|

市场调查报告书

商品编码

1910885

四轮车和三轮车:市场份额分析、行业趋势和统计数据、成长预测(2026-2031 年)Quadricycle And Tricycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

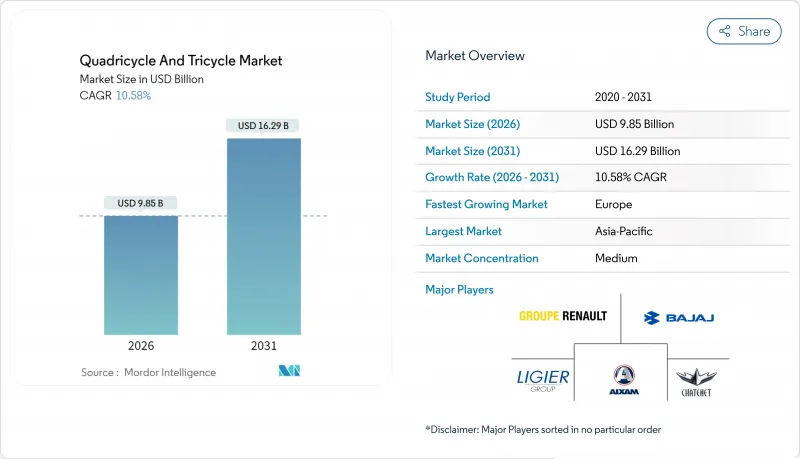

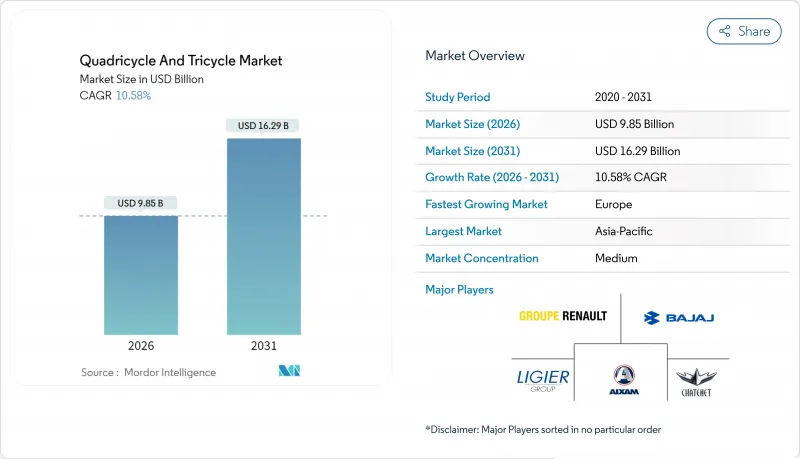

2025年,四轮车和三轮车市场价值为89.1亿美元,预计从2026年的98.5亿美元成长到2031年的162.9亿美元,在预测期(2026-2031年)内,复合年增长率为10.58%。

推动这一成长的因素包括都市区配送密度的增加、降低电动车拥有成本的国家奖励计划,以及促进小型低排放交通工具发展的法规结构。儘管目前内燃机产品仍占据出货量主导地位,但电池成本的持续下降以及换电网路减少的停机时间,使得电动车型得以在生产线上占据一席之地。欧洲更严格的排放法规以及印度计划实施的BS7排放标准正在重塑成本格局,而埃及的嘟嘟车替代计划则充分展现了官方批准四轮微型电动车如何创造新的市场需求。各大汽车製造商正将微型出行定位为新进业者的收入来源,并根据区域政策扩展产品线。这些因素共同推动了四轮和三轮汽车市场(包括货运和客运领域)的快速成长。

全球四轮及三轮车市场趋势及洞察

政府对电动三轮车/微型电动车的补贴和激励措施

奖励正逐步缩小电动车和汽油动力车之间的价格差距。印度的生产连结奖励计画计画拨出大量资金,用于促进本地零件生产并降低单位成本。泰国的EV 3.5计画为组装电动三轮车的企业提供可观的企业所得税减免。同时,马耳他为购买四轮车提供丰厚的财政津贴。中国将小型车辆购置税豁免期限延长数年,凸显了其在电动车奖励的努力。这些措施,加上电池成本的下降,旨在促进电动车的销售。这些可预测的奖励鼓励製造商扩大生产力计画,以降低资本投资风险并提高工厂使用率。

对最后一公里电子商务配送的需求不断增长

都市区配送成本约占总配送成本的五分之四,因此车队管理人员正在寻找能够减少停车时间和拥挤费用的车辆。亚马逊正在欧洲主要城市测试电动三轮货车,而 Flipkart 则在印度城市中心部署换电三轮车。 Gogoro 和 Sun Mobility 提供的电池即服务 (BaaS) 模式能够保持较高的车辆运转率,使驾驶员能够长时间工作而无需担心里程问题。这些经济优势,加上低排放气体区法规的日益严格,促使路线规划转向小型电动车。因此,小包裹配送量的成长直接转化为底盘订单,从而为零零件製造商形成良性循环。

缺乏快速充电/切换基础设施

在大多数新兴市场,充电站密度低于国际能源总署(IEA)建议的每10辆车配备一个充电桩的标准。在充电桩供应不稳定的地区,私人投资者持观望态度;公共负责人也面临预算限制,尤其是在农村地区。在电网不稳定的地区,营运商难以保证商用车辆的运转率。儘管一些政府为充电桩提供补贴,但安装速度仍落后于需求,导致电动车销量放缓。由于能源供应不稳定,车队管理者可能会继续购买内燃机车型,这可能会延缓全面电气化的进程。

细分市场分析

到2025年,三轮车将在四轮车和三轮车市场中占据87.05%的绝对市场份额,这主要得益于印度、泰国和印尼成熟的製造地。三轮车市场预计将稳定成长,但成长速度低于四轮车市场。儘管四轮三轮车的绝对销量较小,但预计到2031年,其复合年增长率将达到10.62%,这主要得益于欧洲和北非地区推行的有利于安全性和防风雨性能的封闭式座舱政策。 Bajaj Auto正在扩大Qute的生产规模,以满足埃及的车辆更新换代需求;而Piaggio则在改进其基于Porter平台的微型电动车平台,以适应欧洲人口密集的都市区市场。因此,区域市场的发展模式受到多种复杂因素的影响,包括成本考量、气候条件以及对车辆类型进行不同分类的法规。

三轮车平台不断发展以保持竞争力,并融合了电池更换相容性和远端资讯处理技术。四轮车设计则采用车顶太阳能辅助和轻质复合材料来减轻电池重量。这使得原始设备製造商 (OEM) 能够建立针对不同使用者需求的开发平臺,而不是在所有地区推广单一平台。竞争优势依赖模组化架构,该架构允许零件共用,同时又能符合区域法规,从而实现柔软性和适应性。整合高级驾驶员警告系统和基本互联功能也有助于四轮车型在以「零事故」安全目标为导向的城市获得监管部门的核准。随着资金来源与零排放目标相契合,四轮车和三轮车市场正在走向多元化,两种车型的发展趋势是共存而非完全融合。

到2025年,商业营运将占四轮和三轮车市场规模的73.10%,随着小包裹递送网路覆盖范围的扩大,这一份额预计还将继续增长。在可预测的路线密度和低排放区免征通行费的推动下,预计到2031年,商业营运将以10.7%的复合年增长率成长。在南亚地区,共享出行仍然主导着共乘和非正规计程车服务,但由于新地铁线和快速公车系统的开通,其成长速度正在放缓。大规模电子商务平台提供的批量保障支援专用组装的建设,使供应商能够获得多年合约。

车队所有者正努力透过安装封闭式驾驶室和空调系统来提高驾驶员留存率,这既能提升舒适度,又能保持较低的每公里成本。城市规划者正在住宅附近设立微型物流枢纽,以缩短运输距离,并凸显紧凑型货舱的适用性。软体负责人目前正在整合专门针对三轮车的路线规划功能,从而在尖峰时段减少燃油或电池消耗。在法规允许的情况下,搭乘用车辆正被改装为旅游接驳车和校园交通工具。在预测期内,四轮三轮车和三轮车市场将从普通客运转型为盈利丰厚且资产周转率合理的专业货运生态系统。

区域分析

到2025年,亚太地区将占四轮三轮车市场41.05%的份额,这主要得益于印度庞大的三轮车製造基地和中国在磷酸铁锂电池领域的规模优势。印度的大规模生产关联补贴(PLI)计画正在重塑供应链,吸引电池製造商和零件供应商。同时,中国扩大了低功率车辆的购置税豁免范围,确保了微型电动车的成本竞争力。泰国的电动车计画正将该国打造成为区域出口中心,并将其供应链与印尼和菲律宾无缝连接。这种策略合作有利于四轮三轮车市场,因为跨境经济活动缩短了前置作业时间,优化了库存週转。

儘管目前出货量小规模,但预计到2031年,欧洲的复合年增长率将达到10.65%。这一增长主要得益于地方政府的立法,例如拥堵收费和减少停车位。伦敦的超低排放区豁免了符合条件的轻型四轮车辆,而巴黎则透过减少路边停车位来鼓励居民选择小型汽车。马耳他针对轻型四轮车辆的奖励措施,加上168/2013号法规下的标准化规定,简化了型式认证流程。借助这一清晰的框架,製造商正计划在欧盟范围内推出新产品,将研发成本分摊到多个市场,并加强其在该地区轻型四轮和三轮车辆市场的地位。

北美正谨慎地加快步伐,充分利用各州层级的法规,例如加州的先进清洁车辆规则。在中东和非洲,埃及正式批准四轮计程车运营,推动了市场成长,并为印度供应商开闢了出口管道。南美洲面临宏观经济问题和基础设施不足等挑战。然而,巴西圣保罗市零排放区的设立以及阿根廷微型电动车试点计画的启动,一旦信贷环境稳定,将带来成长潜力。不同地区的监管时间表各不相同,预示着未来十年主导将发生动态变化,从而确保供应链的灵活性。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 政府对电动三轮车(E-3W)/微型电动车的补贴与奖励措施

- 电子商务对最后一公里配送的需求不断增长

- 排放气体法规加速了从内燃机汽车向电动车的过渡。

- 都市区拥塞和停车限制有利于四轮Scooter

- 商用三轮车电池更换经营模式

- 埃及嘟嘟车换四轮车计划

- 市场限制

- 缺乏快速充电/电池更换基础设施

- 锂离子电池初始成本高

- 消费者转向性能更佳的电动两轮车

- 等待欧盟制定L6E/L7E车辆碰撞安全标准

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 产业间竞争

第五章 市场规模及成长预测(价值(美元)及销售量(单位))

- 按车辆类型

- 四轮车

- 三轮车

- 透过使用

- 对于个人

- 商业的

- 依动力传动系统类型

- 内燃机

- 电动车

- 透过设计/配置

- 搭乘用车

- 货物

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 土耳其

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Bajaj Auto Ltd.

- Piaggio & C. SpA

- Mahindra & Mahindra Ltd.(Last Mile Mobility)

- YC Electric Vehicle Private Limited

- Groupe Renault

- TVS Motor Company Ltd.

- Atul Auto Ltd.

- Kinetic Green Energy & Power Solutions Ltd.

- Terra Motors Corp.

- Ligier Group

- AIXAM MEGA SAS

- Speego Vehicles Co. Pvt. Ltd.

- Saera Electric Auto Pvt. Ltd.

- E-Tuk Factory BV

- Polaris Inc.(Ranger LSV)

- Toyota Motor Corp.(C+Pod)

- BYD Co. Ltd.(mini-EV platforms)

第七章 市场机会与未来展望

The Quadricycle and Tricycle Market was valued at USD 8.91 billion in 2025 and estimated to grow from USD 9.85 billion in 2026 to reach USD 16.29 billion by 2031, at a CAGR of 10.58% during the forecast period (2026-2031).

This growth is driven by increasing urban delivery density, national incentive programs that reduce the cost of electric-vehicle ownership, and regulatory frameworks that incentivize compact, low-emission transportation. Internal-combustion products currently dominate shipments, yet electric models are securing factory line time because battery costs continue to fall and swap networks reduce downtime. Tight emission limits in Europe and planned India BS7 rules reshape cost calculations, while Egypt's tuk-tuk replacement scheme illustrates how formal recognition of four-wheel micro-EVs unlocks fresh demand. Major automakers now treat micro-mobility as an entry-level profit pool, prompting portfolio extensions that mirror regional policy cues. Together, these forces propel the quadricycle and tricycle market onto a steep adoption curve across both freight and passenger niches.

Global Quadricycle And Tricycle Market Trends and Insights

Government Subsidies & Incentives For E-3W / Micro-EVs

Incentive packages are increasingly bridging the price gap between electric and gasoline vehicles. India's Production Linked Incentive scheme is allocating significant funding to boost local component production and reduce unit costs. Under Thailand's EV 3.5 policy, firms assembling electric tricycles are eligible for substantial corporate tax relief. Meanwhile, Malta is incentivizing quadricycle purchases with notable financial grants. In a move underscoring its commitment, China has extended purchase-tax exemptions for smaller vehicles for several more years. These initiatives, coinciding with falling battery costs, aim to boost electric car sales. With these predictable incentives, manufacturers are ramping up capacity planning, seeing it as a way to mitigate risks in capital spending and enhance plant utilization.

Rising E-Commerce Last-Mile Delivery Demand

Urban fulfillment costs account for almost three-fifths of shipping expenses, so fleet managers seek vehicles that reduce parking time and congestion fees. Amazon pilots electric cargo tricycles in several European capitals, while Flipkart equips Indian city hubs with swap-enabled three-wheelers. Battery-as-a-service models from Gogoro and Sun Mobility maintain high asset uptime, enabling operators to run longer shifts without range anxiety. Combined with stricter low-emission zones, these economics tilt route planning toward compact, electric vehicles. Volume growth in parcel shipments, therefore, transmits directly to chassis orders, sustaining a virtuous cycle for component makers.

Sparse Fast-Charging / Swap Infrastructure

Station density remains below the International Energy Agency guideline of one charger per ten vehicles across most emerging markets. Private investors hesitate where utilization rates are uncertain, and public planners face budget constraints, especially in rural areas. In regions with unreliable electricity grids, operators struggle to guarantee uptime for commercial fleets. Some governments subsidize chargers, but the rollout speed still lags behind demand, slowing electric vehicle sales. Without predictable access to energy, fleet managers may continue to purchase internal-combustion models, thereby delaying the tipping point for full electrification.

Other drivers and restraints analyzed in the detailed report include:

- Emission Regulations Accelerating ICE-To-EV Shift

- Urban Congestion & Parking Limits Favouring Quadricycles

- High Li-Ion Battery Upfront Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tricycles accounted for a commanding 87.05% of the quadricycle and tricycle market share in 2025, sustained by entrenched manufacturing clusters in India, Thailand, and Indonesia. The quadricycle and tricycle market size for tricycles is projected to expand steadily, yet at a slower pace than four-wheel formats. Quadricycles, though smaller in absolute volume, are projected to register a 10.62% CAGR through 2031 as European and North African policies reward enclosed cabins for safety and weather protection. Bajaj Auto scales Qute production for Egypt's replacement program, while Piaggio refines its Porter-based micro-EV platform for dense European cores. Regional adoption patterns, therefore, reflect a complex mix of cost priorities, climate conditions, and rulebooks that classify vehicle classes differently.

Tricycle platforms continue to evolve, integrating battery-swap compatibility and telematics to maintain their relevance. Quadricycle engineering now incorporates roof-mounted solar assistance and lightweight composites to offset the mass of the battery. OEMs thus tailor R&D pipelines to distinct user requirements rather than forcing a single platform across geographies. Competitive positioning relies on modular architectures that share components while allowing for local variations in compliance, thereby enabling flexibility and adaptability. The integration of advanced driver alerts and basic connectivity features also helps four-wheel models gain regulatory approval in cities targeting Zero-Accident safety outcomes. As funding pools align with zero-emission targets, the quadricycle and tricycle markets diversify, with both formats coexisting rather than fully converging.

Commercial operations controlled 73.10% of the quadricycle and tricycle market size in 2025, a share expected to increase as parcel networks expand their coverage. Commercial operations are forecast to post a 10.7% CAGR through 2031, driven by predictable route density and fee exemptions in low-emission zones. Passenger formats still dominate ride-hailing and informal taxi services across South Asia; however, the introduction of new metro lines and bus rapid transit corridors is tempering incremental growth. Large e-commerce platforms offer volume guarantees that support dedicated assembly lines, allowing suppliers to secure multi-year contracts.

Fleet owners address driver retention by installing enclosed cabins and climate control systems, which enhance comfort while keeping the cost per kilometer low. Urban planners designate micro-logistics hubs near residential areas, shortening trip lengths and underscoring the suitability of compact cargo beds. Software providers are now integrating route planning specifically for three-wheel vehicles, which reduces fuel or battery consumption during peak congestion. Passenger units pivot toward tourism shuttles and campus transport where regulation permits. Over the forecast window, the quadricycle and tricycle market therefore shifts from general people movement toward specialized freight ecosystems whose earnings justify faster asset turnover.

The Quadricycle and Tricycle Market Report is Segmented by Vehicle Type (Quadricycle and Tricycle), Application Type (Personal and Commercial), Powertrain Type (Internal Combustion Engine and Electric), Design & Configuration (Passenger and Cargo), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific commanded 41.05% of the quadricycle and tricycle market share in 2025, anchored by India's expansive three-wheeler manufacturing base and China's scale advantages in lithium-iron-phosphate chemistry. India's significant PLI initiative is reshaping supply chains, attracting both cell manufacturers and component vendors. Meanwhile, China has extended purchase-tax waivers for vehicles with lower power output, ensuring cost parity for micro-EVs. Thailand's EV program is positioning the nation as a regional export hub, seamlessly connecting its supply bases with those of Indonesia and the Philippines. This strategic alignment benefits the quadricycle and tricycle market, as cross-border economies reduce lead times and streamline inventory cycles.

Europe, while smaller in current shipments, is projected to log a 10.65% CAGR through 2031 as city halls codify congestion fees and parking reductions. This growth is driven by city halls implementing congestion fees and parking reductions. London's Ultra Low Emission Zone offers exemptions for compliant quadricycles, while Paris is reducing curbside stalls, encouraging residents to opt for compact vehicles. Malta's incentive for quadricycles, combined with the standardized rules of Regulation 168/2013, streamlines the homologation process. Capitalizing on this clarity, manufacturers are orchestrating pan-EU launches, distributing R&D costs across multiple markets, and bolstering the region's stake in the quadricycle and tricycle market.

North America is treading cautiously yet picking up pace, harnessing state-level mandates, such as California's Advanced Clean Fleets Rule. In the Middle East and Africa, growth is driven by Egypt's official recognition of quadricycle taxis, which paves the way for export routes for Indian suppliers. South America faces challenges from macroeconomic issues and inconsistent infrastructure. Yet, with Brazil's Sao Paulo introducing a zero-emission zone and Argentina piloting micro-EVs, there's potential for growth once credit conditions stabilize. The varying regulatory timelines across regions suggest a dynamic shift in leadership roles over the decade, ensuring nimble supply chains.

- Bajaj Auto Ltd.

- Piaggio & C. SpA

- Mahindra & Mahindra Ltd. (Last Mile Mobility)

- YC Electric Vehicle Private Limited

- Groupe Renault

- TVS Motor Company Ltd.

- Atul Auto Ltd.

- Kinetic Green Energy & Power Solutions Ltd.

- Terra Motors Corp.

- Ligier Group

- AIXAM MEGA SAS

- Speego Vehicles Co. Pvt. Ltd.

- Saera Electric Auto Pvt. Ltd.

- E-Tuk Factory BV

- Polaris Inc. (Ranger LSV)

- Toyota Motor Corp. (C+Pod)

- BYD Co. Ltd. (mini-EV platforms)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Subsidies & Incentives For E-3W / Micro-Evs

- 4.2.2 Rising E-Commerce Last-Mile Delivery Demand

- 4.2.3 Emission Regulations Accelerating ICE-To-EV Shift

- 4.2.4 Urban Congestion & Parking Limits Favouring Quadricycles

- 4.2.5 Battery-Swap Business Models For Commercial Tricycles

- 4.2.6 Egypt Tuk-Tuk-To-Quadricycle Replacement Programme

- 4.3 Market Restraints

- 4.3.1 Sparse Fast-Charging / Swap Infrastructure

- 4.3.2 High Li-Ion Battery Upfront Cost

- 4.3.3 Consumer Shift To Improved Electric Two-Wheelers

- 4.3.4 Pending EU Crash-Safety Rules For L6E/L7E

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Quadricycle

- 5.1.2 Tricycle (Three-Wheeler)

- 5.2 By Application Type

- 5.2.1 Personal

- 5.2.2 Commercial

- 5.3 By Powertrain Type

- 5.3.1 Internal Combustion Engine

- 5.3.2 Electric

- 5.4 By Design & Configuration

- 5.4.1 Passenger

- 5.4.2 Cargo

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Turkey

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Bajaj Auto Ltd.

- 6.4.2 Piaggio & C. SpA

- 6.4.3 Mahindra & Mahindra Ltd. (Last Mile Mobility)

- 6.4.4 YC Electric Vehicle Private Limited

- 6.4.5 Groupe Renault

- 6.4.6 TVS Motor Company Ltd.

- 6.4.7 Atul Auto Ltd.

- 6.4.8 Kinetic Green Energy & Power Solutions Ltd.

- 6.4.9 Terra Motors Corp.

- 6.4.10 Ligier Group

- 6.4.11 AIXAM MEGA SAS

- 6.4.12 Speego Vehicles Co. Pvt. Ltd.

- 6.4.13 Saera Electric Auto Pvt. Ltd.

- 6.4.14 E-Tuk Factory BV

- 6.4.15 Polaris Inc. (Ranger LSV)

- 6.4.16 Toyota Motor Corp. (C+Pod)

- 6.4.17 BYD Co. Ltd. (mini-EV platforms)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment