|

市场调查报告书

商品编码

1440230

企业资讯檔案:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Enterprise Information Archiving - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

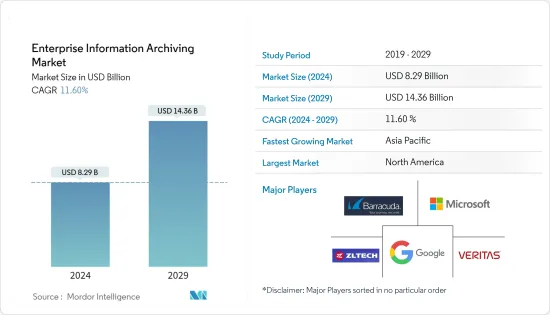

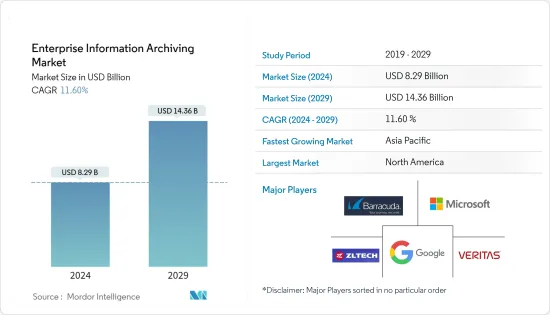

企业资讯檔案市场规模预计到2024年为82.9亿美元,预计到2029年将达到143.6亿美元,在预测期内(2024-2029年)增长11.60%,复合年增长率增长。

企业资讯归檔解决方案的成长主要是由于具有广泛地理分布和客户群的各种组织中资料产生的增加。其他因素,例如资讯归檔储存成本的降低以及政府出于审核和研究目的保留关键企业资料的规定,也推动了所研究市场的成长。

主要亮点

- 全球企业产生的资料主要包括资料的非结构化资料和资料。这些资料有多种格式,从传统资料库中的结构化数值资料到非结构化文字文件、视讯、音讯、电子邮件、股票行情资料和金融交易。企业资讯归檔解决方案将所有类型的资料储存在归檔储存中,并在需要时可供存取。随着组织希望从资料中提取更多价值、智慧和效用,这些解决方案预计将在预测期内出现成长。

- 此外,市场和新兴国家不断增加的技术创新、现代化和研发力度将为整个预测期内的企业资讯檔案市场提供新的机会。

- 企业资讯归檔还透过将旧的或低价值的资料隔离到三级储存并将用户资料储存在二级储存中以便资料存取和处理来自动提高企业效率。近年来,商业资讯檔案产业发展迅速。资料中心的建立是为了支援云,允许以最低的成本进行可扩展的归檔。

- 预计阻碍先进企业资讯归檔解决方案采用的主要因素之一是需要更多的培训和管理能力。鑑于可用的数位组织资讯数量庞大,关键组织正在采用各种创新解决方案来管理企业资料。然而,由于预算限制以及需要更加註重归檔企业资料,许多公司继续使用过时且耗时的方法,例如手动维护数位资讯。

- 由于 COVID-19 的爆发,全球资料总量迅速增加,该市场可能会成长。据 Seagate Technology PLC 称,到 2024 年,资料重要性预计将从 2017 年的 26 ZB 增加到 149 ZB。此外,世界各地的企业都在采用技术解决方案作为其数位化流程的一部分,推动疫情后的市场成长。

企业资讯檔案市场趋势

云端部署领域预计将占据主要市场占有率

- 云端运算的出现对企业的运作方式产生了巨大影响。云端解决方案采用率的提高降低了与基础设施相关的成本,并带来了营运模式的变化。云端基础的部署解决方案使公司能够专注于其核心业务能力。中小企业对云端服务的资本投入不断增加。预计这一因素将在预测期内推动市场。

- 由于部署模式提供的成本和营运优势,基于云端基础方案预计将显着成长。预计在预测期内,此趋势将不再采用本地部署模式。此外,2021 年 11 月,纳斯达克和亚马逊网路服务 (AWS) 开始了多年合作伙伴关係,为全球金融市场开发下一代支援云端的基础设施。这项合作关係将使纳斯达克的北美市场能够在 2022 年从纳斯达克的美国选择权市场之一迁移到 AWS 云端。

- NASSCOM 报告显示,2018 年全球企业在云端技术上的 IT 支出为 1,870 亿美元。今年云端支出预计将达到 3,450 亿美元。它将在未来几年为市场带来更多研究机会。

- 推动云端采用的因素有很多,包括提高效率、快速部署和安全性。云端供应商允许客户从世界各地的不同地点部署工作负载,最大限度地减少延迟并改善用户体验。此外,云端基础的服务更加稳健,因为虚拟机器的遗失可能仅意味着服务可用性的降低。为了最大化利益,企业正在评估哪种云端模型最适合他们的需求,并计划采用整合公共云端云和私有云端的混合云端策略。

- 据 Flexera Software 称,今年有 80% 的受访企业将 Microsoft Azure 用于公共云端目的。 AWS、Microsoft Azure 和 Google Cloud 是一些被称为超大规模资料中心业者的全球主要云端运算平台供应商。

北美保持最高市场占有率

- 北美地区预计将占据主要市场占有率。该行业是最早采用最新技术进步的行业之一,例如传统企业资讯归檔解决方案中与人工智慧、云端和行动技术的整合技术。此外,该地区还包括 Microsoft Corporation、Barracuda Networks Inc.、Proofpoint Inc. 和 Smarsh Inc. 等资讯归檔供应商的所在地。

- 此外,为各行业制定的有关资料归檔的政府标准和法规的存在是该地区推动市场成长的关键驱动因素之一。例如,FINRA 监管通知 10-06 规定,金融公司必须保留所有社群媒体通讯的记录。 《萨班斯-奥克斯利法案》要求上市公司保留所有业务记录,包括电子文檔和讯息,时间不得超过五年。

- 此外,该地区不断增加的云端采用率将进一步推动市场成长。此外,区域参与者正在采取策略伙伴关係,以提高其在市场上的影响力。今年 3 月,提供云端基础设施和託管服务的全球领先云端和网路安全保全服务经销商之一 ZNet Technologies 与北美(美国和加拿大)网路保护领域的全球先驱 Acronis 合作。此次合作将把 Acronis CyberProtect Cloud(一整套可用的网路安全解决方案)与 ZNet 的自动化技术结合,以实现服务供应商申请和 Acronis 产品交付的自动化。

- 此外,今年 5 月,云端优先安全解决方案领先供应商之一梭子鱼网路公司 (Barracuda Networks, Inc.) 扩展了其云端原生 SASE 平台。 Barracuda 的 SASE 平台简化了安全性 SD-WAN、防火墙即服务、零信任网路存取、安全 Web 闸道功能以及对工业物联网设备的安全存取。此增强功能包括混合部署模型和 IIoT 环境的新功能。新技术整合还提供安全的资料传输、编配、资产管理和异常检测。

企业资讯檔案产业概况

由于跨国公司和中小企业的存在,企业资讯檔案市场高度分散。此外,企业资料檔案应用于多种产业,为供应商提供成长机会。市场参与者正在采取合作伙伴关係和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2022 年 11 月:值得信赖的合作伙伴和云端优先安全解决方案的领先供应商之一梭子鱼网路公司 (Barracuda Networks, Inc.) 在瑞典和瑞士为其资料保护服务增加了两个Azure 区域,扩大了已宣布的范围,以满足不断增长的客户需求。这两个地区包括耶夫勒(瑞典)和苏黎世(瑞士北部),用户可以从 13 个 Azure 位置中进行选择,透过云端到云端备份来储存备份资料。

- 2022 年 5 月:诺基亚加强与微软的合作关係,以提高关键任务工业边缘的效能。 Nokia MX Industrial Edge 和 Private Wireless 的 Azure Arc 功能为组织提供了在 OT 设定中利用 Azure 的新选项。此解决方案可让组织使用 Azure Arc 来管理 Azure 工作负载(包括在 MXIE 上执行的工作负载),从而增加了另一层便利性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19感染疾病对产业的影响

- 市场驱动因素

- 加强最终用户严格的法规合规性

- 需要经济高效的非活跃企业资料储存解决方案

- 市场限制因素

- 严重依赖传统方法

- 缺乏企业资料归檔意识

第五章市场区隔

- 按类型

- 内容类型(进一步深入资料是定性的)

- 资料库

- 电子邮件

- 社群媒体

- 即时通讯

- 网路

- 行动通讯

- 同步和共用文件和企业文件

- 服务(进一步深入分析资料是定性的)

- 咨询

- 系统整合

- 培训、支援和维护

- 内容类型(进一步深入资料是定性的)

- 依部署方式

- 本地

- 云

- 按公司规模

- 中小企业

- 大公司

- 按最终用户

- 政府和国防

- 银行、金融服务和保险

- 医疗保健和製药

- 零售与电子商务

- 製造业

- 其他最终用户

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争形势

- 公司简介

- Barracuda Networks, Inc

- Google LLC(Alphabet Inc.)

- Microsoft Corporation

- ZL Technologies Inc.

- Veritas Technologies LLC

- Archive 360

- Mimecast Services Limited

- Smarsh Inc.

- Proofpoint Inc.

- Global Relay Communications Inc.

- Micro Focus International PLC

第七章 投资分析

第八章市场的未来

The Enterprise Information Archiving Market size is estimated at USD 8.29 billion in 2024, and is expected to reach USD 14.36 billion by 2029, growing at a CAGR of 11.60% during the forecast period (2024-2029).

The growth of enterprise information archiving solutions have been primarily attributed to the increasing data generation across various organizations with a wide geographic presence and customer base. Other factors, such as the reduced storage costs for information archiving, and the government mandates to store crucial enterprise information for audit and investigation purposes, have also been driving the growth of the market studied.

Key Highlights

- Data generated by enterprises across the globe includes majorly generated unstructured and structured data. These data are bifurcated into various formats, from structured, numeric data in traditional databases to unstructured text documents, videos, audio, e-mails, stock ticker data, and financial transactions. The enterprise information archiving solutions stores all types of data in the archive storage and then make it accessible when required. As organizations have been positioning themselves to extract more value, intelligence, and utility from the data, these solutions are expected to witness growth during the forecast period.

- In addition, increased technical innovations, modernization, and research and development efforts in the market and emerging nations would provide new opportunities for the enterprise information archiving market throughout the projection period.

- Enterprise information archiving also assisted businesses throughout the globe in automatically improving company efficiency by separating old and less valuable data on tertiary storage and storing user data on secondary storage for faster access and processing. The business information archiving industry growed significantly in recent years. Datacenters with cloud support have been constructed, allowing for scalable archiving at a minimal cost.

- One of the major factors expected to hinder the adoption of advanced enterprise information archiving solutions is a need for more training and management capabilities. Significant organizations have adopted various innovative solutions to manage their enterprise information, considering the vast digital organization information available. However, because of budget restrictions and a need for more awareness about enterprise information archiving, many businesses continue to use old and time-consuming approaches, such as manually maintaining digital information.

- With the COVID-19 outbreak, the market is likely to grow as the total data volume in the world is growing fast. According to Seagate Technology PLC, the data importance is expected to reach 149 ZB by 2024 from 26 ZB in 2017. Moreover, companies across the globe are adopting technical solutions as part of their digitalization process, augmenting market growth after the pandemic.

Enterprise Information Archiving Market Trends

Cloud Deployment Segment is Expected to Holds Major Market Share

- The emergence of cloud computing majorly impacted how businesses operate. This increasing adoption rate of cloud solutions brought changes in the operating models by reducing the cost associated with the infrastructure. The cloud-based deployment solutions enable enterprises to focus on core business competencies. There is an increase in capital expenditure for cloud services by small and medium-sized enterprises. This factor is expected to drive the market during the forecast period.

- Cloud-based solutions are expected to grow significantly due to the cost and operational benefits offered by the deployment mode. It is expected to shift the trend away from the on-premise deployment model over the forecasted period. Furthermore, in November 2021, Nasdaq and Amazon Web Services (AWS) launched a multi-year collaboration to develop the next generation of cloud-enabled infrastructure for the world's financial markets. The partnership would allow Nasdaq's North American markets to migrate to the AWS cloud, commencing in 2022 with one of Nasdaq's U.S. options markets.

- According to NASSCOM's report, global enterprise IT spending on cloud technology stood at USD 187 billion in 2018. Cloud spending is expected to reach USD 345 billion the current year. It would further create an opportunity for the market studied in the coming years.

- Several factors drive cloud adoption, including increasing efficiency, rapid deployment, and security. Because cloud providers allow clients to deploy their workloads from many locations across the globe, latency is minimized, which improves the user experience. Furthermore, cloud-based services are more robust, as the loss of a virtual machine only sometimes implies reduced service availability. To maximize advantages, companies are evaluating which cloud models are most suited to their needs and planning to adopt hybrid cloud strategies, which involve integrating both public and private clouds.

- Flexera Software said 80% of company respondents used Microsoft Azure for public cloud purposes this year. AWS, Microsoft Azure, and Google Cloud are some of the major global cloud computing platform providers known as hyperscalers.

North America to Hold Highest Market Share

- The North American region is expected to account for a significant market share. Within traditional enterprise information archiving solutions, the area is an early adopter of the latest technological advancements, such as integration technologies with A.I., cloud, and mobile technologies. Moreover, the region also includes a stronghold of information archiving vendors, such as Microsoft Corporation, Barracuda Networks Inc., Proofpoint Inc., and Smarsh Inc., among others.

- Also, the presence of governmental standards and regulations framed for various industries regarding data archiving is one of the significant growth drivers for the region, driving the market growth. For instance, FINRA's regulatory Notice 10-06 states that financial firms must retain records of all social media communications. Sarbanes-Oxley Act states that public companies must save all business records, including electronic documents and messages, for less than five years.

- Moreover, the rising cloud adoption in the region further boosts the market growth. Additionally, regional players are adopting strategic partnerships to increase their market presence. In March this year, ZNet Technologies, one of the leading global cloud and cybersecurity services distributors delivering cloud infrastructure and managed services, partnered with Acronis, a global pioneer in cyber protection in North America (USA and Canada). The collaboration combines Acronis Cyber Protect Cloud, the complete cyber security solution suite available, with ZNet's automation technology to automate invoicing and Acronis products delivery for service providers.

- Furthermore, in May this year, Barracuda Networks, Inc., one of the leading suppliers of cloud-first security solutions, expanded its cloud-native SASE platform. The SASE platform from Barracuda simplifies secure SD-WAN, firewall-as-a-service, zero-trust network access, secure web gateway capabilities, and secure access to industrial IoT devices. The extension includes new features for hybrid deployment models and IIoT contexts. New technological integrations also provide safe data transmission, orchestration, asset management, and anomaly detection.

Enterprise Information Archiving Industry Overview

The enterprise information archiving market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Moreover, enterprise information archiving is used in various industries to provide vendors with growth opportunities. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2022: Barracuda Networks, Inc., a trusted partner and one of the leading providers of cloud-first security solutions, announced the addition of two more Azure regions for its data protection services, Sweden and Switzerland, to satisfy growing customer demand in these countries. The two areas include Gavle (Sweden) and Zurich (Switzerland North), offering users 13 Azure locations to select from for storing data backed up via Cloud-to-Cloud Backup.

- May 2022: Nokia strengthens its partnership with Microsoft to improve performance at the mission-critical industrial edge. Azure Arc capabilities on Nokia MX Industrial Edge and private wireless provide organizations with new choices for leveraging Azure in their O.T. settings. The solution adds another layer of convenience by letting organizations manage Azure workloads, including those operating on MXIE, using Azure Arc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment on the Impact of COVID-19 on the Industry

- 4.4 Market Drivers

- 4.4.1 Increasing Stringent Legal Compliances for End-users

- 4.4.2 Need for Cost-Effective Storage Solutions for Inactive Enterprise Data

- 4.5 Market Restraints

- 4.5.1 Significant Dependence on Traditional Approaches

- 4.5.2 Lack of Awareness of Enterprise Information Archiving

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Content Types (Further Drill-down of Data is Qualitative)

- 5.1.1.1 Database

- 5.1.1.2 E-mail

- 5.1.1.3 Social Media

- 5.1.1.4 Instant Messaging

- 5.1.1.5 Web

- 5.1.1.6 Mobile Communication

- 5.1.1.7 File and Enterprise File Synchronisation and Sharing

- 5.1.2 Services (Further Drill-down of Data is Qualitative)

- 5.1.2.1 Consulting

- 5.1.2.2 System Integration

- 5.1.2.3 Training, Support, and Maintenance

- 5.1.1 Content Types (Further Drill-down of Data is Qualitative)

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By Enterprise Size

- 5.3.1 Small and Medium-Sized Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End User

- 5.4.1 Government and Defense

- 5.4.2 Banking, Financial Services and Insurance

- 5.4.3 Healthcare and Pharmaceutical

- 5.4.4 Retail and Ecommerce

- 5.4.5 Manufacturing

- 5.4.6 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Barracuda Networks, Inc

- 6.1.2 Google LLC (Alphabet Inc.)

- 6.1.3 Microsoft Corporation

- 6.1.4 ZL Technologies Inc.

- 6.1.5 Veritas Technologies LLC

- 6.1.6 Archive 360

- 6.1.7 Mimecast Services Limited

- 6.1.8 Smarsh Inc.

- 6.1.9 Proofpoint Inc.

- 6.1.10 Global Relay Communications Inc.

- 6.1.11 Micro Focus International PLC