|

市场调查报告书

商品编码

1440140

乙氧基化甲酯 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Methyl Ester Ethoxylate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

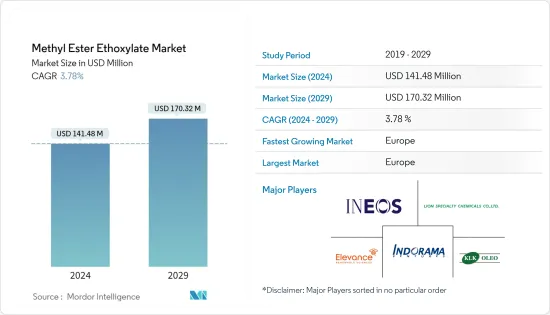

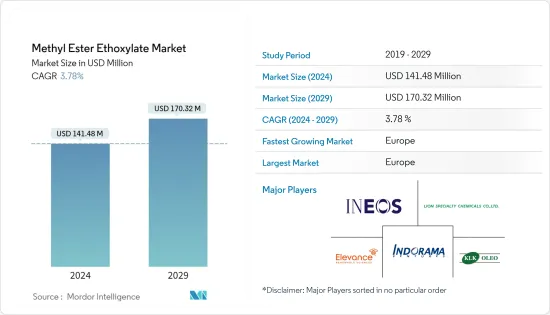

预计2024年甲酯聚氧乙烯醚市场规模为1.4148亿美元,预计到2029年将达到1.7032亿美元,在预测期内(2024-2029年)CAGR为3.78%。

COVID-19大流行对2020年的市场产生了负面影响。然而,在大流行期间,人们对个人卫生和清洁环境的意识增强,刺激了对洗涤剂、工业清洁剂、个人护理产品等应用中乙氧基化甲酯的需求。

主要亮点

- 短期内,个人护理和化妆品需求的激增以及人们对低泡、低冲洗和单洗洗涤剂的认识不断增强,预计将推动市场的成长。

- 另一方面,更有效率的表面活性剂的存在可能会阻碍所研究市场的成长。

- 人们对生物基界面活性剂的认识不断提高,发展中国家的都市化进程不断加快,可能为乙氧基化甲酯市场带来机会。

- 预计欧洲将主导全球市场,并可能在预测期内实现最高的CAGR。

甲酯聚氧乙烯醚市场趋势

洗涤剂和工业清洁剂的需求不断增长

- 乙氧基化甲酯是一种透过羧酸甲酯水解产生甲醇的酯。与脂肪醇乙氧基化物相比,甲酯乙氧基化物是低泡、非离子界面活性剂。

- 脂肪酸甲酯,例如椰子甲酯或大豆甲酯,直接使用催化剂体系进行乙氧基化以获得甲酯乙氧基化物。

- 它们的润湿强度与同等烷基链的脂肪醇乙氧基化物相当。它们不会像脂肪醇乙氧基化物那样形成凝胶。乙氧基化甲酯是优良的乳化剂和洗涤剂。它们还有助于提高低活性配方的黏度。

- 乙氧基化甲酯可用于清洁剂、清洁剂、硬表面清洁剂、乳化剂、洗衣预去污剂等。

- 製备衣物洗涤剂包括透过混合非离子界面活性剂(包括在碱性环境中稳定的乙氧基化甲酯)和水来形成含水非离子预混物。

- 甲酯乙氧基化物是透过对精炼、漂白和脱臭的油进行酯交换形成脂肪甲酯,然后进行乙氧基化过程而形成的。具体而言,脂肪甲酯和环氧乙烷之间的催化反应形成甲酯乙氧基化物。利用此生产製程形成甲酯乙氧基化物作为非离子界面活性剂,省去了生产醇乙氧基化物所需的加氢步骤,降低了去垢剂的生产成本。

- 随着消费者对维持健康卫生和清洁意识的不断提高,全球洗涤剂和工业清洁剂市场预计将在预测期内成长。 COVID-19 大流行导致工业空间清洁活动的增加,进而增加了对工业清洁剂的需求。

- 根据国际肥皂、洗涤剂和保养产品协会的报告,2020年该行业对清洁产品的需求翻了一番,并持续到2021年。消费者对卫生的偏好引发了对特种洗涤剂和清洁剂的需求近来。

- 因此,洗涤剂和清洁剂产量的增加可能会增加对乙氧基化甲酯市场的需求。

欧洲地区预计将主导市场

- 由于德国、义大利和法国等国家的需求增加,预计欧洲将在预测期内主导乙氧基化甲酯市场。

- 德国化妆品、盥洗用品、香水和洗涤剂协会 IKW 的数据显示,肥皂和合成洗涤剂的收入在 2020 年达到 6.32 亿欧元的峰值后,从 2017 年的 3.45 亿欧元攀升至 2021 年的 5.02 亿欧元。 2021年,国内市场消费者购买量增加。此外,该国年轻人对个人护理意识的不断提高预计将推动对护肤品和化妆品的需求。

- 根据欧洲化妆品协会的报告,德国是欧洲地区最大的化妆品和个人护理产品市场。 2021 年,该国的收入贡献超过 140 亿欧元。

- 2020 年,家庭清洁产品的需求突然激增,并持续到 2022 年。消费者卫生和清洁意识的增强支持了这一趋势。

- 2022年,欧盟肥皂和清洁剂、清洁和抛光製剂、香水和盥洗用品的出口大幅成长。2022年10月,这些出口年增率为14.5%。

- 此外,义大利对整个地区的成长做出了巨大贡献。其主要产业包括旅游业、精密机械、汽车、化学、製药、电器、纺织、时装、服装和鞋类。

- 根据Cosmetica Italia预测,2021年义大利美容公司销售额将成长10.4%,达到117亿欧元。此外,消费者对环保、有效化妆品的需求不断增长,可能会增加该国对化妆品的需求。

- 儘管2021年产量强劲回升且国内消费恢復(+6.5%),但义大利化妆品产业尚未恢復到疫情前的活动水准。然而,该协会预计该行业将在 2022 年底前达到 COVID-19 之前的水平,销售额达到 125 亿欧元。

- Cerved 表示,在工业、商业和家庭清洁活动需求不断增长的支撑下,洗涤剂和清洁产品行业在 2021 年温和增长。此外,该国 COVID-19 病例的激增刺激了卫生维护和清洁的需求。

- 在法国,洗涤剂和清洁剂市场主要由工业和家庭应用驱动。国内洗衣液市场不断成长。法国人认为洗衣是他们日常生活的重要部分。在法国,每年生产近 2,000 万台机器。 2021年1月至2022年1月。2021年7月至2022年7月期间,法国超市的清洁产品总销售额超过57亿欧元。同期洗衣产品销售额约 22 亿欧元,且在预测期内可能进一步成长。

- 法国美容联合会(FEBEA)表示,随着消费者需求的增加和法国化妆品製造商投资的增加,预计法国化妆品产业将在预测期内实现成长。此外,网上购物趋势的采用为国内市场提供了广阔的拓展空间。

- 因此,所有上述因素都可能对预测期内欧洲研究市场的需求产生重大影响。

乙氧基化甲酯产业概况

全球甲酯乙氧基化物市场本质上是部分整合的。市场上一些主要的参与者包括 INEOS、KLK OLEO、Lion Specialty Chemicals、Elevance Renewable Sciences Inc. 和 Indorama Ventures 等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 个人护理和化妆品需求激增

- 人们对低泡、低冲洗和单洗洗涤剂的认识不断增强

- 限制

- 更有效的表面活性剂的存在

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场细分

- 按应用

- 洗涤剂和工业清洁剂

- 个人护理和化妆品

- 其他应用

- 按地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)**/排名分析

- 领先企业采取的策略

- 公司简介

- Sinolight Surfactants Technology Co. Ltd

- Elevance Renewable Sciences Inc.

- Indorama Ventures Public Company Limited

- INEOS

- Jet Technologies

- KLK OLEO

- Lion Specialty Chemicals Co. Ltd

- Nanjing Chemical Material Corp.

- Sino-Japan Chemical Co. Ltd

- Venus Ethoxyethers Pvt. Ltd

第 7 章:市场机会与未来趋势

- 人们对生物表面活性剂的认识不断增强

- 发展中国家不断发展的都市化

The Methyl Ester Ethoxylate Market size is estimated at USD 141.48 million in 2024, and is expected to reach USD 170.32 million by 2029, growing at a CAGR of 3.78% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market in 2020. However, consciousness regarding personal hygiene and clean surroundings increased during the pandemic, stimulating the demand for methyl ester ethoxylate in applications such as detergents, industrial cleaning agents, personal care products, and others.

Key Highlights

- Over the short term, surging demand from personal care and cosmetics and growing awareness regarding low foam, low rinse, and single wash detergents are expected to drive the growth of the market.

- On the other side, the presence of more efficient surfactants is likely to hinder the growth of the market studied.

- Increasing awareness regarding bio-based surfactants and growing urbanization in developing countries are likely to act as opportunities for the methyl ester ethoxylate market.

- Europe is expected to dominate the global market and is likely to witness the highest CAGR during the forecast period.

Methyl Ester Ethoxylate Market Trends

Growing Demand from Detergents and Industrial Cleaning Agents

- Methyl ester ethoxylate is an ester that yields methanol on hydrolysis methyl esters of carboxylic acids. Methyl ester ethoxylates are low-foaming, non-ionic surfactants compared to fatty alcohol ethoxylates.

- Fatty acid methyl esters, such as coconut methyl ester or soya methyl ester, can be ethoxylated directly using a catalyst system to obtain methyl ester ethoxylates.

- Their wetting strength is comparable to fatty alcohol ethoxylates of an equivalent alkyl chain. They do not form gels as fatty alcohol ethoxylates. Methyl ester ethoxylates work as excellent emulsifiers and detergents. They also help in building viscosity in low-active formulations.

- Methyl ester ethoxylates have applications in detergents, cleaning agents, hard surface cleaners, emulsifiers, laundry pre-spotters, and others.

- Making a laundry detergent includes forming an aqueous non-ionic premix by mixing a non-ionic surfactant, including a methyl ester ethoxylate stable in an alkaline environment and water.

- Methyl ester ethoxylates are formed by transesterifying refined, bleached, and deodorized oil to form fatty methyl esters, followed by an ethoxylation process. Specifically, a catalyzed reaction between fatty methyl esters and ethylene oxide forms methyl ester ethoxylates. By using this production process to form methyl ester ethoxylates as the nonionic surfactant, the step of hydrogenation required for alcohol ethoxylate production is eliminated, thus, reducing production costs for detergents.

- The global detergents and industrial cleaning agent market is anticipated to grow over the forecast period in line with rising consumer consciousness regarding maintaining healthy hygiene and cleanliness. The COVID-19 pandemic led to a growth in cleaning activities in industrial spaces, which, in turn, increased the demand for industrial cleaning agents.

- According to reports by the International Association for Soaps, Detergents, and Maintenance Products, the industry witnessed a double-fold demand for cleaning products in 2020, which continued in 2021. The consumer inclination toward hygiene has triggered the demand for specialty detergents and cleaning agents in recent times.

- Thus, the rise in production of detergents and cleaning agents is likely to boost demand for the methyl ester ethoxylate market.

European Region is Expected to Dominate the Market

- Europe is expected to dominate the market for methyl ester ethoxylate during the forecast period due to increased demand from countries like Germany, Italy, and France.

- Revenue from soaps and synthetic detergents climbed from EUR 345 million in 2017 to EUR 502 million in 2021, according to IKW, the German Cosmetic, Toiletry, Perfumery, and Detergent Association, after reaching a peak of EUR 632 million in 2020. The industry improved in 2021 with a gain in consumer purchases in the domestic market. Moreover, the rising awareness about personal care among the young population in the country is expected to drive the demand for skin care products and cosmetics.

- According to the reports by Cosmetics Europe, Germany was the largest market for cosmetics and personal care products in the European region. The country accounted for a revenue contribution of more than EUR 14 billion in 2021.

- The demand for cleaning products in the household witnessed a sudden spike in 2020, which continued till 2022. This trend was supported by increased consumer consciousness regarding hygiene and cleanliness.

- EU's exports of soap and detergents, cleaning and polishing preparations, perfumes, and toilet preparations increased considerably in 2022. In October 2022, these exports registered a YoY growth rate of 14.5%.

- Furthermore, Italy contributes a significant share to the overall regional growth. Its major industries include tourism, precision machinery, motor vehicles, chemicals, pharmaceuticals, electrical goods, textiles, fashion, clothing, and footwear.

- According to projections by Cosmetica Italia, sales of Italian beauty companies grew by 10.4% to EUR 11.7 billion in 2021. Further, the growing consumer demand for eco-friendly and effective cosmetics is likely to increase the demand for cosmetics in the country.

- Despite a strong pick-up in production in 2021 and resumption of domestic consumption (+6.5%), the Italian cosmetics industry has not yet returned to its pre-pandemic activity level. However, the association expects the industry to level the pre-COVID-19 figure by the end of 2022 and register a sales figure of EUR 12.5 billion.

- According to Cerved, the detergent and cleaning products sector grew moderately in 2021, supported by increasing demand from industrial, commercial, and household cleaning activities. Moreover, the surge in COVID-19 cases in the country fueled the demand for hygiene maintenance and cleanliness.

- In France, the detergent and cleaning agent market is majorly driven by industrial and household applications. The laundry detergent market in the country has constantly been growing. The French population considers laundry to be a significant part of their daily lives. In France, almost 20 million machines are produced each year. Between January 2021 and January 2022. Total cleaning product sales in French supermarkets amounted to more than EUR 5.7 billion during the July 2021 to July 2022 period. Laundry product sales were roughly EUR 2.2 billion during the same time and are likely to rise further in the forecast period.

- According to the French Beauty Federation (FEBEA), the French cosmetic industry is anticipated to grow in the forecast period with increasing consumer demand and rising investments from cosmetic manufacturers in the country. Moreover, the adoption of online shopping trends has provided a wide scope of expansion in the domestic market.

- Therefore, all the abovementioned factors are likely to significantly impact the demand for the market studied in Europe over the forecast period.

Methyl Ester Ethoxylate Industry Overview

The global methyl ester ethoxylate market is partially consolidated in nature. Some key players in the market include INEOS, KLK OLEO, Lion Specialty Chemicals Co. Ltd, Elevance Renewable Sciences Inc., and Indorama Ventures, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Demand from Personal Care and Cosmetics

- 4.1.2 Growing Awareness Regarding Low Foam, Low Rinse, and Single Wash Detergents

- 4.2 Restraints

- 4.2.1 Presence of More Efficient Surfactants

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Detergents and Industrial Cleaning Agents

- 5.1.2 Personal Care and Cosmetics

- 5.1.3 Other Applications

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Sinolight Surfactants Technology Co. Ltd

- 6.4.2 Elevance Renewable Sciences Inc.

- 6.4.3 Indorama Ventures Public Company Limited

- 6.4.4 INEOS

- 6.4.5 Jet Technologies

- 6.4.6 KLK OLEO

- 6.4.7 Lion Specialty Chemicals Co. Ltd

- 6.4.8 Nanjing Chemical Material Corp.

- 6.4.9 Sino-Japan Chemical Co. Ltd

- 6.4.10 Venus Ethoxyethers Pvt. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Awareness Regarding Bio-sased Surfactants

- 7.2 Growing Urbanization in Developing Countries