|

市场调查报告书

商品编码

1440090

汽车预测技术:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Automotive Predictive Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

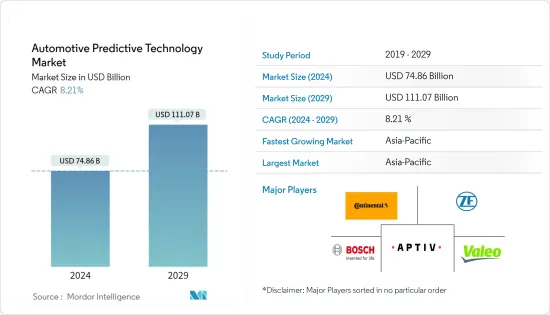

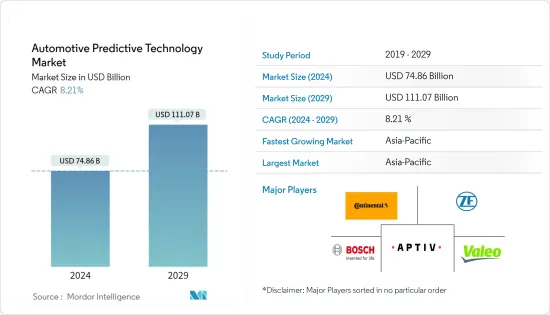

预计2024年汽车预测技术市场规模为748.6亿美元,预计2029年将达到1,110.7亿美元,预测期(2024-2029年)将成长8.21%,以复合年增长率成长。

主要亮点

- 冠状病毒感染疾病(COVID-19)的爆发对汽车预测技术市场产生了负面影响。世界各地的多家汽车和零件製造工厂暂时关闭,供应链中断。然而,汽车产业已开始小幅復苏,预计在预测期内将继续復苏。

- 人工智慧和机器学习等车辆技术可增强高级驾驶辅助系统 (ADAS) 等安全功能,而预测性维护则侧重于减少车辆停机时间并经济有效地提高车辆性能。技术先进功能的成长趋势是一个因素推动市场成长。

- 自动驾驶汽车和技术使用多种预测功能来警告驾驶员注意障碍物并产生其他驾驶警告。几家主要的目的地设备製造商(OEM)正在大力投资自动驾驶汽车的开发,预计此类开发将为市场参与者提供新的机会。

- 预计亚太地区将主导汽车预测技术市场。据估计,未来几年先进驾驶辅助系统 (ADAS) 的安装量不断增加也将增加全部区域对此类技术的需求。

汽车预测技术市场趋势

Likley 在 ADAS 领域将在预测期内主导市场

- 近年来,汽车产业致力于改善 ADAS 系统的研发工作。这导致了高级驾驶员辅助系统的进一步改进,对夜间行人侦测系统、车道偏离警告系统、摄影机、雷达和其他感测器的需求激增,这些感测器正在快速安装在车辆中。因此,厂商不断致力于部署配备此类技术的产品来推动市场需求。

- 2022年7月,现代马达印度推出了顶级运动型多用途车(SUV)的升级版Tucson,标誌着汽车技术的重大进步。这款 SUV 拥有 2 级高级驾驶辅助系统 (ADAS) 功能,开创了智慧驾驶功能的新时代。其突破性功能之一是自动感测技术,结合了最先进的摄影机和雷达感测器的力量。这种创新设定使图森能够准确地侦测道路上的其他车辆、行人,甚至自行车。

- 此外,奥迪、宝马、戴姆勒和沃尔沃等公司只是众多已开始提供夜间行人侦测系统的目的地设备製造商 (OEM) 中的一小部分。如果行人在一定速度范围内,系统会警告驾驶或自动煞车。

- 例如,2022 年 11 月,软体公司 Zenseact 推出了 Onepilot,这是一款由人工智慧 (AI) 支援的软体,可为沃尔沃全电动旗舰 SUV 沃尔沃 EX90 的驾驶员提供新的安全水平。

- 几家主要服务供应商正在花费大量资金为其车辆研发最新的 ADAS 技术,以获得市场占有率。除了大公司之外,一些Start-Ups也从这些大公司获得资金,以提出最新的创新理念和技术。

- 由于这些发展,预计 ADAS 领域将在预测期内主导市场。

预计亚太地区将占据主要市场占有率

- 预计亚太地区将成为预测期内成长最快的市场。汽车的混合和电动以及电动车产量的增加是推动需求的主要因素。印度、中国和日本等国家正逐步将预测技术引入小客车,因为配备此类技术的小客车和商用车价格分布略高。基础设施和法规不足也导致了采用缓慢。

- 亚太地区的汽车製造商也正在投资预测技术,并推出具有基于预测技术功能的新产品。

- 例如,2023年5月,位于班加罗尔的印度大陆技术中心在专门针对印度路况开发先进驾驶辅助系统(ADAS)方面取得了重大进展。他们努力的成果是模组化的 ADAS 解决方案,可以轻鬆适应各种汽车平臺,确保无缝整合和相容性。

- 2021 年 7 月,印度先锋新兴企业Minus Zero 成功建构了由尖端人工智慧和机器学习技术驱动的自主系统,实现了一个非凡的里程碑。这款创新系统经过精心设计,能够在印度交通状况带来的独特挑战中发挥最佳作用。

- 这些因素为整个亚太地区的预测技术创造了重大机会。预计在不久的将来对此类技术的需求将会增加。

汽车预测技术产业概况

汽车预测技术市场适度整合,多个主要和新参与者争夺重要的市场占有率。汽车预测技术市场的一些知名公司包括大陆集团、采埃孚股份公司、罗伯特博世、Aptiv PLC 和法雷奥 SA。这些公司专注于策略合作倡议,以扩大市场占有率和利润。

例如,2022年4月,采埃孚推出了专为城市公车设计的开创性碰撞缓解系统(CMS)。此创新系统提供主动制动,以防止与其他道路使用者(例如车辆、骑自行车的人和行人)发生正面碰撞。此外,CMS有效降低煞车力对乘员的负面影响,确保安全性和舒适性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 对联网汽车的需求增加

- 资料分析和机器学习的进展

- 市场限制因素

- 安装和维护成本高

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间敌对的强度

第五章市场区隔

- 车辆类型

- 小客车

- 商用车

- 最终用户

- 车队车主

- 保险公司

- 其他最终用户

- 硬体类型

- ADAS

- 机载诊断

- 其他硬体类型

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 巴西

- 墨西哥

- 阿拉伯聯合大公国

- 其他的

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Continental AG

- Aptiv PLC

- Garrett Motion Inc.

- Harman International Industries Incorporated

- Visteon Corporation

- ZF Friedrichshafen AG

- Valeo SA

- Robert Bosch GmbH

- Verizon

- Infineon Technologies AG

第七章市场机会与未来趋势

- 与 ADAS(高级驾驶辅助系统)集成

The Automotive Predictive Technology Market size is estimated at USD 74.86 billion in 2024, and is expected to reach USD 111.07 billion by 2029, growing at a CAGR of 8.21% during the forecast period (2024-2029).

Key Highlights

- The outbreak of COVID-19 negatively impacted the automotive predictive technology market. Several vehicles and component manufacturing facilities worldwide were temporarily shut down, resulting in disturbances in the supply chain. However, the automotive industry started recovering slightly and is expected to continue during the forecast period.

- The growing trend of technologically advanced features in the vehicles, such as artificial intelligence and machine learning to enhance safety features like advanced driver-assistance systems (ADAS) and predictive maintenance focused on reducing vehicle downtime and increasing vehicle performance cost-effectively, is driving the market growth.

- Autonomous vehicles and self-driving technologies also use several predictive features to alert drivers about obstacles and produce other driving alerts. Several major original equipment manufacturers (OEMs) are investing heavily in developing autonomous vehicles, and such developments are expected to offer new opportunities for players in the market.

- Asia-Pacific is expected to dominate the automotive predictive technology market, owing to the increasing demand for luxury vehicles across India, China, and Japan. The increasing installation of advanced driver-assistance systems (ADAS) is also estimated to boost the demand for such technologies in the coming years across the region.

Automotive Predictive Technology Market Trends

ADAS Segment Likley to Dominate the Market During the Forecast Period

- In recent years, the automobile industry has motivated its research and development work to improve ADAS systems. This led to further improvements in the advanced driving assistance systems, with a surge in demand for night-time pedestrian detection systems, lane departure warning systems, cameras, RADAR, and other sensors, which are being deployed into vehicles at a considerable pace. So, players continuously focus on deploying products with such technologies to drive demand in the market.

- In July 2022, Hyundai Motor India made a significant stride in automotive technology with the launch of an upgraded version of its top-tier sports utility vehicle (SUV), the Tucson. Boasting level 2 advanced driving assistance systems (ADAS) capability, this SUV introduces a new era of intelligent driving features. Among the groundbreaking features is an automated sensing technology that combines the power of cutting-edge cameras and radar sensors. With this innovative setup, Tucson can now accurately detect other vehicles, pedestrians, and even cyclists on the road.

- Moreover, companies like Audi, BMW, Daimler, and Volvo are a few of many original equipment manufacturers (OEMs) that started offering night-time pedestrian detection systems. It alerts the driver or automatically brakes if there is a pedestrian in the path between a certain speed range.

- For instance, in November 2022, Zenseact, a software company, introduced artificial intelligence (AI)-powered software, Onepilot, that will offer drivers a new level of safety in Volvo's fully electric flagship SUV, the Volvo EX90.

- Several major service providers are spending heavily on research and development of the latest ADAS technologies for vehicles to gain market share. Not only the major companies but several startups are also coming up with the latest innovative ideas and technologies, which are funded by these major players.

- Due to such developments, the ADAS segment is expected to dominate the market during the forecast period.

Asia-Pacific Expected to Hold Significant Market Share

- Asia-Pacific is expected to be the fastest-growing market during the forecast period. Vehicle hybridization and electrification and increasing production of electric vehicles are the primary factors driving the demand. Countries like India, China, and Japan are picking up the pace as predictive technology implementation in passenger cars is taking place gradually, as such cars or commercial vehicles equipped with such technology are in a bit higher price segment. Poor infrastructure and regulations are other reasons responsible for slow adoption.

- Automobile manufacturers in the Asia-pacific region are also investing in predictive technology and launching new products equipped with features based on predictive technology.

- For instance, in May 2023, the Bengaluru-based Continental Technology Centre India is making significant strides in the development of advanced driver assistance systems (ADAS) tailored specifically to Indian road conditions. Their efforts have resulted in modular ADAS solutions, which can be readily adapted to various vehicle platforms, ensuring seamless integration and compatibility.

- In July 2021, a pioneering Indian start-up named Minus Zero achieved a remarkable milestone by successfully creating an autonomous system powered by cutting-edge AI and machine learning technologies. This innovative system is purposefully designed to function optimally amidst the unique challenges posed by Indian traffic conditions.

- Such factors are creating huge opportunities for predictive technology across Asia-Pacific. The demand for such technologies is expected to increase in the near future.

Automotive Predictive Technology Industry Overview

The automotive predictive technology market is moderately consolidated as it accommodates several major and new players vying for significant market share. Some of the prominent companies in the automotive predictive technology market include Continental AG, ZF Friedrichshafen AG, Robert Bosch, Aptiv PLC, and Valeo SA. These companies are focusing on strategic collaborative initiatives to expand their market shares and profits.

For instance, in April 2022, ZF launched a pioneering collision mitigation system (CMS) designed for city buses. This innovative system provides active braking to prevent frontal collisions with other road users, such as vehicles, bicycles, and pedestrians. Additionally, the CMS effectively mitigates the negative effects of braking momentum on passengers, ensuring their safety and comfort.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand For Connected Cars

- 4.1.2 Advancements In Data Analytics And Machine Learning

- 4.2 Market Restraints

- 4.2.1 High Implementation And Maintenance Costs

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.2 End-User

- 5.2.1 Fleet Owners

- 5.2.2 Insurers

- 5.2.3 Other End-Users

- 5.3 Hardware Type

- 5.3.1 ADAS

- 5.3.2 On-board Diagnosis

- 5.3.3 Other Hardware Types

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share**

- 6.2 Company Profiles*

- 6.2.1 Continental AG

- 6.2.2 Aptiv PLC

- 6.2.3 Garrett Motion Inc.

- 6.2.4 Harman International Industries Incorporated

- 6.2.5 Visteon Corporation

- 6.2.6 ZF Friedrichshafen AG

- 6.2.7 Valeo SA

- 6.2.8 Robert Bosch GmbH

- 6.2.9 Verizon

- 6.2.10 Infineon Technologies AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration With Advanced Driver Assistance Systems (ADAS)