|

市场调查报告书

商品编码

1440157

汽车声学工程服务 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Automotive Acoustic Engineering Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

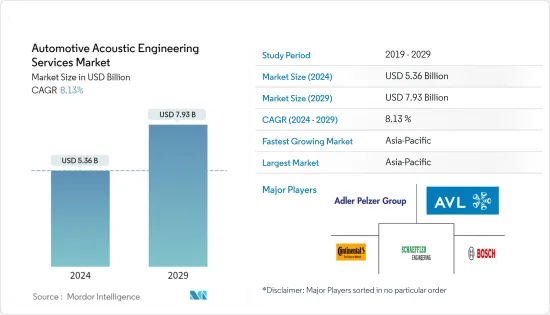

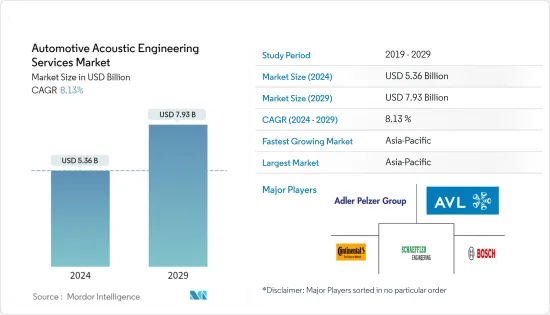

2024年汽车声学工程服务市场规模预计为53.6亿美元,预计到2029年将达到79.3亿美元,在预测期内(2024-2029年)CAGR为8.13%。

COVID-19 大流行影响了汽车声学工程服务市场的成长。 2020年乘用车和商用车销量下降以及整车及零件生产设施临时停产的情况减少。疫情期间主要车辆测试设施已停止,可能会影响市场。

车辆噪音规则日益严格以及对车内舒适度和豪华设施的需求等因素预计将推动全球汽车声学工程服务市场的发展。例如,

从 1970 年第 70/157/EEC 号指令开始,联合国欧洲经济委员会 (UNECE) 发布了一系列有关车辆噪音的 137 项法律。此外,国际标准化组织 (ISO) 和第 43 技术委员会 (ISO/TC 43) 正在解决全球声学问题,其中一些问题与车辆噪音问题有关。因此,全球规则的执行推动了对汽车声学工程设备的需求,推动了全球汽车声学工程服务市场的成长。

引擎小型化意味着在车辆中使用更小、更轻的引擎来产生更大引擎的动力。它可以透过降低引擎排气量和汽缸数或采用强制吸气装置(例如涡轮增压器或机械增压器)和直喷技术来实现。然而,这两个因素都可能显着影响车辆的整体噪音、振动和声振粗糙度 (NVH) 行为。在预测期内,引擎小型化的趋势预计将为全球汽车声学工程市场的发展提供有利可图的前景。

汽车声学工程服务市场趋势

动力总成应用主导市场

根据该应用,动力总成领域在 2021 年收入中占据了主要市场份额。动力总成噪音、振动和声振粗糙度 (NVH) 测试通常关注车辆推进过程中的整体驾驶员体验。这些测试包括影响车辆机动性的一切。允许的噪音水平和声音品质是最重要的,因为传动系统中组装的更多汽车零件会在车辆动态过程中发出令人不快的声音,从而使驾驶体验变得更糟。

多个动力总成部件来源的噪音包括内燃机 (ICE)、尾管、排气系统、变速箱、帮浦、皮带传动系统以及冷却系统中使用的配件。此外,众所周知,燃油泵会将空气中和结构上的颗粒传输到车辆中,主要有助于提高车辆的整体声学标准。这些部件噪音受到立法的监管,以增强车辆的驾驶体验。

联合国欧洲经济委员会 (UNECE) 和噪音与轮胎协调工作小组为其欧洲、亚洲和北美的 56 个成员国制定了相关法规。成员国已在当地执行了某些法规,包括控制动力系统的整体车辆噪音排放。此外,製造商必须确定其通过噪音是否符合现行法规,以确保其噪音排放标准在合规法规限制内。

因此,许多汽车製造商都会进行动力系统测试以保持标准合规性。这些主要测试涵盖多种负载条件下的声压级和动力总成完整性测试,包括车辆启动、加速、稳态、部分负载和最大负载。

因此,动力传动系声学测试的需求预计在预测期内将出现高速成长。

亚太地区将占据主要市场份额

2021 年,亚太地区的收入大幅成长。该地区电动车需求的成长为声学服务提供者提供了机会。

中国是全球最大的汽车市场之一; 2021年,中国乘用车销量超过2,139万辆,与2020年相比,年销量成长6%。儘管与美国存在经济衝突以及COVID-19大流行的影响,中国仍然是全球乘用车市场之一。是汽车声学工程服务商在中国汽车市场占据一席之地的绝佳机会。此外,2021年,中国乘用车出口量超过160万辆,商用车出口量超过40.2万辆。

由于政府的倡议,预计日本将在预测期内在电动车中显着部署汽车声学工程服务,这可能会促进电动车在该国的迅速崛起。例如,

2021年11月,日本政府宣布将电动车奖励措施提高一倍,达到每辆车80万日元,并对充电基础设施提供补贴,以赶上北美和欧洲等成熟经济体的步伐。

在印度,汽车製造商正在与自动驾驶汽车研究机构合作。例如,2021年3月,MG汽车印度公司加入印度理工学院德里汽车研究和摩擦学中心(CART),研究电动和自动驾驶汽车。印度理工学院德里分校将协助名爵进一步专注于CASE出行(互联-自主-共享-电动);透过支持在印度城市景观中部署电动和自动驾驶汽车的研究,这将是汽车声学工程服务成长的明显标誌。

因此,上述所有因素都将增加汽车声学工程服务在各种车辆推进系统中的采用。

汽车声学工程服务业概况

汽车声学工程服务市场集中,少数参与者占主要市场份额。汽车声学工程服务市场的一些知名公司包括西门子、罗伯特博世、Autoneum、Adler Pelzer、Bertrandt AG、Schaeffler Engineering GmbH 等。

主要参与者正在透过开发新的研究和製造设施来扩大规模,以获得市场份额。例如,

2022 年 5 月,Adler Pelzer Group (APG) 与泰兴市政府签署了一份谅解备忘录,计划使用其最新的复合材料技术为客户製造用于内外硬装饰的零件。

2021 年 6 月,Autoneum 宣布与比利时软体公司 Free Field Technologies (FFT) 合作。 Autoneum 经过验证的车辆声学声学模拟方法正在整合到 FFT 领先的建模软体 Actran 中,为杂讯、振动、声振粗糙度 (NVH) 和资料交换的 CAE 设计树立了新标准。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场驱动因素

- 市场限制

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 按流程

- 设计

- 发展

- 测试

- 透过软体

- 校准

- 振动

- 其他的

- 按应用

- 内部的

- 车身及结构

- 动力总成

- 传动系统

- 按车型分类

- 搭乘用车

- 商用车

- 依推进类型

- 内燃机

- 电动和插电式混合动力

- 按地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 世界其他地区

- 中东和非洲

- 南美洲

- 北美洲

第 6 章:竞争格局

- 供应商市占率

- 公司简介

- Siemens Digital Industries Software (Siemens AG)

- Robert Bosch GmbH

- Continental Engineering Services GmbH (Continental AG)

- Bertrandt AG

- Schaeffler Engineering GmbH

- Autoneum Holding Ltd

- IAC Acoustics (Catalyst Acoustics Group)

- AVL List GmbH

- EDAG Engineering Group AG

- FEV Group GmbH

- Spectris PLC

- Adler Pelzer Holding GmbH

第 7 章:市场机会与未来趋势

The Automotive Acoustic Engineering Services Market size is estimated at USD 5.36 billion in 2024, and is expected to reach USD 7.93 billion by 2029, growing at a CAGR of 8.13% during the forecast period (2024-2029).

The COVID-19 pandemic has affected the growth of the automotive acoustic engineering services market. The decline in passenger and commercial vehicle sales in 2020 and the temporary shutdown of vehicle and component production facilities have decreased. Major vehicle testing facilities have been stopped during the pandemic, which is likely to affect the market.

Factors such as increasing stringency in vehicle noise rules and demand for interior cabin comfort and luxury amenities are expected to raise the global automotive acoustic engineering services market. For instance,

Beginning with Directive 70/157/EEC in 1970, the United Nations Economic Commission for Europe (UNECE) released a series of 137 laws regarding vehicle noise. Furthermore, the International Organization for Standardization (ISO) and Technical Committee 43 (ISO/TC 43) are addressing global acoustics issues, some of which are connected to vehicle noise issues. As a result, the global enforcement of rules drives the need for automotive acoustic engineering equipment, fueling the growth of the global automotive acoustic engineering services market.

Engine downsizing entails using a smaller and lighter engine in a vehicle to produce the power of a bigger engine. It can be accomplished by lowering engine displacement and cylinder count or incorporating a forced aspiration device such as a turbocharger or supercharger and direct-injection technology. Both elements, however, may significantly impact the vehicle's overall noise, vibration, and harshness (NVH) behavior. During the projected period, the rising trend of engine downsizing is expected to provide lucrative prospects for advancing the global automotive acoustic engineering market.

Automotive Acoustic Engineering Services Market Trends

Powertrain Application dominating the market

Based on the application, the powertrain segment held a major market share in revenue in 2021. Powertrain noise, vibration, and harshness (NVH) testing are generally concerned with the overall driver experience during vehicle propulsion. These tests include everything that makes the mobility of a vehicle. The allowed noise levels and sound quality are the most important, as more of the auto parts assembled in the drive train is responsible for making unpleasant sounds during vehicle dynamics, thus making the driving experience worse.

The noise from several powertrain component sources includes the internal combustion engine (ICE), tailpipe, exhaust system, gearbox, pumps, belt drive system, and accessories used in cooling systems. Moreover, the fuel pump is known for transmitting airborne and structure-borne particles into the vehicle, thus contributing primarily to the overall vehicle acoustic standard. These component noises are regulated by legislation to enhance the vehicle's driving experience.

The United Nations Economic Commission for Europe (UNECE) and the working party on Noise and Tires coordinates gave the regulations for its 56 member states in Europe, Asia, and North America. The member states have executed certain regulations locally, including controlling the overall vehicle noise emission from the powertrain. In addition, manufacturers must determine their pass-by noise compliance with present regulations to ensure their noise emissions standards are within the compliance regulation limits.

Thus, many vehicle manufacturers conduct the powertrain test to maintain the standards compliances. These main tests cover sound pressure levels and powertrain integrity tests under several load conditions, including vehicle launch, acceleration, steady state, partial load, and maximum load.

Thus, the demand for power train acoustic testing is expected to witness high growth during the forecast period.

Asia-Pacific to hold major market share

Asia-Pacific witnessed major growth in terms of revenue in 2021. The rise in demand for electric vehicles across the region offers opportunities to acoustics services providers.

China is one of the world's largest automotive markets; more than 21.39 million passenger cars were sold in the country in 2021 and recorded an increase of 6% in yearly sales compared to 2020. Despite the economic conflicts with the United States and the impact of the COVID-19 pandemic, China is still one of the largest sellers of automobiles, which is a great opportunity for automotive acoustic engineering service providers to make their place in the Chinese automobile market. Moreover, in 2021, China has exported more than 1.6-million-unit passenger vehicles and 402,000 unit commercial vehicles.

Japan is expected to show remarkable deployment of automotive acoustic engineering services in electric vehicles during the forecast period due to the government initiative, which is likely to catalyze the rapid emergence of EVs in the country. For instance,

In November 2021, Japan government announced to double their incentives for electric vehicles to 800,000 Yen per vehicle and subsidizes charging infrastructure to catch up with matured economies, including North America and Europe.

In India, automakers are partnering with institutes for research in autonomous vehicles. For instance, in March 2021, MG Motor India joined IIT Delhi's Centre for Automotive Research and Tribology (CART) to research electric and autonomous vehicles. IIT Delhi will help MG to further focus on CASE mobility (Connected - Autonomous - Shared - Electric); by enabling supporting research for the deployment of electric and autonomous vehicles in the urban landscape in India, which would be an evident sign of the growth of automotive acoustic engineering services.

Thus, all the factors mentioned above will increase automotive acoustic engineering services adoption across various vehicle propulsion systems.

Automotive Acoustic Engineering Services Industry Overview

The Automotive Acoustic Engineering Services Market is concentrated, with a few players accounting for a major market share. Some prominent companies in the Automotive Acoustic Engineering Services Market are Siemens, Robert Bosch, Autoneum, Adler Pelzer, Bertrandt AG , Schaeffler Engineering GmbH, and others.

Key players are expanding by developing new research and manufacturing facilities to gain market share. For instance,

In May 2022, Adler Pelzer Group (APG) signed a Memorandum of Understanding with the Government of Taixing City, where it plans to manufacture parts for its customers using its latest technologies of composite material for interior and exterior hard trims.

In June 2021, Autoneum announced a collaboration with Free Field Technologies, a Belgian software company (FFT). Autoneum's proven acoustic simulation methods for vehicle acoustics are being integrated into FFT's leading modeling software, Actran, setting new standards in CAE design of noise, vibration, harshness (NVH), and data exchange.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Process

- 5.1.1 Designing

- 5.1.2 Development

- 5.1.3 Testing

- 5.2 By Software

- 5.2.1 Calibration

- 5.2.2 Vibration

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Interior

- 5.3.2 Body and Structure

- 5.3.3 Powertrain

- 5.3.4 Drivetrain

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Commercial Vehicle

- 5.5 By Propulsion Type

- 5.5.1 Internal Combustion Engine

- 5.5.2 Electric and Plug-In Hybrid

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Rest of the World

- 5.6.5 Middle-East and Africa

- 5.6.6 South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Siemens Digital Industries Software (Siemens AG)

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Continental Engineering Services GmbH (Continental AG)

- 6.2.4 Bertrandt AG

- 6.2.5 Schaeffler Engineering GmbH

- 6.2.6 Autoneum Holding Ltd

- 6.2.7 IAC Acoustics (Catalyst Acoustics Group)

- 6.2.8 AVL List GmbH

- 6.2.9 EDAG Engineering Group AG

- 6.2.10 FEV Group GmbH

- 6.2.11 Spectris PLC

- 6.2.12 Adler Pelzer Holding GmbH