|

市场调查报告书

商品编码

1440132

采购软体:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Procurement Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

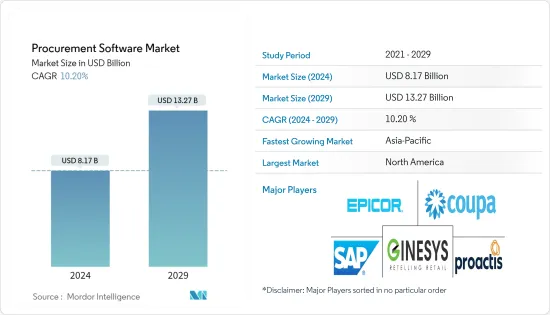

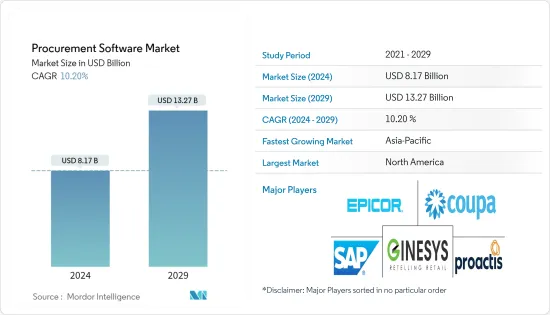

采购软体市场规模预计2024年为81.7亿美元,预计到2029年将达到132.7亿美元,在预测期内(2024-2029年)复合年增长率为10.20%。

软体公司越来越关注需求技术,并重新探索为客户服务的创新方式。推动采购软体行业的主要因素是人工智慧等开发技术的日益集成,这有助于高品质的报告和保持准确性的功能。

主要亮点

- 随着采购程序自动化的需求不断增加,电子采购技术的成熟预计将为预测期内的市场成长开闢新的途径。此外,防止重复记录的需求预计将在未来几年推动采购软体产业的成长。此外,政府政策的落实也有利于市场的开拓。跨境外贸流量的增加将进一步加快市场进步。供需因素之间的市场协同效应预计将影响未来的市场成长。

- 人们越来越希望自动化采购业务以提高效率并节省时间。它还可以将负责人从耗时且不必要的任务中解放出来,从而加快流程。采购流程的自动化变得越来越普遍,特别是在采购申请、采购订单、申请管理、供应商管理和合约核准方面。

- 电子采购软体可协助组织整合和自动化整个采购流程。 ERP 透过加快采购流程、腾出时间专注于其他业务以及透过将电子采购工具与 ERP 解决方案相连接来实现更有效的业务,从而使供应商管理变得更加轻鬆。Masu。除此之外,ERP 解决方案还支援改善业务报告、更好的客户服务、降低库存成本、增加现金流量、节省成本、资料和云端安全性以及供应链管理。这些因素推动市场扩张。

- 由于许多组织缺乏运作遗留系统所需的基础设施,预计软体采购市场在预测期内将面临挑战。相反,缺乏熟练的劳动力阻碍了市场的成长。

- 新冠肺炎 (COVID-19) 危机给多个行业带来了挑战,并导致技术支出减少。该公司仍在适应新的 COVID-19 经济,包括新的内部物流,例如在家工作和建立基础设施以满足新需求。供应链中断、需求份额波动、经济形势以及 COVID-19 的直接和长期影响对采购软体市场的成长产生了负面影响。

采购软体市场趋势

零售业预计将占据重要市场占有率

- 零售业预计将占据很大份额。竞争的加剧、报酬率的下降和品牌忠诚度的下降迫使零售商寻求新的方法来保持盈利和竞争力。零售企业领导者越来越依赖采购团队来降低成本、降低供应风险并创造更多价值。这使得采购软体在零售业得以实施。

- 采购软体可协助零售商整合业务流程并提高其业务的整体价值。这有助于提高财务供应链和合约细节的透明度,以建立申请来完成付款。据印度零售商协会称,预测期内印度零售市场规模预计约为1.7兆美元。因此,采购服务在预测期内有巨大的需求来推动其成长。

- 此外,采购软体工具允许零售商自动化采购任务,并透过竞标从供应商获得最佳价格,这使得零售商采购大量商品变得至关重要。透过实施采购软体解决方案,公司可以与供应商协作、追踪事件并获取警报,并分析商业智慧资料以深入了解采购流程,以进行预测和规划。

- 此外,该技术透过整合供应链和促进库存管理,简化了需求和销售预测的决策流程。它还具有营运成本最低、营运效率更高等优势,预计在未来几年加快零售业市场的成长速度。

- 例如,Ginesy 等公司提供使用者友善的 POS 软体,支援快速申请功能。它还提供了一种快速、简单的申请方法,具有持续的资料同步功能。被印度顶级零售公司使用,使其成为印度最好的 POS 软体。

北美占最大市场占有率

- 对集中采购流程的需求不断增长导致北美在全球占据主导地位。此外,该地区成立的公司的整合预计将推动未来市场的成长。根据 Business.org 统计,该生态系统中排名前 20 的Start-Ups均位于北美。例如,奥斯汀和德克萨斯拥有超过 5,500 家Start-Ups以及 Facebook、Google 和 Apple 等大型科技公司。这将显着增加软体采购的需求。

- 美国正大力寻求提高生产力和加强製造业,重点是改善国内工业部门供应链的活动。北美零售市场的电子零售商热衷于透过纳入当日配送来改善客户体验,而这可以透过有效的供应链管理来有效实现。

- 此外,自动化文件建立和合约起草流程可显着简化合约生命週期,与新的采购软体趋势保持一致。例如,CobbleStone Software 发布了 Contract Insight Enterprise 17.6.1。此版本提供了许多新的和改进的功能,以增强领先的合约管理、供应商管理、采购和采购平台。 Contract Insight 的拖放记录伫列允许使用者在自己的时间启动和管理用于记录建立的文檔,并扩展对基于人工智慧的流程的控制。

- 此外,甲骨文、微软等在北美提供采购软体服务的市场参与者的存在及其创新和併购正在推动该地区的市场成长。

采购软体行业概况

采购软体市场集中度中等,市场上有许多大大小小的参与者活跃于国内和国际市场。市场参与者正在采取产品创新、策略伙伴关係、併购等关键策略。市场的一些主要发展是:

- 2022 年 10 月,SaaS 采购软体平台公司 Tropic 与 B2B 先买后付 (BNPL) 供应商 Tranch 合作,让客户能够支付软体费用。根据这项合作关係,Tropic 客户可以透过 Tranch 提交申请,并使用灵活的 EMI 付款,期限最长为 12 个月。 Tropic 客户必须立即透过 Plaid 关联银行帐户才能开始使用并获得核准。

- 2022年9月,采购和供应链服务公司GEP将在阿布达比开设新办事处,并扩大与中东航空、消费品(CPG)、能源和金融领域多个客户的合作范围。服务以及石油和天然气行业的采购软体服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 市场驱动因素

- 对自动化采购流程的需求不断增加

- 电子采购应用程式和 ERP 解决方案的集成

- 零售业预计将占据重要市场占有率

- 市场挑战

- 与现有系统整合和供应商入职的复杂性

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19 对全球采购软体市场的影响

第五章市场区隔

- 按配置

- 本地

- 云

- 按最终用户产业

- 零售

- 製造业

- 运输和物流

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争形势

- 公司简介

- SAP SE

- Proactis Holdings PLC

- Epicor Software Corporation

- Ginesys(Ginni Systems Limited)

- Coupa Software Inc.

- Zycus Inc.

- GT Nexus(Infor Inc.)

- Ivalua Inc.

- Microsoft Corporation

- Oracle Corporation

- Basware AS

- Mercateo AG

- GEP Corporation

- Jaggaer Inc.

第七章 投资分析

第八章市场机会及未来趋势

The Procurement Software Market size is estimated at USD 8.17 billion in 2024, and is expected to reach USD 13.27 billion by 2029, growing at a CAGR of 10.20% during the forecast period (2024-2029).

Software companies are increasing their focus on in-demand technologies and re-exploring innovative ways to serve their clients. The primary factor driving the procurement software industry is the increased integration of developing technologies, such as Artificial Intelligence, and assists in high-quality reports and features to maintain accuracy.

Key Highlights

- With the growing requirement to automate procurement procedures, the maturation of e-procurement technology is expected to offer up new avenues for market growth over the forecast period. Furthermore, the need to prevent duplicate records is projected to drive the growth of the procurement software industry in the future years. Moreover, the implementation of government policies encourages market development. The increase in the flow of foreign transactions across borders fuels the market's progress even further. The market synergy between supply and demand drivers is predicted to affect future market growth.

- There is a growing desire to automate procurement operations to improve efficiency and reduce time. It also expedites the process by relieving personnel of time-consuming and unneeded tasks. Procurement process automation is becoming increasingly popular, especially in buy requests, purchase orders, invoice management, vendor management, and contract approval.

- E-procurement software helps an organization integrate and automate its whole procurement process. ERP assists in easing supplier management by facilitating the procurement processes, freeing time to concentrate on other tasks, and enabling a more effective business made possible when e-procurement tools are connected with ERP solutions. Among other things, ERP solutions support improved business reporting, better customer service, lower inventory costs, increased cash flow, cost reductions, data & cloud security, and supply chain management. These factors encourage market expansion.

- The market for procurement software is expected to have challenges during the forecast period because many organizations lack the infrastructure necessary to work with traditional systems. On the contrary, the lack of skilled personnel impedes the market growth.

- The COVID-19 crisis has created challenges across multiple industries and has led to a reduction in technology spending. Enterprises are still adjusting to the COVID-19 economy, from new internal logistics like WFH or building infrastructure to cope with new demand. Disruptions in the supply chain, fluctuations in demand share, and economic situations, along with the immediate & long-term impact of the novel coronavirus, possessed a negative effect on the procurement software market growth.

Procurement Software Market Trends

Retail Industry is Expected to Hold Significant Market Share

- The retail industry is anticipated to cater to a significant share. The growing competition, falling margins, and diminishing brand loyalty have made retailers look for new ways to remain profitable and competitive. Business leaders at retail enterprises are increasingly turning to their procurement teams to reduce costs, mitigate supply risks, and create more value. This has enabled the adoption of procurement software in the retail industry.

- Procurement software helps retailers to integrate business processes and improve the overall value of businesses. It facilitates transparency in financial supply chains and contract details for generating invoices to complete payments. According to the Retailers Association of India, the retail market size is expected to be around USD 1.7 trillion over the forecast period in India. So, Procurement services have a huge requirement that drives growth over the forecast period.

- Further, procurement software tools enable retail companies to automate procurement tasks and procure the best rates from vendors for their tender, making it essential for retail companies to procure a large volume of goods. With the implementation of procurement software solutions, companies can collaborate with suppliers, track events and get alerts, and analyze business intelligence data to gain insights into the procurement process for forecasting and planning purposes.

- Moreover, this technology simplifies the decision-making process that concerns demand and sales forecast by consolidating the supply chain and facilitating inventory management. Also, it offers advantages such as minimum operational cost, higher operational efficiency, etc., which are presumed to increase the growth pace of the market in the retail industry in the upcoming years.

- For instance, Companies like Ginesy offer user-friendly POS software that supports fast billing features. It also provides a quick and easy approach to billing with continuous data synchronization. It is being used by the top retail companies in India, making it the best POS software in India.

North America Accounts For the Largest Market Share

- North America dominates globally due to the rising demand for centralized procurement processes. Also, the consolidation of companies incorporated in the region is expected to provide an impetus to market growth in the future. According to Business.org, the top 20 startups of ecosystems are located in North America. For instance, Austin and Texas have more than 5,500 startups and big tech giant firms, like Facebook, Google, and Apple. This enhances the demand for procurement software significantly.

- The United States is rigorously looking to strengthen its manufacturing industry by enhancing its productivity by emphasizing improving activities across the supply chain within the industrial sector in the country. The e-retailers in the North American retail market are rigorously trying to enhance the customer experience by incorporating same-day delivery, which can effectively be achieved through effective supply chain management.

- Moreover, automated document creation and contract writing process that significantly streamlines the contract lifecycle cater to new procurement software trends. For instance, CobbleStone Software released Contract Insight Enterprise 17.6.1. This release brings numerous new and improved features to enhance the leading contract management, vendor management, procurement, and sourcing platform. Contract Insight's drag-and-drop record queue allows users to initiate and manage documents for record creation on their time with expanded control over their AI-based process.

- Further, the presence of the market players involved in providing procurement software services, such as Oracle, Microsoft, and others, are located in North America, boosting the market growth in the region along with their innovations and merger and acquisition.

Procurement Software Industry Overview

The procurement software market is moderately concentrated, owing to the presence of a few large and small players in the market operating in the domestic as well as in the international market. Players in the market are adopting key strategies, such as product innovation, strategic partnerships and mergers, and acquisitions. Some of the key developments in the market are:

- In October 2022, Tropic, a SaaS procurement software platform company, partnered with Tranch, a B2B Buy Now Pay Later (BNPL) provider, to allow their customers to pay their software costs. Under this partnership, Tropic customers submit their invoices through Tranch and can pay them in flexible EMIs for up to 12 months. Tropic customers must instantly link their bank account via Plaid to start and be approved.

- In September 2022, GEP, a procurement and supply chain service company, expanded its presence with the launch of a New Office in Abu Dhabi, working with several middle eastern clients in the fields of aviation, consumer packaged goods (CPG), energy, financial services, and oil and gas sectors for procurement software services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand to automate the procurement processes

- 4.2.2 Integration between E Procurement applications and ERP solutions

- 4.2.3 Retail Industry is Expected to Hold Significant Market Share

- 4.3 Market Challenges

- 4.3.1 Complexity Regarding Integration with Existing System and Supplier Onboarding

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of Impact of Covid-19 on the Global Procurement Software Market

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-Premise

- 5.1.2 Cloud

- 5.2 By End-user Industry

- 5.2.1 Retail

- 5.2.2 Manufacturing

- 5.2.3 Transportation and Logistics

- 5.2.4 Healthcare

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SAP SE

- 6.1.2 Proactis Holdings PLC

- 6.1.3 Epicor Software Corporation

- 6.1.4 Ginesys (Ginni Systems Limited)

- 6.1.5 Coupa Software Inc.

- 6.1.6 Zycus Inc.

- 6.1.7 GT Nexus (Infor Inc.)

- 6.1.8 Ivalua Inc.

- 6.1.9 Microsoft Corporation

- 6.1.10 Oracle Corporation

- 6.1.11 Basware AS

- 6.1.12 Mercateo AG

- 6.1.13 GEP Corporation

- 6.1.14 Jaggaer Inc.