|

市场调查报告书

商品编码

1690699

烯丙基氯-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Allyl Chloride - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

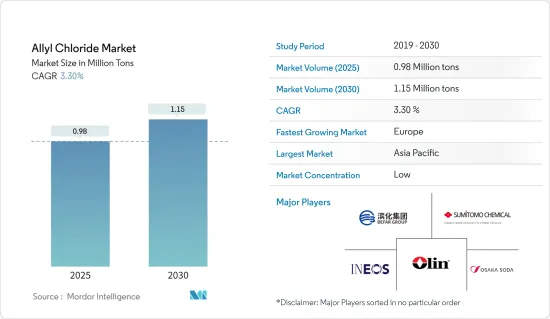

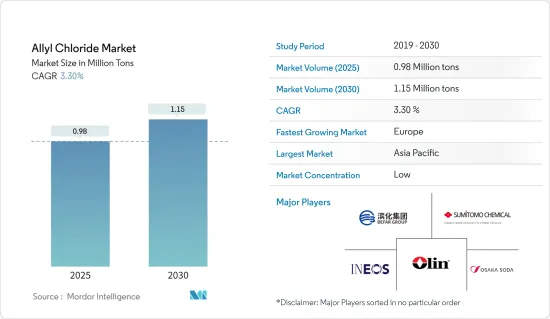

预计2025年烯丙基氯市场规模为98万吨,2030年将达115万吨,预测期间(2025-2030年)的复合年增长率为3.3%。

主要亮点

- 由于 COVID-19 疫情爆发,全球范围内的封锁、製造活动和供应链中断以及生产停顿,对 2020 年市场产生了不利影响。不过,2021年情况开始好转,市场恢復成长轨迹。

- 从中期来看,预计烯丙基氯衍生物在多种应用中的使用增加将成为研究期间推动市场需求的主要因素。

- 然而,严格的政府监管和对生物基环氧氯丙烷的了解不断增加等因素预计会阻碍市场成长。各种烯丙基氯聚合物和共聚物作为塑化剂和乳化剂的出现预计将为研究市场带来机会。

- 由于中国、韩国、印度和日本等国家的消费,亚太地区占据最大的市场。

烯丙基氯的市场趋势

环氧氯丙烷生产中烯丙基氯的使用日益增加。

- 烯丙基氯通常由丙烯与氯反应生成,而环氧氯丙烷通常由烯丙基氯与次氯酸和碱(如氢氧化钠)反应生成。然而,透过向甘油中加入盐酸来生产环氧氯丙烷的情况也在增加。

- 烯丙基氯的主要需求来自于环氧氯丙烷的生产。该化合物可以透过在环氧化过程中转化烯丙基氯或透过烯丙基氯与次氯酸反应来获得。

- 环氧氯丙烷主要用于生产环氧树脂,而环氧树脂广泛用于油漆、黏合剂和塑胶。它还有助于生产合成甘油、纤维、纸张、油墨和染料、溶剂、界面活性剂和药物。

- 环氧氯丙烷的主要製造商包括奥林公司、山东海利化工和 Vinythai AGC 集团。为了满足烯丙基氯市场的需求,一些公司已经启动了环氧氯丙烷生产装置计划。

- 2023年3月,中石化在中国北方的炼油厂启动了一项投资15.6亿美元的计划,将环氧氯丙烷生产纳入升级改造之中。此次扩建旨在透过提高生产能力和创造就业机会来促进中国经济,并发展化学工业。该计划包括300万吨/年催化裂解装置、70万吨/年汽油加氢裂解装置、10万吨/年环氧氯丙烷装置等多套装置。

- 儘管在某些情况下,环氧氯丙烷生产中的烯丙基氯已被甘油取代,但某些製造商(例如 Olin、Solvay 和 ENEOS)仍在使用传统方法,预计这将影响未来的市场。

- 此外,环氧树脂产量的增加也推动了对环氧氯丙烷和烯丙基氯的需求。

- 2023年5月,山东省东营经济技术开发区公布核准东营亿瑞泉新材料科技新计划。计划建设规模为年产20万吨电子级环氧树脂,并开发新型特殊树脂材料。

- 2022 年 2 月,Arco Nobel 宣布了投资计划,以扩大其内部树脂生产,这是其「成长与交付」策略的一部分。这项持续的扩大计画旨在增强对供应中断的抵御能力,并为公司的财务目标和上游碳减排目标做出重大贡献。

- 因此,考虑到这些因素,预计在预测期内,烯丙基氯在环氧氯丙烷生产中的使用将占据市场主导地位。

亚太地区占市场主导地位

- 亚太地区对烯丙基氯的需求最高,因为其在各行业的快速扩张和消费,包括环氧氯丙烷(ECH)、缩水甘油醚、Allylamines、磺酸盐单体、各种水处理化学品以及烯丙基磺酸钠等烯丙基化合物。这项需求主要来自中国、韩国、日本和印度等国家。

- 中国占亚洲环氧氯丙烷总产量的近60%,并一直在扩大其环氧氯丙烷产能,约占全球铭牌产能的一半。例如,2023年3月,中石化开始斥资15.6亿美元对中国北方的一座炼油厂进行升级改造,主要是为了生产环氧氯丙烷。该计划将包括 12 个设施和一个年产 10 万吨(TPA)环氧氯丙烷装置。

- 此外,中国是世界上最大的环氧树脂生产国和五大出口国之一。南亚环氧树脂(昆山)、三木集团、建滔化工集团是中国环氧树脂产业的主要製造商之一。

- 中国医药工业是世界上最大的学名药、治疗药物、原料药和中药生产国之一。日本註册的药品90%以上都是学名药。根据国家统计局预测,2022年医药产业营业收入将超过3.36兆元,与前一年同期比较增0.5%;2021年将超过3.33兆元。

- 在「Aatma Nirbhar Bharat」改革下,印度製药部实施了生产挂钩奖励(PLI) 等计划,以促进关键原料药和关键起始原料 (KSM)/ 製药中间体 (DI) 和原料药的国内生产,为此,该部已在 2020-21 年至 2028-29 年期间拨款 15,000 亿印度卢比。此外,2020-21 年至 2024-25 年期间,还有一项价值 300 亿印度卢比(3.625 亿美元)的批量药品园区促进计划,旨在为在这三个州建立批量药品园区提供财政援助。

- 印度计划在2023年设立约1,000亿卢比(13亿美元)的基金,以促进国内医药成分的生产。此外,印度政府还打算根据一项新政策建立一个电子平台来规范网路药局,以遏制因药品易得而导致的潜在滥用。

- 考虑到这些因素,预计预测期内该地区对烯丙基氯的需求将会增加。

氯丙烯产业概况

全球烯丙基氯产业较为分散,没有一家公司能够占据较大的市场占有率。该行业的主要企业有 INEOS、鹿岛化学、奥林株式会社、大阪曹达、索尔维、住友化学和 BefarGroup。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 烯丙基氯衍生物在多种应用的使用日益增多

- 限制因素

- 增加对生物基环氧氯丙烷的了解

- 严格的环境法规

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 应用

- Allylamines

- 磺酸盐

- 环氧氯丙烷

- 缩水甘油醚

- 水处理化学品

- 其他用途(黏合剂、香料、药物)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AccuStandard

- Befar Group Co.ltd.

- Gelest, Inc.

- INEOS

- Kashima Chemical Co.,LTD.

- Olin Corporation

- OSAKA SODA

- Solvay

- Sumitomo Chemical Co., Ltd

- Thermo Fisher Scientific Inc

- Vizag Chemical

第七章 市场机会与未来趋势

- 各种烯丙基氯聚合物和共聚物作为塑化剂和乳化剂的出现。

简介目录

Product Code: 70999

The Allyl Chloride Market size is estimated at 0.98 million tons in 2025, and is expected to reach 1.15 million tons by 2030, at a CAGR of 3.3% during the forecast period (2025-2030).

Key Highlights

- Due to the COVID-19 outbreak, nationwide lockdowns around the world, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

- Over the medium term, the increasing use of allyl chloride derivatives in several applications will be the primary factor for driving the market demand in the studied period.

- On the flip side, factors such as stringent government regulations and increasing knowledge of Bio-based epichlorohydrin are expected to hinder market growth. The emergence of various allyl chloride polymers and copolymers as plasticizers and emulsifiers is expected to act as an opportunity for the market studied.

- Asia-Pacific region represents the largest market owing to the consumption from countries such as China, South Korea, India, and Japan.

Allyl Chloride Market Trends

Increasing Use of Allyl Chloride in Epichlorohydrin Production

- Allyl chloride is typically produced by reacting propylene with chlorine, while epichlorohydrin is typically manufactured by reacting allyl chloride with hypochlorous acid and a base like sodium hydroxide. However, an increasing amount of epichlorohydrin is now being manufactured by adding hydrochloric acid to glycerin.

- The key demand for allyl chloride comes from epichlorohydrin production. This compound can be obtained either by transforming allyl chloride through the epoxidation process or by reacting allyl chloride with hypochlorous acid.

- Epichlorohydrin finds primary usage in producing epoxy resins, which are widely used in coatings, adhesives, and plastics. It also serves in manufacturing synthetic glycerine, textiles, paper, inks and dyes, solvents, surfactants, and pharmaceuticals.

- Leading epichlorohydrin producers include Olin Corporation, Shandong Haili Chemical, and Vinythai AGC Group. Some companies have initiated production plant projects for epichlorohydrin, aiming to meet the demand in the allyl chloride market.

- In March 2023, Sinopec launched a USD 1.56 billion project at its Northern China refinery, incorporating epichlorohydrin production in the upgrade. This expansion aims to increase production capacity, bolster the Chinese economy through job creation, and advance the chemical sector. The project encompasses several facilities, including a 3000 thousand tonnes per annum catalytic cracker, a 700 thousand tonnes per annum gasoline hydrotreating unit, and a 100 thousand tonnes per annum epichlorohydrin unit.

- While the use of allyl chloride for producing epichlorohydrin has been replaced by glycerin in some cases, certain manufacturers like Olin, Solvay, and INEOS continue using the traditional method, which is expected to shape the market in the years ahead.

- Additionally, the increasing production of epoxy resin is driving the demand for epichlorohydrin and allyl chloride.

- In May 2023, the Dongying Economic and Technological Development Zone of Shandong Province announced its approval of a new project by Dongying Yi Rui Zengnew Material Technology Co. LTD. This project aims to develop electronic-grade epoxy resin and new special resin materials with an annual capacity of 200,000 tons.

- In February 2022, Alko Nobel announced investment plans to expand in-house resin manufacturing as part of its Grow & Deliver strategy. This ongoing scale-up program aims to enhance resilience against supply disruptions and contribute significantly to the company's financial goals and upstream carbon reduction ambitions.

- Therefore, considering these factors, the application of allyl chloride in epichlorohydrin production is expected to dominate the market during the forecast period.

Asia Pacific Region to Dominate the Market

- The Asia-Pacific region witnessed the highest demand for allyl chloride due to rapid expansion and consumption in various industries, including epichlorohydrin (ECH), glycidyl ether, allyl amines, monomers of polyacrylonitrile, various water treatment chemicals, and allyl compounds such as sodium allyl sulfonate. This demand predominantly stems from countries like China, South Korea, Japan, and India.

- China accounts for nearly 60% of Asia's total ECH output and has consistently expanded its epichlorohydrin capacity, representing around half of the global nameplate capacity. For example, in March 2023, Sinopec initiated a USD 1.56 billion upgrade to its Northern China refinery, primarily to enable Epichlorohydrin production. The project includes 12 facilities, featuring a 100,000 tons per annum (TPA) Epichlorohydrin unit.

- Moreover, China stands as the world's largest producer of epoxy resin and is among the top five exporters. Nan Ya Epoxy Resin (Kunshan) Co. Ltd, Sanmu Group, and Kingboard Chemical Holdings Ltd are some of the key manufacturers in China's epoxy resin industry.

- China's pharmaceutical industry ranks among the largest globally, manufacturing generics, therapeutic medicines, active pharmaceutical ingredients, and traditional Chinese medicine. Over 90% of registered drugs in the country are generic. According to the National Bureau of Statistics of China, in 2022, the pharmaceutical industry generated operating revenue exceeding 3.36 trillion yuan (USD 0.459 trillion), showcasing a 0.5% growth from the previous year, with revenue surpassing CNY 3.33 trillion (USD 0.451 trillion) in 2021.

- Under the 'Aatma Nirbhar Bharat' reform, India's Department of Pharmaceuticals is implementing schemes like the Production Linked Incentive (PLI) Scheme for promoting domestic manufacturing of critical APIs and Key Starting Materials (KSMs)/ Drug Intermediates (DIs) and APIs, allocating INR 15,000 crores (USD 1.8 billion) from FY 2020-21 to FY 2028-29. Additionally, the Scheme for the Promotion of Bulk Drug Parks, worth INR 3,000 crores (USD 362.5 million) from FY 2020-21 to FY 2024-25, aims to provide financial assistance for establishing Bulk Drug Parks in three States.

- India plans to establish a fund of nearly INR 1 lakh crore (USD 1.3 billion) to bolster domestic pharmaceutical ingredient manufacturing by 2023. Furthermore, the Government of India intends to set up an electronic platform to regulate online pharmacies under a new policy to curb potential misuse due to easy availability.

- Considering these factors, the region's demand for allyl chloride is expected to rise during the forecast period.

Allyl Chloride Industry Overview

The global allyl chloride industry is fragmented in nature, as no company accounts for a significant market share. Leading companies in this industry are INEOS, Kashima Chemical Co. LTD, Olin Corporation, OSAKA SODA, Solvay, Sumitomo Chemical Co. Ltd, and BefarGroup Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Use of Allyl Chloride Derivatives in Several Applications

- 4.2 Restraints

- 4.2.1 Increasing Knowledge of Bio-based Epichlorohydrin

- 4.2.2 Stringent Environmental Regulations

- 4.3 Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Allyl Amines

- 5.1.2 Allyl Sulfonates

- 5.1.3 Epichlorohydrin

- 5.1.4 Glycidyl Ether

- 5.1.5 Water Treatment Chemicals

- 5.1.6 Other Applications (Adhesives, Perfumes, Pharmaceuticals)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AccuStandard

- 6.4.2 Befar Group Co.ltd.

- 6.4.3 Gelest, Inc.

- 6.4.4 INEOS

- 6.4.5 Kashima Chemical Co.,LTD.

- 6.4.6 Olin Corporation

- 6.4.7 OSAKA SODA

- 6.4.8 Solvay

- 6.4.9 Sumitomo Chemical Co., Ltd

- 6.4.10 Thermo Fisher Scientific Inc

- 6.4.11 Vizag Chemical

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence of Various Allyl Chloride Polymers and Copolymers as Plasticizers and Emulsifiers

02-2729-4219

+886-2-2729-4219