|

市场调查报告书

商品编码

1440350

全球电子签章平台 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Global E-Signature Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

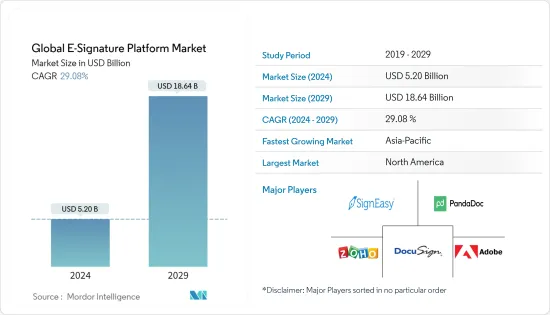

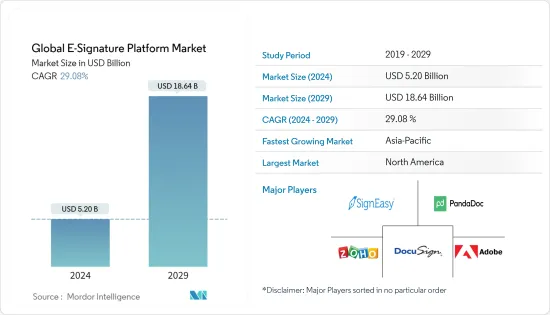

全球电子签名平台市场规模预计到 2024 年将达到 52 亿美元,预计到 2029 年将达到 186.4 亿美元,在预测期内(2024-2029 年)CAGR为 29.08%。

主要亮点

- 各企业正在从传统签名转向电子签名,因为它降低了法律纠纷的风险并提供了更实质的证据。在敏感资讯的传输过程中,对资料安全的需求一直存在。由于电子商务和网路银行的蓬勃发展,公司需要保护其网路以获得客户的信任。这项要求导致电子签名的采用率更高、更快,电子签名充当发送者对任何电子文件真实性的印章。

- 技术进步导致了执行文件的演变。随着对现代、便利的有约束力交易方法的需求不断增加,电子协议和签名近年来发展势头强劲。这些发展极大地改变了文件的输入和执行过程。

- 年轻消费者是金融服务业电子签名兴起的推手。疫情期间,全球Z世代和千禧世代签署了开立银行帐户、贷款协议、投资、财富管理和抵押贷款协议等金融文件,导致电子签名需求迅速成长。

- 电子签名解决方案正在帮助多个行业实现无纸化,这是改善业务、提高盈利能力并为客户提供更好体验的最快方式。例如,在房地产领域使用这些解决方案使代理商和经纪人能够拥有行动工具,可以在任何地方整合合约。

- 在过去的几年里,网路犯罪的威胁演变成个人、组织和社会面临的严重问题。网路的全球普及和数位服务的激增吸引了逐利犯罪分子,是此类攻击的主要驱动力。例如,根据英国国家犯罪局的数据,网路犯罪超过了所有形式的传统犯罪。

- 随着 COVID-19 的爆发,由于远距工作的兴起将重点从依赖纸本文件转移到交易流程的数位化,预计电子签名平台市场将呈现正成长。企业寻求无缝、高效且可以在任何地方完成的业务方法。文件流程一直是企业考虑转向线上的流程之一。

电子签名平台市场趋势

政府和国防部将持有大量股份

- 采用数位签章解决方案有助于联邦、州和地方政府提高各种文件处理和自动化功能,改善对关键资料的访问,同时降低与获取数据相关的成本。数位签章和验证解决方案有用的一些基本应用包括邮件投票、请愿自动化、表单资料提取和邮件处理。

- 政府机构目睹了市政当局伪造签名的诈欺案件不断增加。州和地方政府在打击诈欺者方面也紧随其后。他们与数千个不同的利害关係人花费了大量资金并追踪交易。

- 政府为开发数位基础设施付出了各种努力,这引发了对基于软体的累积资料解决方案的需求。美国政府已经制定了 IT 计划,例如数位体验、身分、凭证、存取管理 (ICAM) 和数位策略。

- 2021 年 5 月,Rashtriya Swayamsevak Sangh(RSS)附属机构 Swadeshi Jagran Manch(SJM)发起了一项电子签名活动,呼吁印度政府利用其主权向更多製药公司授予生产 COVID-19 的强制许可疫苗和药物。

- 此外,许多政府机构投资于军事和国防部门的数位化。例如,2021年10月,北大西洋公约组织(NATO)启动了人工智慧战略,并宣布为国防部门数位化提供10亿美元资金。这些倡议预计将促进电子签名在军事和国防部门的使用。

亚太地区将占据重要市场份额

- 与其他遵循宽鬆/简约电子签名法或前瞻性电子签名法的国家不同,中国遵循分层电子签名法。该法律采用两层方法,允许数位签名和电子签名,以及虚拟签名的合法化。

- 此外,《中华人民共和国电子签名法》是结合欧盟指令、《联合国电子通讯公约》和《贸易法委员会示范法》制定的。然而,该国的一些法官对于是否按照法律要求尊重电子签名的有效性犹豫不决。因此,该国对极其敏感文件的高级数位签章的需求不断增加。

- 中国在人力资源流程中主要在员工合约、保密协议、隐私权声明、员工发明协议、福利文件和新员工入职文件中使用电子签名。电子签名获得了更多关注,特别是自 COVID-19 大流行爆发以来。随着第三波和第四波 COVID-19 的爆发,以及远距工作的延期和津贴,这一趋势预计将盛行。

- 日本法律在可接受性或可执行性方面没有区分基于证书的数字与其他电子签名,这进一步为市场上的供应商带来了机会。然而,《电子签章法》规定了某些特定身分验证服务的要求,例如授权服务提供者或日本公钥基础设施。

电子签名平台产业概况

数位签章市场主要由国内外多家企业争夺市场空间。市场的技术进步也为公司带来了可持续的竞争优势。云端等技术正在重塑市场趋势。研究市场的竞争非常激烈,预计在预测期内将会加剧。

- 2021 年 10 月 - PandaDoc 为 PandaDoc 免费电子签名用户推出了与 HubSpot CRM 的整合。此整合将 PandaDoc 的文件管理和电子签名功能与 HubSpot CRM 免费结合在一起。

- 2021 年9 月- NetDocuments 是面向法律专业人士的基础内容管理平台,推出了与DocuSign eSignature 的集成,它将NetDocuments 的治理和安全性与eSignature 的强大功能相结合,为用户在发送、接收和发送时提供原生整合的无缝解决方案。追踪电子签名。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

- 研究框架

- 二次研究

- 初步研究

- 数据三角测量与洞察生成

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争激烈程度

- 评估 COVID-19 对市场的影响

- 电子签名的类型(SES、AES 和 QES)以及提供不同电子签名的供应商

- 市场驱动因素

- 电子签名的兴起和基于云端的服务的采用

- 远距工作文化和海外合约的增加

- 市场挑战/限制

- 与网路攻击和诈欺相关的漏洞不断增加

第 5 章:市场细分

- 按部署

- 本地部署

- 云

- 按组织规模

- 中小企业

- 大型企业

- 按最终用户

- BFSI

- 政府和国防

- 卫生保健

- 油和气

- 资讯科技和电信

- 物流运输

- 其他最终用户产业

- 按地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 韩国

- 亚太其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第 6 章:竞争格局

- 公司简介

- Docusign Inc.

- Zoho Corporation Pvt Ltd

- Adobe Inc.

- Signeasy (esign)

- Pandadoc Inc.

- Hellosign Inc. (hellosign Api)

- Airslate Inc. (signnow)

- Yousign

- Silanis-esignlive (onespan Inc.)

- Rightsignature (citrix Systems)

第 7 章:市场投资与未来趋势

- 投资分析

- 市场的未来

The Global E-Signature Platform Market size is estimated at USD 5.20 billion in 2024, and is expected to reach USD 18.64 billion by 2029, growing at a CAGR of 29.08% during the forecast period (2024-2029).

Key Highlights

- Various enterprises are shifting from traditional signatures to electronic signatures because it reduces the risk of legal disputes and provides more substantial evidence. There has been a constant need for data security during the transmission of sensitive information. Due to the e-commerce and online banking boom, companies needed to secure their networks to gain customers' confidence. This requirement led to greater and faster adoption rates of electronic signatures, which act as the sender's seal of authenticity over any electronic document.

- Technological advancements led to the evolution of executing documents. With the increasing demand for modern, convenient methods for entering binding transactions, electronic agreements and signatures have gained momentum in recent years. Such developments significantly changed the entering and execution processes of the documents.

- Younger consumers are a driving force behind the rise in electronic signatures in the financial services industry. During the pandemic, Gen Z and millennials worldwide signed financial documents, such as opening a bank account, loan agreement, investment, wealth management, and mortgage agreements, which resulted in a burgeoning electronic signature demand.

- E-signature solutions are helping multiple industries go paperless, which is the fastest way to improve their businesses, increase their profitability, and give clients a better experience. For instance, using these solutions in the real estate sector enables agents and brokers to have the mobile tools to put contracts together anywhere.

- Over the past few years, the threat of cybercrimes evolved into a severe problem for individuals, organizations, and society. The global adoption of the internet and the proliferation of digital services, which attract profit-seeking criminals, is the primary driver for such attacks. For instance, as per the National Crime Agency of the United Kingdom, cybercrimes surpassed all forms of traditional crimes.

- With the outbreak of COVID-19, the electronic signature platform market is anticipated to exhibit a positive growth rate, owing to the rise in remote working that shifted the focus from relying on paper-based documentation to the digitalization of the transaction process. Enterprises seek business methods that are seamless and efficient and can be done from anywhere. Document processes have been one that enterprises are considering shifting online.

E-Signature Platform Market Trends

Government and Defense to hold significant share

- The adoption of digital signature solutions helps in a wide range of document processing and automation capabilities for federal, state, and local governments that improve access to critical data while simultaneously reducing the cost associated with obtaining it. Some of the essential applications where digital signature and verification solutions are helpful include Vote-by-Mail, petition automation, Forms Data Extraction, and mail processing.

- The government agencies have witnessed increasing fraud cases by forged signatures in municipalities. The state and local governments are not far behind on the targets for fraudsters. They spend a significant amount of money with thousands of different stakeholders and keep track of the transactions.

- Various efforts by the government have been put into developing a digital infrastructure that triggers the need for software-based solutions for the data accumulated. The US government already has IT initiatives, such as digital experience, identity, credential, access management (ICAM), and digital strategy.

- In May 2021, Rashtriya Swayamsevak Sangh(RSS) affiliate Swadeshi Jagran Manch(SJM) launched an e-signature campaign that appeals to the Indian government to use its sovereign rights to grant a compulsory license to more pharmaceutical companies for the production of COVID-19 vaccines and medicines.

- Moreover, many government agencies invest in digitization in the military and defense sectors. For instance, in October 2021, North Atlantic Treaty Organization (NATO) launched an AI strategy and announced a USD 1 billion funding in the defense sector for digitization. These initiatives are expected to boost e-signature usage in the military and defense sectors.

Asia Pacific to Hold Significant Market Share

- China follows a tiered electronic signature law, unlike other countries that follow permissive/minimalist electronic signature laws or perspective electronic signature laws. The law subscribes to a two-tiered method and allows permitting of both digital signatures and electronic signatures, along with the legalization of virtual signatures.

- Additionally, the Electronic Signature Law of the People's Republic of China was modeled in combination with the European Union directive, United Nations Convention on Electronic Communications, and UNCITRAL Model Law. However, some judges in the country have hesitated to honor the validity of electronic signatures as the law demands. Due to this, the country is witnessing increased demand for advanced digital signatures for extremely sensitive documents.

- China mainly uses e-signatures for employee contracts, NDAs, privacy notices, employee invention agreements, benefits paperwork, and new employee onboarding documents during the HR process. The e-signature has gained more traction, especially since the outbreak of the COVID-19 pandemic. This trend is expected to prevail with the onset of the third and fourth wave of COVID-19, along with extension and allowance for remote working.

- The Japanese law does not distinguish certificate-based digital from other electronic signatures in terms of admissibility or enforceability, which further drives opportunities for vendors in the market. However, the E-Signature Act stipulates the requirements for some specified authentication services, such as authorized service providers or Japanese public key infrastructure.

E-Signature Platform Industry Overview

The digital signature market primarily comprises multiple domestic and international players fighting for market space. Technological advancements in the market also impart a sustainable competitive advantage to the companies. Technologies, such as the cloud, are reshaping the market trends. The competition in the market studied is high, and it is expected to increase over the forecast period.

- October 2021 - PandaDoc launched an integration with HubSpot CRM for PandaDoc Free eSign users. The integration combines PandaDoc's document management and e-signature capabilities with HubSpot CRM for free.

- September 2021 - NetDocuments, the foundational content management platform for legal professionals, introduced its integration with DocuSign eSignature, which combines the governance and security of NetDocuments with the power of eSignature to deliver a natively integrated, seamless solution for users when sending, receiving, and tracking e-signatures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Defination

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation And Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

- 4.4 Types of E-Signatures (SES, AES and QES) and Vendors Offering Different E-Signatures

- 4.5 Market Drivers

- 4.5.1 Rise In E-signatures And Adoption Of Cloud-based Services

- 4.5.2 Increase In Remote Work Culture And Overseas Contracts

- 4.6 Market Challenges/Restraints

- 4.6.1 Increasing Vulnerability Related To Cyber-attacks and Frauds

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Organization Size

- 5.2.1 Small and Medium Enterprise

- 5.2.2 Large Enterprise

- 5.3 By End-User

- 5.3.1 BFSI

- 5.3.2 Government and Defense

- 5.3.3 Healthcare

- 5.3.4 Oil and Gas

- 5.3.5 IT and Telecom

- 5.3.6 Logistics and Transportation

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 South Korea

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Docusign Inc.

- 6.1.2 Zoho Corporation Pvt Ltd

- 6.1.3 Adobe Inc.

- 6.1.4 Signeasy (esign)

- 6.1.5 Pandadoc Inc.

- 6.1.6 Hellosign Inc. (hellosign Api)

- 6.1.7 Airslate Inc. (signnow)

- 6.1.8 Yousign

- 6.1.9 Silanis-esignlive (onespan Inc.)

- 6.1.10 Rightsignature (citrix Systems)

7 MARKET INVESTMENTS AND FUTURE TRENDS

- 7.1 Investment Analysis

- 7.2 Future of the Market