|

市场调查报告书

商品编码

1440167

超音波换能器:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Ultrasound Transducer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

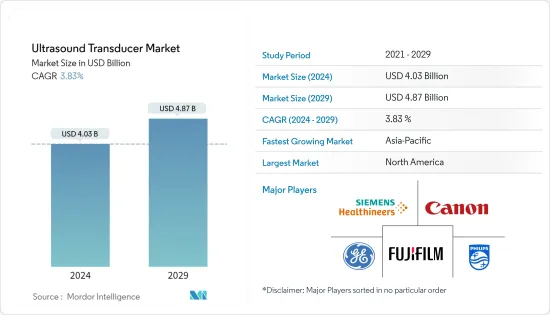

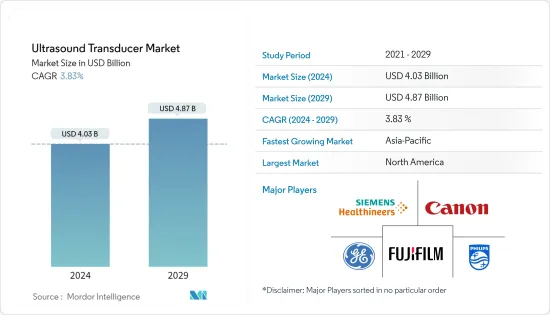

超音波换能器市场规模预计到2024年为40.3亿美元,预计到2029年将达到48.7亿美元,在预测期内(2024-2029年)增长3.83%。复合年增长率为

冠状病毒感染疾病(COVID-19)大流行对超音波换能器市场产生了重大影响。根据 2021 年 10 月发表在《麻醉师当前观点》上的报导,超音波设备、换能器和耦合凝胶可以成为病原体传播的载体。超音波是针对 COVID-19 患者的前线诊断和监测工具。对于COVID-19患者,超音波可用于胸前心臟超音波、超音波引导胸腔穿刺术和血管通路。例如,根据 2021 年 3 月发表在《大数据前沿》上的一项研究,世界各地越来越多的证据表明,肺部超音波可以检测出 COVID-19感染疾病的症状。此类研究在大流行期间推动了市场成长。此外,还建议采取标准化策略,以最大程度地降低 COVID-19 疾病向患者和医护人员传播的风险,预计将市场成长推至疫情前的水平。事实确实如此。

推动市场成长的主要因素是对微创治疗的需求不断增长以及心血管、呼吸和腹部疾病盛行率的增加。 Karoline Freeman 及其同事在《BMC Gastroenterology Journal》2021 年 3 月号上发表的一项研究发现,全球整体发炎性肠道疾病(IBD) 的发生率为每 10 万人中 69.5 例。此外,2022 年 2 月在 BMC Medicine 上发表的一项研究发现,与用餐相关的腹痛在世界范围内很常见,并且与其他胃肠道(GI) 和非胃肠道身体症状、心理困扰和健康有关。非消化器官系统症状。生活品质下降。经常出现与用餐相关的腹痛的人更有可能符合肠-脑相互作用障碍(DGBI)的诊断标准。腹部疾病的这种增加将导致超音波来诊断腹部疾病,由于超音波换能器的采用越来越多,从而推动了市场的成长。

此外,对微创治疗的需求不断增长也是推动市场成长的主要因素。根据 IEEE Transactions on Medical Imaging 2021 年 4 月发表的一项研究,预计超音波影像成像将取代透视检查,成为微创脊椎手术的黄金标准。研究人员正在致力于开发用于导航的超音波成像,利用其用户友好和无辐射的独特特性。因此,这种在微创手术中的超音波应用取代有害的透视检查将导致采用率的增加,从而推动市场成长。

微创方法,包括超音波引导技术,正在广泛使用。因此,一些市场参与者推出了他们的产品并正在推动超音波换能器市场的成长。例如,2021 年 12 月,飞利浦在 EuroEcho 2021 上宣布推出心臟超音波图测试,以提供完全整合的超音波解决方案。此外, FUJIFILM SonositePX 于 2021 年 3 月推出了新的感测器系列,包括 L19-5,这是 Sonosite 有史以来频率最高的感测器,具有明确的近场分辨率和 1 cm 扫描深度。Deucer 已发布。 L19-5 感测器的占地面积仅为 20 毫米,使其适合表面扫描应用,例如血管通路、小儿科和肌肉骨骼评估。由于产品在市场上的可用性,此类发布促进了市场成长,从而提高了采用率。预计这些因素将共同推动预测期内的市场成长。

然而,严格的法规和缺乏操作先进设备的技术纯熟劳工阻碍了市场成长。

超音波换能器市场趋势

凸面细分市场预计未来将健康成长。

由于与其他换能器相比,凸形换能器具有效率高、能够聚焦深部器官等优点,因此未来凸形换能器产品将产生健康成长。这些设备提供更清晰的影像并且也更加可靠。凸面换能器波束形状非常适合某些疾病的详细检查。

此外,凸面感测器在经阴道、腹部和经直肠疾病诊断中的高采用率将推动该领域的成长。此外,一些市场相关人员正在製定产品发布和核准等策略。例如,2022 年 2 月, FUJIFILM Sonosite, Inc. 推出了全新的优质 Sonosite LX 系统,扩大了其新一代 POCUS 产品组合。该系统包括该公司生产的最大的临床影像和可扩展监视器。旋转和倾斜可改善即时提供者协作。此外,GE Healthcare 于 2021 年 3 月发布了 Vscan Air,这是一款无线袖珍超音波设备,可提供清晰的影像品质、全身扫描功能和直觉的软体。该产品是最小、最轻的手持式超音波设备之一,提供全身扫描功能和清晰的影像品质。

因此,由于上述因素,预计市场在预测期内将显着成长。

预计北美将在市场上占据重要份额,并且在预测期内也将获得类似的份额。

由于慢性病盛行率上升、对尖端医疗设备的高需求、研发成本的上升、患者对早期诊断的偏好增加以及对超音波换能器的需求不断增加,北美是世界超音波换能器市场中占有很大份额。超音波系统。根据美国心臟协会公布的2022年统计数据,2021年美国心臟衰竭盛行率为600万人,占总人口的1.8%。因此,我国心臟衰竭患者的负担非常高。为了更好地诊断和治疗而对超音波换能器设备的需求预计将增加,并有望在预测期内进一步推动市场成长。

美国在北美地区超音波换能器市场中占有最大份额。一些市场相关人员正在实施策略性措施以促进市场成长。例如,2021 年 11 月,Butterfly Network, Inc.(一家提供优质医疗影像服务的创新数位健康公司)与 Longview Acquisition Corp. 签订了最终的业务合併协议。 Butterfly iQ 是唯一一款能够在单一手持式探头中使用半导体技术进行全身成像的超音波换能器。此类策略倡议预计将推动北美超音波换能器市场的成长。

超音波换能器产业概况

超音波换能器市场竞争适度,由几家主要企业组成。目前主导该市场的公司包括皇家飞利浦公司、西门子医疗公司、通用电气医疗集团、日立医疗系统公司、富士胶片索诺声公司、深圳迈瑞生物医疗电子公司、佳能医疗系统公司、ESAOTE SPA 和三星麦迪逊。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 对微创治疗的需求不断增长

- 心血管、呼吸系统和腹部疾病的盛行率增加

- 市场限制因素

- 超音波产品高成本

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 副产品

- 凸面

- 线性

- 腔内的

- 相位阵列

- 连续波多普勒

- 其他的

- 按用途

- 肌肉骨骼系统

- 心血管

- OB/GYN

- 一般影像

- 其他的

- 按最终用户

- 医院

- 诊断中心

- 门诊手术中心

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争形势

- 公司简介

- Koninklijke Philips NV

- Siemens Healthineers

- GE Healthcare

- Fujifilm Holdings Corporation(fujifilm Sonosite)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- Canon Medical Systems Corporation

- ESAOTE SPA

- Samsung Electronics Co. Ltd(samsung Medison)

- Telemed Ultrasound Medical System

- Alpinion Medical Systems Co. Ltd

- Broadsound Corporation Information

- Ezono Ag

第七章市场机会与未来趋势

The Ultrasound Transducer Market size is estimated at USD 4.03 billion in 2024, and is expected to reach USD 4.87 billion by 2029, growing at a CAGR of 3.83% during the forecast period (2024-2029).

The COVID-19 pandemic has significantly impacted the ultrasound transducer market. According to an October 2021 published article in Current Opinion in Anaesthesiologist, ultrasound machines, transducers, and coupling gels can serve as vectors for the transmission of pathogens. Ultrasound is a front-line diagnostic and monitoring tool for patients with COVID-19. In COVID-19 patients, ultrasound can be used for transthoracic echocardiography, and ultrasound-guided thoracentesis and vascular access. For instance, according to the study published in Frontiers in Big Data, in March 2021, growing evidence around the world is showing that lung ultrasound examination can detect manifestations of COVID-19 infection. Such studies have driven market growth during the pandemic. Moreover, standardized strategies were recommended to minimize the risk of the spread of COVID-19 to patients and healthcare providers, which is in turn expected to boost the market's growth to pre-pandemic levels.

The major factors contributing to the market's growth are the rising demand for minimally invasive therapies and the increasing prevalence of cardiovascular, respiratory, and abdominal disorders. According to a research study by Karoline Freeman et al., published in BMC Gastroenterology Journal March 2021, globally, the incidence of inflammatory bowel disease (IBD) was found to be 69.5 per 100,000 population. In addition, according to the study published in BMC Medicine in February 2022, meal-related stomach pain is common all over the world, and it's linked to other Gastrointerstinal(GI) and non-GI physical symptoms, psychological distress, healthcare use, and a lower quality of life. People who have frequent meal-related stomach pain are more likely to meet the diagnostic criteria for disorders of gut-brain interaction (DGBI). Such rise in abdominal conditions will lead to adoption of ultrasound for the diagnosis of abdominal conditions, driving the market growth due to higher adoption of ultrasound transducers.

Moreover, the rising demand for minimally invasive therapies is another major factor driving the market growth. According to the study published in IEEE Transactions on Medical Imaging in April 2021, ultrasound imaging is predicted to take the role of X-ray fluoroscopy as the gold standard in minimally invasive spinal surgery. Researchers are working to develop ultrasonic imaging for navigation, taking advantage of its unique characteristics of being user-friendly and radiation-free. Such applications ultrasounds in minimally invasive surgeries replacing the harmful X-ray fluoroscopy will therefore lead to higher adoption driving the market growth.

Minimally invasive approaches, including ultrasound-guided techniques, are being used significantly. Thus, several market players are launching products, boosting the ultrasound transducer market's growth. For instance, in December 2021, Philips introduced cardiac ultrasound solutions for a fully integrated echocardiography experience, bringing together new transducer technology, artificial intelligence (AI)-driven automated measurements, and remote access at EuroEcho 2021. Additionally, in March 2021, Fujifilm SonositePX launched a new family of transducers, including the L19-5, Sonosite'shighest frequency transducer ever, with well-defined near field resolution and a scan depth of 1 cm. The L19-5 transducer has a tiny footprint of 20 mm, making it appropriate for superficial scans including vascular access, pediatrics, and musculoskeletal assessments. Such launches will also boost the market growth due to the availability of the products in the market, therefore, lead to rise in adoption. Such factors altogether are anticipated to drive the market's growth over the forecast period.

However, the market's growth is hampered by stringent regulations and a scarcity of skilled labor to operate the advanced equipment.

Ultrasound Transducer Market Trends

Convex Segment is Estimated to Witness a Healthy Growth in Future

The convex segment by product is expected to witness healthy growth in the future, attributed to several benefits associated with this convex transducer device, such as high efficiency and the ability to focus on the deeper organs compared to other transducers. These devices also give clearer images and have highly improved reliability. The beam shape of the convex transducer is ideal for the in-depth investigation of several disorders.

Moreover, the high adoption of convex transducers in diagnosing transvaginal, abdominal, and transrectal conditions will promote segment growth. Furthermore, several market players are engaged in strategies, such as product launches and approvals. For instance, in February 2022, FUJIFILM Sonosite, Inc. has expanded its next-generation POCUS portfolio with the introduction of its new, premium Sonosite LX system This system includes the largest clinical image produced by the company and a monitor that can be extended, rotated, and tilted for improved, real-time provider collaboration. Additionally, in March 2021, GE Healthcare released Vscan Air, a wireless, pocket-sized ultrasound that provides crystal-clear image quality, whole-body scanning capabilities, and intuitive software. The product is one of the smallest and most lightweight handheld ultrasound devices and provides whole-body scanning capabilities with crystal clear image quality.

Thus, the market is expected to witness significant growth over the forecast period due to the above-mentioned factors.

North America is Expected to Hold a Significant Share in the Market and Expected to do Same in the Forecast Period

North America is expected to hold a significant market share in the global ultrasound transducer market due to the rising prevalence of chronic diseases, high demand for technologically advanced medical devices, growing research and development expenditure, rising patient preference for early diagnosis, and increasing demand for ultrasound systems. According to 2022 statistics published by American Heart Association, the prevalence rate of heart failure in the United States was 6 million, which is 1.8% of the total population, in 2021. Thus, the high burden of cases of heart failure in the country is expected to increase the demand for ultrasound transducer devices for better diagnosis and treatment which is further expected to boost the growth of the market over the forecast period.

The United States owns the largest share of the ultrasound transducer market in the North American region. Several market players are engaged in implementing strategic initiatives to boost the market's growth. For instance, in November 2021, Butterfly Network, Inc., an innovative digital health company working to enable universal access to superior medical imaging, and Longview Acquisition Corp. entered into a definitive business combination agreement. The Butterfly iQ is the only ultrasound transducer to perform whole-body imaging using semiconductor technology with a single handheld probe. Such strategic initiatives are expected to fuel the growth of the ultrasound transducer market in North America.

Ultrasound Transducer Industry Overview

The Ultrasound Transducer market is moderately competitive and consists of several major players. Some companies currently dominating the market are Koninklijke Philips N.V., Siemens Healthineers, GE Healthcare, Hitachi Medical Systems, FUJIFILM Sonosite Inc., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Canon Medical Systems Corporation, ESAOTE SPA, and Samsung Medison Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand of Minimally Invasive Therapies

- 4.2.2 Increasing Prevalence of Cardiovascular, Respiratory, and Abdominal Disorders

- 4.3 Market Restraints

- 4.3.1 High Cost of the Ultrasound Product

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Convex

- 5.1.2 Linear

- 5.1.3 Endocavitary

- 5.1.4 Phased array

- 5.1.5 CW Doppler

- 5.1.6 Others

- 5.2 By Application

- 5.2.1 Musculoskeletal

- 5.2.2 Cardiovascular

- 5.2.3 OB/GYN

- 5.2.4 General Imaging

- 5.2.5 Others

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Diagnostic Centers

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Koninklijke Philips N.V

- 6.1.2 Siemens Healthineers

- 6.1.3 GE Healthcare

- 6.1.4 Fujifilm Holdings Corporation (fujifilm Sonosite)

- 6.1.5 Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- 6.1.6 Canon Medical Systems Corporation

- 6.1.7 ESAOTE SPA

- 6.1.8 Samsung Electronics Co. Ltd (samsung Medison)

- 6.1.9 Telemed Ultrasound Medical System

- 6.1.10 Alpinion Medical Systems Co. Ltd

- 6.1.11 Broadsound Corporation Information

- 6.1.12 Ezono Ag