072

3D 感测和成像:市场占有率分析、行业趋势和统计、成长预测(2024-2029 年)3D Sensing and Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

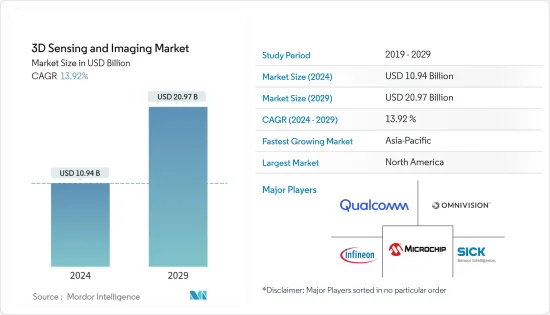

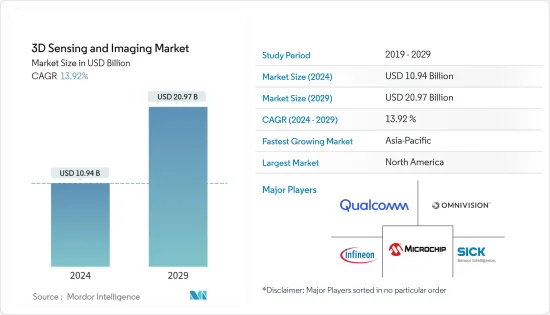

3D感测和成像市场规模预计到2024年为109.4亿美元,预计到2029年将达到209.7亿美元,在预测期内(2024-2029年)增加139.2亿美元,复合年增长率为%。

感测器在各行业中的应用不断增加,促进了可即时测量形状的 3D 技术的发展。曾经大型的设备现在透过先进技术变得更小。

主要亮点

- 家庭游戏产业为消费者提供了 3D 感测的首批实际应用之一,其中飞行时间 (ToF) 感测器可捕捉玩家的动作和手势,以创造新的互动式游戏体验。

- 然而,3D 感测的到来在当今的智慧型手机技术中最为明显。为用户提供的 3D 扫描透过脸部辨识增强安全性,为世界提供 3D 感测为高性能深度感测摄影和扩增实境创造了新的机会。

- 曾经看似不太可能从3D感测技术中受益的汽车产业,如今随着5G和物联网技术的先进驾驶辅助系统(ADAS)和自动驾驶汽车的推出,3D感测已成为交通安全的重要组成部分。此外,LiDAR 系统提供短距离和远距3D 感测,使车辆能够即时独立评估周围环境。

- 例如,2021 年 2 月,着名的 1-5 级 ADAS 和 AD 感测技术公司 LeddarTech 宣布推出 Leddar PixSet,这是一个用于 ADAS 和自动驾驶研发的感测器资料集。

- 正如 CMOS 感测器取代了 CCD 设备一样,新型、基于利基市场的成像器的出现正在扩展机器视觉应用的功能。这些系统在汽车领域的主要应用是品质检查和机器引导。此外,各种机器视觉技术正在被引入汽车侦测应用。这包括 3D 成像、多摄影机系统、条码读取、智慧摄影机和线扫描摄影机。

- 在技术方面,整个行业越来越多地采用飞行时间、结构光和立体视觉,推动市场成长。例如,3D技术被用于安装在入口处和其他地方的子弹摄影机,以监视人们的活动。 FLIR Systems(美国)生产配备立体技术的立体视觉摄影系统。

- COVID-19 影响了全球多家OEM的业务,涉及从生产到研发的各个阶段。消费和工业应用的 3D 感测市场受到 COVID-19感染疾病期间消费者支出趋势下降的不利影响,导致全球宏观经济放缓。然而,智慧型手机和游戏机越来越多地采用3D感测和成像技术,预计将增加市场对3D感测和成像技术应用的需求。

3D感测与成像市场趋势

汽车产业预计将推动市场成长

- 创建环境及其内容的综合 3D 地图需要收集广泛的资料,从数百公尺处发生的情况到对诱发因素的警惕。与传统的基于扫描的感测器(例如雷达和基于摄影机的成像)相比,LiDAR(光检测和测距)可捕获更详细的资讯并提供更高的精度,使其成为远距和短距离扫描的领先技术,这是其中之一。

- 光达主要应用于汽车ADAS(高级驾驶辅助系统)(ADAS),以提高要素便利性,并配备人机介面以实现安全引导和平稳操作。车辆的自主性需要相当高的精度和障碍物侦测辅助,以便在道路上避让和安全导航。

- 在机器人车辆中使用光达意味着使用多个光达系统来绘製车辆周围环境的地图。采用光达对于实现感测器之间的高度冗余以确保乘客安全是必要的。机器人车辆需要尽可能高水准的人机交互,通常比配备 ADAS 系统的自动驾驶汽车更重要。完全自动驾驶或机器人乘客车辆的正确开发仍在开发中,光达预计将在其中发挥重要作用。

- 2022 年 2 月,梅赛德斯-奔驰宣布与 Luminar Inc 合作,为自动驾驶系统提供雷射雷达。此次合作可能有助于汽车製造商加速未来自动驾驶技术的开发。汽车供应商的此类发展进一步加强了市场成长。

- 根据美国公路交通安全管理局 (NHTSA) 的规定,在 3 至 5 级自动驾驶中,自动驾驶系统必须能够在最少或无需人为干预的情况下监控驾驶环境。目前 Euro NCAP(欧洲新车评估计画)对驾驶监控系统 (DMS) 的要求正在稳步朝着下一代车辆内部扫描方面的欧洲安全标准迈进。

预计北美将占据主要市场占有率

- 预计北美在预测期内将占据重要的市场占有率。美国是该地区最大的市场。由于消费性电器产品和汽车行业的高需求,3D 感测器正在被用于该行业的多种应用。

- 该地区物联网投资的增加也推动了市场的成长。根据 ISE 杂誌 2021 年发布的研究,美国政府在 2020 财年投资了 1,400 亿美元,用于涉及新兴技术的一系列联邦政府资助的研发项目。物联网已被确定为联邦研发投资的成长领域之一。目前,这项技术被美国许多主要致力于提高竞争力、经济繁荣和国家安全的主要联邦机构列为具有战略重要性。

- 此外,由于近年来消费者在家的时间增加以及游戏设备的显着发展,国内游戏产业录得稳定成长。美国拥有最大的游戏业市场之一,仅次于中国。 3D 感测器和 3D 影像相机广泛用于 AR/VR 装置、手持操纵桿和其他游戏装置的萤幕互动。

- 此外,美国科技巨擘苹果的AR耳机预计将于2022年发布,据称将配备强大的3D感光元件。据说这些感应器比 iPhone 和 iPad 上用于 Face ID 的感应器更先进。人们也相信,3D 感测器的视场 (FOV) 将会扩大,从而改善物体侦测。

- 由于娱乐、广告和医疗产业越来越多地采用先进技术,加拿大成为另一个重要的 3D 感测和成像市场。 UniSoft 的数据显示,71% 的加拿大家长每周至少与孩子玩一次电子游戏,这表明该地区对游戏设备的需求量很大。

3D 感测和成像行业概述

3D感测和成像市场是一个竞争激烈的市场。随着创新和永续产品的增加,许多公司正在开拓新市场、赢得新契约并提高市场占有率,以保持在全球市场的地位。一些主要进展是:

- 2022 年 2 月 - 半导体公司意法半导体推出一系列新的高解析度飞行时间感测器,为智慧型手机和其他设备提供先进的 3D 深度成像。透过推出VD55H1 3D深度感测器,ST旨在加强其在飞行时间(ToF)产品市场的市场地位,并补充其全系列深度感测技术。

- 2022 年1 月- LIPS Corporation 宣布新公司3D 解决方案提供商LIPS Corporation 宣布推出基于Ambarella 的CV2 CVflow Edge AI 识别SoC 的新型LIPSedge S215/S210 3D 立体相机,该相机是提供AI 识别处理的公司在CES 上发布的2022 年。全新LIPSedge S系列3D立体相机支援高达4K高解析度,具有宽视野、远距和高精度的特性。

- 2021 年 10 月 Lumentum Holdings Inc. 推出了业界首款 10 W泛光照明器模组,该模组能够整合适用于工业和消费 3D 感测应用的高性能三结垂直共振腔面射型雷射(VCSEL) 阵列。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 小型电子设备中光学和电子元件的集成

- 消费性电器产品对 3D 设备的需求不断增长

- 汽车中的影像感测器变得越来越普及

- 不断提高的安全性和监控系统需求

- 市场限制因素

- 影像感测器製造成本高

- 与其他设备的整合有限

- 设备维护费用昂贵

第六章市场区隔

- 成分

- 硬体

- 软体

- 服务

- 科技

- 超音波

- 结构光

- 飞行时间

- 立体视觉

- 其他技术

- 类型

- 位置感测器

- 影像感测器

- 温度感应器

- 加速感应器

- 接近感测器

- 其他的

- 连接性

- 有线网路连接

- 无线网路连线

- 最终用户产业

- 家用电器

- 车

- 卫生保健

- 航太和国防

- 安全和监视

- 媒体和娱乐

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Infineon Technologies AG

- Microchip Technology Inc.

- Omnivision Technologies, Inc.

- Qualcomm Inc

- Sick AG

- Keyence

- Texas Instruments Incorporated

- GE Healthcare

- STMicroelectronics

- Adobe

- Autodesk

- Panasonic

- Trimble

- Faro

- Lockheed Martin

- Dassault Systems

第八章投资分析

第九章市场机会与未来趋势

The 3D Sensing and Imaging Market size is estimated at USD 10.94 billion in 2024, and is expected to reach USD 20.97 billion by 2029, growing at a CAGR of 13.92% during the forecast period (2024-2029).

Increasing the adoption of sensors in various industry verticals has led to the development of 3D technology that can gauge shapes in real-time. Instruments that were once bulky are now miniaturized due to advanced technologies.

Key Highlights

- The home gaming industry offered one of the first practical applications of 3D sensing for consumers, with time of flight (ToF) sensors capturing the movements and gestures of players to create a new interactive gaming experience.

- However, the arrival of 3D sensing is most noticeable in today's smartphone technology. User-facing 3D scanning enhances security through facial recognition, while world-facing 3D sensing creates new opportunities for high-performance depth-sensing photography and augmented reality.

- The automotive industry, which once seemed like an unlikely beneficiary of 3D sensing technology, is currently featuring advanced driver-assistance systems (ADAS) and autonomous vehicles enabled by 5G and the IoT, making 3D sensing a crucial part of transportation safety. Additionally, the LiDAR systems offer short- and long-range 3D sensing that enables vehicles to independently assess their surroundings in real time.

- For instance, in February 2021, LeddarTech, a prominent player in Level 1-5 ADAS and AD sensing technology, announced the availability of Leddar PixSet, a sensor dataset for ADAS and autonomous driving research and development.

- Just as CMOS sensors have replaced CCD devices, the emergence of newer, niche-based imagers is expanding the functionality of machine vision applications. Major applications of these systems in the automotive sector are quality inspections and machine guidance. Moreover, various machine vision technologies are being deployed in automotive inspection applications. This includes 3D imaging, multi-camera systems, barcode reading, smart cameras, and line scan cameras.

- In terms of technology, the growing adoption of time of flight, structured light, and stereoscopic vision across industries is driving the market's growth. For instance, stereoscopic vision technology is used in bullet cameras installed for monitoring people's movement at door entrances and other places. FLIR Systems (U.S) manufactures Stereo Vision cameras Systems with stereoscopic vision technology.

- COVID-19 impacted the operations of multiple OEMs across the globe that were involved in various stages ranging from production to R&D. The 3D sensing market for consumer and industrial applications was negatively affected during the COVID-19 pandemic due to the decline in the consumer spending trends, which led to the macro slowdown of the economy all over the globe. However, the increasing adoption of 3D sensing and imaging technology in smartphones and gaming consoles is expected to increase the demand for 3D sensing and imaging technology applications in the market.

3D Sensing & Imaging Market Trends

Automotive Sector Expected to Drive Market Growth

- Capturing a wide range of data, from what is happening hundreds of meters down the road to how vigilant the driver is, is required to create a comprehensive 3D map of the environment and the things inside it. LiDAR (light detection and ranging), which captures more detailed information and provides more accuracy than classic scanning-based sensors like radar and camera-based imaging, is one of the major technologies for long- and short-range scanning.

- LiDAR is primarily used for advanced driver assistance systems (ADAS) in automobiles for the driver's convenience, with a human-machine interface for safe guidance and smooth operation. The autonomous nature of the vehicle needs considerably high accuracy and assistance for obstacle detection for avoidance and safe navigation through the roadways.

- Using LiDAR in robotic vehicles means using multiple LiDAR systems to map the vehicle's surroundings. The adoption of LiDAR is necessary for a high level of redundancy between sensors to ensure the safety of the passengers. Robotic vehicles have the highest possible requirement of human interaction and are generally more advanced than autonomous cars with ADAS systems. The proper development of completely autonomous or robotic vehicles for passengers is still in development, and LiDAR is expected to play a huge part in that.

- In Feb 2022, Mercedes Benz announced its partnership with Luminar Inc for the supply of LiDAR for its autonomous driving systems. The partnership will help the automaker accelerate the development of its future automated driving technologies. Such developments from the automotive vendors are further strengthening the market growth.

- According to the National Highway Traffic Safety Administration (NHTSA), from levels three to five of autonomous driving, an automated driving system should be able to monitor the driving environment with minimal or no human interaction. The current Euro NCAP (European New Car Assessment Programme) mandate for driver monitoring systems (DMS) is well on its way to becoming a European safety standard for next-generation vehicles in terms of in-cabin scanning.

North America Expected to Hold Major Market Share

- North America is expected to hold a significant market share in the forecast period. The United States is the largest market in the region. The high demand from the consumer electronics and automotive sectors employs 3D sensors for multiple applications in their domains.

- The growing investments in IoT in the region also aid the market's growth. As per a study published by ISE Magazine in 2021, the US government invested USD 140 billion in a broad range of federally funded R&D programs in FY 2020, including emerging technologies. IoT has been identified as one of the growing areas of federal R&D investments. The technology is now ranked as strategically important by many major US Federal agencies that focus on increasing competitiveness, economic prosperity, and national security.

- Also, the gaming industry in the country has been recording steady growth due to customers spending more time at home and the huge developments in gaming equipment in recent years. The United States has one of the largest markets in the gaming industry, ranking only behind China. AR/VR devices, handheld joysticks, and other gaming equipment widely use 3D sensors and 3D imaging cameras for on-screen interactions.

- Further, American tech giant Apple's AR headset is expected to launch in 2022 and will reportedly feature powerful 3D sensors. These sensors are said to be more advanced than the ones used in iPhones and iPad for Face ID. Also, the 3D sensors are said to get an increased field-of-view (FOV), likely improving object detection.

- Canada is another significant 3D sensing and imaging market, owing to the increasing adoption of advanced technologies in the entertainment, advertising, and medical industries. According to UniSoft, 71% of Canadian parents play video games with their children at least once a week, demonstrating the significant demand for gaming equipment in the region.

3D Sensing & Imaging Industry Overview

The 3D sensing and imaging market is a highly competitive market. With increased innovations and sustainable products, to maintain their position in the global market, many companies are increasing their market presence by securing new contracts by tapping new markets. Some of the key developments are:

- February 2022 - STMicroelectronics, a semiconductor company, launched its new series of high-resolution Time-of-Flight sensors to provide advanced 3D depth imaging for smartphones and other devices. With the launch of the VD55H1 3D depth sensor, ST aims to strengthen its market position in the Time-of-Flight (ToF) product market and complement its full range of depth sensing technologies.

- January 2022 - LIPS Corporation announced its new LIPS Corp., a provider of 3D solutions, announced the new LIPSedge S215/S210 3D Stereo Cameras at CES 2022, based on CV2 CVflow edge AI perception SoC from Ambarella, a company offering AI perception processing. The new LIPSedge S Series 3D Stereo Camera can support up to 4K high-resolution and feature wide FOV, long range, and high accuracy.

- October 2021 - Lumentum Holdings Inc. introduced an industry-first 10 W flood illuminator module, which could integrate a high-performance three-junction vertical-cavity surface-emitting laser (VCSEL) array for industrial and consumer 3D sensing applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Integration of Optical and Electronic Components in Miniaturized Electronics Devices

- 5.1.2 Rising Demand for 3D-Enabled Devices in Consumer Electronics

- 5.1.3 Growing Penetration of Image Sensors in Automobiles

- 5.1.4 Growing Requirement of Security and Surveillance Systems

- 5.2 Market Restraints

- 5.2.1 High Manufacturing Cost of Image Sensors

- 5.2.2 Limited Integration With Other Devices

- 5.2.3 High Cost Required for the Maintenance of these Devices

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 Technology

- 6.2.1 Ultrasound

- 6.2.2 Structured Light

- 6.2.3 Time of Flight

- 6.2.4 Stereoscopic Vision

- 6.2.5 Other Technologies

- 6.3 Type

- 6.3.1 Position Sensor

- 6.3.2 Image Sensor

- 6.3.3 Temperature Sensor

- 6.3.4 Accelerometer Sensor

- 6.3.5 Proximity Sensors

- 6.3.6 Others

- 6.4 Connectivity

- 6.4.1 Wired Network Connectivity

- 6.4.2 Wireless Network Connectivity

- 6.5 End-user Industry

- 6.5.1 Consumer Electronics

- 6.5.2 Automotive

- 6.5.3 Healthcare

- 6.5.4 Aerospace & Defense

- 6.5.5 Security & Surveillance

- 6.5.6 Media and Entertainment

- 6.5.7 Other End-user Industries

- 6.6 Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Latin America

- 6.6.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 Microchip Technology Inc.

- 7.1.3 Omnivision Technologies, Inc.

- 7.1.4 Qualcomm Inc

- 7.1.5 Sick AG

- 7.1.6 Keyence

- 7.1.7 Texas Instruments Incorporated

- 7.1.8 GE Healthcare

- 7.1.9 STMicroelectronics

- 7.1.10 Google

- 7.1.11 Adobe

- 7.1.12 Autodesk

- 7.1.13 Panasonic

- 7.1.14 Trimble

- 7.1.15 Faro

- 7.1.16 Lockheed Martin

- 7.1.17 Dassault Systems