|

市场调查报告书

商品编码

1440218

资料历史学家:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Data Historian - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

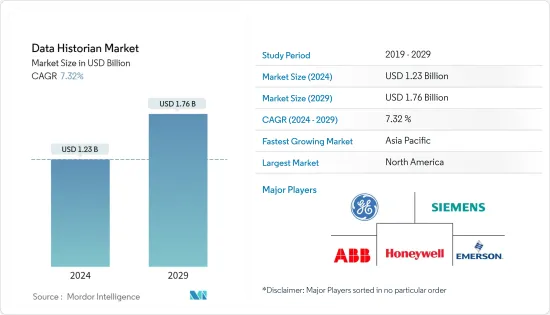

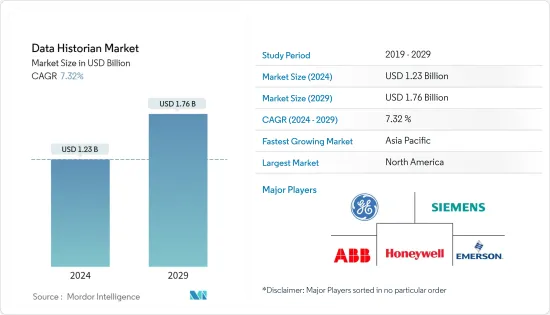

资料 Historian 市场规模预计 2024 年为 12.3 亿美元,预计到 2029 年将达到 17.6 亿美元,在预测期内(2024-2029 年)增长 7.32%,复合年增长率增长。

由于物联网设备、云端应用程式和社交媒体等各种来源产生的资料量不断增加,对资料历史学家的需求不断增加。

主要亮点

- 许多行业都受到需要保存历史资料的监管和合规要求的约束。资料历史学家提供了一种满足这些要求的方法,同时使组织能够从资料中提取见解。这对于金融服务等产业尤其重要。因此,这些行业的需求正在对市场做出贡献。

- 资料中心的发展透过提供储存、处理和分析大量资料所需的基础设施,促进了资料历史学家的发展。此外,资料中心通常提供先进的处理能力,例如高效能运算资源和资料分析工具,以帮助组织从资料中提取有价值的见解和趋势。

- 因此,资料历史学家在资料中心和工业控制系统(ICS)中最常见,因此对资料中心的投资迅速增加,支持了市场的成长。例如,根据 NASSCOM(印度)的数据,到 2025 年,印度资料中心投资预计将从 2021 年的 38 亿美元增加到 46 亿美元。

- 此外,随着工业 4.0、智慧工厂和智慧工厂的出现,世界各地的组织正在展示向在其流程的多个层面使用大量资料的转变。这增加了组织对资料历史解决方案的需求,以实现有效管理、稳定高效的工厂运作以及强大的分析。然而,资料功能和复杂性不断增加、实施成本高昂以及开发有限等因素正在阻碍市场成长。

- COVID-19 对资料历史记录市场产生了各种影响。随着资料产生的激增增加了对资料储存和分析的需求,对资料历史解决方案的需求也随之增加。这为专门从事资料历史技术和服务的公司提供了成长机会。

- 此外,疫情也扰乱了商业和全球经济,导致包括资料史学家在内的新技术支出放缓。这减缓了资料历史记录市场的成长。此外,向远距工作的转变为资料收集和管理带来了挑战,使得资料负责人更难以提供准确和完整的资料历史记录。

资料历史记录市场趋势

云端采用推动市场成长

- 云端采用率的提高是资料历史学家发展的关键因素。云端开发的成长提供了可扩展且灵活的云端基础设施,可以处理大量资料,使其成为资料历史学家的理想云端基础设施。此外,云端的发展使得资料历史学家与其他云端基础的工具和服务(例如资料分析和视觉化)的整合变得更加容易,从而产生了对资料历史学家的需求。

- 采用云端服务来储存和管理消费者资料可归因于云端采用率的增加。付款闸道、线上资金转帐、数位钱包和整合客户体验等服务在 BFSI 行业中发挥重要作用,并支援整体向云端部署的迁移。

- 2022 年6 月,媒体、娱乐和技术创投组合Eros Investments(Eros Media World、Eros Now、Mzaalo of Xfinite)签署了一项协议,以推进和扩展人工智慧(AI) 和机器学习(ML)。与Wipro 签署有限公司基于内容本地化的解决方案。 Eros Investments 和 Wipro 的联合内容在地化服务将以两种部署模式提供给媒体和娱乐公司:平台即服务和私有云端部署。不同行业的公司在云端采用领域利用解决方案的努力预计将进一步支持市场的成长。

- 此外,云端部署允许资料历史学家轻鬆扩展其基础设施,以满足客户不断变化的需求,从而消除对昂贵硬体的需求,并降低资料历史学家的整体成本。这使得中小型企业更容易使用资料历史学家。

- 疫情发生以来,许多企业对云端运算的需求激增,云端服务提高了基础设施效率,降低了营运成本,并根据情势变化优化业务运营,新的云端实施模式由此诞生。

预计北美将占据最高的市场占有率

- 由于该地区资料历史记录市场创新研发支出的增加,预计北美将占据最高的市场占有率。此外,该地区还有Honeywell国际公司、通用电气公司和罗克韦尔自动化公司等供应商继续投资该市场。

- 该地区对资料历史学家的需求正在稳步增长。这是由于对工业自动化资料的需求持续增长以提高性能、各个经济部门越来越多地使用巨量资料分析以及不断扩展的物联网基础设施推动了资料量不断增加。收集并分析技术市场趋势,例如

- 该地区也对 IT、BFSI、零售和医疗保健行业的全球资料中心需求做出了重大贡献。世邦魏理仕等房地产专家报告称,美国资料中心空间占全球近90%。这进一步增加了对资料历史记录市场的需求。

- 例如,Google过去五年在26个州的办公室和资料中心投资超过370亿美元,这还不包括2020年和2021年在美国研发投资超过400亿美元的费用。此外,2022年4月,Google宣布计划在2022年向美国办事处和资料中心投资约95亿美元。

- 此外,北美的组织越来越认识到资料分析在决策中的价值,并正在寻找管理和储存大量资料的解决方案。这增加了对资料历史学家的需求。

资料历史学家产业概述

由于市场上存在众多参与者,资料历史记录市场是分散的。市场参与者正在采取合作伙伴关係、併购、新产品发布以及研发投资等策略,以进一步创新,以获得最高的市场占有率。这些是市场上看到的一些主要发展。 2022 年 10 月,Uptake Technologies Inc. 与 ADX 团队合作,使用 ADX 建置了工业资料历史资料库。自从 Microsoft 决定停止时间序列见解 (TSI) 的开发以来,Uptake 一直致力于在 Azure Data Explorer (ADX) 上重新建置其旗舰 OT 云端资料历史资料库 Fusion。 2022 年 4 月,GE Digital 最近宣布推出 Proficy Historian for Cloud,这是 AWS Marketplace 上提供的世界上第一个云端原生营运资料史学家。这款云端基础的工业资料管理软体旨在促进 OT资料从设备级到企业更简单、更可靠地移动到云端。 Proficy Historian for Cloud 可协助公司利用现有 IT 云端投资并整合 OT 和企业资料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 评估新型冠状病毒感染疾病(COVID-19)对市场的影响

第五章市场动态

- 市场驱动因素

- 对流程和效能改进的整合资料的需求不断增加

- 工业巨量资料的兴起

- 市场挑战

- 实施成本高

第六章市场区隔

- 按成分

- 软体

- 服务

- 依部署方式

- 本地

- 云

- 按最终用户产业

- 资料中心

- 石油天然气

- 纸浆

- 水资源管理

- 製造业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争形势

- 公司简介

- General Electric Company

- Siemens AG

- ABB

- Honeywell International Inc.

- Emerson Electric Co.

- AVEVA Group plc

- Rockwell Automation Inc.

- OSIsoft LLC

- ICONICS

- Open Automation Software

第八章投资分析

第9章 市场的未来

The Data Historian Market size is estimated at USD 1.23 billion in 2024, and is expected to reach USD 1.76 billion by 2029, growing at a CAGR of 7.32% during the forecast period (2024-2029).

The increasing amount of data generated by various sources, such as IoT devices, cloud applications, and social media, is driving demand for data historians.

Key Highlights

- Many industries are subject to regulations and compliance requirements that require storing historical data. Data historians provide a way to meet these requirements while enabling organizations to extract insights from the data. This is particularly important in the industries such as financial services. Thus, demand from such sectors is contributing to the market.

- The growth of data centers facilitates the growth of data historians by providing the infrastructure necessary for storing, processing, and analyzing large amounts of data. Further, data centers often offer advanced processing capabilities, such as high-performance computing resources and data analytics tools, which can help organizations extract valuable insights and trends in their data.

- As a result, investment in data centers is rising rapidly and supporting market growth, as data historians are most common in data centers and industrial control systems (ICS). For instance, according to NASSCOM (India), the investment value in data centers in India is expected to reach USD 4.6 billion by 2025 from USD 3.8 billion in 2021.

- Moreover, with the advent of Industry 4.0, smart factories, and smart plants, organizations worldwide are demonstrating a shift to the usage of massive amounts of data at several layers of their process. This leads to organizations' growing demand for data historian solutions to achieve effective management, stable and efficient plant operations, and robust analysis. However, factors such as increasing data capabilities and complexities, high deployment costs, and limited development are stifling market growth.

- COVID-19 had a mixed impact on the data historian market. The increased demand for data storage and analysis due to the surge in data generation led to an increased demand for data historian solutions. This provided growth opportunities for companies specializing in data historian technology and services.

- Furthermore, the pandemic has also disrupted businesses and the global economy, causing a slowdown in spending on new technologies, including data historians. This has resulted in a slowdown in the growth of the data historian market. Additionally, the shift to remote work has caused data collection and management challenges, making it more difficult for data historians to provide accurate and complete data history.

Data Historian Market Trends

Cloud Deployment To Drive the Market Growth

- The growth in cloud deployment has been a key factor in the growth of data historians. The growth of cloud development has led to the availability of scalable and flexible cloud infrastructure that can handle a large amount of data, making it ideal for data historians. Further, cloud development has made it easier to integrate data historians with other cloud-based tools and services, such as data analysis and visualization, and creating demand for data historians.

- Cloud services adoption for the storage and management of consumer data can be attributed to the growth of cloud deployment. Payment gateways, online transfers of the fund, digital wallets, unified customer experiences, etc. services are playing a significant role in the BFSI industry, assisting with the overall shift to cloud deployment.

- In June 2022, Eros Investments, a media, entertainment, and technology portfolio of ventures - Eros Media World, Eros Now, and Xfinite's Mzaalo signed an agreement with Wipro Ltd to evolve and scale the Artificial Intelligence (AI) and Machine Learning (ML) based content localization solution. Eros Investments and Wipro's joint content localization service will be available to media and entertainment companies in two deployment models such as platform-as-a-service and private cloud deployment. Such initiatives from companies of different sectors to avail solutions in the area of cloud deployment are further expected to support market growth.

- Moreover, cloud deployments are allowing data historians to easily scale up their infrastructure as per the changing needs of their customers and eliminate the need for expensive hardware, reducing the overall cost of data historians. This makes it easier for small and medium-sized businesses to use data historians.

- Since the pandemic, the demand for cloud computing skyrocketed among many businesses as cloud services improve infrastructure efficiency, lower operating costs, and optimize business operations in response to changing conditions, giving rise to various cloud deployment models.

North America Expected to Hold Highest Market Share

- North America is expected to hold the highest market share owing to increasing spending on research and development for innovation in the data historian market in the region. Moreover, the region has vendors like Honeywell International Inc., General Electric Company, Rockwell Automation, Inc., etc., continuously investing in the market.

- The demand for data historians is expanding steadily in the region, fueled by consistently increasing demand for industrial automation data for performance improvement, rising use of Big Data analytics across various economic sectors, and constantly expanding IoT infrastructure, which generates an increasing amount of data that can be collected and analyzed, and other tech market trends.

- The region also contributes substantially to the global data center demand from the IT, BFSI, retail, and healthcare industries. Real estate experts, such as CBRE, have reported that the United States occupies almost 90% of data center space worldwide. This is further boosting the demand for data historian markets.

- For instance, in the past five years, Google has invested more than USD 37 billion in its offices and data centers in 26 states which is in addition to the more than USD 40 billion in research and development invested in the United States in 2020 and 2021. Further, in April 2022, Google announced plans to invest approximately USD 9.5 billion in its United States offices and data centers in 2022.

- Moreover, organizations in North America are increasingly recognizing the value of data analysis in decision-making and are looking for solutions to manage and store a large amount of data. This is driving the demand for data historians.

Data Historian Industry Overview

The data historian market is fragmented due to the many players in the market. Players in the market are adopting strategies like partnerships, mergers and acquisitions, new product launches, and investing in R&D for further innovations to capture the highest market share. Some of the key developments seen in the market are as such. In October 2022, Uptake Technologies Inc. collaborated with the ADX team to build an industrial data historian using ADX. Since Microsoft decided to stop the development of Time Series Insights (TSI), Uptake has been working to re-platform the flagship OT cloud data historian, Fusion, on Azure Data Explorer (ADX). In April 2022, GE Digital recently announced the availability of the world's first cloud-native operational data historian available in the AWS Marketplace, Proficy Historian for Cloud. This cloud-based industrial data management software is designed to facilitate a more simplified and reliable movement of OT data to the cloud spanning from device level to enterprise. Proficy Historian for Cloud helps companies leverage existing IT cloud investments and combine OT and enterprise data.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment on the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Consolidated Data for Process and Performance Improvement

- 5.1.2 Rising Industrial Big Data

- 5.2 Market Challenges

- 5.2.1 High Deployment Costs

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment Mode

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By End-user Industry

- 6.3.1 Data Centers

- 6.3.2 Oil & Gas

- 6.3.3 Paper & Pulp

- 6.3.4 Water Management

- 6.3.5 Manufacturing

- 6.3.6 Other End-user Industry

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 General Electric Company

- 7.1.2 Siemens AG

- 7.1.3 ABB

- 7.1.4 Honeywell International Inc.

- 7.1.5 Emerson Electric Co.

- 7.1.6 AVEVA Group plc

- 7.1.7 Rockwell Automation Inc.

- 7.1.8 OSIsoft LLC

- 7.1.9 ICONICS

- 7.1.10 Open Automation Software