|

市场调查报告书

商品编码

1440124

低程式码开发平台 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Low-code Development Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

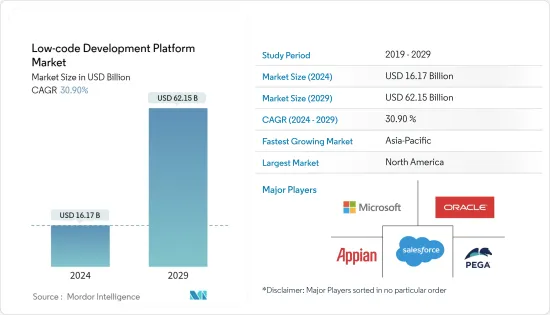

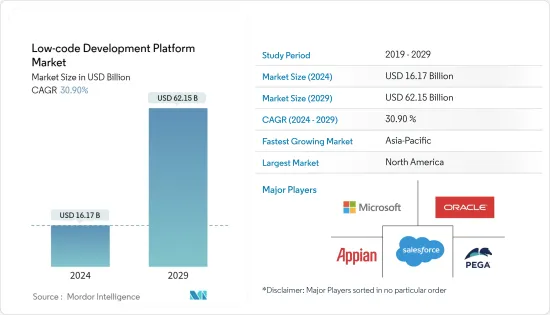

低程式码开发平台市场规模预计到 2024 年为 161.7 亿美元,预计到 2029 年将达到 621.5 亿美元,在预测期内(2024-2029 年)CAGR为 30.90%。

主要亮点

- 在企业转向数位现代化之后,低程式码采用率迅速成长,其中包括改善使用者体验、自动化流程和升级关键系统。由于成本低廉,低程式码开发平台被证明是理想的选择。

- 低程式码的优点是它的拖放介面,可以节省时间。在低程式码中,每个流程都在图形介面的帮助下直观地显示,使一切都更容易理解。开发人员更容易创建他们的应用程式。

- 儘管低程式码解决方案并不新鲜,但由于公司面临满足利害关係人对更多数位转型的需求的挑战,因此对该技术的需求在过去两年中激增。透过更快的业务应用程式交付,公司可以使用低程式码工具扩展数位转型工作。此外,使用低程式码工具可以大幅减少创新所需的时间。

- 低程式码解决方案使组织能够比传统的本地开发更快、更敏捷地产生工作解决方案和整合。整合曾经是一个劳力密集的 IT 流程,需要双方进行客製化开发。

- 低程式码解决方案可能与任何竞争对手或类似供应商不相容。即使使用者可以汇出原始码,也会依赖厂商的平台来运作,使用者只能作为备份。

- COVID-19 大流行造成的破坏增加了企业采用低程式码平台的趋势。以前没有低程式码平台系统的公司无法轻鬆快速地调整其 ERP 系统以应对远端操作的新挑战。另一方面,拥有低程式码平台的公司适应速度明显更快。

低程式码开发平台市场趋势

资讯科技领域将显着成长

- IT企业在主导低程式码开发平台市场中发挥了关键作用。这是因为在这个垂直领域运营的公司需要为自己和客户开发许多应用程序,无论是行动应用程式还是线上应用程式(或两者兼而有之)。

- 低程式码开发平台的优势使得应用程式能够快速创建、共享和更新,从而提高生产力并优化资源利用率。因此,它推动了 IT 公司对 LCDP 的需求。

- 在过去的几年里,IT 行业的企业对 LCDP 表现出了更大的兴趣,因为依靠其软体应用程式为开发人员和客户带来了可观的回报。

- 根据 Caspio 最近进行的研究,63% 的低程式码平台用户拥有满足自订应用程式需求的技能和资源,而 61% 的用户表示他们能够按时、按范围、在预算范围内成功交付自订应用程式。此外,58% 使用低程式码平台的受访者表示他们可以满足企业对自订应用程式请求的需求。

- 此外,在 COVID-19 大流行期间,随着企业对透过网路与客户和客户互动的打包软体和应用程式的需求不断增加,该行业出现了大量积压。因此,IT企业需要部署这些平台来确保竞争优势并优化资源利用。

亚太地区预计将占据最大的市场份额

- 由于行动应用程式的日益普及,预计亚太地区在预测期内将大幅成长。此外,该地区的许多中小企业资源有限,迫使他们采用託管服务。该地区政府也采取了行动优先策略,为公民提供更好的服务,从而推动市场发展。

- 华为全球技术服务推出通用数位引擎(GDE)平台。 GDE采用「1+4+N」架构:「1」是开放的云端原生平台。 「4」是资料共享、生产流程智慧化、能力共享、整合低程式码自主开发四种能力。该平台将数位化、智慧化技术引入营运商规划、建设、维护、优化、营运流程,帮助营运商向数位化营运商和合作伙伴转型,使能营运创新「N」个应用场景。

- 2023 年 11 月 14 日,OutSystems Japan 宣布在日本市场推出用于云端原生应用程式开发的低程式码解决方案 OutSystems Developer Cloud。 OutSystems 为开发人员和企业开发人员提供高效能、低程式码的应用程式平台。它可以安全地用于大型应用程序,并允许从前端到后端的全端开发。

- 2022 年 1 月,总部位于旧金山的低程式码平台 Retool 宣布,它可能会透过独家产品扩大在印度的业务,因为它可能会受到 IT 服务提供者和新创公司的巨大吸引力。

- 印度正在进行许多数位化措施和开发,包括低程式码平台。 2022年7月,位于清奈的SaaS公司Kissflow发布了统一的低程式码/无程式码工作平台,加速了业务数位转型。新平台结合了企业级用户的全方位任务管理。最终用户、团队、团队经理、流程专家、公民开发人员和 IT 开发人员都包括在内。

低程式码开发平台产业概况

低程式码开发平台市场适度分散,参与者众多,全球治理面临重大挑战,较小的供应商逐渐占据了主要市场份额。财力雄厚的市场厂商积极参与策略併购活动,而小公司则参与产品创新策略以获取市场份额。

- 2022 年 11 月 - SAP 推出了新的低程式码应用程式开发工具包,以解决业界合格程式设计师的稀缺问题,并向更广泛的业务用户提供软体开发技能。 SAP 表示,这将使非技术业务使用者能够建立和修改业务应用程式、自动化业务流程以及设计企业网站。

- 2022 年 3 月 - Zoho Corporation 宣布发布最新版本的低程式码解决方案 Zoho Creator,该解决方案可协助企业客户和个人开发人员创建业务应用程式。透过此次升级,Zoho 的 Creator 平台将应用程式开发、商业智慧和分析以及流程自动化等功能整合到一个平台中,同时也协助 IT 团队管理安全性、合规性和治理。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

- COVID-19对产业影响的评估

第 5 章:市场动态

- 市场驱动因素

- 对快速客製化和可扩展性的需求不断增加

- 提高企业流动性

- 消除所需 IT 技能方面的差距

- 市场挑战

- 对供应商提供的客製化的依赖

第 6 章:新兴科技趋势

第 7 章:市场细分

- 按应用类型

- 基于网路

- 基于行动装置

- 基于桌面和伺服器

- 依部署类型

- 本地部署

- 云

- 按组织规模

- 中小企业

- 大型企业

- 按最终用户垂直领域

- BFSI

- 零售及电子商务

- 政府和国防

- 资讯科技

- 能源和公用事业

- 製造业

- 卫生保健

- 其他最终用户垂直领域

- 按地理

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

第 8 章:竞争格局

- 公司简介

- Microsoft Corporation

- Appian Corporation

- Oracle Corporation

- Pegasystems Inc.

- Magic Software Enterprises Ltd

- AgilePoint Inc.

- Outsystems Inc.

- Mendix Inc.

- ZOHO Corporation

- QuickBase Inc.

- Clear Software LLC

- Kony Inc. 8.14 ServiceNow Inc.

- Skuid Inc.

第 9 章:供应商市场定位分析

第 10 章:投资分析

第 11 章:市场机会与市场未来

The Low-code Development Platform Market size is estimated at USD 16.17 billion in 2024, and is expected to reach USD 62.15 billion by 2029, growing at a CAGR of 30.90% during the forecast period (2024-2029).

Key Highlights

- The rapid growth of low-code adoption happened after businesses moved to digital modernization, which included improving user experiences, automating processes, and upgrading critical systems. Due to their low cost, low-code development platforms proved ideal.

- The advantage of low code is its drag-and-drop interface, which saves time. In low code, every single process is shown visually with the help of a graphical interface that makes everything easier to understand. It is easier for developers to create their applications.

- Although low-code solutions are not new, the demand for the technology soared in the last two years as companies were challenged to meet stakeholder demand for more digital transformation. Through faster business application delivery, companies can expand digital transformation efforts with low-code tools. In addition, the time it takes to innovate is dramatically reduced with low-code tools.

- Low-code solutions allow organizations to produce working solutions and integrations with more speed and agility than traditional on-premise developments. Integration used to be a labor-intensive IT process requiring custom development on both sides.

- The low-code solution might not be compatible with any competitor or similar provider. Even if the user can export the source code, it will depend on the vendor's platform to work, and the user can only use it as a backup.

- The disruption caused by the COVID-19 pandemic increased the tendency of enterprises to adopt low-code platforms. Companies that did not previously contain low-code platform systems could not easily and quickly adapt their ERP system to the new challenges of remote operations. On the other hand, companies with a low-code platform adapted significantly faster.

Low Code Development Platform Market Trends

Information Technology Segment to Witness Significant Growth

- IT enterprises played a key role in dominating the low-code development platform market. This is because the firms operating in this vertical need to develop many applications, either for mobile or online (or both), for themselves and their clients.

- The benefits of low-code development platforms enabled apps to be created, shared, and updated quickly, leading to improved productivity and optimized resource utilization. It is thus driving the demand for LCDPs among IT companies.

- Over the past few years, enterprises operating in the IT sector showed greater interest in LCDPs, owing to their significant payoffs for their developers and customers relying on their software applications.

- As per recent research conducted by Caspio, 63% of low-code platform users include the skill and resources to fulfill the demand for custom apps, whereas 61% suggest that they successfully deliver custom apps on time, on scope, and within budget. Further, 58% of respondents using low-code platforms indicated that they can keep up with the business's demand for custom app requests.

- Further, amid the COVID-19 pandemic, the sector witnessed huge backlogs with the rising request for packaged software and apps from enterprises to engage with customers and clients over the Internet. Thus, IT enterprises are required to deploy these platforms to ensure a competitive advantage and optimized resource utilization.

Asia Pacific is Expected to Hold the Largest Market Share

- The Asia-Pacific region is anticipated to grow significantly over the forecast period, owing to the increasing adoption of mobile applications. Additionally, the region includes many SMEs with limited resources, forcing them to adopt managed services. The governments in the region also adopted a mobile-first strategy to provide better services to their citizens, thereby driving the market.

- Huawei Global Technical Service launched the General Digital Engine (GDE) platform. The GDE adopts the "1+4+N" architecture: "1" is an open cloud-native platform. "4" means four capabilities that enable data sharing, intelligent production flow, capability sharing, and integrated low-code self-development. The platform introduces digital and smart technologies into carriers' planning, construction, maintenance, optimization, and operation processes to help them transform into digital carriers and partners, enabling operations to innovate "N" application scenarios.

- On November 14th, 2023, OutSystems Japan Co., Ltd. announced the debut of their low-code solution OutSystems Developer Cloud for cloud-native application development in the Japanese market. OutSystems offers a high-performance, low-code application platform for developers and enterprise developers. It can be utilized securely in large-scale applications and allows full-stack development from front-end to back-end.

- In January 2022, San Francisco-based low-code platform Retool announced that it might expand its presence in India with exclusive offerings as it could see massive traction from IT service providers and startups.

- Many digital initiatives and development, including low-code platforms, are occurring in India. In July 2022, Kissflow, a Chennai-based SaaS firm, released its unified low-code/no-code work platform, accelerating business digital transformation. The new platform combines the whole range of task management for enterprise-wide users. End users, teams, team managers, process specialists, citizen developers, and IT developers are all included.

Low Code Development Platform Industry Overview

The low-code development platform market is moderately fragmented, with many players, significant governance challenges globally, and smaller vendors cumulatively holding a major market share. The market vendors with deep pockets are actively involved in strategic M&A activities, while small companies are involved in product innovation strategies to gain market share.

- November 2022 - SAP introduced a new low-code application development toolkit to address the industry's scarcity of qualified programmers and to deliver software development skills to a broader audience of business users. According to SAP, this will enable non-technical business users to construct and modify business applications, automate business processes, and design corporate websites.

- March 2022 - Zoho Corporation announced the release of the newest edition of its low-code solution, Zoho Creator, which assists corporate customers and individual developers in creating business applications. With this upgrade, Zoho's Creator platform integrates, among other things, application development, business intelligence and analytics, and process automation into a single platform while also assisting IT teams in managing security, compliance, and governance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID -19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Rapid Customization and Scalability

- 5.1.2 Increasing Enterprise Mobility

- 5.1.3 Elimination of Gaps in Required IT Skills

- 5.2 Market Challenges

- 5.2.1 Dependency on Vendor Supplied Customization

6 EMERGING TECHNOLOGY TRENDS

7 MARKET SEGMENTATION

- 7.1 By Application Type

- 7.1.1 Web-based

- 7.1.2 Mobile-based

- 7.1.3 Desktop- and Server-based

- 7.2 By Deployment Type

- 7.2.1 On-premise

- 7.2.2 Cloud

- 7.3 By Organization Size

- 7.3.1 Small and Medium Enterprises

- 7.3.2 Large Enterprises

- 7.4 By End-user Vertical

- 7.4.1 BFSI

- 7.4.2 Retail and E-commerce

- 7.4.3 Government and Defense

- 7.4.4 Information Technology

- 7.4.5 Energy and Utilities

- 7.4.6 Manufacturing

- 7.4.7 Healthcare

- 7.4.8 Other End-user Verticals

- 7.5 By Geography

- 7.5.1 North America

- 7.5.2 Europe

- 7.5.3 Asia-Pacific

- 7.5.4 Latin America

- 7.5.5 Middle-East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Microsoft Corporation

- 8.1.2 Appian Corporation

- 8.1.3 Oracle Corporation

- 8.1.4 Pegasystems Inc.

- 8.1.5 Magic Software Enterprises Ltd

- 8.1.6 AgilePoint Inc.

- 8.1.7 Outsystems Inc.

- 8.1.8 Mendix Inc.

- 8.1.9 ZOHO Corporation

- 8.1.10 QuickBase Inc.

- 8.1.11 Clear Software LLC

- 8.1.12 Kony Inc. 8.14 ServiceNow Inc.

- 8.1.13 Skuid Inc.